Individuals soon will be able to roll forward the unused portion of their concessional contributions cap. Rob Lavery explains how the new rules work and how strategising now could be advantageous for superannuants.

This financial year is the first in which eligible super fund members will be able to roll unused portions of their concessional contributions over to future years. These members will be able to effectively stockpile their ability to make tax-deductible or salary-sacrifice contributions for use in 2019/20 and future years. Careful use of these new rules will provide significant taxation and retirement planning advantages.

Eligibility

A fund member will be eligible to use the catch-up rules to increase their concessional contribution cap in a financial year if:

- Their total superannuation balance at the end of 30 June of the financial year prior to the year of contribution is less than $500,000, and

- They have not used their full concessional contribution cap in any or all of the prior eligible financial years up to a maximum of five financial years immediately before the year of contribution.

The provision will allow superannuants who haven’t fully used their concessional contributions cap of $25,000 to roll the unused portion from the 2019 financial year forward in one of the following five financial years.

Practically, this means that in:

- 2019/20 – only 2018/19’s unused cap can be used in addition to the current year’s,

- 2020/21 – only 2018/19’s and 2019/20’s unused cap can be used in addition to the current year’s,

- 2021/22 – only 2018/19’s, 2019/20’s and 2020/21’s unused cap can be used in addition to the current year’s,

- 2022/23 – only 2018/19’s, 2019/20’s, 2020/21’s and 2021/22’s unused cap can be used in addition to the current year’s, and

- 2023/24 and thereafter – used cap space from each of the five prior financial years can be used in addition to the current year’s.

SMSF trust deeds

It is important to ensure the trust deed of an SMSF permits members to make catch-up concessional contributions. Any provisions limiting acceptable contributions to those within set caps may need to be updated to reflect the new rules.

Order of catch-up contributions used

When a member uses some of their unused concessional contributions cap from previous years to increase their concessional cap, it is assumed the unused cap from the earliest of the five previous years is used first.

Example

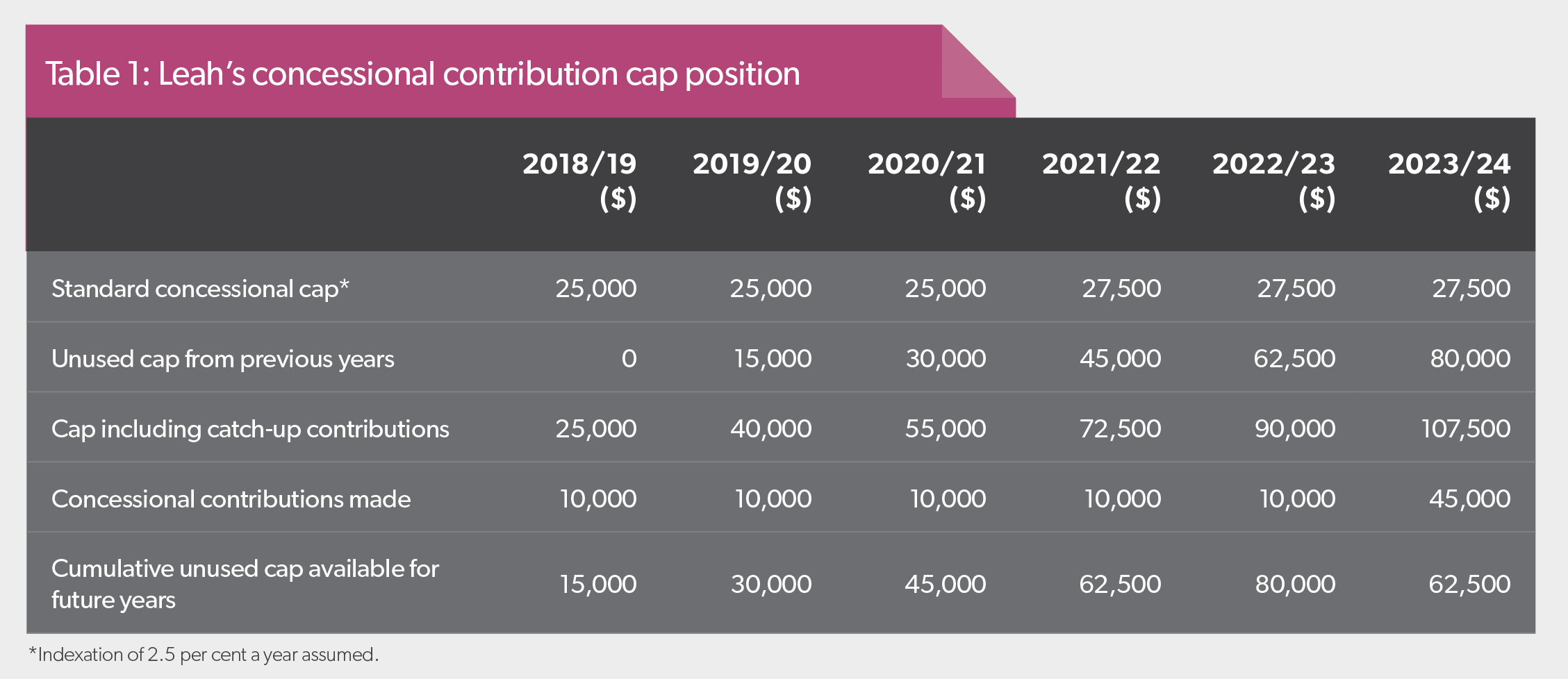

Leah’s employer pays her superannuation guarantee (SG) contributions of $10,000 to her superannuation fund every year.

In 2023/24, Leah makes a deductible personal contribution of $30,000 in addition to her employer’s concessional SG contribution of $10,000 on her behalf. At the end of 30 June 2023, Leah had a total superannuation balance of less than $500,000.

Table 1 summarises Leah’s concessional contribution cap position.

Leah’s total concessional contributions of $40,000 in 2024/25 exceed the $27,500 conventional cap in that year by $12,500 – $12,500 of her unused cap from 2018/19 will be used to increase her concessional contribution cap to $40,000. The $2500 in unused cap from 2018/19 that Leah does not apply will not carry forward into 2024/25 as it would then be six financial years earlier. As such, that $2500 of her 2018/19 cap is lost.

Leah’s unused cap carried forward to 2024/25 will be the sum of her unused caps from the five prior years (2019/20 to 2023/24). If the unused $15,000 from the 2019/20 cap is not contributed in 2024/25, it will also be lost.

Total superannuation balance

The total superannuation balance generally includes the balances or surrender values of all the member’s accumulation accounts, income streams and unallocated rollovers.

There are some very specific rules around the total superannuation balance. These include that:

- defined benefit income streams are generally given a value that reflects the credits and debits that have been applied to the member’s transfer balance account. There are set formulas that apply to many types of defined benefit income streams, and

- structured settlement contributions, usually related to some sort of compensation payments or personal injury settlements, do not count towards a member’s total superannuation balance.

The ATO provides detailed information on the calculation of a member’s total superannuation balance, particularly through its Law Companion Ruling 2016/2. It is important members of SMSFs take into account all their superannuation interests, including those outside the SMSF, when calculating whether their total superannuation balance is below the $500,000 threshold.

Determining date

The critical date when considering whether a member’s total superannuation balance will allow them to make catch-up concessional contributions in a financial year is 30 June of the prior financial year. If their account balance at the end of 30 June was below $500,000, they will be eligible to make catch-up contributions.

It is important to understand that each financial year is viewed separately. A member could have a total superannuation balance over $500,000 on 30 June before one financial year and have it drop below $500,000 on 30 June before a subsequent year to see them eligible to make catch-up contributions in that subsequent year.

Example

Ela, 40, has unused concessional contribution cap space in 2018/19 of $10,000 (and for simplicity we have assumed no indexation has occurred).

She receives a large bonus in 2019/20 and would like to make as large a personal deductible contribution as she can to reduce her tax bill. She considers using her $10,000 of unused concessional contributions cap space from 2018/19 to increase her concessional contributions cap from $25,000 to $35,000.

Managing a member’s total superannuation balance is going to become a standard element with regard to end-of-financial-year planning, particularly as catch-up concessional contributions come into play.

Rob Lavery

Her total superannuation balance as at 30 June 2019 was $502,000. Unfortunately this means she is unable to increase her concessional contribution cap using catch-up contributions as her total superannuation balance is above the $500,000 threshold. As such, she uses the full conventional cap of $25,000 in 2019/20.

In 2020/21, Ela makes a significant capital gain and is again looking to make as great a personal deductible contribution as she can. Her total superannuation balance as at 30 June 2020 has dropped to $497,000 due to poor investment performance. This is below the $500,000 threshold. Consequently, Ela can add her unused cap space of $10,000 from 2018/19 to her 2020/21 concessional contributions cap using the catch-up contributions provisions. This will allow her to make $35,000 in concessional contributions in 2020/21 without breaching her cap.

Managing the total superannuation balance

Managing a member’s total superannuation balance is going to become a standard element with regard to end-of-financial-year planning, particularly as catch-up concessional contributions come into play. As employees are able to claim deductions on personal contributions, increasing the maximum deduction available before triggering excess contributions will become increasingly important.

There are a number of different ways a member’s total superannuation balance can be managed. Two of the most common are making payments and contribution splitting.

Making payments

The simplest way to reduce a member’s total superannuation balance is to make additional payments from their super savings. There are a number of considerations to make when considering this approach. These include:

- access – the obvious initial consideration is whether the member is able to withdraw funds from the superannuation system. Those running income streams must have met a condition of release and, as such, should be able to make payments of some description. If the income stream is one from a transition-to-retirement strategy or non-commutable pension, they may be limited in the quantum of additional payments they can make. Similarly, members running only non-commutable income streams may also be restricted in their ability to reduce their total super balance,

- tax – any tax that will be payable on the additional withdrawal from super needs to be considered. For members over the age of 60 who plan to withdraw from a taxed fund, tax should be zero and hence not a hindrance to any withdrawal strategy, and

- any other fees and costs.

Contribution splitting

Partnered members who are close to the threshold may consider splitting their concessional contributions made in the previous financial year to their spouse. This may see their total super balance drop enough to use catch-up contributions without the funds leaving the super environment or the family unit.There are some issues with this strategy that should be considered, such as whether the member and their spouse are eligible to split contributions and the costs involved.

Planning ahead

While catch-up contributions cannot be used until next financial year, plans can be made now to help members use their concessional contributions cap when it will benefit them most. Eligible members can minimise their use of this year’s concessional cap in order to use it more effectively in a future year. Practically, this process will provide the greatest benefit where a member has a known spike in income in a future year.

Example

Naimh, 46, is employed as a part-time business analyst and earns $85,000 yearly. In 2018/19 and 2019/20 this puts Naimh in the 32.5 per cent tax bracket and her employer pays her $8075 in SG contributions. She visits her financial planner Erin in May 2019. Naimh has an investment property on the market which, when sold, is likely to result in a taxable capital gain of over $150,000. The sales process has been slow and she does not expect the property to sell until well into 2019/20.

Erin is helping Naimh to determine when she should make a personal deductible contribution to super to reduce her tax bill. If Naimh uses her full concessional cap in 2018/19 by making a personal deductible contribution of $16,925 this financial year, she will pay 15 per cent tax on the contribution as opposed to her marginal rate plus Medicare levy of 34.5 per cent. This will represent a tax saving of around $3300.

If Naimh makes no personal deductible contribution in 2018/19, but rolls her unused cap of $16,925 forward to 2019/20 under the catch-up contribution rules, assuming her total super balance is below $500,000, the income the deduction will reduce is likely to be in the top marginal bracket of 47 per cent (including Medicare levy) due to her large capital gain. The deduction will then result in a tax saving of $5416, that is, $2116 more than it would have in 2018/19.

The big picture

Practically speaking, catch-up concessional contributions will not be available until next financial year. That said, savvy planning in 2018/19 can help members maximise the value of their concessional contributions cap in future years. Clever management of their total superannuation balance may also open other opportunities that would otherwise be unavailable.