Warren Buffett loves them, and investment magazine Barron’s once said they “probably rank as the most successful financial product of the past two decades”. And while they are being taken up by many SMSFs around the country, there are still a lot of self-directed investors who are yet to embrace their benefits.

What am I talking about? Exchange-traded funds or ETFs.

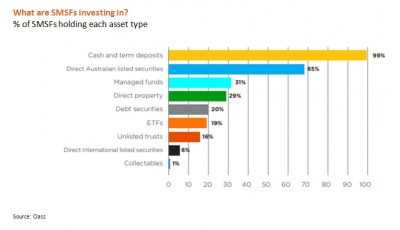

According to the Class June 2018 “SMSF Benchmark Report”, around one in five SMSFs covered by the survey were using ETFs within their investment portfolios. That’s not bad, but still less than the proportion of SMSFs that hold term deposits or direct shares. It also still means 80 per cent of SMSF investors don’t own any ETFs at all.

What is so good about ETFs? For those who still don’t know, ETFs are simply a type of regulated managed investment. Unlike their unlisted fund counterparts, but like listed investment companies (LIC), ETFs can be bought and sold on the Australian Securities Exchange (ASX) just as easily as a company share.

But unlike LICs, ETFs are open-ended in that the number of units on issue can be increased or decreased over time in line with investor demand – a process that allows the market price of an ETF to normally closely reflect the ETF’s net asset value (NAV). Thus, ETFs can avoid the closed-end LIC problem of their market price often trading at a substantial premium or discount to NAV.

Today’s most popular ETFs are still those that provide passive low-cost exposure to either the Australian or global equity markets. International equity ETFs now comprise just under 40 per cent of the market or only a little less than that of Australian equity ETFs.

But ETFs and other exchange-traded products can provide much more than diversification across equity markets. There are now many funds that provide broad exposure to bond markets, or invest in bank term deposits, hybrid securities and even commodities such as gold and oil.

In short, ETFs provide reasonably low-cost diversified access to any number of asset classes that an SMSF investor may care to choose from. They can be bought and sold on the ASX just as easily as a company share.

If you’re an SMSF investor, what’s not to like?

According to the latest “BetaShares ETF Review”, there were 231 exchange-traded products as at the end of July 2018, which collectively had $40 billion in funds under management. Although still a relatively small share of the overall funds management industry, these funds have continued to enjoy strong growth in market share, with funds under management up 33 per cent in the past 12 months alone.

According to the “2018 BetaShares/Investment Trends ETF Report”, there were around 315,000 ETF investors in September last year, a number which has doubled in the past three years. Around one-third of these investors run their own SMSF. Financial planners are also getting on board, with the Investment Trends report suggesting almost half now recommend ETFs and another 20 per cent plan to do so at some stage in the future.

Along with broad exposure to the local and international markets, there has also been growing use of ETFs to provide more granular equity exposure to certain industry sectors, such as healthcare, resources and technology, or certain countries and regions, such as the United States, emerging markets, Europe and Japan.

SMSF investors seeking more defensive cash and bond exposure should know there’s an ETF for that also. There are ETFs that invest in cash and bank term deposits, so you can keep all your investments on the ASX. And there are innovative bond ETFs providing exposure to higher-yielding corporate bonds or bonds from emerging markets. There’s even an exchange-traded product on the ASX providing exposure to bank hybrids, thereby making it easier for investors to gain access to the relatively attractive income return potential of this type of investment without the concentration risks associated with holding only individual securities.

If you prefer active managers, another new trend has been the introduction of actively managed ETFs. Due to the advantages of the ETF structure, some of Australia’s top active fund managers, such as Legg Mason and AMP Capital (both in alliance with BetaShares) and Magellan, have relatively recently established ‘active ETFs’ to improve investor access to some of their active strategies.

As should be evident, ETFs continue to open up an exciting new world of investment opportunities for SMSF investors. As a product structure, they lend themselves to both active and passive strategies and can provide diversified exposure to a range of investment themes or asset classes.

If you’re among the 80 per cent of SMSF investors who are yet to consider adding an ETF or similar products to your portfolio, it might be something worth thinking about.

David Bassanese is chief economist at BetaShares.