The latest Australian Prudential Regulation Authority (APRA) statistics show the highest rate of new SMSF growth in five years, but we still haven’t cracked the 600,000-fund milestone. So why aren’t we there yet? Understanding the data in the industry’s quarterly reporting is key to answering this question.

As I said, the latest APRA quarterly superannuation report, covering up to September 2021, contained some very positive news for the SMSF industry, with net new funds established in the quarter at their highest level in five years.

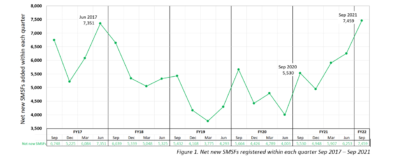

The number of net new funds added in the September quarter was 7459, which is up 35 per cent on the 5530 net new funds reported in the same quarter last year and just beating the 7351 net new funds recorded back in June 2017. Coming on the back of strong showings in the March and June quarters, this is great news for the industry given the last couple of very disruptive years.

Figure 1. Net new SMSFs registered within each quarter Sep 2017 – Sep 2021

APRA reports the total number of SMSFs now sits at 598,452, still just shy of the 600,000 mark the industry often refers to.

Given the strong growth in this and the two previous quarters, it does beg the question of why we haven’t yet broken through that 600,000-fund threshold.

We’ve been talking about nearly 600,000 for over four years

COVID has messed up many people’s sense of time, but even allowing for that, it seems like SMSFs have been on the cusp of exceeding 600,000 funds for years now.

It’s not your mind playing tricks on you. Back in September 2017, the reported the number of SMSFs was within 2000 funds of the 600,000 milestone (598,620 funds). The latest APRA report for September 2021 says there were 598,452 funds, slightly less than there were four years ago.

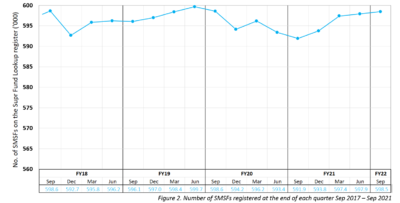

Below is a graph of the number of SMSFs, as first reported, quarterly over the past four years:

Figure 2. Number of SMSFs registered at the end of each quarter Sep 2017 – Sep 2021

The count shown in Figure 2 is the number of SMSFs that are classified as active on the government’s Super Fund Lookup register at that time and, as can be seen from the graph, this number has been treading water in the 590,000 to 600,000 range for the past 16 quarters.

So it is not our imagination, SMSFs really have been struggling to break through the 600,000 threshold.

But where’s the growth gone?

With the total number of SMSFs on the register not really changing over four years, why are we still talking about growth?

To get to the bottom of this, let’s start by noting the September 2021 report, just published, does not contain the numbers shown in the graph above.

The APRA report contains ‘revised’ numbers. To get the original numbers you need to go back and look at each of the original quarterly reports, or look at the press stories published when the numbers were first announced.

In addition, the APRA figures are based on data from the ATO and that data contains heavily revised numbers for prior periods going back many years. In short, the ATO ‘rewrites history’ and the historical data and the revised numbers are much lower than what was previously published.

Rewriting history

Below is the latest ‘revised’ data, as released by APRA (the red line), which covers the industry up to the end of September 2021.

The ‘original’ numbers have been retained for comparison (the blue line), so we can see how much the historical data has been changed.

With each new report the number of funds for earlier quarters keeps getting revised down and, as you can see, the current number of SMSFs in September 2020 is 12,000 below the number first reported.

Industry growth vs new fund growth

The APRA data shows the SMSF industry has gained 19,000 funds (579.2 to 598.5) over the last year, but the ‘loss’ of 12,000 funds due to the backdated revisions of the earlier numbers means the industry growth is actually only 7000 funds (591.9 to 598.5) for the year.

The blue line in the graphs effectively shows the overall industry growth, that is, the number of funds on the register at that point in time. The revised numbers give a view of the new blood flowing into the industry.

New blood is good for the industry as it is driving the average age of members down and helping to even out the member gender balance.

Unfortunately, the ‘bleed’ of funds out of the industry is somewhat hidden by the revisions and we need more data than APRA reports to better understand that.

The ATO is due to release its quarterly SMSF reporting in the next couple of weeks. That data will give a better breakdown of where the revisions are and in a future article we’ll take a look at what is causing those revisions and why they are being backdated.

In the meantime, if your business is making plans based on SMSF growth, it is important to distinguish between the overall industry growth as opposed to net new fund increases.

Kevin Bungard is global chief operating officer and Australian general manager at MyWorkpapers.