The transfer balance cap has emphasised the advantageous nature of a contribution splitting strategy between spouses, Anne-Marie Esler writes.

I have always been a big believer in equalising super balances between members of a couple in order to minimise the effects of adverse changes to legislation. The same could also be said for equalising investments both inside and outside the superannuation environment, but that is another story. As we all know, successive governments (from both sides of the political spectrum) have continually tinkered with superannuation laws, constantly moving the goalposts on the provision of advice. With the introduction of the transfer balance cap last year, now more than ever it is important to revisit financial planning strategies in the accumulation phase of super. In this article, we look specifically at how splitting super contributions between spouses can limit the impact of the transfer balance cap.

Overview

Super contributions splitting, which was introduced to the Australian super system from 1 July 2006, allows individuals to split or transfer contributions with their spouse. Individuals can split an amount that is the lesser of 85 per cent of a financial year’s ‘taxable splittable contributions’ (which are basically concessional contributions) and the concessional contribution cap (currently $25,000 a year). Taxable splittable contributions include superannuation guarantee (SG), salary sacrifice and personal deductible contributions, but do not include non-concessional contributions. Members may also split 100 per cent of ‘untaxed employer splittable contributions’, which are contributions made on behalf of members of a public sector super scheme.

Contribution splitting can only be actioned in the year following the end of the previous financial year and members can only action one split per year. For example, contributions made during last financial year (2017/18) can only be split during this financial year (2018/19) on or before 30 June 2019. There is one exception to this rule. Super contributions splitting is allowed during a financial year when a member is rolling over or transferring their entire account balance to another super fund or commencing a pension.

Since the introduction of the transfer balance cap last year, strategies that aim to equalise the super balances of a couple, especially super contributions splitting, are now more important than ever. The transfer balance cap imposes a $1.6 million cap on the amount of money that can be transferred to the (tax-free) retirement phase of superannuation, effectively capping the amount of money that can be used to commence a pension. From 1 July 2018, trustees of SMSFs must lodge a transfer balance account report with the ATO where a transfer balance account event occurs in respect of a member. A transfer balance account event includes an SMSF member being paid an income stream that was in force prior to 1 July 2017 and commencement of a new income stream after 1 July 2017.

The following case study highlights the benefits of providing advice in this area.

Case study

We recently assisted a financial adviser providing advice to a young couple who were the perfect candidates for super contributions splitting. The husband, Steve, 44, is a sales executive working full-time and earning a salary of $300,000 a year. He currently has two super funds with a combined balance of $424,000. His employer makes SG contributions up to the maximum and Steve salary sacrifices a portion of his salary so the combined contributions are just within the $25,000 concessional contributions cap.

Steve’s wife, Cath, 45, is a stay-at-home mum with a super balance of $35,000 and is currently receiving no income or super contributions. The couple have three young children.

The adviser recommended Steve split the maximum allowable contributions with Cath each year, which is 85 per cent of $25,000 or $21,250 a year (indexed).

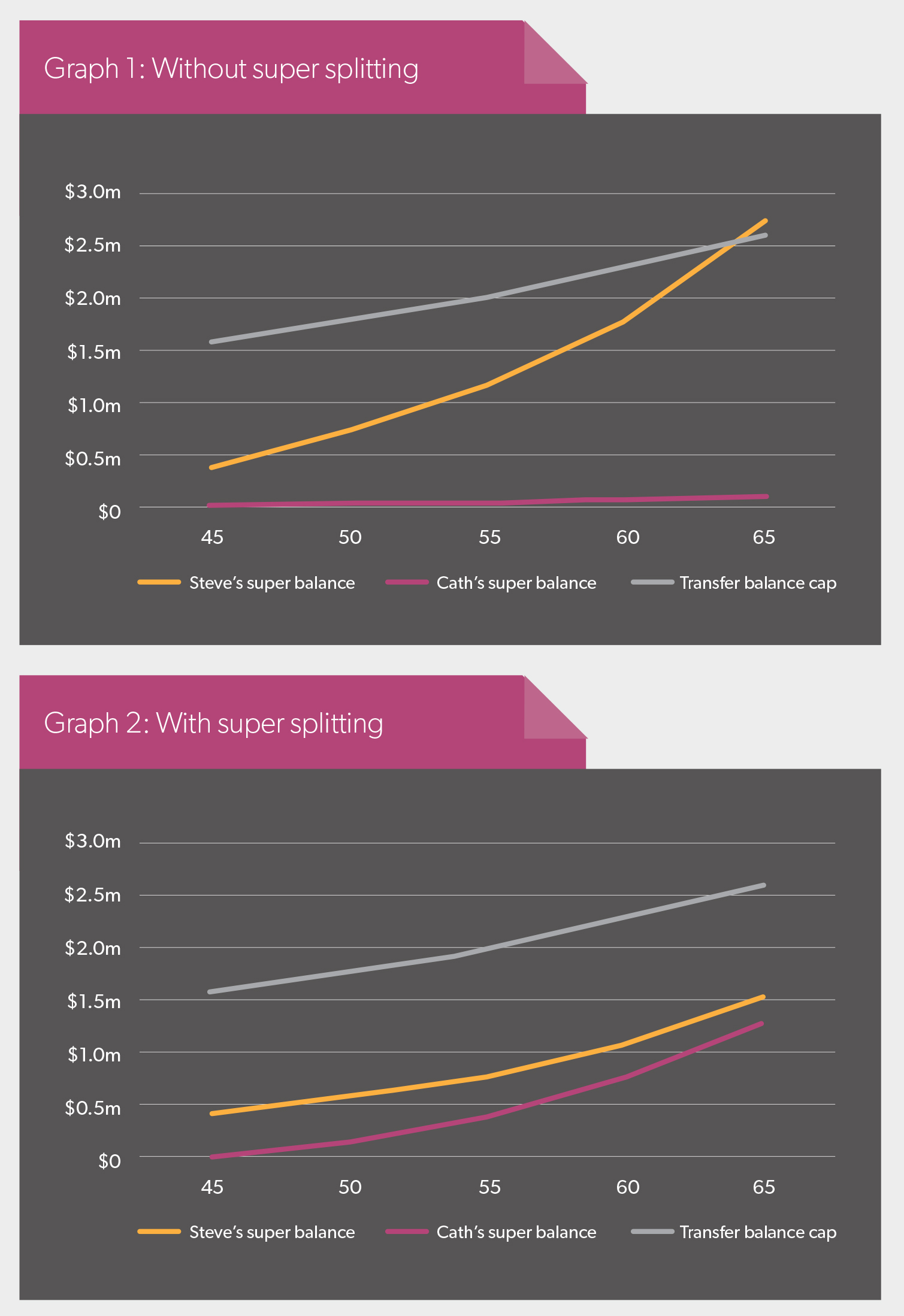

In order to illustrate the outcomes, we projected Steve and Cath’s superannuation balances based on their current circumstances and then compared this to Steve super splitting the maximum concessional contributions with Cath each year. The results are illustrated in Graphs 1 and 2.

In the first instance it is apparent in this case that super contributions splitting will assist in building Cath’s retirement savings, which quite obviously need a boost. Based on our projections, her superannuation balance increases from $140,000 at age 65 without further super contributions to $1.32 million with contribution splitting. This alone, I believe, is reason enough to recommend this strategy.

The second benefit arises due to Steve and Cath’s respective ages. As Cath is one year older than Steve, and expects to retire first (if she returns to work at all), she will be the first to be able to access her superannuation benefit. Splitting Steve’s super contributions with Cath will therefore provide access to these savings earlier.

The third benefit of splitting super contributions from Steve to Cath lies in the impact of the transfer balance cap, which restricts to $1.6 million the amount of money Steve can use to commence a pension within the tax-free pension environment. This cap will, of course, be indexed, but considering a starting super balance of $424,000, together with $25,000 of concessional contributions each year (also indexed) and based on a high-growth portfolio that returns 8.5 per cent a year net of fees and taxes, we anticipate Steve will have a super balance in excess of the transfer balance cap at age 65.

On the other hand, if Steve and Cath take their financial adviser’s advice, and instead split 85 per cent of Steve’s concessional contributions to Cath each year, the likelihood of Steve exceeding the transfer balance cap is reduced to nil before the age of 65. And instead, Cath’s super balance increases to $1.32 million with super contributions splitting. Even without contributions, Steve’s super balance is still a healthy $1.55 million at age 65 and, more importantly, Steve and Cath’s super balances are more equally aligned.

Since the introduction of the transfer balance cap last year, strategies that aim to equalise the super balances of a couple, especially super contributions splitting, are now more important than ever.

Anne-Marie Esler

More equal superannuation balances across couples brings with it a number of secondary advantages to those highlighted above, including the following:

- having access to two low-tax thresholds and using these both to their full potential. This would be the case if either or both of Steve or Cath are forced to withdraw their accumulated superannuation savings as a lump sum prior to age 60,

- protection from future negative changes to superannuation taxes that may target higher super balances. Consider the current situation (without super splitting) where Steve has a super balance of $2.76 million at age 65 and Cath a mere $140,000. Imagine the government at the time lowering the transfer balance cap to $500,000 or any other change that will adversely affect Steve and not Cath, but which may not impact on either of them if each of their balances were lower and more in line,

- more equal super balances also allow Steve and Cath the opportunity to contribute non-concessional contributions into one or both of their super accounts while they are both still under the transfer balance cap. This enables both Steve and Cath to take advantage of the non-concessional contribution cap at any time (or every year) if, for example, they receive an inheritance, Steve receives a redundancy or the couple downsize their home at retirement. The flexibility and planning opportunities this may bring are priceless, and

- although this wouldn’t apply in Steve and Cath’s case (hopefully), there may also be implications for potential Centrelink benefits. This would be where one member of the couple has reached qualification age for the age pension and is applying for the age pension, while the other member is still ineligible for the age pension and a larger portion of funds will not be assessable under the income and assets tests.

Despite all of the above, there are some things to consider before recommending clients commence splitting super contributions with their spouse, such as:

- not all super funds offer super splitting and some funds charge a fee for providing this service,

- some funds will only split to accounts within their own fund and will not transfer split contributions to another super fund. Obviously this is not an issue with SMSFs,

- clients need to apply to their super fund to split the contributions. The application needs to be made during the 12 months after the end of the financial year in which the contributions are made,

- if your client has made personal deductible super contributions, they must lodge the appropriate form with the super fund to claim the tax deduction before splitting contributions, and

- lastly, and probably most importantly, the member of the couple intending to split their contributions needs to be comfortable with taking this action.