New government legislation has resolved the uncertainty surrounding the treatment of pensions in the event of death. David Shirlow takes a look at the resulting positive tax implications.

Recently the federal government introduced regulations giving effect to a measure announced as part of its “Mid-Year Economic and Fiscal Outlook” statement in October 2012 concerning tax issues arising in the event of the death of a superannuation pensioner. The regulations registered a few weeks ago now provide relief on both fund earnings tax and benefits tax calculation issues, which the industry had pursued with the government. At last we have a clear and favourable outcome on these issues.

The problems with death and pensions tax

Issues with the tax treatment of pension accounts in the event of a superannuation pensioner’s death first emerged as early as 2004, when the Australian Taxation Office (ATO) published its Interpretative Decision ID 2004/688 concerning a particular scenario arising on the death of an SMSF member. After the superannuation tax reforms of 2007, the ATO developed more comprehensive views, leading to the release in 2011 of Draft Taxation Ruling TR 2011/D3. In that draft ruling, the ATO expressed the view that an account-based or allocated pension would cease as soon as the pension recipient dies, unless a dependent beneficiary of the deceased is automatically entitled under the fund rules to receive a pension upon that death.

In the absence of the new regulations, this view would generally give rise to two potential tax consequences in situations where a pension recipient dies and the pension does not automatically revert to another beneficiary. The potential tax consequences are:

- the tax exemption generally applicable to the relevant pension account would cease upon death and the tax rate of 15 per cent would apply to assessable earnings credited to it from that time; and

- the manner in which the tax-free components (TFC) and taxable components (TC) of death benefits paid in respect of the pension interest would be calculated differently from the time of death. This means that, for example, 100 per cent of earnings added to the account post-death would count as TC. Of course, this is only of practical significance if the recipient of the death benefit is not a tax dependant of the deceased, since benefits paid to tax dependants are not subject to tax.

While both these consequences could have led to administrative complications, from an SMSF perspective the primary concern has been with the potential additional tax liability. In particular, the focus has been on the potential for a substantial capital gains tax liability from the sale of the assets backing the deceased member’s pension account for the purpose of paying a benefit to any relevant beneficiary.

The new regulatory solution

The new regulations amend the law to address these tax issues in the vast majority of cases in relation to account-based pensions, allocated pensions and term-allocated (or market-linked) pensions.

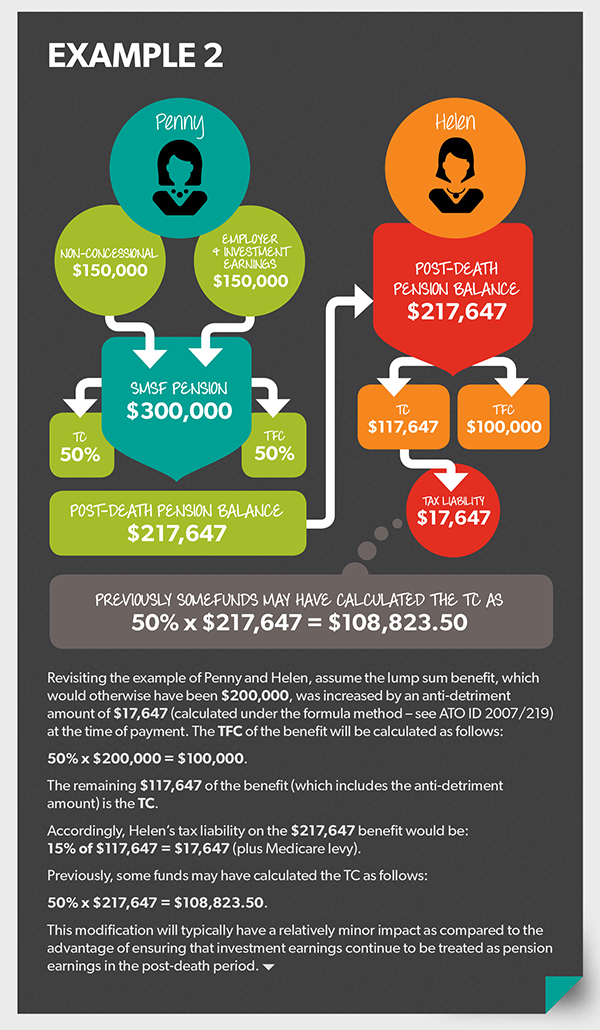

Let’s start with an explanation of the effect of the regulations in the simple case, then examine more complicated examples. In all cases, assume an SMSF member who has a pension account dies and the pension does not automatically revert to another beneficiary on death. Also assume that, technically, the pension account represents one super interest – the member may or may not have other super interests in the fund, such as an accumulation account or another pension account.

The simple case

This is where:

- a death benefit is paid as a lump sum or a new income stream or a combination of both;

- the benefit is paid from the deceased’s pension account;

- no insurance (including fund self-insurance) amount is paid into that pension account after death;

- no anti-detriment benefit is paid;

- the only amount added to that pension account after death is investment earnings; and

- the benefit is paid as soon as practicable after death, which is required under the Superannuation Industry (Supervision) Act 1993 in any case.

In these cases, the effect of the amendments is that:

the earnings on the assets backing the deceased’s pension account continue to be tax exempt right up until the time of the benefit payment; and

the TFC and TC of any death benefit will generally be based on the percentages that were fixed when the pension commenced to determine the components for all benefit payments to the pension recipient. This applies both where the death benefit is taken as a lump sum or a new pension. In the latter case, these components will apply to each payment under that new pension.

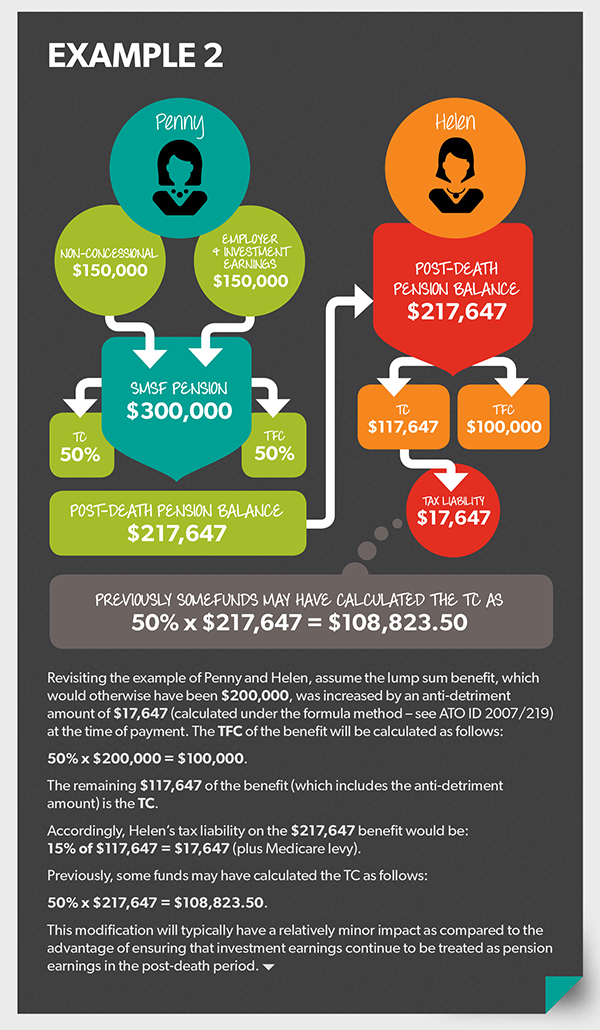

Adding anti-detriment amounts

If the only variation from the simple case is that the benefit is increased by the addition of an anti-detriment amount at the time of payment, then the effect of the amendments is:

- the earnings on the assets backing the deceased’s pension account continue to be tax exempt right up until the time of the benefit payment; and

- so far as benefits tax is concerned:

- 100 per cent of the anti-detriment amount is treated as TC;

- the TFC and TC of the rest of the benefit will generally be based on the percentages of these components fixed at the time the pension commenced.

Given that benefits tax will only be applicable for a tax non-dependant, this prescribed component treatment for the anti-detriment amount will only be relevant for benefits paid to a non-dependent child of the deceased.

Adding post-death insurance proceeds or self-insurance amounts

To the extent that a death benefit is attributable to insurance policy proceeds or fund self-insurance paid into the pension account after death, then it will be treated as TC.

So the treatment of these insurance amounts is similar to the treatment of an anti-detriment amount and will typically differ from the treatment of the rest of the benefit.

Other cases

If amounts are added to the deceased member’s non-reversionary pension account other than as described, then we can expect the following tax implications arising from the views likely to be expressed by the ATO in its forthcoming final ruling:

- earnings on such amounts will not be exempt from tax; and

- all post-death additions (including investment earnings) would count as TC of the relevant death benefit.

Also, if the death benefit is not paid as soon as practicable, then the fund earnings tax exemption will cease once the payment is late or, in some cases, with effect from the date of death.

A timely regulatory solution

The new rules providing continued fund earnings tax exemption apply from the start of the 2013 income year, and those dealing with benefit tax component calculations apply from 4 June 2013.

While resolution has been a long time coming, it seems that in most cases the regulations provide a timely and practical solution for trustees dealing with tax issues surrounding the death of an SMSF pensioner.

Example 1:

Example 2: