Providing advice for SMSF clients is becoming increasingly attractive for financial services professionals. In this two-part series, GRANT ABBOTT highlights the critical ingredients needed to construct a successful SMSF advisory business.

You have to love superannuation and for those who love a challenge that involves strategy building, making big changes to clients’ financial and family affairs and creating a business, then SMSFs are an absolute blessing and have been since their birth in 1994.

However, SMSF advice was not always regarded as the great opportunity it is today. In 1994, I began talking about SMSFs at professional development days for accountants and financial planners and telling anyone who would listen that SMSFs were here to stay and were a great tax, savings and retirement vehicle. Despite my enthusiasm and passion, which still stand today, not too many professionals listened. There were virtually no SMSF assets in those days ($11 billion) and they were primitive in structure. Further, the superannuation guarantee (SG) had only just been introduced and with preservation and reasonable benefit limits, there was not much incentive to lock away money in super as negative gearing, agribusiness investments, family trusts and infrastructure bonds seemed a lot easier. But having come from a background of superannuation and taxation law and having advised large managed funds and super funds, it was obvious the shift to SMSFs had to happen.

Things jumped a few steps when a few fledgling SMSF participants, including the Australian Taxation Office (ATO), got together in 2001 and established the SMSF Professionals’ Association of Australia and SMSF professionals had a profile. Also, the tech wreck crash in 2001 resulted in many baby boomers with reasonable balances in retail super losing money and deciding it was time to do it themselves.

Another kick upwards came in 2004 when the Financial Services Reform Act required financial planners providing SMSF advice to be licensed, show their competency and have general SMSF training skills, while a licensing exemption was set in place for accountants advising on SMSFs. This resulted in accountants only advising on SMSFs and not retail or industry super, and has probably been the most significant legislative change to promote the growth of the SMSF industry.

In recent years, the global financial crisis has added the icing on the cake and now SMSFs are no longer the quaint cousins who are ignored, but mainstream and in front of the rest of the pack. And the best is yet to come with accountants’ licensing and generations X and Y pushing their way into SMSFs.

But here is the sad fact. In all this time, in the nearly two decades SMSFs have been around growing at 20 per cent a year, there have been very few accountants or financial planners who have built a strong, sustainable SMSF advisory business earning in excess of $41 million in yearly fees. Admittedly a lot of accountants have got great administration businesses, but SMSF administration is one small cog in an SMSF strategic advice business with several hundred thousand dollars of yearly fees on the table. And that is a tragedy in a sector that alone has assets of almost $500 billion.

So I want to give you my view on how to create a strong SMSF advisory business. This is a view from someone who has been in the SMSF game for 20 years and run a number of SMSF businesses, and has seen a number of accountants and financial planners use the following recommendations to develop $1 million-plus SMSF businesses.

But building an SMSF business is not for everyone. The heart must have an entrepreneurial flame and a desire to do things differently, as an SMSF business is very different from a planning or accounting practice. It also requires commitment and most of all the two biggest commodities many financial services businesses don’t have: an SMSF focus and being able to dedicate time to SMSFs – every day in the early stages of the business.

The future of SMSFs means guaranteed success

I am going to give you my first big secret in making a success of any business. Be involved in a business that grows in a recession, takes off in boom times and constantly changes so that your services will always be needed and can’t be outsourced offshore or overtaken by technology. In Australian business, apart from super, is there any other line of business that has managed to meet these criteria. So if you find that business, you are set for a lengthy and prosperous business life, provided it is carried out with purpose and a plan.

One tip that is especially useful for advisers and accountants under the age of 50 is to read Deloitte’s “Dynamics of the Australian Superannuation System – the next 20 years: 2011-2030”, published in 2011. It is the report on super and provides a railroad track for all of us to follow. I have been using Deloitte statistics for building all of my SMSF businesses since the mid-1990s and what I love is that they always underestimate where SMSFs are going to be at any point in time. For those too lazy to do the research, here are three of the most important facts for you to know:

- SMSF assets are projected to be $2 trillion by 2030, but will grow considerably higher if there is an increase in concessional contribution caps. That is a 300 per cent increase in 17 years or just under a generation.

- By 2030, the Australian superannuation system will be worth $6.2 trillion, with $3.4 trillion being controlled by generation X (those born between 1964 and 1982).

- By 2030, SMSF advice fees will reach $37.5 billion compared to retail and industry fund advice fees of $8 billion.

If you are a gen X or gen Y SMSF adviser or accountant, SMSFs provide a gilt-edged career for life or better still a specialised boutique business option within the next five years to reap real business success provided you have a strong business model.

Below are some critical factors to consider.

Strategy is crucial to long-term success

Strategy is a plan of action with the desire to bring about a certain course of events. In terms of SMSFs, it is a plan of action that will result in the optimal achievement of a client’s long-term financial desires. With lump sums and pensions tax free post age 60, removing tax from the strategy equation means achieving a client’s desires with an SMSF is much easier than a family trust, company or any other structure. In all respects, particularly for those close to retirement, an SMSF is strategically superior to any other superannuation fund or even family trust for that matter due to the range of options and control afforded to trustees of the fund and their advisers.

But there is good, bad and great strategy, with the difference being the mind, knowledge and skills of the person who created it. My goal has always been to spend time researching, learning, reading and immersing myself in SMSF knowledge, and the application of knowledge and the law to client circumstances. The more I learned, the more I wrote, the more I applied, the better my SMSF strategies. Irrespective of whether the market goes up or down, my SMSF strategic skills will continue to grow.

If the government makes a change to SMSFs, as it always will, then I am being provided with another opportunity to enhance and build my strategic skills. The beauty of developing your mind to build the best SMSF strategies possible is that you are creating and developing something that is uniquely yours. No-one can take it away from you; it is a capital asset. It is not dependent upon exterior factors and is something you can grow or let die, should you so choose.

The bigger and more elegant the SMSF strategy, the better the reward. If I can devise a great SMSF estate plan for a client with $2 million in SMSF assets, then I deserve to be appropriately remunerated. And I have seen a number of successful and current SMSF advisers charging beyond $30,000 for a strategy, particularly if backed by a private ruling.

Over the past 15 years there have been many new entrants and experienced accountants in the SMSF advising industry who have asked me the best way to build a good SMSF advice business. My answer has not changed and will not change.

Focus on strategy; be an expert by investing in yourself with SMSF education and building your repertoire of strategies. Then go out and build the number of clients you have in the $1 million-plus market or the potential to get there in a decade or so, provide them with a strong SMSF advising platform covering compliance, restructuring, SMSF estate planning, incapacity and how to build a multi-generational fund. Find out all about their family, build a family SMSF and build their trust. Charge appropriate fees for all advice – ensure each fund has sufficient insurance for all members for death and incapacity plus a strong and secure SMSF estate plan. If required, look after their investments, but that should never be the focus because if the market turns, then client trust is lost despite your SMSF strategic brilliance.

At every turn there is an opportunity

This has stood me in good stead with SMSFs and with the ongoing ability for a new generation to come into play with SMSFs, never have there been more opportunities just waiting to be taken. SMSFs currently stand at $480 billion, according to the latest ATO statistics, with the largest asset class being cash, equities making a comeback and property on the rise. The next five to 10 years, provided your SMSF business model and plan is sound and well executed, will provide not only great opportunities but guaranteed business success. Personally I am more excited about SMSFs than I ever have been.

SMSF business model

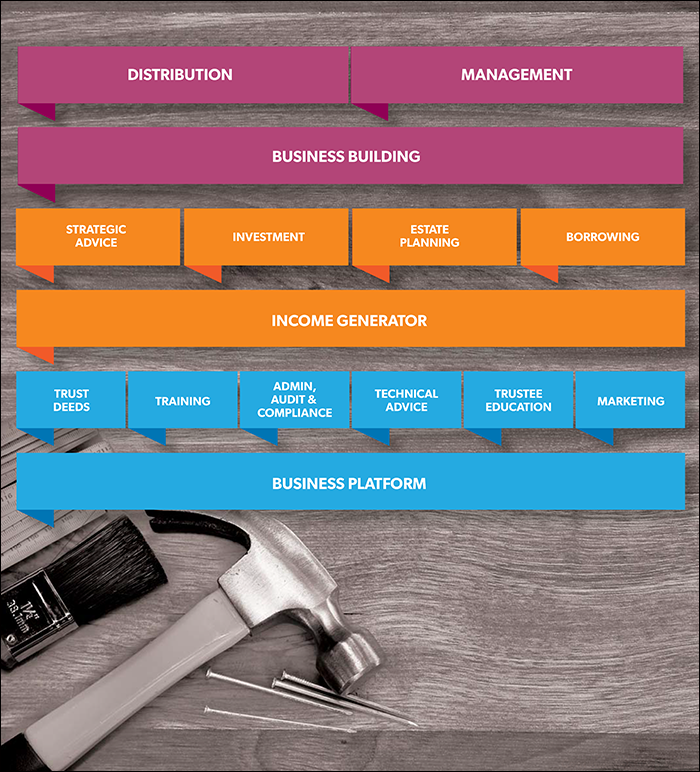

The SMSF business model in diagram one is a model I designed in 1999 from years of observation of accounting businesses that have developed a successful SMSF business or division. It is also a high-end business generating strong revenues and is not reliant on investment advice, as many financial planners have found is not the way to gain and retain SMSF clients.

The business platform is the driver of the revenue model. In part two of this article, I will consider each part of the SMSF business model and how to put all the parts into place to create a strong business.

Figure 1: SMSF business model