Amanda Skelly outlines the reasons why SMSF trustees should consider investment opportunities arising in the United States.

The growth of the exchange-traded fund (ETF) market in Australia is indicative of how we embrace innovative ways to invest.

Since the listing of Australia’s first-ever ETF, the SPDR S&P/ASX 200 Fund, the ETF market has grown exponentially with a 10-year compound annual growth rate of 33 per cent.

SMSFs have been the early adopters of ETFs and as these investors look for greater portfolio diversification, new ETFs are being introduced, allowing access to a broader range of markets – one being the US, which is currently experiencing a revival.

So why should SMSF trustees look to make allocations to the US now? We see two key reasons:

- Diversification to the Australian share market, and

- The ‘American competitive renaissance’ and the unique investment opportunities now available in the US.

Access new sectors and a diverse range of companies

The S&P 500 and S&P/ASX 200 indices are both familiar household names and represent around 80 per cent of the total market capitalisation within their respective markets.

However, they differ significantly in many aspects due to different economic landscapes and financial market developments. Because of this, there may be a number of compelling reasons for Australian investors to consider investing in the US to diversify their portfolios.

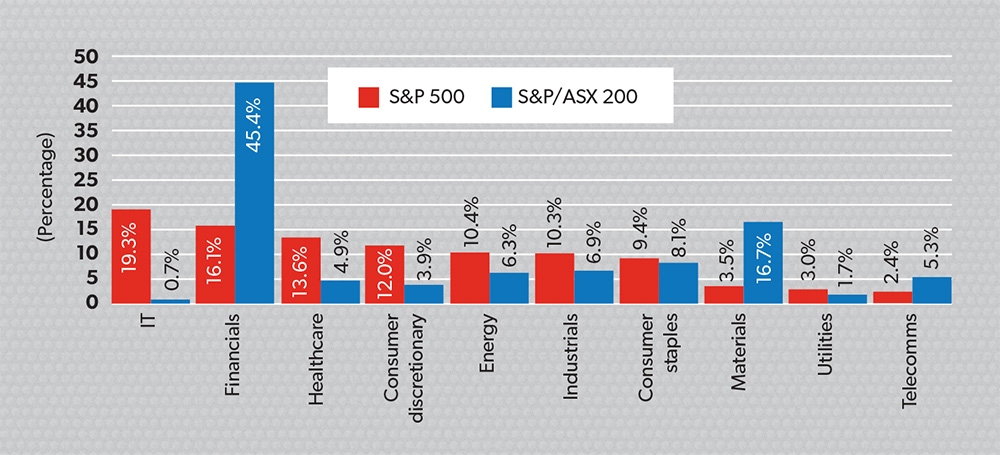

The S&P 500 is highly diversified among sectors, with no single sector dominating more than 20 per cent of the index. Information technology is the biggest sector, accounting for 19 per cent of the index, closely followed by financials and healthcare.

Compare this against the S&P/ASX 200, which is highly concentrated in financials, with around 45 per cent of the index, as shown in Figure 1.

Figure 1: Make-up of the S&P 500 and S&P/ASX 200

The S&P 500 has significantly higher weighting to the IT and healthcare sectors, with names like Apple, Microsoft and Google featuring in the IT sector. Within the healthcare sector of the S&P 500, Johnson & Johnson, Pfizer and Merck, which are worldwide providers of healthcare and pharmaceutical products, are familiar names.

With ageing populations and the retiring of the baby boomers, healthcare exposure provides investors with the opportunity to leverage the growth within this sector.

Comparatively speaking, Australia has a much lower representation of healthcare.

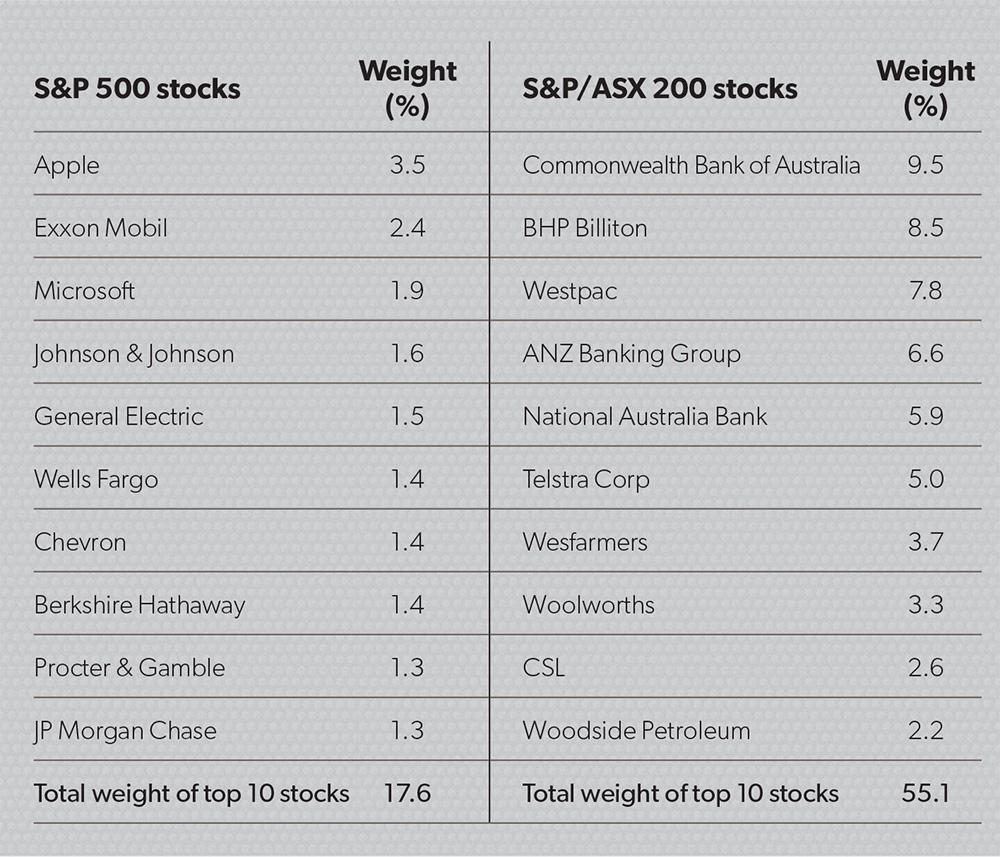

Table 1 summarises the differences between both indices. As you can see, Australians are familiar with many of the top 10 companies and most probably use their goods or services daily.

Table 1: Top 10 Index members in the S&P 500 and the S&P/ASX 200

Source: S&P Dow Jones Indicies, Why does the S&P 500 Matter to Australia? September 2014

The American competitive renaissance

The US economy is on the mend. While technological innovation and research and development investments in the US energy and healthcare sectors are boosting the production of new, lower-priced drugs and moving the US towards energy independence, there’s also increased productivity and economic growth created by these innovations, which are contributing to a renaissance of American competitiveness across these diverse industries.

There are three main drivers behind the American competitive renaissance: wage convergence, cheaper, homegrown energy and technological innovation. All three appear to have long-term staying power.

The next wave of US growth will evolve from the technological innovation of three distinct sectors: energy, pharmaceuticals and transportation.

Wage convergence

The past few decades witnessed offshoring globally due to lower labour costs, with the vast pool of cheap labour in China being the prime example. But, as more Chinese workers move into the middle class, Chinese wages have risen and the benefits of offshore manufacturing have started to erode.

China also faces a looming demographic problem: decades of adherence to a one-child policy have stunted growth in the labour force, putting upward pressure on wages and raising the issue of a worker shortage.

One result has been movement of offshoring to countries with even lower-paid workers, such as Vietnam. But more importantly, the shrinking wage gap between the US and emerging economies is beginning to drive jobs back home.

Cheaper, homegrown energy

Less than a decade ago, it seemed virtually all US deposits of oil and natural gas had been discovered. Energy prices were hostage to a falling domestic supply and increasing dependence on imports – and the occasional supply shocks that came with overseas geopolitical tension.

But today, fracking technology has increased supply to the extent that the US is the largest global oil producer.

For US manufacturing, significant oil and natural gas offer a competitive advantage over foreign producers, whose energy costs have risen while US prices have declined. Natural gas-fired utility plants can supply electricity at lower prices, adding to the benefits of re-shoring.

Goods can be transported at a lower cost. And for the chemical, metal and fertiliser industries, where natural gas is used as a raw material, cheaper gas offers another cost advantage over offshore competitors.

Technological innovation

The US has always prided itself on being a fertile ground for invention and new ideas. While a penchant for innovation may be hard to quantify, the willingness to invest in innovation is a critical and quantifiable driver of the American competitive renaissance.

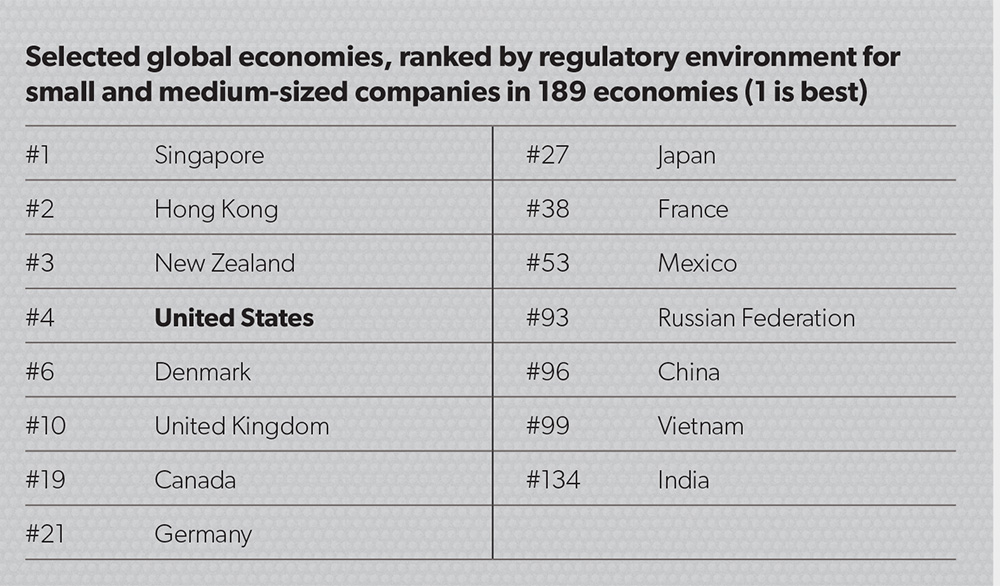

Two recent measures offer evidence US investors and companies are willing to put their money where their mouth is and invest in new products and ideas. Further, US companies in general are easy to do business in. In its annual “Doing Business” report, the World Bank compares the regulatory environments in 189 economies and ranks the ease of doing business for small and medium-sized companies, which have often provided the most fertile ground for innovation.

The rankings measure not only how easy it is to set up a business and comply with regulations, but the degree of regulatory protection afforded a company once it is up and running.

As you can see in Table 2, the US scores very highly within the global stage.

Table 2: Ease of doing business – A tailwind for US Innovation

Source: Doing Business 2014: Understanding Regulations for Small and medium-Size Enterprise © 2014 international and Development/The World Bank

How to secure your piece of the apple pie

Energy: investing in America’s march toward energy independence

The energy sector makes up around 9.7 per cent of the S&P 500, and allows investors to gain exposure to leading companies such as Exxon and Chevron.

The US is in the early stages of an energy revolution, transforming itself from an energy importer to an energy exporter. Although falling crude oil and natural gas prices can be a double-edged sword, lowering profits per unit but increasing demand, we believe the energy revolution, in general, will be positive for companies across the oil and gas industry. In fact, an unusually cold winter in 2013/14 caused natural gas prices to rally in the early months of 2014, and stocks of energy producers followed suit. Cheap natural gas has another benefit: a significantly lower carbon footprint than either coal or oil.

Producers of refined oil products, including the major integrated oil and gas firms, are seeing lower raw material costs than overseas competitors, which we believe makes US-refined gasoline and fuel oils more competitive globally. Unlike crude oil, US-produced gasoline and other refined fuels can be exported, and as with liquefied natural gas, the export market is growing.

Pharmaceuticals: an industry in the process of reinventing itself

The pharmaceutical sector sits within healthcare within the S&P 500, with healthcare making up 13.9 per cent of the index. Pharmaceuticals allow investors to gain exposure to leading companies such as Merck and Eli Lilly.

Pharmaceutical companies research, develop, manufacture and sell drugs. Biotechs engage in similar work as the pharmaceuticals industry, but are more focused on research and development of new innovative drugs to meet unique needs. In the pharmaceuticals and biotech industry, innovations are being driven by an upcoming ‘patent cliff’, where a significant number of patents on highly profitable drugs are set to expire over the coming years.

Further, the Affordable Care Act, which aims to reduce drug prices by giving generic drug manufacturers expedited processing, is also increasing completion and innovation.

Transportation: a sector that has been highly correlated to re-shoring, the energy revolution and the overall economy

Transportation sits within the industrials sector, which makes up around 10.3 per cent of the S&P 500. Transportation allows investors to gain exposure to leading companies such as Delta Airlines and UPS.

The transportation sector is a bellwether of the US economy because virtually any physical good sold, imported or exported must be transported to its final owner. Since the transportation sector serves almost every other sector of the economy, transportation companies tend to have a diverse customer base and thus be less sensitive to a stumble in any one client industry.

And because every mode of transportation is based on fuel-consuming vehicles, the stable or declining fuel prices brought on by oil and gas fracking have also aided profits in the sector. For these reasons, investing in transportation offers investors an attractive way to participate in the recovering US economy, the renaissance in American manufacturing and the energy revolution as well.

Since the US recession during 2008/09, freight shipments and passenger travel have seen a near-steady increase for almost five years. In our view, this increase is driven in part by the recovering US economy, and also by secular trends that have benefited individual industries within the transportation sector.

Compelling proposition

The American competitive renaissance is a small story within a larger narrative. We believe the background narrative is that the US continues to lead the world out of the financial crisis — perhaps not as fast as some would like, but steadily upward nonetheless. We believe investing in the US share market presents potential strategic, long-term opportunities.

ETFs provide a compelling proposition to invest in these trends, easily accessed through the recently launched SPDR S&P 500 on the ASX, a further indication of the Australian ETF market’s strength.