The year 2016 witnessed a variety of events that had a significant impact on investment markets. Marcus Evans reveals how SMSFs dealt with these challenges and how these attitudes may translate into 2017.

Last year came with unexpected political events and market volatility across the board, but SMSFs weathered the storm, faring relatively well given the uncertainty and general anxiety in the market.

Caution was the overarching theme for SMSFs in 2016. While many other investors displayed outright fear in the face of market volatility, SMSFs tended to keep their powder dry and showed a leaning towards defensive investments.

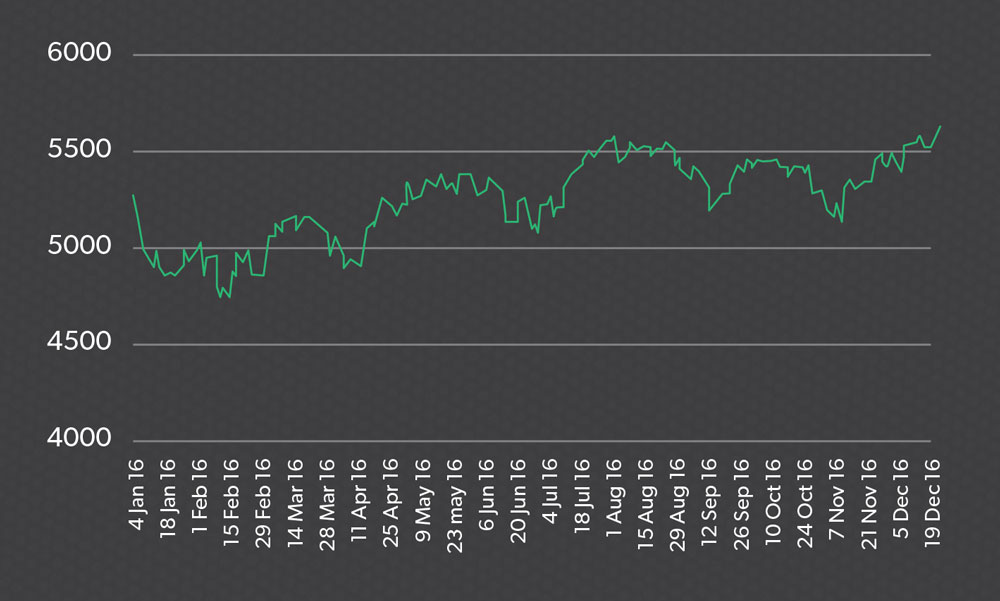

While traders will always trade, some of their confidence appeared to mellow in the wake of the performance of the Australian Securities Exchange (ASX), which had more ups and downs than a theme park rollercoaster. The ASX 200 closed the first day of trade at 5270, hit an intraday low of 4760 on February 12, peaked intraday at 5611 on August 1, and then bounced between about 5200 and 5500 for the remainder of the year.

Many SMSFs showed more cautious sentiment than non-SMSFs, with 34 per cent of SMSFs finding individual investments their greatest challenge, according to research by Investment Trends. In anticipation of a more rosy investment environment in 2017 there was an expectation of a pullback in equity investments, amid the Santa Clause/Trump rally. As a consequence, there were good amounts of cash sitting on the sidelines.

Following the unexpected outcome of the United States election, the market was on a tear and finished the year strongly at 5643. It was a testing year for everyone, particularly the market experts who failed to predict the outcomes of Brexit, Trump, the resources resurgence and the most recent Organization of the Petroleum Exporting Countries deal, before the market added insult to injury by rising rather than falling after each event and contradicting the experts’ predictions.

Closer to home, the federal budget announcement on proposed changes to superannuation brought voluntary contributions almost to a halt. The impact of this announcement was reflected in the September quarter superannuation flows reported by SuperConcepts in which contributions fell dramatically.

The legislation, which has now been given assent, will cap the balances held in pension accounts at $1.6 million, decrease the annual cap on concessional contributions to $25,000 (previously $30,000 and $35,000 for over 50s) and decrease the annual non-concessional contributions cap to $100,000 (previously $180,000) a year from 1 July 2017.

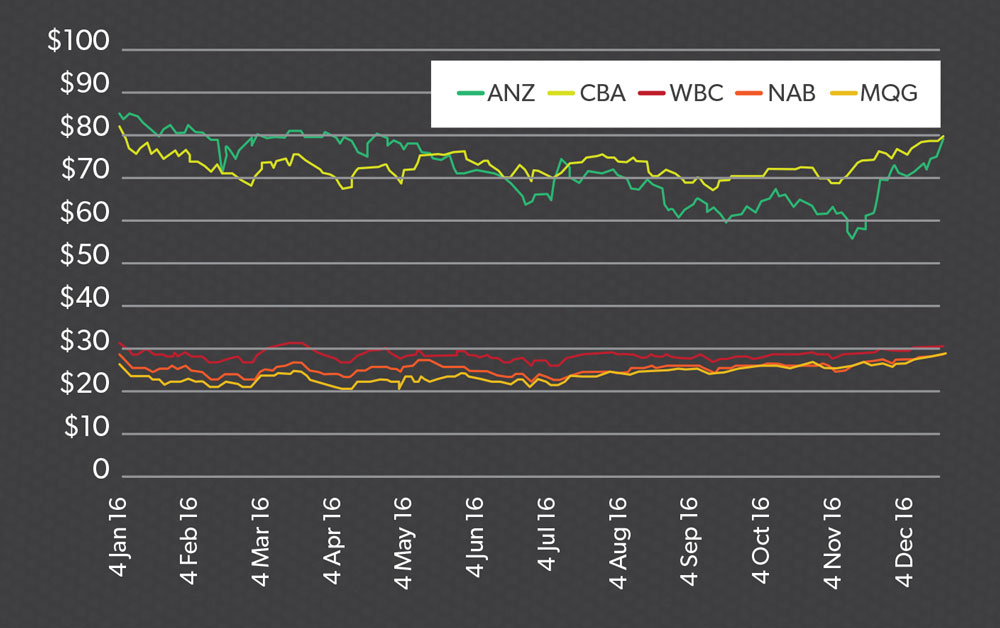

The domestic equity market experienced a short-lived love affair with the bond proxies and China-facing consumer products stocks, before unceremoniously dumping them in December for the big bank stocks and the previous ‘wallflower’ resources stocks. Given the heavy weighting of SMSFs towards the ASX 20, and the lower-than-expected performance of the large banks, miners, food retailers and telecommunications companies, the end of this love affair was a blessing for SMSFs as they would have reaped the benefits of the resurgence in mining and bank stocks in the latter part of the year.

Despite market uncertainties, SMSFs, which mainly trade online, seem to have taken the market in their stride. Since Brexit, the share of total trading volumes by SMSFs has increased − although generally, SMSFs trade in smaller volumes than their non-SMSF counterparts. A recent analysis of CommSec’s SMSF clients showed they were net buyers of stocks during periods of market volatility and were more likely to trade during periods of volatility than non-SMSFs. From a CommSec perspective, SMSFs have remained the most active investors in the retail segment; they trade, on average, 30 per cent more than non-SMSFs.

However, in a nod to the overall trend towards cautiousness, while SMSF trading volumes have remained on par with 2015, there has been a trend toward a smaller deal size, which is a likely indication of less conviction in those trades. Bank stocks comprise nearly one-quarter of all trades by value for SMSFs and energy accounts comprise nearly another quarter. Despite this activity, CommSec has also seen CHESS (Clearing House Electronic Sub-register System) holdings of stocks between the ASX 100 and ASX 200 grow by 3 per cent, at the expense of the top 100, indicating a movement towards the mid to small-cap market.

Another key trend for SMSFs in 2016 was the search for yield. In addition to the bond proxies and stocks such as Transurban and Sydney Airport, hybrids have emerged as an investment of interest. Recent SMSF research by SuperConcepts has called out an increased allocation to hybrids by the SMSF funds under its administration. Data from CommSec also supports this trend, with SMSFs making up 50 per cent of hybrid holdings, an increase of 18 per cent in the past 12 months.

Like the previous year, many CommSec SMSFs continued to use exchange-traded funds (ETF) and listed investment companies (LIC) to diversify into international equities. However, in 2016 the overall volume of ETFs declined slightly. One pattern that emerged was the move from ETFs to direct shares when the market spiked down, and the focus on specific shares that become attractive from a valuation perspective. In the average CommSec SMSF portfolio, ETFs and LICs comprise around 18 per cent of total CHESS holdings. SMSFs make up about a quarter of all ETF trades, although ETF activity is down marginally on 2015.

This compares to a recent BetaShares/Investment Trends ETF report that showed the number of SMSFs with ETF holdings almost doubled over the past 12 months, from 46,000 to 83,000, representing almost 15 per cent of the total number of SMSFs in Australia. The growing use of ETFs by SMSFs reveals they are gradually adopting a top-down approach, putting greater emphasis on the analysis of sectors or industries, instead of company by company.

The trends toward defensive investment flowed through to term deposits. The low relative interest rates on offer for term deposits discouraged rollovers and new investment in 2016. These funds have been observed to flow through into transaction accounts, and time will tell if they eventually flow into the equity market chasing either growth or a higher return, or into specialist income funds.

Recent research from SuperConcepts also indicated that while the percentage of funds held in direct property remained relatively constant over 2016, the number of SMSFs with borrowings against that direct property increased from 30 per cent to 38 per cent. This trend is consistent with other research that showed new SMSFs were more likely to invest in property or be set up primarily to invest in the property market. In 2017, it will be interesting to observe how this trend plays out, particularly if we see a cooling in the major markets of Sydney and Melbourne.

SMSF investors are often stereotyped as taking on too much risk by not having enough diversification in their portfolios. Research by BetaShares has indicated a recognition by SMSF investors of a need to diversify away from Australian equities and property in their investment portfolios. To that end, SMSF investors are increasingly seeking global equity products.

Managed funds, like ETFs and LICs, have provided a convenient way to access international and fixed interest exposure. Research by Class Super showed SMSFs attached to platforms had significantly higher allocation to managed funds and as a consequence had significantly higher exposure to those two asset classes. For the 12 months to November 2016, Colonial First State noted a strong preference towards cash.

Figure 1: ASX 200 daily

Data source: ASX website.

Figure 2: Big four banks and Macquarie

Data source: IRESS Market Data.

So where to from here? Will the trends of 2016 flow through into 2017?

Considering the failures of the experts to predict the markets in 2016, without a crystal ball it is impossible for anyone to predict with certainty what will happen in 2017. However, there are a number of events that will impact on the market − though to what extent, and in what direction, is anyone’s guess.

US interest rates and interest rates in general are expected to increase as there are indications rates around the globe are at the bottom of the cycle. These higher interest rates would impact on bonds and bond proxies to some extent. President Donald Trump’s plans to spend up on infrastructure, and changes to regulation and trade in the US, will cause concern as well as opportunity. And, as always, European politics will likely provide more of the same in 2017 in terms of volatility.

In Australia, the certainty we now have around the new superannuation rules may lead to a move by SMSFs to maximise contributions before 30 June and, at a minimum, increase their cash holdings. The interesting question will be what happens if the market continues to rise, property starts to cool and cash starts to seek new opportunities.

Marcus Evans is head of SMSF customers at Commonwealth Bank of Australia.