SMSFs can be a powerful structure in enabling the purchases of businesses in a succession planning context. Grant Abbott details how superannuation unrelated investment trusts can facilitate these types of strategies.

There is never a dull day when it comes to the strategy side of SMSFs. With so many rulings, new laws, cases and ideas from various corners of the SMSF industry floating around, it is difficult to keep up, even when you live, breathe and sleep SMSF strategies. For those part-time SMSF trustees getting the right information, strategies and ideas can be a real challenge.

At the moment, our legal team is researching and preparing material for the SMSF Strategies Day to be held in Brisbane (14 July), Melbourne (16 July), Sydney (18 July), Perth (21 July), Adelaide (23 July) and Newcastle (25 July). This is the one series I personally look forward to each year and pour all of our resources and my heart and soul into it.

One of the strategies we will be looking at on the day is the use of a superannuation unrelated investment trust (SUIT), where members of generation X use their superannuation in an SMSF along with borrowings to acquire a business from an existing baby boomer.

With more than 1.4 million baby boomers exiting their businesses over the next decade, it is a great strategy for the asset and income poor, but super rich gen Xers to put their foot on the best small businesses. The strategy follows and expands on a recent legal strategy query from an accountant, which is detailed below.

Technical question

I have a client that is a four-partner real estate firm that has just put a down payment on a commercial premises, which will be let to the business. The client is able to raise a significant deposit from the combined super balances from each partner and their spouses, however, there will be a shortfall for which bank finance will be required.

The partners of the real estate business operate from a unit trust structure and are the directors and shareholders of the corporate trustee at 25 per cent each.

As the business partners are different ages, we decided to form four separate SMSFs with the view for those SMSFs to acquire as many units as each member can raise. That way the unit trust will not be controlled by any party as each SMSF will only have different ownership interests in the unit trust.

We are comfortable the commercial space is business real property and can be acquired in some capacity by an SMSF and leased back to the real estate business at commercial rates.

Strategy discussion

In relation to structuring, can you discuss the following questions:

1. Can a unit trust structure be created without breaching the in-house rules under section 66 of the Superannuation Industry (Supervision) (SIS) Act, that is, would this be a related trust if we had 25 per cent for each SMSF and all four directors were joint appointors?

The issue to be determined is whether a member or related group has actual control of the unit trust. The test for control of a unit trust can be found in section 70E(2) of the SIS Act. That section provides that control of a unit trust will arise if one or more of the following three tests are met:

where a member or group of related parties with the member hold more than 50 per cent of the income and capital entitlements of the trust,

the majority of the trustees of the trust are accustomed or under an obligation (whether formal or informal), or might reasonably be expected, to act in accordance with the directions, instructions or wishes of a group in relation to the entity (whether those directions, instructions or wishes are, or might reasonably be expected to be, communicated directly or through interposed companies, partnerships or trusts), and

a group in relation to the entity is able to remove or appoint the trustee, or a majority of the trustees, of the trust.

Applying to the facts of this case, the partnership issue is the key issue. In that regard, an associate of a member includes a partner and their spouse (see Section 70B of the SIS Act). Currently, if the four parties operate their business through a unit trust and not a partnership, then they should not be associates unless they are relatives. If they are not associates, then the control issue above does not come into play.

In our opinion, an unrelated unit trust for SMSFs is the right legal structure for these purposes. As a unit trust, there are no appointers

In terms of control of trustee, we recommend all four parties should be trustees or better still establish a standard company with each party appointed as a director so that there is no party with control, such as a single director, or even two directors with one of the directors acting as permanent chairperson with a casting vote.

2. Can the unit trust borrow the balance of funds required if we establish a SUIT?

The trustee of the SUIT has the power to borrow money. Specifically clause 14.1(b) of the NowInfinity SUIT allows the trustee “to buy, transfer, acquire, hire or lease any real or personal property or to borrow any moneys from the trustee in its personal capacity or in the capacity of trustee of any other trust fund or otherwise howsoever or from any company or partnership whatsoever notwithstanding that the trustee is a shareholder director or member or partner of any such company or partnership or from the husband and wife or child or children of any trustee”.

When approaching a bank to apply for a borrowing, it will want to see the SUIT document properly executed and generally a corporate trustee in place. The corporate trustee of the SUIT must be different to the special purpose corporate trustee of the SMSF investors.

3. Can the unit trust borrow to make improvements to the property, that is, the commercial fit-out for the office spaces required for the business?

Section 67 of the SIS Act does not allow the trustee of a fund to borrow. However, section 67A enables the trustee of a superannuation fund to borrow to acquire property, but not to make improvements to a property.

A SUIT is a unit trust and not a superannuation fund. Provided it is not caught by the in-house assets test, canvassed earlier, the SIS Act would not apply to the trustee of the SUIT. In terms of making improvements, it is crucial to look at the trustee powers of the SUIT trust deed.

In particular, clause 13.1(g) empowers the trustee to “hold, use, purchase, construct, demolish, maintain, repair, renovate, reconstruct, develop, improve, sell, transfer, convey, surrender, let, lease, exchange, take and grant options or rights in, alienate, mortgage, charge, pledge, reconvey, release or discharge or otherwise deal with any real or personal property and in particular shares, debentures or securities of any company and with or without deferred restricted qualified or special rights relating thereto”.

As such, the trustee of the SUIT can use money borrowed to improve the commercial premises, including acquiring lease fit-out.

4. Are there any other issues?

It is important to also ensure:

- The acquisition price will be the market value of the property in the SUIT’s balance sheet. Although the market valuation rules under SIS regulation 8.02B apply for a superannuation fund, they will not apply to a SUIT as it is a unit trust not regulated by the superannuation laws. Compare this to the SIS regulation 13.22C trust, which is a specific related-party trust that is exempt from the in-house assets test and regulated under the SIS regulations. Although not required to value to market each year, it is still best practice for the SUIT trustee to value the property on a regular basis. Importantly, the trustees of each of the investor SMSFs will need to value their investment in the SUIT on a year-end basis as per SIS regulation 8.02B.

- The lease of the commercial premises to the business must be at market value. In that regard, it is important to get a proper valuer and ensure the terms and conditions are no more favourable to the lessee than they would be to any other arm’s-length party as outlined in section 109 of the SIS Act.

- We would strongly advise an exit strategy and in that vein a unitholder’s agreement should be drafted with each SMSF trustee’s desires in mind. With SMSF trustee investors of different ages, there may be different investment time frames. If one of the 25 per cent interests is acquired by another trustee, say a younger trustee, then they will hit the 50 per cent limit with any further acquisition of a unit, turning the SUIT into a related trust for that specific SMSF investor.

- Similarly, a death strategy needs to be conducted to determine what will happen with the underlying investment in the event of the death of one of the members of the SMSF investing in the SUIT. It may be that the remaining trustee of the fund holding the deceased member’s superannuation benefit may want to dispose of their interest in the SUIT to pay out the spouse. A good insurance strategy to cover the death or disability of the member or all of the members of the SMSF holding the SUIT would be prudent, and would allow the SUIT arrangement to remain intact at the time of death when a cash payout is required.

Additional considerations

There are two further layers on the above SUIT strategy that can be considered:

- The acquisition of a property management income stream from a third party and the various requirements to get this up and running. This can be compared to buying an insurance book or trailing commissions from a financial planning firm.

- The acquisition of an accounting practice through a SUIT, where three managers complete a management buyout of their firm using their current superannuation and borrowings.

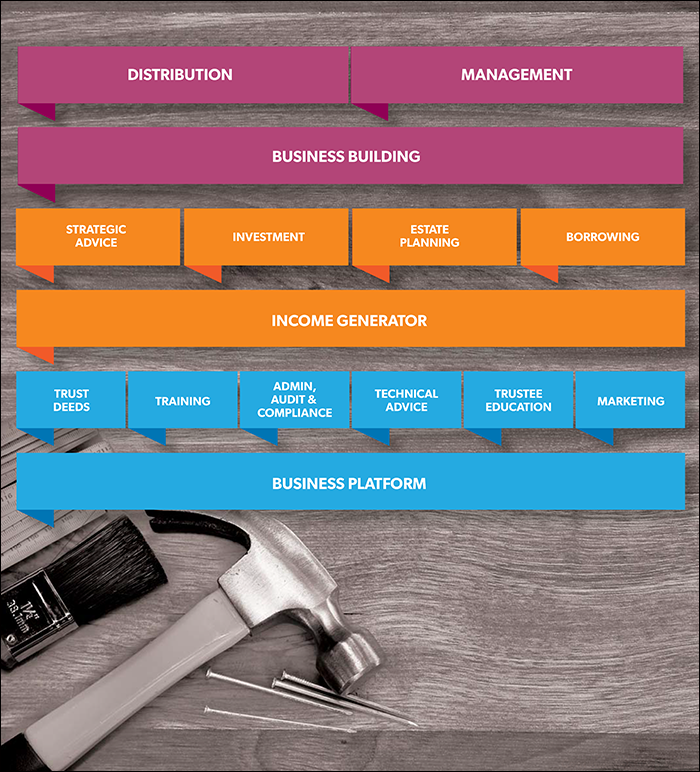

Figure 1