With Australia’s $500 billion in SMSF assets heavily weighted in favour of direct investments, and with less than 10 per cent in managed funds, there exists a possible risk to retirement savings and security. Wes Gillett reports on how the funds management and platform industries can respond to provide better solutions for SMSFs.

To understand the current bias toward direct assets, it helps to remind ourselves about why the SMSF market has grown to the point it now represents almost one-third of retirement assets in this country.

There are a few key perceived benefits provided by these stand-alone funds. The emphasis is on ‘perceived’, given there are arguments to be made around lack of understanding and information that lead to some of those views. That said, the SMSF structure is one that is flourishing and rather than resist it, the financial services industry is best positioned to support trustees with better information and investment solutions to help them meet their retirement goals.

Costs

The most often heard reason SMSF trustees give for their existence is the cost of retail super funds and/or the managed funds they have invested in via platforms. There is some historical basis to this, but the widespread access to wholesale managed funds on platforms whose administration fees have reduced by around 50 per cent in the past few years, plus the extension of cheap industry offerings, has largely mitigated this reason. Yet, very little narrative surrounds the total cost to an SMSF trustee when accounting, legal and administrative costs are added to the mix. The debate generally focuses on ‘how much is enough’ to justify the existence of a stand-alone fund, presumably as an SMSF, due to these mainly fixed costs. Advice fees are sometimes cited as another reason for escaping to the self-driven world, but we all know the positive effect of good advice, and many studies exist to prove how poor market timing decisions by uneducated investors have had catastrophic long-term effects on wealth.

Control

There is certainly a degree of transparency and granularity about a parcel of shares a managed fund cannot hope to replicate, and it’s fair say directly held assets shine in this space. Investors can, and frequently do, point to a lack of clarity and understanding in manager decision-making that has exposed them to more risk than they realised. Advice givers understand the benefit of managing expectations and educating clients, though traditional managed product structures have not delivered the necessary transparency. As an aside, the historical practice of just picking an array of managed funds often results in excessive exposure to specific industries or stocks due to the homogeneity in the portfolios of many large-cap funds. Well-informed investors and their accountants have realised the frailties in lazy portfolio construction and perhaps use this to justify taking control of their investment decisions.

More choice

Many SMSF trustees cite their ability to invest in real assets unavailable through retail funds/platforms as a major benefit. This is a fair argument, and one the managed product industry is not structurally set up to counter. Direct property has been a key driver and regulators have focused on sole purpose provisions to ensure these lumpy assets are held for the right reasons. Even so, direct property funds and new fractional property offerings do not address the emotional aspects of solely owning bricks and mortar in or out of an SMSF. The looming risk of removal of the ability of an SMSF to hold geared property may lower the exposure to those assets, but only time will tell.

Tax and income

Accountants regularly argue the ability to exercise more control over tax and access to tax-effective dividends are key reasons to hold assets directly through an SMSF. There is no real way for fund managers to counter this with traditional pooled product structures with their embedded tax management. Franked dividends from investing directly in some of Australia’s largest companies are a compelling and very transparent benefit managed funds offer in a less obvious or tangible way.

So, given the realities of these issues, does it make sense to remain wedded, unwaveringly, to traditional managed product structures’ applicability to SMSFs? Should we, as industry participants, now embrace the reality of the new direct world, while focusing on resolving the inherent vulnerabilities and weaknesses represented by these assets and how they are deployed?

What about portfolio risk?

The landmark 1986 study by Brinson, Hood and Beebower of United States pension funds underscored the effect on returns of asset allocation versus individual stock picking in a properly diversified portfolio. This and subsequent studies consistently find that over 90 per cent of portfolio performance is related to asset allocation rather than stock selection.

One of the key risks endemic to SMSF asset mix is a lack of strong portfolio construction and a well-articulated asset allocation strategy. This clearly poses a real risk to fund members and it is incumbent on advice givers to educate current or prospective clients and their accountants on the additional risk this may present.

Managed investments, while massively under-represented in SMSF assets, do provide genuine diversification and are controlled, in the main, by specialists in either asset management and/or portfolio construction. But continuing to bang the drum of the benefits of traditional managed funds over direct assets may not help in overcoming those four key arguments above in any material way.

Given these key SMSF drivers, it is no surprise managed portfolios and separately managed accounts are now getting much more attention due to the way they deliver most of the benefits of direct and managed investing in the one structure.

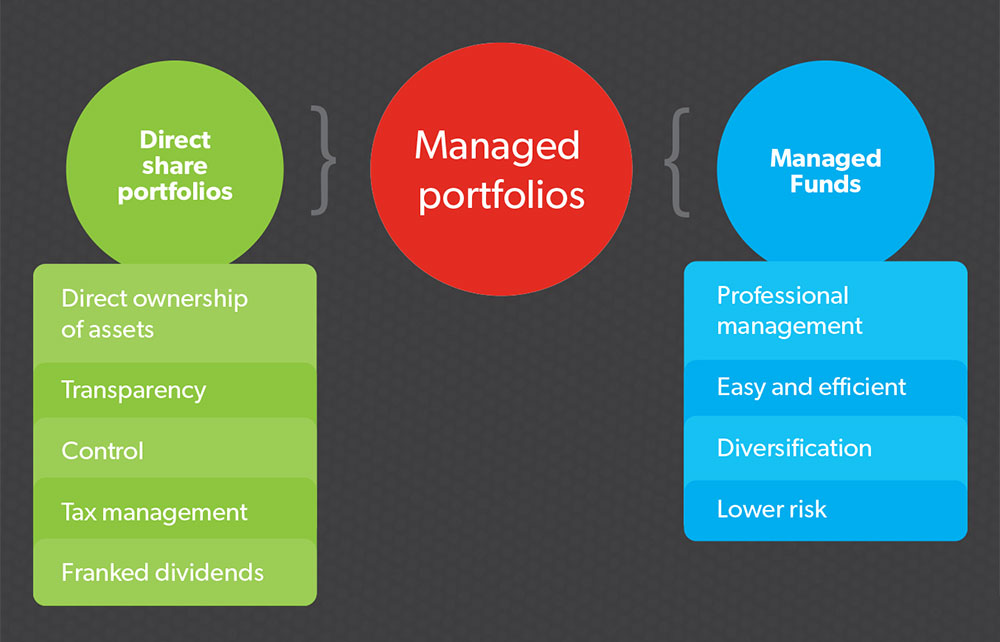

Managed portfolios of direct assets can provide all the identified benefits of direct equity investments, such as direct asset ownership, lower transaction costs, control, transparency and tax-effective income. Importantly, they provide the additional benefits of traditional managed products, such as professional portfolio management, easy administration and lower risk through diversification (Figure 1).

One of the main reasons these product structures are now getting so much attention is that platform technology has now advanced to the point that direct portfolios of assets can be deployed as efficiently as, and alongside, traditional products, such as managed funds and individual stocks.

Using managed portfolios, advisers can now more adequately fulfil the needs of direct investment-biased clients with efficiency and cost effectiveness. Products and services previously only offered by broking houses or high-end private client groups are now accessible to everyone.

Figure 1

Where can the advice industry add value to SMSF trustees?

If the advice industry is to satisfy the core needs of the burgeoning SMSF market, it must continually reinvent the range of products and services it deploys. The rise of this increasingly self-directed segment can and will continue to look for better ways to meet its investment objectives. The first and possibly most critical issue is to redress the asset mix imbalance that currently exists in many SMSFs that do not have a diversified investment strategy. Education around the meaning of risk and volatility is a never-ending process advisers are uniquely positioned to provide.

One of the biggest issues the advice industry continually faces is to ensure their clients are not buying and selling assets at precisely the wrong time. We are well around the continual tug-of-war many investors face between fear and greed, which causes them to purchase growth assets near the top of the market, then exit after a correction. There are manifold studies showing how self-directed investors often enjoy poor returns on their portfolios largely as a result of this phenomenon. That said, we are not saying ‘self-driven’ and ‘advised’ strategies are mutually exclusive.

The importance of appropriate asset allocation cannot be overstated. As advice givers, we are well aware of the changing dynamic around how asset allocation is managed at the individual client and portfolio level. Our industry has come a long way in decrying the notion of strategic asset allocation (SAA) in favour of dynamic or tactical asset allocation.

We now understand risk appetite is not static and that our clients are increasingly looking for managers to dial risk up and down depending on market fundamentals (if not their own circumstances). Similarly, advisers whose value proposition is based around portfolio construction are under pressure to take more active bets on risk and market movement, especially subsequent to the global financial crisis. The old adage of “you can’t time the market” is giving way to a more dynamic approach to asset allocation.

Investors will look to advice givers to help them better execute this dynamic approach to risk. At an elementary level, technology must be deployed to ensure costs are minimised and efficiency maintained for both practitioners and investors. Transaction and administration costs can potentially increase significantly in a dynamic environment, and hence the right technology is key to keeping a lid on this.

Technologies are already emerging that enable investors and advisers to work in concert, with increasing flexibility to shift the locus of control over investing from the adviser toward the investor, but not necessarily completely.

Good technology should enable SMSF trustees and other investors to fulfil investment needs and also access professional advice at specific points in time to validate or support their own efforts. This is clearly in deference to the traditional holistic advice model the industry has been built around. In this regard, technology providers need to respond to this changing dynamic.

In short, the value traditionally provided by platforms to advice practitioners will most likely need to metamorphose into more directly supporting the needs of investors to do more than just generate static reporting. These key technologies could feasibly develop portfolio construction, modelling and transaction capability aimed at investors, though in parallel with advisers. This will enable a more flexible relationship between adviser and client as needs and circumstances dictate.

One final thought is around how advisers add value to direct stock investors. The “Investment Trends – Planner Direct Equities and SMSF Report 2015” has highlighted some fundamental issues with the ease of administration of direct stocks, the accessibility of easily understood research, and management of corporate actions. Clearly platforms are well positioned to respond to these concerns for adviser and investor alike, and may serve to stem the attraction of low-cost online brokers.

Platforms are becoming more relevant to the self-directed and broker market by increasingly integrating non-custodial assets with those held in custody by the platform. Advisers have an increasing number of tools to better support assets on and off platforms, and in time these tools may well assist clients to move toward better portfolio management disciplines on the back of good advice.

Wes Gillett is head of marketing and distribution at Hub24.