As a lawyer, I do a lot of work advising and representing approved SMSF auditors who are themselves being audited/reviewed by the ATO and/or who have been referred to the Australian Securities and Investments Commission (ASIC).

Accordingly, I’m often very interested in the ‘business’ of being an approved SMSF auditor and the direction in which this group of professionals is headed.

Earlier this month, the ATO released its “Self-managed super funds: A statistical overview 2022-23”.

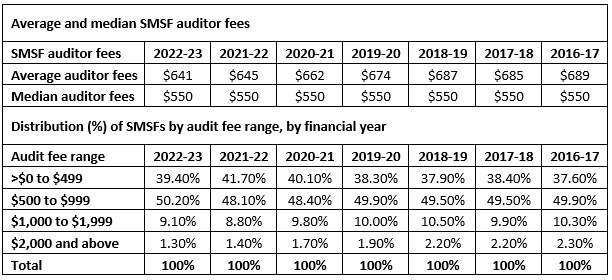

For many years now, SMSF annual returns have asked for the ‘SMSF auditor fee’ as separate items – specifically via items H1 and H2 on the form.

Accordingly, the ATO would have excellent data on how much auditors are charging for an audit.

The relevant extract regarding audit fees is as follows:

How consistent the typical SMSF audit fees have remained over the years is intriguing. My understanding is the median is often the best representation of typical when large outliers might otherwise skew data. I note the median has very consistently been $550 for as far back as the data goes.

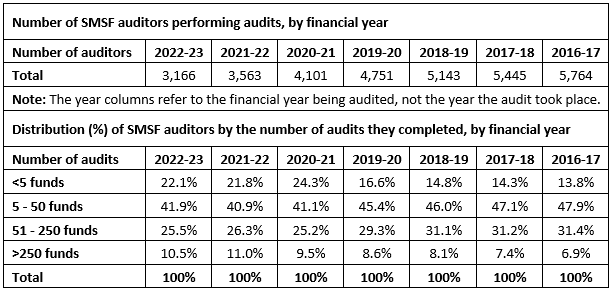

The number of approved SMSF auditors in practice is also worth noting and is reflected in the following data set.

It is clear the number of approved SMSF auditors servicing the sector is dropping significantly each year. This is unsurprising. As the SMSF Auditors Professional Association Stakeholder Group key messages on 10 December 2024 stated: “The ATO tabled its SMSF auditor compliance and engagement report for the period 1 July 2024 to 30 November 2024. The report identified … a notable rate of voluntary registration cancellations by auditors after the commencement of ATO compliance action.”

Of surprise to me was the increase in the number of approved SMSF auditors who perform fewer than five SMSF audits a year.

These are interesting trends among the SMSF audit community and worth monitoring as to how they will develop in the coming years.

Bryce Figot is special counsel at DBA Lawyers.