As the domestic exchange-traded fund market gains depth, Amanda Skelly takes us through how their use in portfolio construction is also evolving.

Exchange-traded funds (ETF) are a powerful and versatile investment tool, but they are best used to serve a broader business and investment strategy. In this article, we discuss the key areas successful advisers have considered when incorporating ETFs in their business. We also look at how to best leverage the benefits of active and passive management.

Five tips for effectively incorporating ETFs in a business

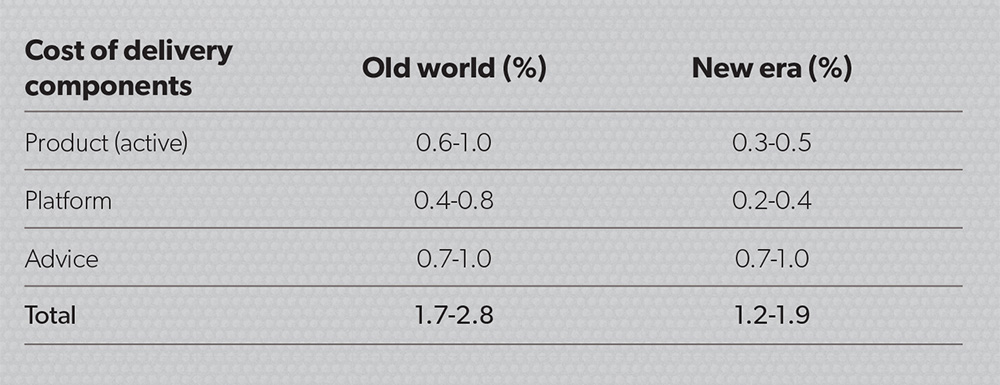

In conjunction with ETF expert Tim Bradbury of ETF Consulting, we have created the following tips for advisers considering using ETFs.

Table 1

1. Start with a clear investment and business rationale.

The advisers who use ETFs most effectively begin with a clear view on how they want to manage their business and their client portfolios, then determine how to use ETFs to support that approach.

Using a single ETF to bring investment costs down without understanding the broader business implications can result in difficult client conversations down the track.

For example:

- ETFs in Australia seek to deliver the performance of a particular index. Being clear with your client on your philosophy on active and passive management and the role of each in the investment portfolio can help in times where an active strategy performance has come under pressure.

- ETFs trade like direct shares, providing intraday liquidity. This feature is important for some advisers – particularly in times of market stress. For others it is less so. Understanding how to trade ETFs and any trading guidelines can be very valuable when explaining your philosophy to clients.

- ETFs are lower cost when compared to actively managed funds (see Table 2).

Table 2: Percentage of funds outperformed by the index.

How will you use any savings in investment cost from using ETFs? Where are you adding additional value for your clients? Or are you simply ensuring your current level of service be maintained without risk of having to increase fees dramatically due to additional compliance-related burdens?

2. Understand the key numbers for your business.

ETFs have the potential to radically change the cost structure of your business, providing significantly lower-cost access to a huge variety of asset classes and investment markets.

That’s important during this new era of investing where new technologies and changing client demands are driving increased margin pressure.

3. Consider the high-level numbers for a typical advice business as seen in Table 1.

For a balanced strategy targeting a return of consumer price index plus 3.5 per cent, the cost of delivery under an old world approach is around 30 per cent of the total pre-tax return.

That is no longer a viable business strategy for an adviser charging fee-for-service.

In contrast, ETFs offer considerable opportunity for margin and revenue consolidation, allowing advisers to deliver a high-quality product and platform for between 0.6 per cent and 0.8 per cent.

Consider the various ways you can use ETFs for your client’s investment strategy.

There are a variety of ways you can use ETFs within a client portfolio, but, as always, the strategy must come first. Here are some of the ways ETFs have been leveraged within an overall investment strategy:

- As a low-cost entry point for low-balance clients, allowing the advice practice to build the relationship and demonstrate the value of investing, with the flexibility to easily roll the investment into a wrap as the client’s wealth builds and their needs become more complex.

- As the core of client equity portfolios supplemented by direct equity holdings or investments through active Australian or international equity managers. Many advisers find this approach helps their clients better understand the investment process and improves the investment discussion.

- For precise and flexible asset allocation within bespoke portfolios for high net wealth clients particularly international holdings.

- To take tactical positions in equities easily and cost effectively, while keeping trading and administrative overheads to a minimum.

4. Understand primary and secondary markets

As advisers and investors trading on the Australian Securities Exchange, we only see the secondary ETF market.

So it’s important to understand that lying behind it is the primary market where market makers carry out the creation and redemption process giving ETFs their unique structure.

Because market makers can access deeper liquidity pools than are available on-exchange, they can minimise price slippage and create additional liquidity as required.

So, when a large order is placed on the exchange, a market maker can arrange to have additional ETFs created by selling or buying the fund’s holdings.

That means the liquidity of an ETF is always greater than the apparent market depth and average daily volume displayed on your trading screen. While your screen accurately represents the price of an ETF, it does not reflect the larger volumes that are available to be bought or sold.

It also means the bid/offer spread is usually very close to the weighted average sum of the spreads of the underlying securities, taking into account the price of the underlying holdings and any relevant currency fluctuations.

5. Choose the right trading and custody option for your business.

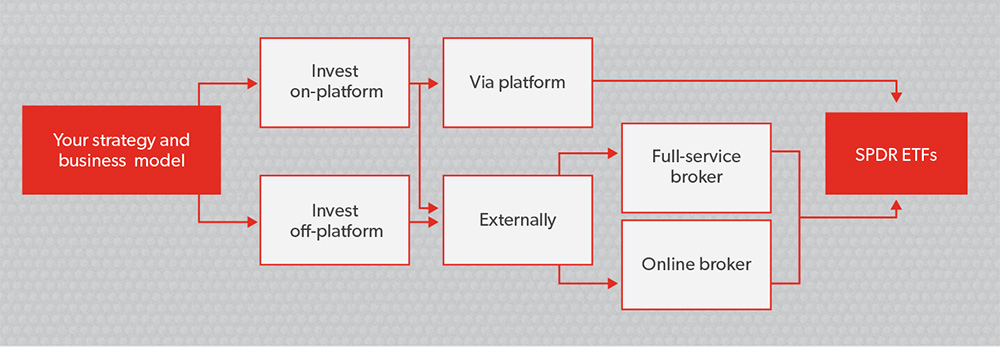

ETFs give you the flexibility to choose the trading and custody options that best suit your business model. Key questions to ask include:

Do I plan to hold the ETFs on or off platform, for example, within a wrap or as part of a direct equity portfolio?

If holding them on platform, do I want to trade through the platform or through an external broker before settling those trades back into the platform?

If holding them off platform, do I want to trade through an intermediary desk or a full-service advisory broker offering?

This is largely a function of cost and your level of comfort trading directly (see Chart 1).

Chart 1

Integrating the best of active and passive approaches

Australian investors and their advisers devote considerable time and energy to allocating investment capital between shares, property, cash and other asset classes, then selecting individual shares and other investments.

But while this high level of engagement is positive, it’s also important to ask whether active investment management always delivers the best outcome. Depending on a client’s individual situation and risk tolerance, choosing a passive approach for a portion of the portfolio could potentially help reduce investment costs, achieve higher returns and diversify more effectively into unfamiliar asset classes and regions.

Passive and active management are no longer mutually exclusive

Individual management style and investor time frame should influence passive versus active investment decisions. The lower cost of passive funds may make them more practical than active funds if you intend to move frequently in and out of positions with higher turnover strategies.

One factor that could point you to an active fund for a long-term buy-and-hold position is that while passive funds outperformed most active funds over the past several years, the longer-term rankings of each index relative to its active peer group illustrates that over longer time horizons, passive’s performance victory is not so clear cut across all asset classes.

Passive funds may serve well as a means to best augment longer-term positions with more tactical investment ideas, while active funds may be the best solution to take advantage of a successful manager when their approach is most in favour.

A continuing trend among advisers is the combination of beta through index funds in a portfolio’s core with the potential to add alpha in satellite positions. In many portfolios the vehicle of choice for the combination approach is increasingly becoming the ETF. Rather than use ETFs simply as a cost-effective alternative to actively managed funds, today’s savvy advisers have discovered advantages to using passive investing to access a wider set of market betas as a core holding.

Conversely, you can use the core and satellite and avoid style drift by placing active managers at the core and using ETFs as a means to gain access to more specific, timely exposures.

For example, consider how an adviser could augment an actively managed emerging markets equity fund with low-cost ETFs that provide exposure to global real estate investment trusts and developed international equities.

No longer simply a cost-effective alternative to active funds, ETFs can now serve as both a replacement and complement to active funds. How you should split a portfolio between passive and active management depends on a number of factors, including specific investment goals and tax circumstances, as well as one’s level of confidence when selecting active managers.

Whether your client’s goal is low-cost core exposure, quick and cost-effective rebalancing back to a strategic asset allocation or implementing tactical portfolio decisions, passive funds, including ETFs, can be an important and effective portfolio addition.

Seven ETF trading tips

- Take care when buying on the ASX open or close when spreads can be higher. Generally look to transact after 11am or before 3.30pm.

- Be aware of the trading hours of the underlying securities, especially for international ETFs. Aim to trade when the underlying markets are open, allowing market makers to apply up-to-date net asset values.

- Generally use limit orders to market orders to avoid price slippage.

- Beware trading on volatile days when bid/ask spreads can widen. Consider waiting until the market cools.

- When comparing similar ETFs, choose those with strong trading volumes and tighter spreads.

- Choose the execution method that best suits your business model.

- If in doubt, ask your issuers’ markets desk for help or speak directly to the market makers for large trades.