Daniel Butler and William Fettes report on the current rules governing the holding of risk insurance within an SMSF.

Advisers should be aware there have been recent changes that reduce flexibility in implementing different types of insurance in an SMSF context.

From 1 July 2014, regulated superannuation funds have only been able to provide insured benefits consistent with the following conditions of release (subject to certain grandfathering relief):

- death,

- terminal medical conditions (TMC),

- permanent incapacity (PI) (also known as total and permanent disablement (TPD) any occupation and not TPD own occupation), and

- temporary incapacity (TI).

New restrictions – TPD own occupation

It has long been the practice of certain superannuation funds, especially SMSFs, to hold permanent incapacity or TPD insurance policies.

However, from 1 July 2014, regulation 4.07D(2) of the Superannuation Industry (Supervision) Regulations 1994 (SISR) now reads: “A trustee of a regulated superannuation fund must not provide an insured benefit in relation to a member of the fund unless the insured event is consistent with a condition of release specified in item 102 [death], 102A [TMC], 103 [PI – ‘TPD any occupation’] or 109 [TI] of Schedule 1.”

Accordingly, in relation to TPD insurance, the relevant condition of release is item 103 for PI.

Sub-regulation 1.03C of the SISR defines permanent incapacity in relation to a member as follows: “A member of a superannuation fund or an approved deposit fund is taken to be suffering permanent incapacity if a trustee of the fund is reasonably satisfied that the member’s ill-health (whether physical or mental) makes it unlikely that the member will engage in gainful employment for which the member is reasonably qualified by education, training or experience.”

Importantly, for a member to meet this definition, they must not be able to return to employment in any occupation for which they are reasonably qualified by education, training or experience. This definition is often referred to as a TPD any occupation definition.

Trauma insurance

Broadly, trauma insurance covers situations where a person suffers a specified illness (for example, heart attack, cancer or stroke). The Australian Prudential Regulation Authority first expressed doubts about trauma insurance and the sole purpose test in “Superannuation Circular No. III.A.4” in February 2001, and then in SMSFD 2010/1 the ATO said it was acceptable subject to certain qualifications. However, the recent changes settle this question in the negative. SMSFD 2010/1 has since been withdrawn by the ATO and trauma cover can now only continue in a superannuation fund environment if it has grandfathered status from being in place prior to 1 July 2014.

The following paragraphs from the withdrawn determination SMSFD 2010/1W summarise the current state of affairs with regard to trauma insurance:

“5. The insured event under a trauma insurance policy, as described in SMSFD 2010/1, is not consistent with any of the conditions of release set out in sub-regulation 4.07D(2) of the SISR. Therefore, from 1 July 2014, a trustee of an SMSF is prohibited from providing such an insured benefit in relation to a member unless the member joined the fund before 1 July 2014, and was covered in respect of that insured benefit before 1 July 2014.”

“6. It is the commissioner’s view that an SMSF trustee that continues to provide a trauma insurance benefit to a member who joined the fund before 1 July 2014, and was covered in respect of that insured benefit before 1 July 2014, can purchase a trauma insurance policy to support the provision of that benefit and still satisfy the sole purpose test in section 62 of the Superannuation Industry (Supervision) Act provided the conditions set out in SMSFD 2010/1 are met.”

Why conditions of release matter

Insurance funded via superannuation funds is subject to a major hurdle in respect of marrying up a particular insured event with a condition of release under superannuation law. To help illustrate this point, consider a fund member who suffers a specified insured event (for example, a heart attack in respect of a trauma policy). Although insurance proceeds might well be paid to the trustee in accordance with the policy, the fund may be unable to pay these proceeds to the member unless the member qualifies under a condition of release, for example, PI (that is, TPD any occupation), TMC or TI.

Insurance in superannuation

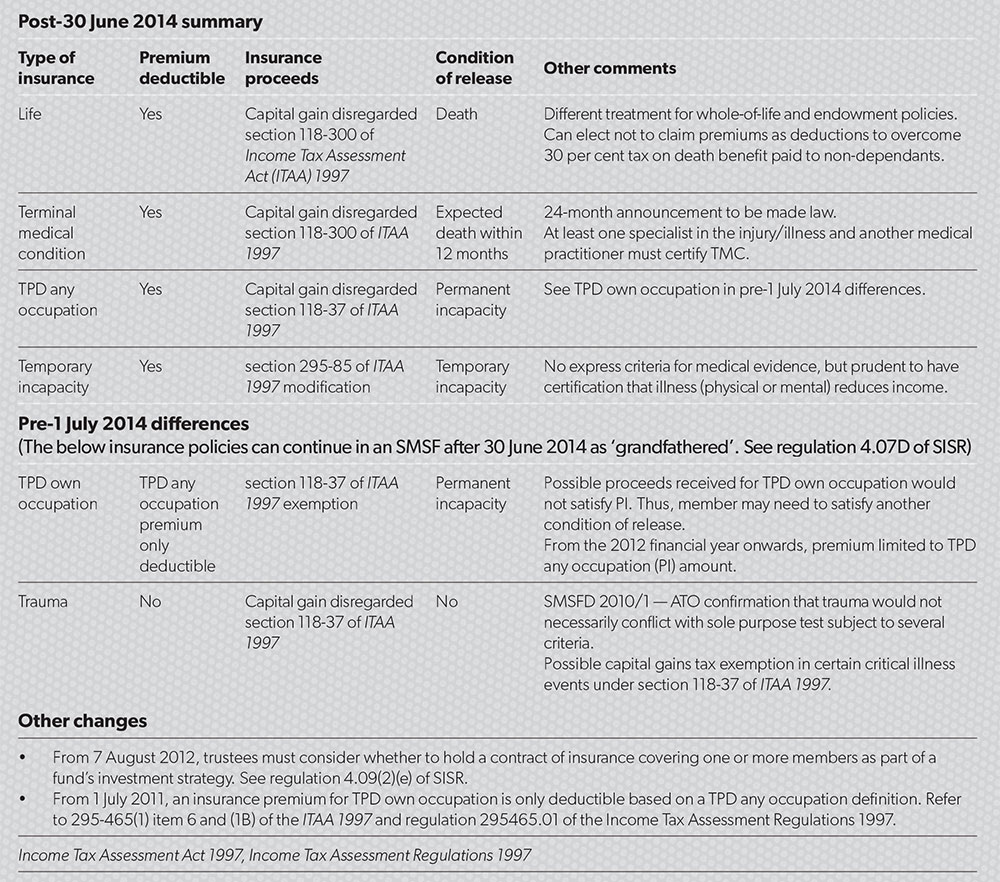

The table below summarises the current SMSF insurance landscape.

The decision of whether or not to take out insurance is an important one which must be considered by SMSF trustees under regulation 4.09(2)(e) of SISR in accordance with a regularly reviewed investment strategy. Accordingly, advisers should make sure they are fully abreast of these developments to ensure their advice and insurance strategies are legally accurate and effective in line with the changing landscape. Also, advisers need to be careful advising on insurance matters unless they are appropriately licensed and qualified.

Table 1