The proposal to allow SMSFs with a good compliance record to switch to a triennial audit cycle is deeply flawed, writes Ron Phipps-Ellis.

The SMSF industry is a $700 billion sector that is unique on a world scale so far as it places concessionally taxed assets targeted for the retirement of individuals directly into their own control and then directs them to comply with complex legislated rules.

Most trustees rely on their accountant, administrator or financial adviser to assist them with strategies and legislative compliance.

The value superannuation auditors represent in the collaboration process in building relationships with accountants, administrators and advisers is often overlooked and is not fully appreciated. An annual audit always has been, and always should be, an integral and essential part of the compliance process.

With that in mind, I cannot understand any logic in allowing SMSF trustees to self-assess their compliance with legislation in any three-year audit cycle just to save costs and purportedly reduce red tape. If the proposed legislation to allow this proceeds, it is likely fees for professional services paid by trustees will increase.

Responses to the government’s three-year audit cycle consultation paper closed on 31 August. It is important to acknowledge the government’s focus and commitment to reducing red tape and the compliance burden for SMSF trustees where suitable, however, the purported benefits of this measure have been questioned by numerous responses submitted to Canberra.

“The Super System Review: Final Report” of 29 May 2009, paragraph 7.5.1 Timing of audits states: “Given the growing size of the SMSF sector and the importance of the audit role, the panel believes that the current frequency of annual audits is appropriate and should not be reduced.”

It is unclear why the government has chosen to revisit this recommendation nearly 10 years on without formal investigation and industry consultation prior to announcing the proposal. Additional uncertainty exists given SMSFs were excluded from the 2018 draft Productivity Commission report.

The 2009 report recommended and resulted in the sensible mandating of both competency standards and independence requirements, as well as the compulsory registration of SMSF auditors.

Since then, the following interesting facts have emerged:

- The number of Australian Securities and Investments Commission (ASIC)-approved SMSF auditors has fallen from an estimated 11,500 in 2007 to less than 6000 in 2018. If the proposal is legislated, it is possible the number of registered auditors will continue to trend downwards. This proposition is supported by discussions below.

- The imposition of auditor registration fees of $1927 and deregistration fees of $899 since July 2018 was another unexpected surprise to the industry.

- The average and median level of audit fees has dropped rather steeply since 2008. Currently there is no available data to estimate the average or median SMSF audit fee for 2018, but it has certainly decreased in the past decade, which by itself has incentivised good record-keeping and compliance for SMSF trustees.

- The annual SMSF annual return (SAR) lodgement fee has progressively increased from $159 in 2008 to $259 currently. This is a clear financial disincentive to SMSF trustees.

To support our submission to the government opposing the three-yearly audit cycle, Evolv recently commissioned surveys of key participants in the SMSF sector. Specifically, three separate surveys were sent to trustees, accountants/SMSF administrators and auditors.

The survey distribution was also supported by Benchmark Media in providing links to their trustees and accountants database.

We received a total of 583 individual responses representing around 44,500 SMSFs.

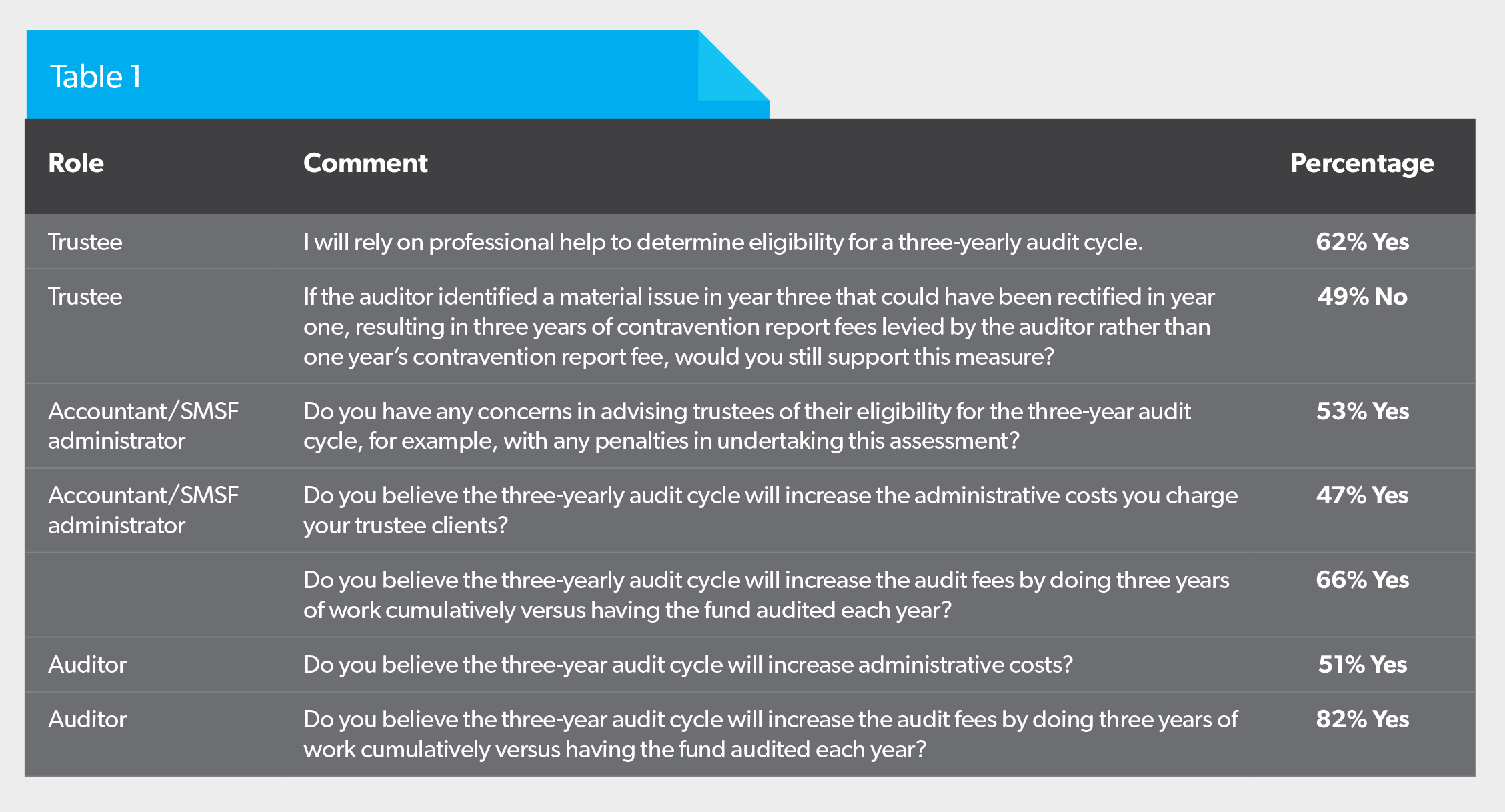

To reinforce our position that the measure will likely lead to increased costs at the audit and other service provider levels, our survey respondents provided the results in Table 1:

Further factual evidence obtained from the survey arguing against the implementation of the proposal showed:

- 43 per cent of trustees indicated they would remain in an annual audit cycle even if it was determined they would be eligible for the three-yearly audit cycle,

- 78 per cent of accountants/SMSF administrators indicated they do not agree with the measure and will advise their trustee clients to remain in an annual audit cycle,

- 95 per cent of auditors do not agree with the proposed measure,

- 80 per cent of accountants/SMSF administrators believe the three-yearly audit cycle will lead to trustee non-compliance,

- 70 per cent of accountants/SMSF administrators are concerned about audit firms’ ability to adapt their resourcing to meet the requirements of the proposed measure,

- 69 per cent of auditors believe the measure will negatively impact on their business workflow,

- 85 per cent of accountants/SMSF administrators do not believe the proposed measure is in the best interest of the integrity of the SMSF sector,

- 82 per cent of auditors believe the measure will adversely affect their ability to provide trustee education and guidance via a management letter, and

- 48 per cent of auditors will review their decision to provide SMSF services should the measure be passed. (SMSF auditor registrations and competency could decline).

Some practical certainties of why audit fees will increase from an auditor’s perspective include:

- Where errors are identified by auditors requiring amendments to any three years of financial statements, the cascading adjustments required to each subsequent financial year will increase both audit costs and administration fees for multiple years, versus for just one year if an annual audit was conducted. Contravention fees for multiple audit years might also have been avoided.

- It is usually only in extremely limited circumstances that economies of scale in audit fees can be achieved by auditing consecutive years of SMSFs at once.

- Where changes occur to service providers (accountants, financial advisers or auditors) in the preceding years of the audit being conducted, increased fees will result.

- Where trustees seek advice from their adviser to assess their eligibility for the three-year audit cycle, they will normally be charged for this service. Advisers will most likely increase their fees to cover their financial liability of being responsible for any penalties.

- Where adequate source documentation cannot be located for each audit year, fees for contraventions will increase (especially contravention fees for section 35C(2)).

- Audit firms will struggle to maintain adequate levels of professional resourcing during alternate years where their SMSF clients are not required to be audited.

- Some uncertainties need clarification from the government. These include:

- Where an SMSF qualifies for a three-yearly audit cycle, will a single audit report be required covering all three financial years, or alternatively whether an audit report will still be required for each individual year.

- Whether any repercussions of failing to appropriately self-assess eligibility for a three-yearly audit cycle will result. It stands any monetary penalties will immediately negate any potential cost savings of having a three-yearly audit cycle.

We also envisage some unintended consequences in the following areas will occur:

- Resourcing: retaining, or recruiting and retraining staff every few years is just practically impossible to implement. Larger full-service firms have the ability to train staff to move between other divisions within the firm, but smaller accounting firms, and in particular most specialist audit-only firms, do not have that capability. The likelihood of creating capacity via overseas resourcing might become more of a viable option. Consolidation of audit firms might also result, but it seems inevitable the number of ASIC-registered SMSF auditors will further reduce.

- Independence: there is a greater chance of both auditor and accountant impairment if they are pressured by SMSF trustees to potentially ignore compliance issues to ensure funds qualify for the triennial audit exemption. The proposed legislation will most likely increase these intimidation threats.

- Compliance: the proposed legislation might encourage some trustees to ignore compliance laws, knowing the fund will not be audited for several years. A key issue for SMSF auditors relating to compliance is obtaining sufficient appropriate audit evidence – it is already difficult to obtain relevant and reliable evidence for the current year being audited. If we move to triennial audits, we would be asking for documentation from trustees up to four years after the event. This may result in more contraventions being reported to the ATO and, more worryingly, up to four years after the contravention occurred.

- Audit quality might decline as auditors struggle to maintain their required professional competence and skill levels. Professional bodies and tertiary education centres might struggle to deliver relevant courses to fewer superannuation auditors.

- The continued investment in technology for the superannuation audit industry is likely to be stifled. The willingness of super auditors to adapt to new audit methodologies brought about by important advances in data-fed transactions and data analysis will stagnate. This should be compared to the advances in technology that auditors undertaking statutory audits have already moved towards.

It seems incongruent that Australian Prudential Regulation Authority-regulated funds, large proprietary companies, Australian financial services licences and other industries continue to require annual audits.

In my personal view, this proposal clearly undervalues the importance superannuation auditors represent to the ATO as their agents and to the relationships super auditors develop with other professionals servicing the SMSF industry. As such, reducing the frequency of this interaction is not in the best interest of the industry and is likely to increase administration fees with the burden of proper oversight reverting to the accountants and administrators in the intervening years of audit.

Market forces have substantially reduced the prices of super fund audits over the years to a level that has been accepted in the industry. Government legislation disturbing this in favour of self-assessment of audits by trustees every three years seems unnecessary as it is likely to increase the compliance burden and red tape, with limited quantifiable foreseeable benefits resulting.

Significant uncertainty now awaits SMSF auditors as to the likely outcome of this proposal.