For clients with capital gains, higher taxable income in one year or a bumper year in business, an extra tax deduction may be useful to minimise tax.

Also, tax cuts coming into effect in 2024/25 mean a tax deduction will be more valuable in the 2024 income year.

To benefit from the tax advantages available in the current financial year, a double deduction strategy can be used by an SMSF using contributions reserving.

What is contributions reserving?

According to superannuation law, when an SMSF receives a contribution, the trustees have 28 days after the end of the month in which that contribution is accepted to allocate it to a member’s account. This provides an opportunity in an SMSF to receive a contribution in one income year and allocate it in the next.

In simple terms, the member can claim two years’ worth of tax deductions in the current financial year, that is, the deduction for 2024/25 concessional contributions can be claimed in 2023/24 by making the contributions for the following year in June. The fund pays 15 per cent tax on the full amount this financial year, but only the amount allocated to a member this year counts towards the 2023/24 caps, therefore avoiding a breach of the concessional contribution limit. For example, a member can make contributions during 2023/24 of $27,500 and a further contribution of $30,000 in June 2024 without exceeding the contribution caps.

There are, however, risks associated with this strategy so expert licensed financial advice should be sought to avoid receiving an excess concessional contributions determination from the ATO.

Also, appropriate documentation must be prepared and lodged by the fund trustees when implementing this strategy, such as allocation resolutions, a request to adjust concessional contributions form and a notice of intent to claim a tax deduction.

Further, care should be taken to ensure the amount contributed in June is separate and discrete as the ATO will not accept breaking up contributions into individual amounts and assigning them to a reserve.

If used correctly, this is a very useful strategy to minimise tax in one year. In addition, unused portions of the concessional contributions cap from previous years can be incorporated into the strategy to boost the tax benefit arising from it. The following case study illustrates how this is possible.

Case study

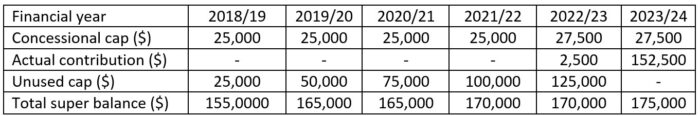

Terri is 55, self-employed and has a total super balance of less than $500,000 on 30 June of the previous financial year. She made a personal capital gain of $400,000 from the sale of an investment property. The net capital gain assessable for income tax purposes is $200,000 as the asset was held for more than one year after applying the 50 per cent discount.

This year (2023/24), Terri has $125,000 of unused carry-forward contributions accumulated from 2018/19 to 2022/23 she is contributing into her SMSF. This is after she contributes $27,500 for the 2024 income year and $30,000 for the 2025 income year using the contributions reserving strategy. It means her total concessional contributions for 2023/24 will be $182,500, and on a total capital gain of $500,000 she will only pay tax on $17,500 of the net capital gain at her marginal rate.

Susan O’Connor is principal of Susan O’Connor Accounting.