The returns for the year ended 28 February 2018 have had a significant impact on SMSF portfolios heavily invested in local shares, regardless of whether this was driven by the search for capital growth or income, as well as those funds with a significant allocation to residential property.

I have provided a short commentary on each subject beginning with the experience for portfolios with a bias toward growth stocks listed on the Australian Securities Exchange (ASX).

"Residential property prices in Melbourne and Sydney have come off, resulting in the continuing trend of reducing annual returns for our SMSF P1 portfolio when looking at rolling 12-month periods."

Nick Shugg

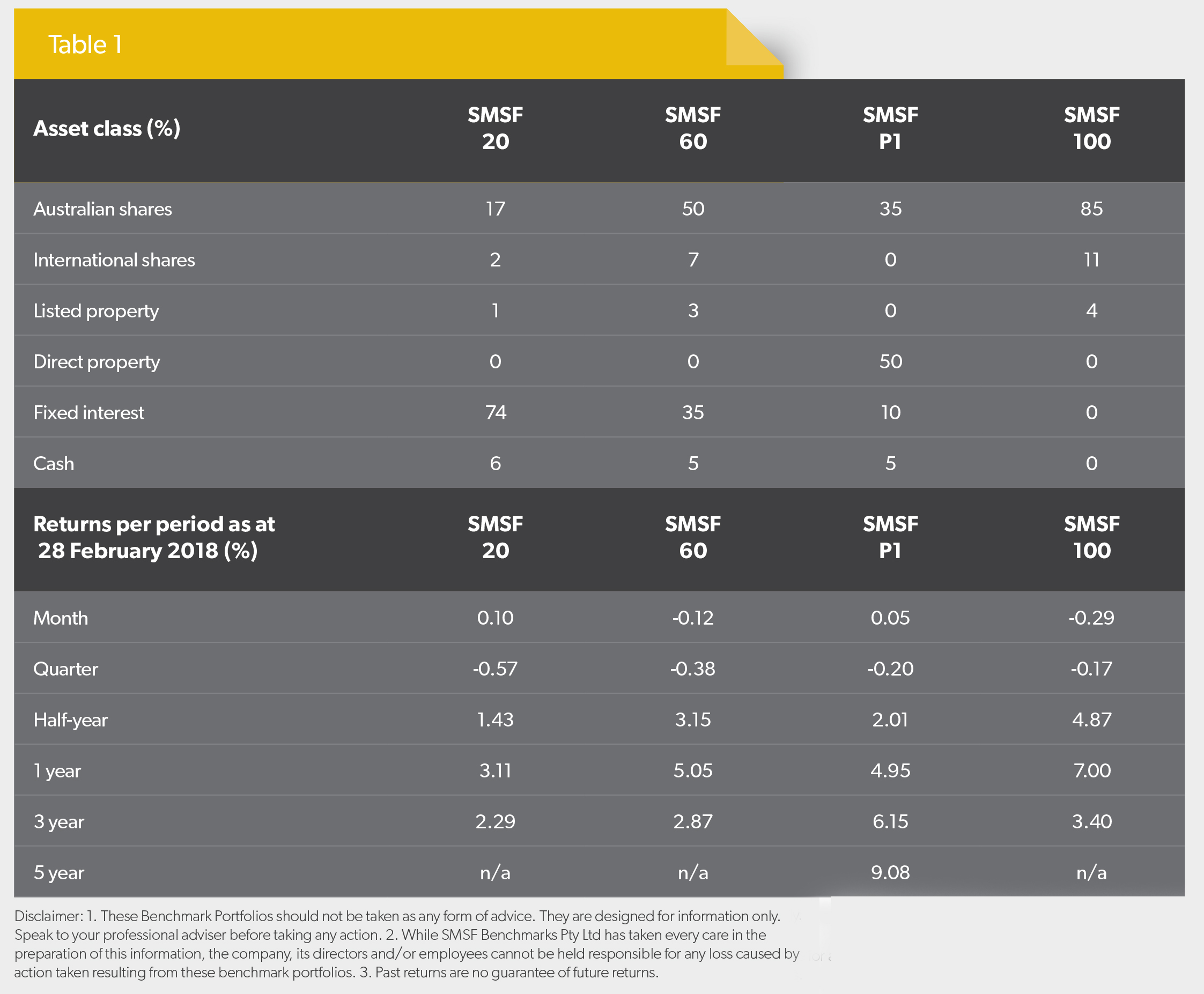

Our SMSF 100 portfolio, which has 85 per cent of its holdings in Australian shares, 11 per cent in international stocks and the remaining 4 per cent in listed property, would typically have had a lower 12-month return to the end of February 2018 than the return to the end of January 2018. This was mainly driven by the fact the ‘sub-asset class’ of high-yield Australian shares had a return of 9.35 per cent to 31 January, but only delivered a return of 5.56 per cent for the 12 months ended 28 February.

Residential property prices in Melbourne and Sydney have come off, resulting in the continuing trend of reducing annual returns for our SMSF P1 portfolio when looking at rolling 12-month periods. This comparative portfolio incorporates a 50 per cent allocation to direct property with a further 35 per cent allocated to Australian equities, another 10 per cent allocated to fixed income and the remaining 5 per cent placed in cash. Over the past year, SMSFs with no direct property are likely to have outperformed SMSFs with direct property, although the three-year returns are still higher for SMSF P1.

Any SMSF investments in Australian shares may well have underperformed larger Australian Prudential Regulation Authority (APRA)-regulated funds during the full year ending 28 February 2018. This is mainly due to the preference they have towards high-yield shares and a lack of exposure to smaller domestic companies, which delivered a 12-month return of 19.6 per cent, and Australian resource companies, which generated a return of 23.52 per cent over the same period.

The typical home-country stock bias exhibited by SMSF portfolios is another factor that would have resulted in underperformance when compared to their APRA-regulated counterparts. A higher exposure to global equities would have meant greater access to the strong returns from overseas markets such as the United States, which witnessed an increase in returns for the year ended 28 February of 15.17 per cent, and the jump in emerging markets that saw Asia excluding Japan returns up 33.08 per cent for the same period.