Many wealthier super members took action in 2016/17 to reduce their retirement-phase pension accounts to $1.6 million. At the time, they generally did so by rolling back the excess to an accumulation account because this was often the simplest and quickest approach to take.

An issue many are now considering is whether that accumulation account is best placed remaining in super or whether it should be taken out of super and invested in the individual’s own name.

As the 2017/18 financial statements start rolling off the presses, it’s an opportune time to consider this issue again.

A simple example

We start by considering a simple case, Alex. He:

- is aged 65,

- has $2 million in super, including a $1.6 million retirement-phase pension and a $400,000 accumulation account, and

- his super consists entirely of a taxable component.

Drivers to cash out his accumulation account from super and instead invest $400,000 in his own name are:

- during his lifetime, at least in the early years, he would pay virtually no tax on the income generated personally (whereas earnings on his accumulation account will be taxed at 15 per cent in his SMSF), and

- his entire super is taxed at 15 per cent (plus Medicare if applicable) if paid to his adult children (who are not dependants for tax purposes) on his death. Hence cashing out his accumulation account would save his family at least $60,000 (15 per cent x $400,000) if he died immediately.

One of the major influences here is the amount of other income Alex already has in his own name. If he has no other income, our calculations (assumptions shown below) suggest he is better off removing the $400,000 from super and investing it personally.

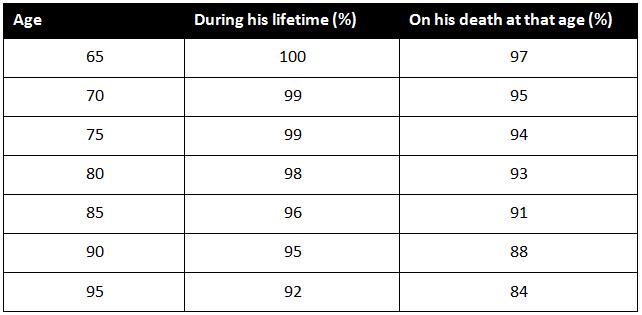

To illustrate, Table 1 shows a comparison of the two options both during Alex’s lifetime and on his death. The comparison is expressed as a percentage:

- when the percentage is 100, the outcome for Alex is the same regardless of whether he takes the $400,000 out of super or leaves it accumulating (drawing on it as and when he needs to in order to meet living costs),

- when the percentage is higher than 100, Alex or his family are better off leaving the accumulation account in super. If it is (say) 105 per cent, Alex is 5 per cent better off leaving the money in super, and

- when the percentage is lower than 100, Alex or his family are better off removing the $400,000 accumulation account from super and investing it personally.

For example, if Alex died immediately, one would expect the percentage to be less than 100 (that is, his family would have been better off if he had removed his accumulation account from super rather than leaving all of his current balance in super).

This is because Alex’s beneficiaries would have to pay death benefits tax on his entire super (including the $400,000 accumulation account) rather than just the balance in his pension account. Had Alex taken his accumulation account out of super before dying, they would have saved 15 per cent of $400,000 or $60,000 (3 per cent of his $2 million balance). The percentage shown in the table below is therefore 97 per cent.

Table 1: Is Alex better off leaving a $400,000 accumulation account in his SMSF or cashing it out? (A result of more than 100 per cent means leaving it in super is better. Less than 100 per cent means it would have been better if he had withdrawn his accumulation account from super.)

Note that these figures assume:

– Alex has no other income,

– tax rates remain unchanged from 2018/19,

– his investments (or those held by his SMSF) achieve returns of about 6 per cent,

– half of these returns come in the form of income (taxed in the current year) and half in capital appreciation (that is, growth),

– he is periodically buying and selling assets rather than triggering large capital gains on death,

– he needs $80,000 a year (increasing in line with the consumer price index at 3 per cent) to live on, and

– this is drawn firstly from minimum pension payments, then personal investments and then (if applicable) additional drawings from his accumulation account.

The table indicates Alex is:

- consistently better off both during his lifetime and (in his family’s case) on his death if he removes the accumulation account from super and invests it personally, and

- the difference during his lifetime is fairly small until he reaches a very advanced age (by which time we are likely to see changes in tax thresholds, et cetera, making the modelling less relevant).

In other words, if Alex is mostly concerned about his own position, he can afford to be fairly neutral about whether it’s a good idea to remove his accumulation account from super. If his primary focus is on his family, he should probably seriously consider removing the accumulation account from super. (Although following that logic he should probably remove his entire balance from super as the death benefit taxes on $2 million would be $300,000. The trouble is it makes him so much worse off during his lifetime that eventually it affects his beneficiaries’ inheritance enough to outweigh the death benefit taxes.)

Adding non-super income

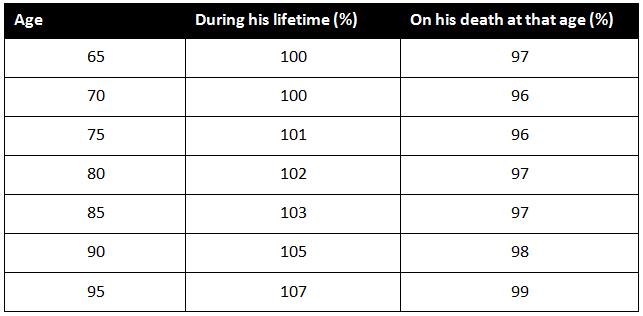

Perhaps not surprisingly, however, the position changes if Alex has even a modest amount of income already in his own name. If we repeat the calculations assuming he is receiving other income of $20,000 a year (increasing in line with inflation), the table becomes:

Table 2: What if Alex has other income of $20,000 a year? Is he better off leaving a $400,000 accumulation account in his SMSF or cashing it out? (A result of more than 100 per cent means leaving it in super is better. Less than 100 per cent means it would have been better if he had withdrawn his accumulation account from super.)

The outcome is not surprising given additional investment income will quickly place him in a personal tax bracket above the super rate of 15 per cent.

If Alex has even more other income, the dollar values will increase (that is, Alex will pay even more tax on the $400,000 portfolio he moves out of super). However, the relativities don’t change as much – the percentage difference between the ‘do nothing’ approach (leaving all his wealth in super) and cashing out his accumulation account follows a similar pattern to the above. In other words, it is the first $20,000 in non-super income that has the most impact on his decision.

What if the accumulation account was much larger?

What really changes the position is if Alex’s super balance was considerably higher.

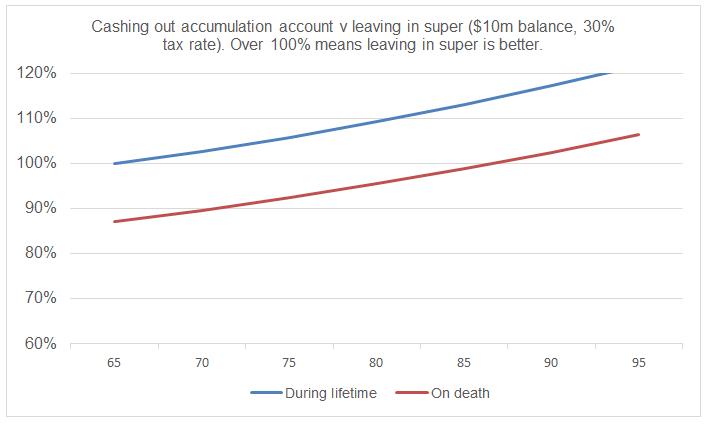

Consider an extreme case: Patrick has $10 million in super (0 per cent tax-free component) and therefore has an $8.4 million accumulation account. He has no need for the income generated by his pension or any assets purchased if he transfers his accumulation account out of super. He is confident he can structure his investments so that any non-super income is taxed at 30 per cent (rather than the highest marginal income tax rates).

Naturally there are strong arguments to leave his accumulation account in super during his lifetime as income will be taxed at only 15 per cent. But what about Patrick’s beneficiaries should he die?

If he died immediately, for example, cashing his accumulation account out of super beforehand would save his family $1.26 million (nearly 13 per cent of his total super balance).

A common question for those in Patrick’s position is whether the downside of additional tax during their own lifetime is worth the savings in death benefit taxes achieved if the monies are removed from super early.

The graph below attempts to address this question – it compares Patrick’s position both during his lifetime (blue line) and on his death (orange line), assuming he either:

- cashes out his accumulation account, or

- leaves it in super.

In both cases we assume he leaves his pension account in super. Where the graph is above 100 per cent, it is better to leave the accumulation account in super.

This suggests that if Patrick dies in the first 20 years, his beneficiaries would actually be better off if he’d removed his accumulation account from super (that is, the orange line is below 100 per cent until around the 20-year mark).

However, he is materially worse off personally (during his lifetime) – the blue line is consistently above the 100 per cent mark.

Conclusion

Whether to take money out of super or leave it in there has always been a dilemma faced by super members as they age and it has become more acute now it is impossible to leave the entire balance in pension phase. Death benefit taxes are often cited as a very powerful driver in favour of withdrawal, but it pays to remember that:

- this is less of an issue when both members of a couple are alive (because the surviving spouse can remove a deceased member’s balance from super during their own lifetime – meaning the decision does not need to be made until then), and

- generally cashing out large amounts now will be detrimental during the individual’s own lifetime if they have even a modest amount of non-super income.

Meg Heffron is director at Heffron SMSF Solutions.