An SMSF must be considered to be an Australian superannuation fund to remain complying. Nicholas Ali examines how trustees can satisfy this definition even when they are overseas.

For SMSFs to receive tax concessions, they must be considered complying super funds. To be a complying super fund an SMSF must satisfy the residency test. To satisfy the residency test an SMSF must meet the definition of an Australian superannuation fund. If a superannuation fund ceases to be an Australian superannuation fund, the taxation concessions available to it may be lost. For a fund to be considered an Australian superannuation fund it must satisfy all three of the following tests at all times during a financial year:

- the fund was established in Australia or any asset of the fund is situated in Australia,

- the central management and control of the fund is ordinarily in Australia, and

- either the fund had no member who is an ‘active member’ or at least 50 per cent of:

- the total market value of the fund’s assets attributable to superannuation interests held by active members, or

- the sum of the amounts that would be payable to or in respect of active members if they voluntarily ceased to be members,

- is attributable to superannuation interests held by active members who are Australian residents. An active member basically means a member who makes contributions to an SMSF.

Central management and control

Assuming the first test can be readily satisfied, ATO Taxation Ruling TR 2008/9 shows the commissioner’s interpretation of what constitutes central management and control (CM&C). This centres on the strategic and high-level decision-making processes, which must be made in Australia.

Such activities would include:

- formulating the investment strategy for the fund,

- reviewing and updating or varying the fund’s investment strategy, as well as monitoring and reviewing the performance of the fund’s investments,

- if the fund has reserves, the formulation of a strategy for their prudential management, and

- determining how the assets of the fund are to be used to fund member benefits.

The day-to-day operational side of the fund’s activities, such as administrative duties, will not constitute CM&C. Examples of such activities provided in the TR 2008/9 include the physical investment of the fund’s assets, the fulfilment of administrative duties and the preservation, payment and portability of benefits.

For example, if the trustees are overseas and their financial planner executes investment decisions in line with the fund’s investment strategy, the CM&C will reside with the trustees and not the financial planner.

The CM&C of the fund can be outside Australia temporarily and it will still be considered within Australia, however, even if the trustees are overseas. Subsection 295-95(4) of the Income Tax Assessment Act 1997 (ITAA 1997) states: “To avoid doubt, the central management and control of a superannuation fund is ordinarily in Australia at a time even if that central management and control is temporarily outside Australia for a period of not more than two years.”

TR 2008/9 goes on to say: “Subsection 295-95(4) of the ITAA 1997 does not otherwise restrict the meaning of ‘ordinarily’ so that the CM&C of the fund can only be outside Australia for a period of two years or less. If the CM&C of the fund is outside Australia for a period greater than two years, the fund will satisfy the CM&C test if it satisfies the ‘ordinarily’ requirement in paragraph 295-95(2)(b) of the ITAA 1997.

“While the CM&C of a fund can be outside Australia for a period greater than two years, the period of absence of the CM&C must still be temporary. Furthermore, if the CM&C of the fund is not temporarily outside Australia, it will not be ‘ordinarily’ in Australia at a time even if the period of absence of the CM&C is two years or less.”

A crucial test is whether the trustees and/or members are permanently moving overseas. If it is evident they are moving overseas permanently, then CM&C may likely ordinarily reside outside Australia.

Case study

Trevor and Andrea are trustees and members of the Trevorson Superannuation Fund, which is an SMSF. Trevor is seconded to work for an extended period in Dubai, and Trevor and Andrea have no planned return date to Australia. Trevor and Andrea earn income in Dubai and are Dubai residents for tax purposes. Neither Trevor nor Andrea intend contributing to superannuation while they are overseas.

In this instance, CM&C – the high-level and strategic decision-making – of the Trevorson Superannuation Fund will most likely be conducted outside Australia by Trevor and Andrea. Tasks performed by accountants, administrators or investment managers would not normally constitute high-level CM&C, but rather operational and day-to-day management of the fund’s activities.

This may mean the fund is not considered an Australian superannuation fund as it has not satisfied all of the tests at all times during the financial year and thus it may be made non-complying.

If a fund is made non-complying due to non-residency, the outcome could severely impact on the retirement savings of the members. The tax rate applying to non-complying funds is set by section 26(2) of the Income Tax Rates Act 1986, which currently states: “The rate of tax payable by a trustee of a non-complying superannuation fund in respect of the taxable income of the fund is 45 per cent.”

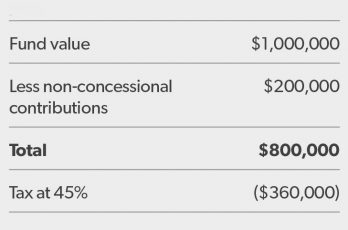

In essence, the taxable income of the fund is determined as being the assessable income of the fund, which, according to the ATO, is the asset value less non-concessional contributions.

If we go back to our clients, Trevor and Andrea, let’s assume the Trevorson Superannuation Fund had the following value and components at the end of the financial year:

Therefore, if the fund is made non-complying due to breach of the residency rules, it will lose $360,000 in tax. The tax commissioner is not able to exercise any discretionary powers where a fund is made non-complying due to it failing to meet the definition of an Australian superannuation fund. As can be seen from the above example, this is a disastrous outcome for Trevor and Andrea.

An effective way to ensure CM&C remains in Australia is for members to execute an enduring power of attorney (EPOA). An EPOA is an instrument that enables a person (the donor) to empower another person (the attorney) to make financial and property decisions on their behalf. Therefore, while fund members and trustees are outside Australia, the EPOA ensures CM&C remains in Australia (as conducted by the person residing in Australia with the EPOA) and the fund remains a complying superannuation fund.

The attorney stands in the non-resident trustee’s place and can act as individual trustee or director of the corporate trustee, undertaking the high-level and strategic decision-making in Australia. As outlined in TR 2008/9, it is important the CM&C is being made by the attorney and they are not acting on instruction from the trustee/member while they are overseas. If this is the case, CM&C may be considered to reside with the trustee or member who is not in Australia and the SMSF may not satisfy the definition of an Australian superannuation fund.

Implementing an EPOA is a crucial consideration for those who have their own SMSF and are considering working or residing overseas.

Nicholas Ali

Implementing an EPOA is a crucial consideration for those who have their own SMSF and are considering working or residing overseas. Planning prior to the trustees or members leaving overseas can mitigate against the fund becoming non-complying and the adverse tax consequences that come with it.

Active member test

To recap, the active member test will be satisfied at all times during the financial year if either:

- the fund had no active members at all during that financial year, or

- if the fund has one or more active members at any time during the financial year – the aggregate of the member balances of the non-resident active members must be less than the aggregate of the member balances of all resident active members.

A member is an active member in a financial year if a contribution to the fund has been made for or by them during that financial year.

In this context, contributions means benefit transfers and rollovers and not merely new contributions to the superannuation system.

Non-resident members can still make contributions (and the fund still satisfy the definition of an Australian superannuation fund) if the non-resident member’s account balances are less than the aggregate of the balances of resident active members. However, this is fraught with danger as consequences of getting this wrong can be catastrophic.

Case study

The Mongo Superannuation Fund has three members – Paul, Richard and Ashley. Ashley is a non-resident member and has a balance of $1 million. Paul has a balance of $750,000 and Richard has a balance of $350,000. All three members are active members (that is, they all contribute to the fund). Ashley – the non-resident member – could make contributions to the fund as his member balance is less than the combined member balances of the resident members, Paul and Richard. But the contribution cannot cause the non-resident active members to have member balances more than the aggregate of the member balances of the active resident members. Remember, the fund must satisfy all three tests at all times during a financial year.

Furthermore, if one resident member – say Paul – was to leave the fund during the year, this would cause Ashley’s member balance (the non-resident active member) to be greater than the remaining resident active member’s balance. From the time Paul left the fund it would have failed the active member test (the fund must satisfy all three tests at all times during the financial year). As the fund has failed the active member test, it cannot qualify as a resident-regulated superannuation fund and would therefore lose its complying status.

One option would be to ensure non-resident members are not active members or to ensure non-resident members contribute to an Australian Prudential Regulation Authority-regulated superannuation fund, and roll the benefit to an SMSF when they become resident members.

The importance of an EPOA if members are to reside overseas cannot be overstated. The same goes for satisfying the active member test. A fund not satisfying the residency rules is seriously at risk of being made non-compliant. See CBNP Superannuation Fund and Commissioner of Taxation [2009] AATA 709 for a real-life case where non-residency severely affected the retirement savings of an SMSF member.