SMSFs with property investments in New South Wales face the additional liability of land tax. Michael Hallinan provides an insight into the intricacies of this levy.

Any SMSF that owns real estate in NSW or has entered into a limited recourse borrowing arrangement (LRBA) where the acquired property is NSW real estate will be affected by NSW land tax.

Because land tax is levied at progressive rates on each taxpayers total land interests, the issue of attribution through entities is paramount.

Land tax overview

In broad terms, NSW land tax is levied on owners of NSW real estate being freehold land. For this purpose, ownership means being the legal owner of the land (that is, the registered proprietor) or being the actual or deemed equitable owner of land.

Tax is levied on the aggregate taxable value of all ownership interests held by the taxpayer on 31 December. Consequently, land tax liability in respect of 2015 is determined by ownership interests at 31 December 2014.

The current rates are 1.6 per cent (standard rate) and 2 per cent (premium rate) plus $100. Additionally, some (but not all) taxpayers are entitled to a zero rate threshold.

Application to SMSFs

In relation to SMSFs, there are five key issues. Firstly, whether the land owned by the SMSF is entitled to an exemption.

Secondly, whether the SMSF is entitled to the land tax threshold (no tax being payable in respect of the first $432,000 of taxable value). Thirdly, how land tax applies to land held by a holding trust under an LRBA.

Fourthly, how tax applies to land held in a unit trust that qualifies as a Superannuation Industry (Supervision) (SIS) Regulation 13.22C unit trust. And finally, whether ownership interests of the SMSF are attributed to the members of the SMSF.

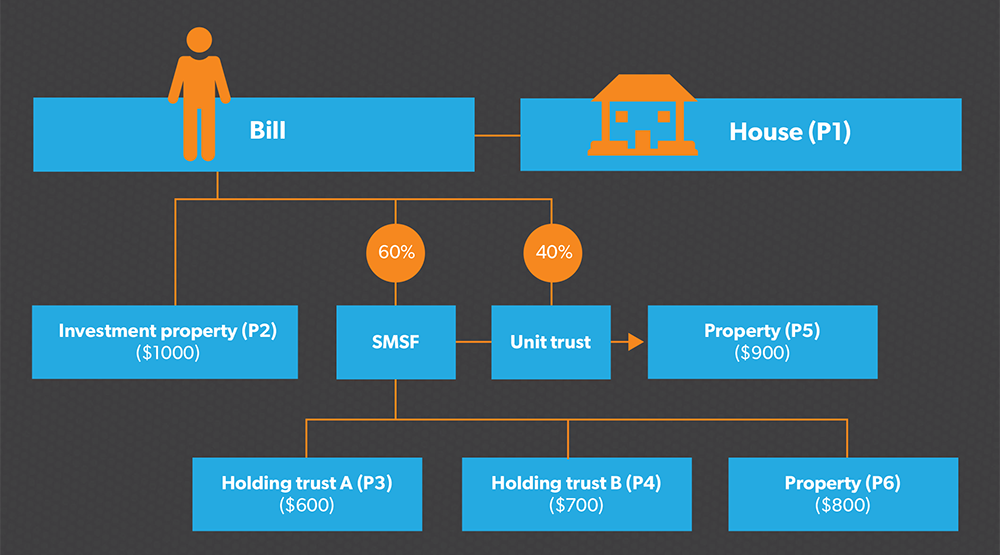

These issues will be considered in the following situation (see Figure 1). In this diagram, Parcel 1 is the home of Bill and all other parcels of land are commercial or residential property.

Bill owns a house (P1) and an investment property (P2). He is the sole member of an SMSF and sole director of the corporate trustee of the SMSF. Bill also holds 40 per cent of the units of the unit trust. The SMSF has entered into two LRBAs – Holding Trust A (acquired property is P3) and Holding Trust B (acquired property is P4). The SMSF holds 60 per cent of the units in a Regulation 13.22C unit trust, which owns property P5. Additionally, the SMSF owns a property (P6). The land values of each of the properties are set out in the diagram (thousand dollars).

In this diagram there are five land tax payers: Bill, the trustee of the SMSF, the trustee of holding trust A, the trustee of holding trust B and the trustee of the unit trust.

Figure 1

Land tax treatment of the holding trusts

The two holding trusts will each have the same land tax treatment. Consequently, only holding trust A will be considered in detail.

The trustee of holding trust A is the owner of a parcel of land (being Parcel 3) as it is the registered proprietor of Parcel 3. The trustee of the SMSF is also treated as being an owner of Parcel 3 by reason that it is the equitable owner of the parcel.

Bill is not treated as being an equitable owner of Parcel 3 and the deemed ownership rules do not apply to Bill (as the SMSF is not a fixed trust for land tax purposes, Bill cannot be treated as being the deemed equitable owner of Parcel 3).

Assuming Parcel 3 is not exempt from land tax, a primary land tax assessment will be issued to the trustee of Holding Trust A. Before the land tax liability can be determined, tw o initial issues must be considered.

he first is whether an exemption from land tax applies to Parcel 3. The second is whether the trustee is entitled to the land tax threshold (effectively a zero rate on the first $432,000 of taxable value).

The application of the land tax threshold effectively reduces the land tax assessment by $6912 (being 1.6 per cent of $432,000).

For private sector land owners the main exemptions from land tax are the primary production exemption and the principal place of residence exemption. As Parcel 3 is commercial real estate, neither exemption applies.

The land tax threshold applies to complying superannuation funds and also applies to trusts (referred to in the land tax legislation as ‘fixed trust’) where the beneficiary or beneficiaries of the trust are or are treated as being the equitable owners of the land. In the case of Holding Trust A, the sole beneficiary is the SMSF trustee and the SMSF trustee (because it is absolutely entitled to Parcel 3) is treated as being the equitable owner of Parcel 3.

Consequently, the trustee of Holding Trust A will be entitled to the land tax threshold.

The land tax assessment for the trustee of Holding Trust A will be $2788 ($100 plus 1.6 per cent of the excess of the land value – $600,000 – over the threshold amount, which for 2015 is $432,000). As the land value of Parcel 3 is only $600,000, the premium land tax rate of 2 per cent is not relevant (the premium rate is only relevant if the land value exceeds $2.641 million for 2015).

In relation to Parcel 3, the trustee of the SMSF will be treated as being the equitable owner of the parcel. Consequently, in the land tax assessment of the SMSF, the land value of Parcel 3 will be included.

A similar analysis applies to the trustee of Holding Trust B. In this case, as Parcel 4 has a land value of $700,000, the land tax assessment for the trustee of Holding Trust B will be $4388 (calculated as $100 plus 1.6 per cent of the excess of the land value – $700,000 – over the threshold amount of $432,000).

Land tax treatment of the unit trust

The land tax treatment of the unit trust depends on whether the unit trust is treated as a fixed trust for land tax purposes. If so, the trustee of the unit trust will be entitled to the land tax threshold.

If not, then the trustee of the unit trust will not be entitled to the threshold.

While the unit trust satisfies the requirements of SIS Regulation 13.22C, this of itself does not mean the unit trust will be a fixed trust for land tax purposes.

For a unit trust to be treated as being a fixed trust, the unit trust must satisfy the relevant criteria, which is set out in section 3A(3B) of the Land Tax Management Act.

The relevant criteria are that the trust deed must specifically provide that:

- the unit holders are presently entitled to the income of the trust (subject only to the payment of proper trust expenses),

- the unit holders are presently entitled to the capital of the trust,

- the unit holders may require the trustee to wind up the trust and distribute the trust property or the net proceeds of the trust property,

- the above entitlements of the unit holders cannot be removed, restricted or otherwise affected by the exercise of any discretion or failure to exercise any discretion conferred by any person by the trust deed,

- there can only be one class of unit issued, and

- the proportion of trust capital to which a unit holder is entitled on a winding up or surrender of units must be fixed and must be the same as the proportion of income of the trust to which the unit holder is entitled.

Assuming the unit is a fixed trust for land tax purposes, the trustee of the unit trust will be entitled to the land tax threshold. The land tax assessment of the trustee of the unit trust will be $7588 (being $100 plus 1.6 per cent of the excess $900,000 over $432,000).

As the unit trust is a fixed trust, then each unit holder will be treated, for land tax purposes, as being the equitable owner of a proportionate part of Parcel 5. In the example, the trustee of the SMSF owns 60 per cent of the units and so will be treated as owning for land tax purposes an interest of $540,000 in Parcel 5.

Consequently, the trustee of the SMSF will be attributed with $540,000 of land interests in the trustee’s own assessment.

SMSF trustee

The trustee of the SMSF is the registered proprietor of Parcel 6 and so is the owner of that parcel for land tax purposes.

The trustee of the SMSF is also treated as being the owner of parcels 3 and 4 (by reason of being the equitable owner of those parcels as beneficiary of the holding trusts) and is also attributed with a 60 per cent interest in Parcel 5 (by reason of being a 60 per cent unit holder in the unit trust, which is a fixed trust).

Aggregating all of the SMSF trustees’ land interest in the various parcels gives rise to a total land value of $2.64 million. The land tax assessment for the trustee will be $35,428 (being $100 plus 1.6 per cent of the excess of $2.64 million over $432,000).

As the trustee of the SMSF and the other trustees have been assessed to land tax in respect of the same parcels (for example, in respect of Parcel 3 – the trustee of Holding Trust A and the trustee of the SMSF; in respect of Parcel 4 – the trustee of Holding Trust A and the trustee of the SMSF; in respect of Parcel 5 – the trustee of the unit trust and the trustee of the SMSF), a tax credit will be provided to the trustee of the SMSF in relation to the land tax assessed to (and paid by) the trustees of the holding trusts and the unit trust. This tax credit is provided by section 25(2) of the Land Tax Management Act and the amount of the credit is “such amount (if any) as is necessary to prevent double taxation”.

The trustee of the SMSF will be entitled to a land tax credit of $11,729 (being $2788 plus $4388 and 60 per cent of $7588). As Parcel 6 is owned directly by the trustee of the SMSF, there is no other land tax payer in relation to that parcel and so there is no tax credit required.

The net land tax assessment for the trustee of the SMSF will be $23,699 (being $35,428 less $11,729).

Bill

Bill is the registered proprietor of two parcels, being Parcel 1 and Parcel 2. As Bill uses Parcel 1 as his principal place of residence, no land tax liability applies to Parcel 1, irrespective of its land value.

Bill also holds 40 per cent of the units in the unit trust and will be attributed for land tax purposes with a proportionate interest in Parcel 5.

While Bill is the sole member of the SMSF, there is no attribution to Bill of any land interests held by or attributed to the trustee of the SMSF. The technical reason for this non-attribution is that the SMSF is not treated as a fixed trust (because Bill even though he is the sole member of the SMSF is not the equitable owner of land held by the trustee of the SMSF and because the SMSF cannot satisfy the relevant criteria).

The land tax assessment for Bill will be $9188 (being $100 plus 1.6 per cent of the excess of $1 million over $432,000).

Planning points

Three significant planning points should be noted.

First, as SMSFs cannot qualify as fixed trusts and are specifically excluded from special trusts, they are entitled to the land tax threshold and there is no attribution of land interests of the SMSF to the member of the SMSF.

Second, while each holding trustee is separately assessed for land tax purposes and is entitled to the benefit of the land tax threshold, the benefit of multiple thresholds is lost at the SMSF level as the trustee of the SMSF is entitled to only one threshold. In short, the land tax position of the trustee of the SMSF is not affected by whether land is held in holding trusts.

Third, there may be a considerable advantage in holding land in different SMSFs, even if the membership of each SMSF is identical. If parcels 3, 4, 5 and 6 were held in different SMSFs, the assessments issued to the trustees of each of the different SMSFs would be entitled to the land tax threshold: so four thresholds would apply and not just one, which could be an annual saving in land tax of $20,436 (being the reduction in land tax due to the application of the threshold by three less $300 as each land tax assessment is $100 plus the tax rate applied to the land value).

If this strategy is to be used, different trustees would have to be used for each SMSF. Obviously there would be the cost of establishing and operating the three additional SMSFs, but these costs can be readily identified and estimated to determine the tax saving.