Financial planners are now subject to tax agent services legislation. Tony Greco has a look at what additional professional obligations now apply.

Welcome to the newest category of tax adviser, aptly titled ‘tax (financial) adviser’.

The government has amended the tax agent services law to introduce this new third category of tax adviser. Tax agents and business activity statement agents no longer share this space on their own.

It’s been a long journey bringing financial advisers within the Tax Agent Services Act (TASA). The industry has historically maintained that any tax advice included as part of providing financial advice is incidental in nature.

By maintaining this position, the financial planning industry has managed to evade being caught under the TASA net and, as a result, scrutiny from the Tax Practitioners Board (TPB). This is all about to change.

The financial planning industry has begrudgingly acknowledged that tax forms an integral part of providing personal financial advice. The industry cannot avoid scrutiny from the TPB and the TASA rules anymore.

Financial planners require an understanding of tax laws in nearly all the activities undertaken in providing professional advice to a client. Financial planners consider the tax implications for clients when advising on super, investments, savings mechanisms, estate planning, debt management, government benefits, insurance needs and retirement planning.

The tax implications are at the core of planners’ considerations in nearly all aspects of financial advice.

Recognising tax is integral to the advice they provide, financial planners have been required to include the following disclaimer in all statements of advice since the introduction of the TASA regime back in 2010:

- the provider of the advice is not a registered tax agent or tax (financial) adviser under the new law, and

- if the receiver of the advice intends to rely on the advice to satisfy liabilities or obligations or claim entitlements that arise, or could arise, under a taxation law, the receiver should request advice from a registered tax agent or a registered tax (financial) adviser.

The disclaimer was a last minute trade-off to facilitate giving the industry more time to come to grips with operating under the TASA regime. The disclaimer must continue to be used during the transitional period until the financial planner registers with the TPB.

The tax agent services regime requires anyone ascertaining or advising about the liabilities, obligations or entitlements of an entity or person under taxation law for a fee, to become registered with the TPB.

This includes financial planners who consider the tax implications for clients when providing professional financial advice. The objective of TASA is to bring all providers of tax advice within the TASA regime. Considering valuers and quantity surveyors have had to register with the TPB when TASA was first introduced, financial planners have been lucky to delay coming under the TASA regime until now.

To facilitate the development of requirements appropriate to the tax advice provided by financial planners, the government has amended the tax agent services law to introduce a new third category of tax (financial) adviser service. This new category of tax adviser allows financial planners to provide tax advice that is associated with the provision of financial advice.

Once a tax (financial) adviser is registered with the TPB, the adviser will be permitted to give tax advice covering any tax matter, provided it is in the course of providing financial advice. The only exclusion is lodgement of returns and representing taxpayers with the commissioner.

If you provide personal advice, you will likely fall under the definition of providing a tax (financial) advice service and will be required to register with the TPB. If you only provide factual information about tax laws or general advice about tax laws, then you are unlikely to be captured by the TASA regime as it does not take into consideration the client’s specific circumstances and hence it is not reasonable to expect someone will rely on the advice.

Registration

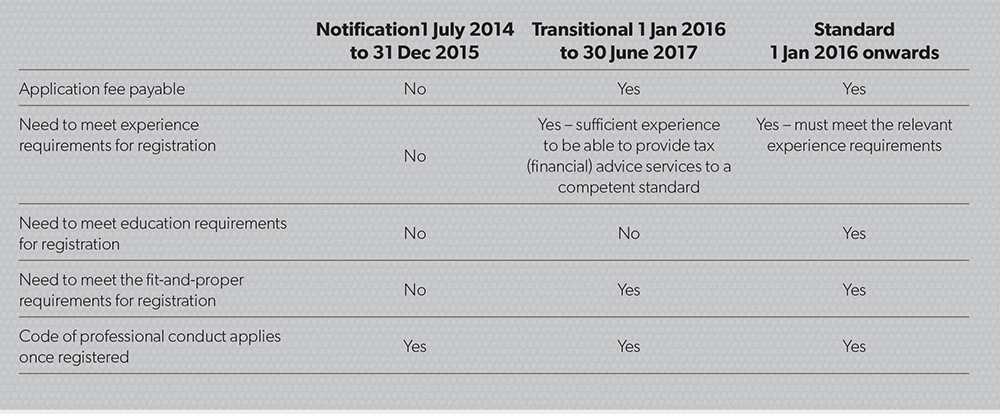

From 1 July 2014, financial planners have a three-year transition period to register with the TPB and comply with the requirements of the regime and the TASA code. Licensees and authorised representatives will be able to be registered directly with the TPB during the notification phase, which lasts for 18 months, ending on 31 December 2015 (see Figure 1).

Figure 1: Registration process

Australian financial services (AFS) licensees and authorised representatives who do not notify the TPB must continue to use the disclaimer when providing tax (financial) advice services for a fee or other reward. The disclaimer will only be effective until 31 December 2015.

After this date, unregistered entities that continue to provide tax (financial) advice services for a fee or other reward may be liable for civil penalties, regardless of whether they use a disclaimer.

Important to note is that while you are not required to have completed any education or training requirements during the notification phase, once you have notified the TPB you are subject to TASA’s code of professional conduct. One of the code’s requirements is competency, so financial planners will be accountable for any tax advice provided in the advice given. The previously used disclaimer cannot be used to shelter responsibility anymore.

Transitional option – 1 January 2016 until 30 June 2017

From 1 January 2016, all AFS licensees and their representatives will be able to apply to register with the TPB if they meet the transitional or standard eligibility requirements. This applies to all representatives, not just authorised representatives, and includes:

- employees or directors of the AFS licensee,

- employees or directors of a related body corporate of the AFS licensee, and

- other individuals acting on behalf of the AFS licensee.

At the time of writing, there are four different registration options available when applying for registration (see below). These include a combination of qualification and experience criteria.

Similar to tax agents, there will also be a registration option based on voting membership of a recognised professional association (item 304). If the applicant is a voting member and has six years of full-time relevant experience in the preceding eight years, the applicant will not have to complete any board-approved courses in commercial law or taxation law.

In effect, a financial adviser will be allowed to give tax advice despite not having undertaken any education in Australian tax law or commercial law.

Given a tax (financial) adviser will be able to provide tax advice covering any tax matter, we are concerned there is no requirement for any formal education standard. It has already been noted ASIC Regulatory Guide 146 lacks any comprehensive education on Australian taxation law. Given this lack of prior tax-related education, we are worried about the level of tax education standards of financial planners registering under the TASA regime under this option.

Qualifications and experience requirements

To apply to register or renew your registration as a tax (financial) adviser under the standard option, you will need to be, or have been within the preceding 90 days, an AFS licensee or a representative of an AFS licensee.

You will also need to meet the qualifications and experience requirements through one of the following four options.

Tertiary qualifications (item 301)

- To meet the requirements under item 301, you must have:

- been awarded a degree or postgraduate award from an Australian tertiary institution (or a degree or award that is approved by the board from an equivalent institution) in a relevant discipline,

- completed a board-approved course in commercial law and a board-approved course in Australian taxation law, and

the equivalent of 12 months of full-time, relevant experience in the preceding five years.

Diploma or higher award (item 302)

To meet the requirements under item 302, you must have:

- been awarded a diploma or higher award from a registered training organisation (or an equivalent institution) in a relevant discipline,

- completed a board-approved course in commercial law and Australian taxation law, and

- the equivalent of 18 months of full-time, relevant experience in the preceding five years.

Work experience (Item 303)

To meet the requirements under item 303 you must have:

- completed a board-approved course in commercial law,

- completed a board-approved course in Australian taxation law,

- the equivalent of three years of full-time, relevant experience in the preceding five years.

Membership of professional association (Item 304)

To meet the requirements under item 304 you must:

- be a voting member of a recognised tax (financial) adviser association or recognised tax agent association, and

- have the equivalent of six years of full-time, relevant experience in the preceding eight years.

TASA code of conduct

- From 1 July 2014, financial planners who register as tax (financial) advisers will need to comply with the TASA code of conduct. There are five requirements under the code:

Honesty and integrity

- You must act honestly and with integrity.

Independence

- You must act lawfully in the best interests of your client.

Confidentiality

- Unless you have a legal duty to do so, you must not disclose any information relating to a client’s affairs to a third party without your client’s permission.

Competence

- You must ensure the service you provide is provided competently.

- You must maintain knowledge and skills relevant to the tax agent services that you provide.

Other responsibilities

You must maintain the professional indemnity insurance that the board requires you to maintain.

You must respond to requests and directions from the board in a timely, responsible and reasonable manner.

The TPB guidance on continuing professional education (CPE) is 60 hours over a three-year period, with a minimum of six hours of relevant CPE in any given year. With respect to professional indemnity (PI) insurance, the TPB has proposed recognising existing PI insurance policies during the implementation period from 1 July 2014 to 31 December 2016.

However, upon lapse of that policy or by 1 January 2017, whichever occurs first, a tax (financial) adviser must obtain a policy that complies with the TPB’s requirements.

Table 1: Overview of notification, transitional and standard options

Having dodged the TASA bullet until now, the financial planning industry must now come to grips with the obligations imposed by TASA. It is important all providers of tax advice are governed by the one hymn sheet, which is one of the fundamental principles behind the introduction of the TASA regime. Accountants wanting to provide financial advice are similarly looking at the various licensing options under the AFS licensing regime, which is responsible for the regulation of all providers of financial advice.

Welcome to the world of convergence.