Commencing from 1 July 2014, the Australian Taxation Office (ATO) will have a broad range of graduated penalties and administrative directions at its disposal to address any non-compliance of the superannuation laws, in addition to its existing powers.

The Self-managed Independent Superannuation Funds Association (SISFA) has long advocated that the ATO needs to possess and apply effective, flexible and proportionate powers to address contraventions of the law.

Main points

The new rules introduce a system of administrative directions and penalties for contraventions relating to SMSFs that occur on or after 1 July 2014, including:

- providing the ATO with powers to give rectification directions and education directions, and

- imposing administrative penalties for certain contraventions of the law.

The new rules provide the ATO with the ability to give a rectification direction or an education direction where it reasonably believes a trustee or director of a corporate trustee of an SMSF has contravened a provision of the superannuation law.

A rectification direction will require a person to undertake specified action to rectify the contravention within a specified time frame and provide the ATO with evidence of the person’s compliance with the direction.

An education direction will require a person to undertake a specified course of education within a specified time frame and provide the ATO with evidence of completion of the course. The person will also be required to sign or resign the trustee declaration form to confirm they understand their obligations and duties as a trustee or trustee director of an SMSF.

Penalties imposed under the new administrative penalty regime are payable personally by the person who has committed the breach and therefore must not be paid or reimbursed from assets of the SMSF.

Administrative penalties

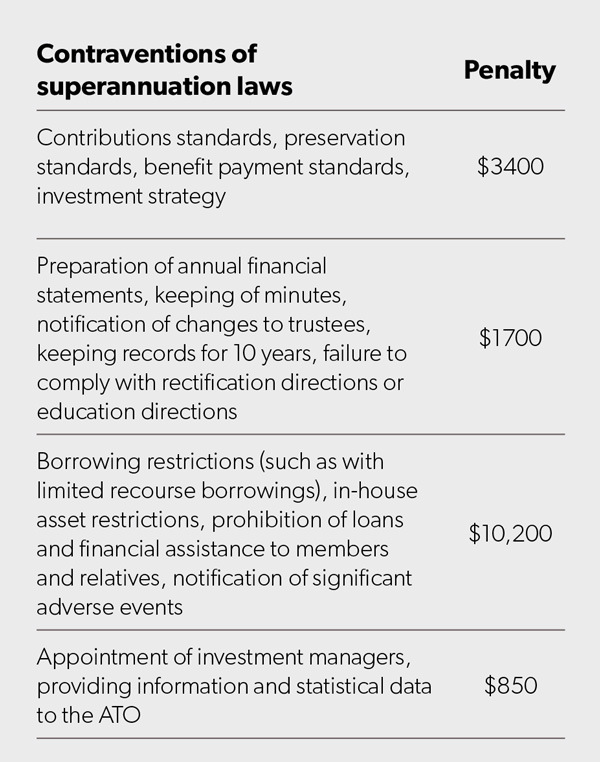

An administrative penalty is not imposed for all contraventions of the Superannuation Industry (Supervision) (SIS) Act, only those included in a table detailed in the act. These are summarised below:

These administrative penalties are only imposed in relation to SMSFs.

Watch out for ‘carry-over’ contraventions

Some contraventions only occur in the year of income a particular transaction took place. However, certain transactions, if not rectified, may cause trustees to contravene the SIS Act or SIS Regulations over a number of income years.

For example:

SMSF trustees are prohibited from borrowing money or maintaining an existing borrowing of money except in limited circumstances. Therefore, trustees may contravene this provision in the year of income that the borrowing is undertaken and for each year of income the borrowing is maintained in breach of the rules. Hence, any existing limited recourse borrowing arrangements ought to be thoroughly examined by advisers and independently audited to ensure no carry-over contraventions arise

Similarly, where the market value of a fund’s in-house assets exceeds the 5 per cent threshold, the trustees are required to prepare a written plan before the end of the following income year and carry out steps to ensure the fund’s in-house asset ratio returns to 5 per cent or less.

Trustee structure is relevant

If a trustee that is a body corporate becomes liable to an administrative penalty, then the directors of that body corporate are jointly and severally liable to pay the amount of the penalty. However, for individual trustees penalties will be imposed on each of them separately.