Estate planning is an aspect of SMSF advice that has renewed relevance since the super reforms were introduced. While certain matters remain under discussion, Jemma Sanderson takes a look at the items requiring consideration now.

Following on from the article a year ago (“Death Benefit Anomaly” in selfmanagedsuper Issue 018), the position regarding the treatment of superannuation benefits when a member passes away under the Fair and Sustainable Superannuation provisions hasn’t changed.

Although the author is of the view there is an anomaly between the Superannuation Industry (Supervision) Regulations 1994 and the Income Tax Assessment Act 1997 that could result in our estate planning strategies not being entirely thwarted by the new provisions, the ability to have this anomaly reviewed and accepted by the regulators of superannuation in Australia is limited currently. However, as indicated at the concurrent session at the SMSF Association National Conference on 15 February, the association and members of the industry will be looking to make appropriate submissions to the relevant authorities (Treasury, Minister, ATO) on the issue, with the aim of some action on and confirmation of the contentiousness addressed.

In the meantime, where to from here?

The landscape for death benefits has changed since 1 July 2017 and it is even more important to get it right given these parameters:

1. A surviving spouse is only able to have one transfer balance cap (TBC) and not also retain that of the deceased.

2. Where a pension is reversionary, the survivor has 12 months to consider their own affairs before the reversionary pension balance is assessed towards their own TBC.

3. Where a pension is not reversionary, the survivor needs to deal with it as soon as practicable, which could also be 12 months.

4. The transfer balance credit of the pension for the survivor will be different, depending on whether the pension was reversionary or not.

5. Generally, the survivor will roll back their own pension account to accumulation prior to the deceased’s account being assessed towards their TBC.

6. The accumulation benefits of the deceased (where they already have a pension up to their TBC) will need to be paid out of the superannuation environment, as well as any pension amount of the deceased in excess of the survivor’s own TBC.

7. The content of any documentation within a superannuation fund regarding the destination of those payments is incredibly important:Is it binding on the trustee?

a. Is the beneficiary eligible to receive the payment?

b. Is the beneficiary eligible to receive the payment?

c. What are the taxation implications?

d. Which assets are to be transferred?

e. Are there any stamp duty implications?

f. What occurs after the transfer of the benefits to the beneficiary or the estate with regard to:

i. taxation of income to the beneficiary,

ii. taxation of income via the estate or testamentary trust,

iii. transfer of assets to a subsequent structure (stamp duty)?

g. Who is in control?

In recent times with the new provisions, particularly in light of the substantial transfer of wealth, and the prevalence of blended families, concerns with respect to estate planning and superannuation include:

1. Ensuring the pension and overall superannuation position for the survivor is optimised:

a. What is the TBC position of each spouse?

b. Does the pension need to be made reversionary?

c. How can that occur (if not already) without potential taxation component implications?

d. If the pension is not reversionary, are there substantial adverse implications upon death?

2. Ensuring that the benefits pass to those intended:

a. Is there a binding death benefit nomination (BDBN) (or equivalent)?

b. Is it actually valid and binding?

c. Who controls who receives a benefit?

d. If the benefits are paid to the estate, where are they directed to from there?

3. What are the taxation implications?

a. Payment to the survivor – tax-free.

b. Payment to adult children – taxation on the taxable component.

c. Payment to the estate – taxable to the extent it benefits non-dependants.

4. What assets might need to be exited from the fund when one member passes away?

a. What are the stamp duty implications?

b. What are the implications via the estate or directly to the beneficiary?

5. Where to next for the beneficiary when they have the asset?

a. What will their personal tax position be?

b. Has their position regarding asset protection and estate planning been considered?

There are many more questions arising given the new rules, and therefore the estate planning arrangements for many clients need to be reviewed in detail and the above addressed.

For example

As at 30 June 2017, Don, 62, restructured his pensions such that he had $1.6 million in retirement phase (Table 1). Don’s wife, Mel, 60, commenced her own retirement-phase pension on 1 July 2018 when she retired (Table 2). All of Don and Mel’s wealth is in super, aside from their home, which is owned as joint tenants. Don’s pensions were always set up to revert to Mel so all the money could stay in super for her benefit if he passed away. He has a BDBN in place that stipulates his benefits are to be paid to his estate. Don’s will was last updated when he set up his pensions within the fund back in 2009, so his residual estate pays equally to his five children on the basis everything would revert to Mel within the SMSF. As at 30 June 2023, Don and Mel’s pension benefits are as in Table 3. The accumulation benefits are as in Table 4 as at 30 June 2023. Don dies.

Pension accounts

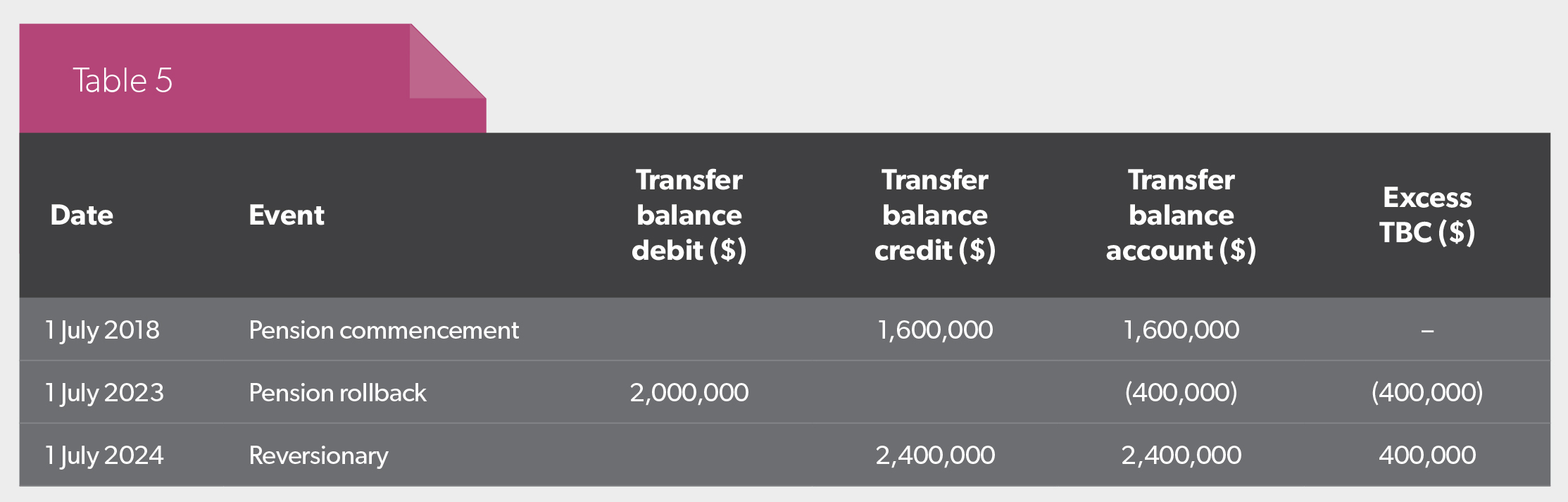

Mel has 12 months to deal with the pension position within the fund before there are TBC implications. A year after his death, she commutes her own pension, rolling it back to the accumulation phase. Her transfer balance account would therefore be as in Table 5.

With the rollback/commutation of her own pension account, Mel would be able to receive up to $2 million of Don’s pensions without having an excess TBC. Therefore, of the $2.4 million in his pension accounts, she would generally have to receive $400,000 as a lump sum death benefit to remain within her own TBC.

Accumulation

Don’s $7.65 million accumulation account needs to be paid out of super. This needs to occur as soon as practicably possible. In total, $8.05 million will be exiting super.

In this regard:

1. As the reversionary beneficiary, the $400,000 excess TBC from Don’s pensions can be paid directly to Mel as is her entitlement. There will be no lump sum tax payable on this payment to her.

2. With the accumulation, on the basis that the BDBN is indeed binding, Mel is required to pay the $7.65 million to Don’s estate.

3. The will then determines who receives the benefit.

4. This would be the children, equally.

5. As non-death benefits dependants, there will be tax payable on the taxable component, which is 15 per cent on $7.15 million or $1.0725 million.

6. This above tax position could be mitigated, where the benefits were either paid to Mel, or paid to the estate and a testamentary trust set up for Mel’s benefit.

7. If the intention is that the children receive the money, then paying to Mel may achieve a superior tax outcome, however, then the money is hers, to do with as she desires.

8. Further, the above doesn’t factor in consideration for the assets to be transferred:

a. What if there was property?

i. Stamp duty implications, depending on the state and also depending on where the ultimate destination of where the property is desired to end up.

ii. Do the kids want to receive directly and be subject to tax on the ongoing income, given restructuring would likely give rise to stamp duty (depends on the state)?

iii. Were there particular beneficiaries who may wish to keep the property as it is used in their business?

b. What is the capital gains tax (CGT) impact on the transfer of assets at the fund level? CGT cost base reset may well have occurred at 30 June 2017, however:

i. What has been the appreciation since then? Fifty per cent from the values.

ii. What is the exempt current pension income proportion in the SMSF in the year everything is dealt with?

A. Could be different years, so different proportions, as the accumulation needs to be dealt with as soon as practicable, so whether that is in the 2024 financial year or later.

B. Conveniently Don dies on 1 July, but that is not typical.

iii. Were there any deferred gains that will now arise from the transfer of assets out of the fund and then ensuring they are dealt with correctly.

iv. Which assets might Mel wish to retain in the fund?

Again, the above is not an exhaustive list of areas to consider for clients in this new estate planning landscape with their super. Invariably, there are other structures involved, and particularly where blended families are in the mix, the above is even more important to get right and to consider the current and future implications.

Action required

The treatment of super death benefits given the new TBC provisions is an area where ongoing review, guidance and advice to clients will be paramount, and debate will arise as to the most appropriate outcome. As in all cases, the ultimate outcome will depend on the circumstances, which is why it pays to review any arrangements for clients now. In light of the above issues and considerations, it pays to exercise care when advising in this area in order to consider all of the required issues, and always follow the mantras: read the deed and seek professional advice.