The need for private investment in infrastructure continues to grow. Andrew Maple-Brown examines the strengths of the asset class and how SMSF members can benefit.

Roads, broadcast towers, electricity grids, water pipelines and other physical structures and networks that we rely on every day can be broadly defined as infrastructure. These assets are essential to the basic functioning of our society and its economic productivity. Without the necessary infrastructure investment, an economy would limit its full output potential and curb its economic growth and human development.

Infrastructure investment allows us to enjoy lower congestion, creating greater overall competition and fuelling a stronger and more robust economy. In PwC’s “Capital Project and Infrastructure Spending: Outlook to 2025” report, the World Economic Forum estimates that every dollar spent on infrastructure generates an economic return of 5 per cent to 25 per cent.

Across the world, the challenge continues to be how to address the inadequacy and poor performance of the current infrastructure framework. When countries such as the United States suffer from poor D-grade infrastructure ratings in the “American Society of Civil Engineers 2013 Report Card for America’s Infrastructure”, it is difficult to ignore the increasing need for infrastructure investment as a driver of sustainable economic growth.

Currently, the global demand for infrastructure is not even close to being met, with a staggering $1 trillion to $1.5 trillion gap between the need for infrastructure development and the constrained balance sheets of most governments around the world, according to the “Bridging the Gap – Meeting the Infrastructure Challenge with Public-Private Partnerships” report. With public budgets unable to bridge this demand, there has been a shift towards private sector capital to complement infrastructure investment. In particular, G20 finance ministers committed to “remove constraints to private investment by establishing sound and predictable policy and regulatory frameworks” during their February 2014 meeting.

This increasing reliance on the private sector, driven by an ongoing pipeline of asset privatisations and public-private partnerships, has expanded the opportunity for both large and small investors to access the infrastructure asset class.

Defining infrastructure – make sure you compare apples with apples

There are two commonly used avenues for investing in infrastructure – either through securities that are listed on global exchanges or as unlisted equity, which can be a direct investment into the assets or via pooled investment vehicles. Our view is that infrastructure is a homogenous asset class and so the optimal allocation between listed and unlisted infrastructure will be driven by individual investor circumstances. The single asset class premise is built upon a number of long-term observations, including:

- Assets owned by listed and unlisted infrastructure are the same,

- Regulators of infrastructure businesses are the same, and

- Management expertise is comparable between listed and unlisted, but is also asset specific.

It is also important to consider how infrastructure investors actually define the infrastructure assets they invest in. The market typically defines infrastructure on the basis of its physical attributes, whereas at Maple-Brown Abbott we take a different approach. We define infrastructure not only by the physical characteristics of the assets, but also by the commercial frameworks in which the assets operate (being either a monopoly or strongly competitive position) and whether their earnings are regulated, contracted or linked to a concession agreement.

Our approach to investing in infrastructure

At Maple-Brown Abbott, our core investment strategy is to only invest in stocks from a strictly selected infrastructure focus list of around 110 companies across more than 25 countries. The stocks on the focus list are those that provide the strongest combination of inflation protection and low volatility.

We also clearly define what we don’t believe to be true infrastructure assets, such as stevedoring companies (commonly known as ports), ‘above rail’ railways and integrated utilities. This pure and focused approach provides a focus list that excludes businesses with highly cyclical demand risk or competitive, market-based pricing.

Our process is driven by a number of factors, including, but not limited to:

- the quality of the assets, management and governance of the businesses,

- the inflation linkage of these assets and the dividends these assets pay to investors,

- the volatility of cash flows to equity holders in these businesses, driven by both the individual asset risk profile and its underlying capital structure, and

- the expected real growth profiles of the businesses based on views from our proprietary research.

We use a high-conviction approach to ensure our strongest stock views are included in the portfolio. As a result, a portfolio is expected to have between 25 and 35 global investments at any one time, and generally with the top 10 ranked stocks making up about 50 per cent of the portfolio.

Individual manager capacity is an important consideration for its impact on the potential returns we can deliver. We proactively calculate the capacity of the strategy by looking at the number of available stocks in which we are able to take a meaningful position. We believe true capacity for core infrastructure is currently US$3.5 billion to US$4 billion, with amounts above this requiring a broadening of the infrastructure definition, assumed increased liquidity risk, or a reduction in the number of stocks in which high-conviction positions can be built.

The outcome? A high-conviction, low-turnover portfolio that delivers on the key characteristics of inflation protection and low volatility.

Has the sector delivered on investor expectations?

We believe investors are most attracted to the infrastructure sector due to its key characteristics of long-term asset durations, inflation-linked revenues, contractual operations within strong regulatory environments and high barriers to entry or monopolistic market positions.

These qualities combine to provide a more defensive investment offering, which can also provide diversification benefits to a typical portfolio. In particular, infrastructure has delivered higher income yields, lower volatility and diversification, as outlined below.

Higher income yields

With interest rates at record lows around the world, stable and high-yielding assets are both hard to come by and in high demand. Listed infrastructure continues to offer a material yield premium to global equities and a clearly higher degree of stability based on the underlying infrastructure asset characteristics.

Over the past decade, infrastructure dividends have been growing at a substantially higher rate than other equity investments at a real annual rate of 1.4 per cent in comparison to 0.5 per cent for global equities (see table 1).

Table 1

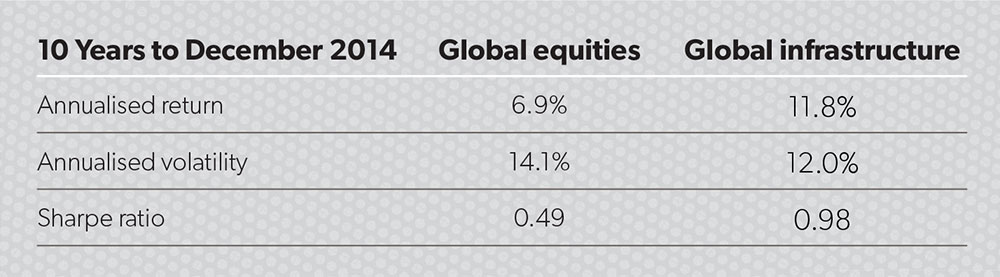

Lower volatility

In addition to higher yields, the regulated or contracted environments most infrastructure assets operate under provide for lower cash-flow volatility. This lower volatility has been important to investors as they view the asset class as a more defensive diversifier within their portfolios. Additionally, the lower volatility has been a key factor of the attractive risk-adjusted returns that have been achieved by the sector as measured by the Sharpe ratio (see table 2).

Table 2

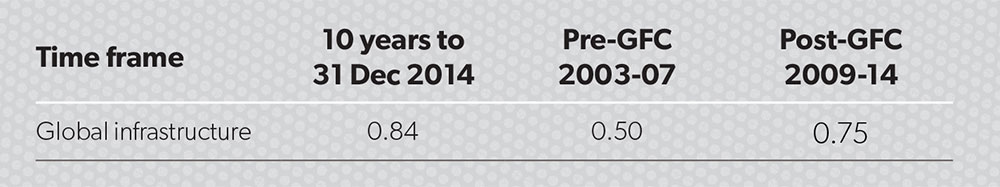

Table 3: Correlation with global equities

Further diversification benefits

While infrastructure correlations with global equities have been somewhat high over the longer term, this can be partially attributed to correlations across most asset classes spiking during the global financial crisis (GFC).

In more recent years, correlations between infrastructure and global equities have shifted back towards the lower levels observed before the GFC, and accordingly an allocation towards infrastructure may provide further diversification benefits and help to reduce overall portfolio volatility.

So, how much is enough?

There’s been a lot of media coverage in recent times in relation to the risks in Australian SMSF portfolio construction with home country bias and a lack of exposure to international assets. A lot of SMSF investors are now looking for a way to invest internationally. Statistics from the “Australian Taxation Office Quarterly Self-managed Super Fund Statistical Reports June 2014” support this premise. Total net Australian and overseas SMSF assets are $543 billion as at June 2014. Of this, only $2.2 billion, or 0.4 per cent, is invested directly into international shares, with only $437 million into overseas managed investments. It is safe to assume global infrastructure is a small subset of this allocation.

Similarly, research contained in the “Investment Trends April 2014 SMSF Investor Report” shows SMSF investors typically allocate about 2 per cent to 3 per cent of their SMSF money to international assets, via managed funds, exchange-traded funds or direct international shares. The research shows SMSFs’ appetite for international exposure grew between 2012 and 2013 before levelling off in 2014.

The key question is how much infrastructure is enough, or possibly too much, in a diversified portfolio? This is a difficult question to answer, given each and every investor is different with differing investment objectives and constraints, risk tolerances and time horizons.

While still a relatively new asset class in institutional investors’ portfolios, we have seen growing allocations over recent years. Investors have been directing more money into alternative strategies for diversification benefits and to satisfy their search for stable, sustainable and inflation-protected income, particularly where long-dated inflation-sensitive liabilities must be met. This has been most notably seen in pension, superannuation and sovereign wealth funds moving more capital into the asset class.

There are significant variances in the size of strategic allocations to infrastructure being recommended by asset consultants and in investor portfolios. This is to be expected as the asset class is still new and advisers are only beginning to focus on the portfolio benefits. Generally speaking, we find most investors in the asset class target an allocation somewhere in the mid-single digits as a percentage of an overall portfolio. However, this article does not provide advice and we recommend individuals seek professional advice tailored to their circumstances.

Andrew Maple-Brown is head of global listed infrastructure and a portfolio manager with Maple-Brown Abbott.