As the superannuation rules for contributions become more complex, so too do the strategies you can use, especially when using them in conjunction with each other. For accountants and advisers, get the strategies wrong and you put SMSF clients at risk with financial penalties. But get them right and your clients can maximise their opportunities.

A common strategy that is most effective to use now, but where confusion still exists and mistakes are often made, is when the carry-forward rule for concessional contributions (CC) and the reserving strategy are combined.

Case study

Amanda is 63 and hasn’t put much into super as her total super balance was under $500,000 as at 30 June 2020. Since 1 July 2018, she has not fully used all of her CC cap and has made a good profit in the 2021 financial year due to the opportunities arising in her cleaning business. With business showing a good return, she wants to maximise her super as she sees retirement looming up ahead. Let’s see what’s possible with the combined use of the bring-forward concessional contribution rules and the reserving strategy.

Carry forward of unused CCs

The carry-forward rule has applied from 1 July 2018 and will allow Amanda to claim a tax deduction for unused CCs that can be carried forward on a five-year rolling basis. In the year in which the unused CCs are claimed, she must have a total super balance as at 30 June in the previous financial year of no more than $500,000. For this financial year, it will be her total super balance on 30 June that is relevant.

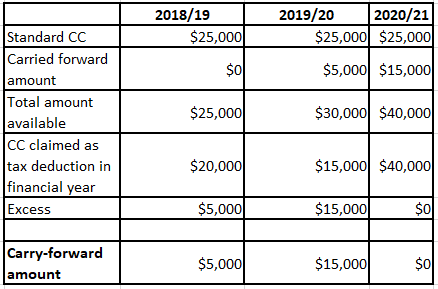

Here’s an example of how the carry-forward rule applies:

Amanda has carried forward amounts that haven’t been claimed under her unused standard CC cap amount. As her total super balance on 30 June 2020 was less than $500,000, she can claim a tax deduction for CCs, which will include the carried forward contributions of $15,000.

Reserving strategy

The reserving strategy is a long-standing strategy and involves a person:

- making CCs in June of the financial year equal to two years’ standard contributions, and

- having the equivalent of the current year’s standard CC allocated to their accumulation balance in June, and

- allocating the remainder of the contribution. The amount of contribution allocated is equal to the next financial year’s standard CC to their accumulation account by 28 July in the next financial year.

The increased amount of CC is claimed as a tax deduction in the first financial year. However, the relevant CCs are counted against the member’s accumulation account in the year in which they are allocated.

In its simplest form, assume Amanda’s standard annual CC amount is $25,000 for the 2021 financial year and $27,500 for the 2022 financial year. By using the reserving strategy, she could make CCs in June 2021 equal to the total of the two years’ standard contributions ($52,500) in the 2021 financial year and a tax deduction for $52,500 can be claimed in that year. In regard to member balances, $25,000 of the amount contributed will be allocated to Amanda’s accumulation account in June 2021, with the remaining $27,500 to be held in a contribution holding account in the fund until it is allocated to her accumulation account before 28 July 2020 in the 2022 financial year.

The main advantage of this strategy is that a larger-than-normal CC can be made to the fund in one financial year and the individual can claim a tax deduction for the whole amount in that year. If the larger-than-normal amount was required to be credited to the member’s accumulation account, they would end up with an excess CC assessment. However, by allocating part of the CC to the member’s account in June in one financial year and the remainder in the next financial year, as above, no excess arises.

Use of the reserving strategy has a worthwhile but limited life. That is, once it has been used, future use is limited to leaps of two financial years. That means if the reserving strategy has been used over the 2021 (June 2021) and 2022 (July 2021) financial years, it cannot be used again until June in the 2023 financial year and July in the 2024 financial year and so on.

Combining both strategies

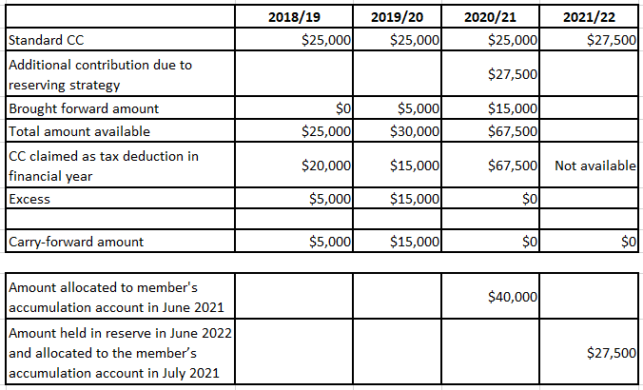

The carry-forward concessional contributions and the reserving strategy can be combined. If we use the table from above and add an additional financial year column to it, then the combined strategy would work as follows:

The benefit of using the combined strategy in 2020/21 is that:

- the whole of the carried forward unused CC cap amount, plus

- the standard CC cap for the 2021 financial year, plus

- the standard CC cap for the 2022 financial year

have been claimed as tax deductions in the 2021 financial year and the standard CC cap amount ($27,500) is held in the contribution holding account during June 2021 and allocated to the member’s accumulation account in the next financial year by 28 July 2021.

The result is an increased deductible contribution in 2020/21 and no excess CCs in both 2020/21 and 2021/22.

Graeme Colley is SMSF technical and private wealth executive manager at SuperConcepts.