The low interest rate environment has compelled some SMSF members to consider investing in hybrids to make their cash deliver higher returns. Elizabeth Moran details how to properly assess the merit of these instruments when considering an allocation to them and the role they should play within a portfolio.

Over the past few months there has been a flurry of hybrids issued on the Australian Securities Exchange (ASX) and a corresponding rush to invest by yield-starved investors looking for a home for their growing piles of cash.

Margins have been increasing since Commonwealth Bank of Australia (CBA) Perls VII were issued at a very low 2.8 per cent margin in 2014 to the peak CBA Perls VIII margin of 5.2 per cent earlier this year – that’s a big jump and helps explain the resurgent issuance and take up by investors.

More recently, the Westpac Capital Notes 4 were issued with a 4.9 per cent margin. While the margins are attractive, it’s important to assess the relative value of hybrids rather than buying the latest one on offer. The sell-off of older hybrids has pushed their return up and it’s quite possible a relative value assessment will have you thinking about a range of options.

Assessing hybrids is no different to any other investment. It is about ensuring the highest possible return given the lowest possible risk. To do this, it is worth revisiting some of the main features and risks of hybrids.

What are hybrids?

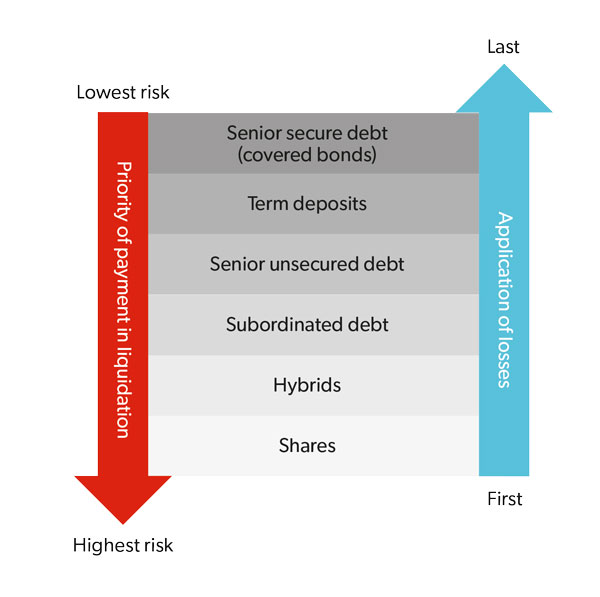

Hybrids are complex capital instruments issued mainly by banks and other financial institutions. Traditionally hybrids were part debt and part equity, but in recent times have become much more equity-like with the capacity to forgo paying interest and, under certain conditions, becoming perpetual investments with no maturity date. Hybrids are issued to meet regulatory requirements set out by the Australian Prudential Regulation Authority (APRA), and the funds contribute to minimum required capital holdings. They are deemed ‘loss-absorbing’ instruments, meant to be written off if needed so the banks can continue to survive without needing taxpayer funds.

Hybrids have evolved over time to meet changing regulations, which means terms and conditions have changed depending on the regulations at the time of issuance. Theoretically hybrids sit somewhere between equity and subordinated debt on a standard capital structure, however, because no two hybrid issues are the same, the true position can vary greatly depending on the terms and conditions of each issue.

The large and varying combinations of terms and conditions, often hidden in the fine print, are what make an assessment of the relative risks of each issue so difficult.

Many hybrid securities have been promoted as investments that offer stable and defensive income streams. In fact, because of their equity-like characteristics, they should form part of your equity allocation.

Assessing value

I’ve found most investors assess the value of hybrids at a superficial level, using simple metrics like price and yield to call. To truly understand whether the returns on offer are appropriate and whether new hybrids are better propositions than older ones, investors need to look deeper. Trigger events for conversion and the price at which a hybrid is converted to equity are two of the major areas where these securities can vary.

These trigger events could include a loss of earnings causing the deferral of interest payments, or a change in tax laws or failing to meet regulatory capital requirements. Each of the triggers can give the bank the right to repay, or convert the hybrid at first call or much later than expected at prices determined by a complex set of terms and conditions.

When assessing a new or existing hybrid, I’d suggest a four-step process.

Table 1: Listed hybrids

Note: Prices accurate as at 9 June 2016. *Yield to call includes franking.

Assess hybrids on offer by the same bank

One of the best ways to evaluate hybrids is to compare them with hybrids already on issue by the same bank. Are the terms and conditions the same? Is the yield to call lower, similar or better? What is the amount on issue and the term to expected call? Is the issue considered cheap funding for the bank?Let’s use ANZ as an example. It currently has five hybrids on issue. All were issued with a margin of 3.1 per cent to 3.6 per cent at first issue, but have a range of terms until first call. If given the choice, which would you invest in, based on the information in the table above?

Shorter terms to call are attractive as there’s more certainty in the performance of the bank, which is a bonus. ANZ is also now issuing new hybrids so that it can repay the first two, so I’d be a fairly confident investor in the ANZPAs and ANZPCs. Then you’d need to take a four-year step to invest in the ANZPDs for a 1.5 per cent pick up in trading margin. Is that enough?

Personally, I’d be less interested in the ANZPEs and ANZPFs, given the longer terms to call for similar margins and returns. So which of the first three hybrids is more appealing?

Checking the prospectuses, I found:

1. ANZPC was the first hybrid issued under new Basel III rules: it contains a capital trigger but no non-viability clause. If ANZ’s capital falls below 5.125 per cent, the ANZPCs automatically convert to shares to bolster capital and try and protect the bank from failing. But unlike the newer hybrids and the ANZPD, the PCs do not have a non-viability clause, so are lower risk. APRA can, at their determination of non-viability convert hybrids and new subordinated debt to equity. The ANZPC wouldn’t convert but the PD, PE and PF would, meaning the PC is structurally superior. This is a key distinction between the two securities, but what additional compensation would you demand to invest in the higher-risk PDs?

2. The ANZPCs have a maximum exchange percentage of 50 per cent for a regular trigger, other similar securities have 20 per cent, so ANZPC holders will get less shares than other hybrid holders based on a regular trigger, which isn’t so favourable.

3. But, ANZPCs have the lowest volume-weighted average price (VWAP) (explained below) of the group. When the PCs were issued the ANZ share price was relatively low and issue VWAP was $19.53. That means the PCs have the lowest hurdle for conversion and could convert to shares while other ANZ hybrid holders could be blocked and miss first call dates.

VWAP is important to understand. It’s used in the conversion calculation of hybrids to shares and in most cases uses the average daily volume weighted average sale price of the share for the 20 business days prior to first issue as part of the calculation for a standard conversion. If conversion is under duress, the share price used is usually the weighted average sale price of the shares for the five days immediately preceding conversion.

Share prices are important in conversion and getting repaid at call or some other future date, so investors need to be aware of share prices, especially as the call date draws closer.

Deciding between the three ANZ hybrids is complex and you need to weigh a number of factors.

Compare those hybrids with a similar structure

Once you have done comparative analysis with hybrids from the same issuer, you can go through a similar process with similar structured hybrids from other banks, again assessing the terms and conditions, yield and term to call. If I was to continue assessing the ANZPC, the Westpac WBCPC has a similar structure and would be a good comparator. In that instance you would base your investment decision on time and yield to call and any perceived difference in risk between the two banks.

Look at the global market

To truly get a feel of relative value, you would then consider international hybrid markets. The European market has much greater depth, with 47 banks issuing A$145 billion equivalent in 98 hybrids. In Australia, our bank hybrid market is worth about A$30 billion from 10 issuers. European hybrid issuance is much broader and offers a global perspective.ANZ’s new US dollar issue is a fantastic development for the market. It will give an international perspective on risk and return of the Australian dollar securities. It may also mean other banks follow ANZ into international markets and ultimately there is less on offer domestically.

Consider the alternatives

As part of the process of assessing hybrids, and acknowledging their complexity and volatility, it is worth looking at the securities that sit immediately above and below them in a company’s capital structure. If you like the hybrids for the yield and have a higher tolerance for volatility, you may be better served investing directly in the company’s shares and focusing on dividends. While there is no certainty over the dividend and no maturity date, you do have the opportunity to outperform if both move higher.

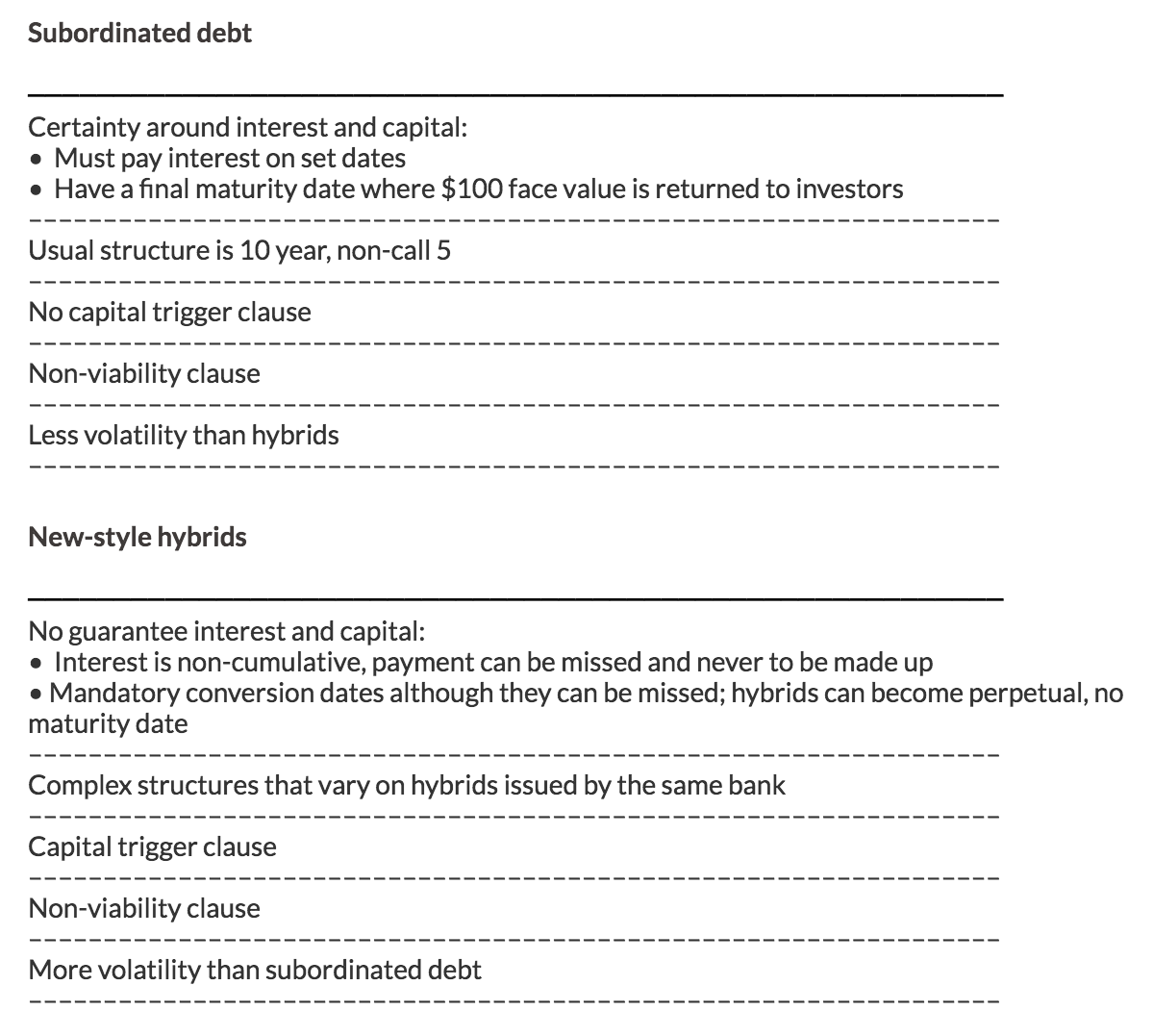

If you are uncomfortable with the volatility of hybrids and like stability, you may be better off looking at subordinated bonds. Above is a side-by-side comparison of subordinated debt and ‘new-style’ hybrids.

Subordinated bonds provide a meaningful alternative to hybrids as they are lower risk debt instruments that display less volatility and have certainty of income and repayment levels. Subordinated debt is also primarily traded in the institutional over-the-counter market with greater capacity for global comparisons.

Summary

If it is not obvious already, hybrids need lengthy, detailed investigation before investing. I’m not saying don’t invest; rather do your homework, understand the risks and determine if the returns are enough to compensate. Finally, if you do invest, include them in your equity allocations as they are now far more equity-like than ever before.