The past five years have witnessed one of the greatest ever bull runs on Wall Street, the beating heart of which has been the tech sector.

Think of the companies and you’ll understand. In July, Apple became the first company to hit $1 trillion. Microsoft, with its stranglehold on office software, is now thought to be worth more than Switzerland. Amazon, with a profit machine like AWS, new products like Alexa and cheap new services popping up left, right and centre, is said to be taking over the world.

The performance figures speak for themselves. In the past five years, United States tech has delivered a staggering return of 20.5 per cent a year, while the S&P 500 has delivered an annualised return of 13.7 per cent.

Australian investors have watched these rocketing returns pie-eyed. Wanting a slice of this most delicious cake, Australians have used listed funds – and especially exchange-traded funds (ETF) – as devices of choice for carving some.

ASX tech funds swell

We can see this clearly on the Australian Securities Exchange (ASX) listing boards. In August 2014, there were no technology-focused ETFs or listed investment companies (LIC) available on the ASX. Yet today there are seven: four ETFs and three LICs. These funds collectively hold more than $1.1 billion of assets, mostly hoovered up in the past two years.

There’s good reason to think the flight to tech ETFs will continue. As we all know, technology has changed the world, even in our own lifetimes. These changes include the unnoticed innovations such as airbags, first introduced by Daimler in 1992, which have saved hundreds of thousands of lives, agricultural tech, which got going in the 1960s and has more than doubled Australian crop production, and simple household fans, which have helped lower rates of sudden infant death syndrome.

The changes also include more obvious stuff. Excel spreadsheets can be tiresome, but we’re all now dependent on them. Smartphones can be distracting, but none of us fancies returning to household landlines. We all know the wonders the internet has done.

FANGs have changed investing

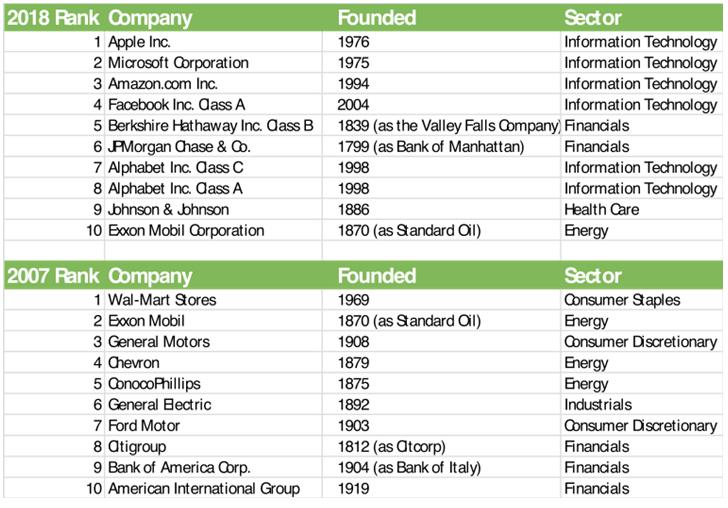

In addition to livelihoods, technology has also changed investing. Today, the top four spots on the S&P 500 are taken by Apple, Facebook, Microsoft and Amazon – all tech companies.

This in itself may sound unsurprising. But what’s really revolutionary here is the speed at which these high-performing technology companies – FANGs (Facebook, Amazon, Netflix and Google) -have become so large and the speed with which they’ve delivered these returns for investors.

Facebook is only 14 years old, Google is only 19 and Amazon – ancient by comparison – is 22. The non-tech companies in the top 10 – ExxonMobil, JP Morgan, Johnson and Johnson, Berkshire Hathaway – are all over 100 years old. (Admittedly, Berkshire Hathaway has only been with Warren Buffett for 50 of them).

How did they get so big so quickly? Largely because of their super-normal profitability, which is made possible by de facto monopoly as Financial Times chief economist Martin Wolf observed. Google, Facebook, Netflix and Microsoft have become household names with no clear competitors in sight. In the absence of serious competition, monopoly profits shoot the lights out – as ExxonMobil learnt in its Standard Oil days.

There is no tech bubble

Still, the rapid rise of these companies has made some think tech’s inflows are a function of the sector’s strong showing in recent years and ultimately just a trend. Others take this a step further and argue that tech is in a bubble. After all, how can Microsoft be worth more than Switzerland? And isn’t Amazon’s trailing price-earnings (PE) ratio of 150 a bit extreme?

Yet there are good reasons to think tech companies’ high valuations are here to stay. And good reasons too to believe in the coming years Australian interest in tech funds will only grow. Here’s why.

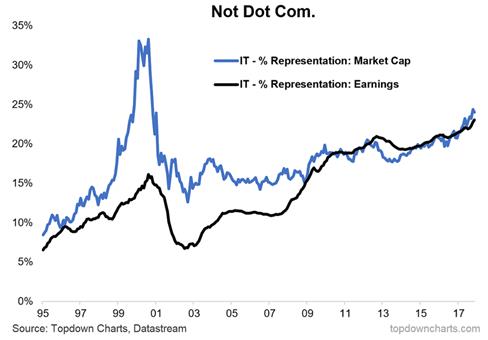

First, a clearing of the air: there is no dotcom-style tech bubble. During the peak of the dotcom boom in 2000 the PE ratio of the tech sector within the S&P 500 was in the 80s. Today, that ratio is below 20. In the dotcom bubble, the tech sector took one-third of the market capitalisation of the S&P while only providing one-sixth of its earnings. Today, by contrast market cap and earnings are moving neck-and-neck.

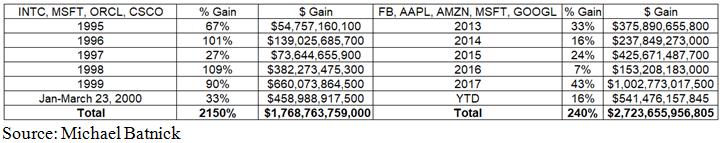

Nor have company valuations soared in the past five years in the way they did during the dotcom boom. As Ritholtz Wealth Management research director Michael Batnick has shown, Intel, Cisco, Microsoft and Oracle gained 80 per cent a year from 1995 until the crash. Yet today’s top tech stocks – Facebook, Apple, Amazon, Microsoft and Google – have compounded at only 28 per cent a year for the past five years.

To be sure, tech stocks are highly valued in today’s market. But there is a vast difference between being highly valued and hugely overvalued.

How to invest in tech

With this in view, how might Australian investors invest in tech? One way is to use ETFs, which have the advantage of being passively managed and therefore cheap, with the added advantage of being entirely transparent. With a tech ETF, anyone with an internet connection can see what’s inside the index the fund tracks. And because fees are super low, investors get to keep more of the returns their money earns. So what might some choices be?

One is the ETFS Morningstar Global Technology ETF (ASX: TECH). Charging 0.45 per cent, TECH is the cheapest technology fund on the ASX, and tracks an index built by research house Morningstar. Its team of experts looks at tech companies from around the world to determine which have the strongest competitive advantages (“widest moats”) and most durable profits. As it invests globally, and as Australia’s tech sector is relatively small, TECH can help investors diversify outside Australia.

Another ETF, for those with a more adventurous leaning, might be the ETFS Robo Global Robotics and Automation ETF (ASX: ROBO). This unique ETF tracks robotics and automation companies and targets the root and stem of the automation revolution (from self-checkouts to self-driving cars to healthcare robots).

Whatever investors decide, technology is a place to be. And thanks to financial technology like ETFs, it’s easier and cheaper for investors than ever before.

Kris Walesby is chief executive of ETF Securities.