The popularity of SMSFs has led to many people overlooking the use of family trusts, but Michael Hutton and Peter Bembrick illustrate how the two structures can work well together.

The rise in SMSFs as the investment structure of choice for many has resulted in a very useful investment structure – family trusts – often being overlooked.

In fact, despite recent changes to regulations affecting family trusts, they still provide tremendous flexibility for managing investment portfolios and family wealth. Further, they complement SMSFs very well.

A family trust is a discretionary trust that has elected with the ATO to distribute the trust’s annual income only to predetermined family member beneficiaries. The ATO definition of family members can include parents, grandparents, siblings, children, nephews, nieces, lineal descendants and spouses of any of these.

The beneficiaries of family trust income distributions are required to pay tax on that income. But distributions don’t have to be made equally to all family member beneficiaries. The trustee has the discretion to decide which family members receive an income distribution, with the general aim being to make a distribution to family members with the lowest taxable income, who will in turn pay the least amount of tax.

Despite this being a useful family wealth distribution strategy, there is a tendency for family trusts to be overlooked in favour of SMSFs as a way of managing wealth. Yet family trusts have a number of advantages over SMSFs that shouldn’t be ignored. These include:

- asset protection,

- the facilitation of intergenerational wealth transfer,

- no limit on the contributions that can be made to the trust,

- the ability to income split with family members, providing substantial tax benefits, particularly where there are low-income earners in the family,

- no age limits to access funds,

- the ability to hold personal-use assets, such as a holiday home,

- the ability to run a business through the trust, and

- estate planning flexibility.

In fact, family trusts have far fewer restrictions and rules than SMSFs and are simpler to operate.

Nevertheless, the growth in SMSFs in recent years has been extraordinary – there are currently 550,000 SMSFs in Australia, and perhaps 350,000 family trusts, despite the fact family trusts have been around for much longer.

With the establishment and ongoing costs of SMSFs falling, technology options streamlining administration and the superannuation member population broadening, the growth and popularity of SMSFs is unlikely to abate any time soon.

While it is still important to have a decent-sized balance to set up an SMSF, the minimum amount needed for establishment is falling in line with the reduction in the cost of fund administration due to the greater use of technology and outsourcing.

While $300,000 used to be quoted as a minimum balance to establish an SMSF, this has now dropped to around $200,000 or even less. This has led to a younger cohort setting up SMSFs.

The big attraction of SMSFs is in the tax benefits superannuation offers as well as the flexibility they give in managing retirement savings.

An SMSF can also complement family business structures, provided it is cost effective. Business owners wanting to own their business property can do so via an SMSF. As well as making contributions to the SMSF, the business grows the fund by making rental payments. There could also be an opportunity for business owners, who sell their business, to sell their business property to an SMSF and receive capital gains tax concessions.

Make no mistake, superannuation is an excellent tax-advantaged vehicle for retirement savings. But the benefits of family trusts are also significant.

Through a family trust, ownership of assets, such as a share portfolio or holiday house, can continue uninterrupted, even if a family member dies. This is because the family member doesn’t own the asset, the trust does, and consequently the assets don’t form part of the individual’s estate.

This makes family trusts an ideal tool for multi-generational wealth transfer, while SMSFs, on the other hand, must be wound up upon the death of the last member. This course of action can also raise tax issues.

In addition, it means assets held by an SMSF must be sold and if the family wishes to keep an asset, such as property, they will be liable for stamp duty and conveyancing costs.

But it shouldn’t be an either/or consideration.

For instance, those wanting to invest a substantial amount, say more than $300,000, who have either exhausted their contributions to super, or are young and want more accessibility than super provides, may find a family trust worthwhile. This is particularly so if there are low-income beneficiaries in the family group to whom taxable distributions can be allocated.

In fact, we would contend the SMSF and the family trust work well in tandem as investors move through the investing life cycle. There is a place for both.

The family trust can be commenced at the beginning of the wealth generation phase. While investors are younger, the wealth generation focus should be concentrated on building up the wealth in the family trust and reducing tax by distributing income among various family members.

This strategy also provides excellent asset protection advantages. This is because individual beneficiaries do not own the assets of a family trust. Instead they are owned by the trust and administered and controlled by the trustee of the trust. As well as having estate planning benefits – as there are no implications for change of ownership on the death of a family trust member – it can provide asset protection advantages in other circumstances, such as when a family member is sued.

As an investor moves closer to retirement age, the SMSF comes into its own. The focus changes from wealth generation to wealth preservation and investments should be gradually shifted across to the SMSF. This is done with the adoption of a strategy using after-tax (non-concessional) superannuation contributions. For 2014/15, as an example, up to $180,000 can be contributed each year by each member before the contributions cap is reached.

Shifting wealth between structures does not mark the end of the useful life of the family trust. Once the members of the SMSF retire and start drawing down from the fund, any money withdrawn that doesn’t need to be spent for living can be reinvested into the family trust.

Income from the family trust can also supplement any superannuation pension received during retirement. A pension age couple can earn an income of $28,974 each per year from the family trust, before additional tax needs to be paid.

The family trust continues to also have benefits from an intergenerational wealth transfer perspective. Unlike superannuation, where the fund needs to be wound up and paid out on the death of the member, the family trust can continue for the benefit of the next generation. If the next generation doesn’t have an immediate need for the proceeds from the super fund, they can also be added to and invested into the family trust.

This investment sequence is a good example of how using a family trust and an SMSF in tandem can provide excellent flexibility and tax effectiveness, combined with first-rate asset protection and innovative estate planning options for a family.

The rationale is that retirees with few assets outside the family home will continue to benefit from government support, while those with a higher level of assets will no longer be eligible for the same financial assistance.

The above changes will have a major impact on retirement planning for those who are currently entitled to pension benefits, with the government forecasting that 91,000 will lose their entitlement to the pension, 235,000 will have their pension reduced and 170,000 will receive a pension increase.

Thankfully, even those no longer eligible for the part-rate age pension will still receive the Commonwealth Seniors Health Card, which allows for cheaper medicine, health services and electricity bills. Anyone who has a pensioner’s concession card will continue to receive subsidised utilities and transport, and cheaper prescription medicines.

Therefore people who are currently receiving pension benefits, or may be eligible to receive pension benefits, should seek advice as to how these changes will impact on them and whether their finances can be restructured to take account of these changes.

Federal budget items While many SMSF investors were nervous the recent federal budget would contain changes adversely affecting their wealth generation plans, the government kept its promise not to place any new taxes on superannuation. It even went further by saying it wouldn’t make any adverse changes to super during this term of parliament and beyond.

Nevertheless, few governments to date have been unable to resist tinkering with the superannuation system, and one person’s idea of an adverse change may not be the same as those in power.

The government has also proposed changes to the pension assets test threshold to apply from 1 June 2017. The assets test changes are designed to assist those on a full pension by increasing the amount of assets a person can have (in addition to the family home) before their pension entitlement is decreased, as shown in the following table.

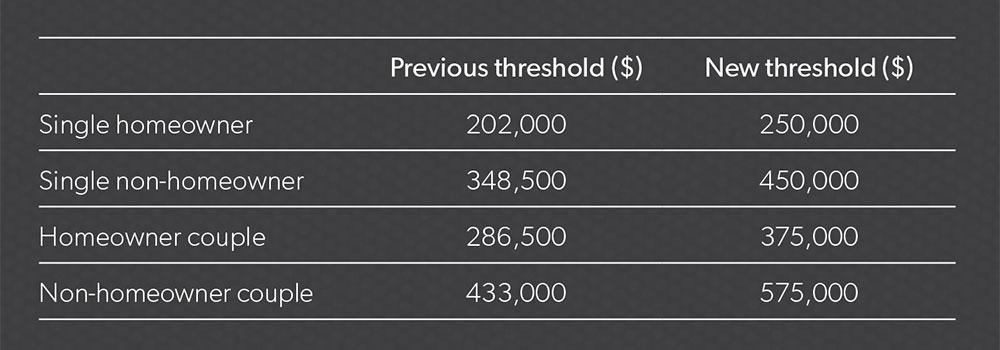

On the other hand, the government will reduce the assets threshold for those on a part pension, per the following table: