Using SMSF reserves remains a very effective strategy for trustees. In recognition of this, Grant Abbott has extended his examination of reserves to include two further parts.

This is the carry-on story for SMSF reserves – one of my favourite and one of the least understood areas in the SMSF advice field. For many years I have extolled the virtues of reserves and it is great a strategy, as we discovered in detail in part 2. The contributions reserve strategy is not only readily accepted by the commissioner of taxation, but is also widely used by SMSF practitioners across Australia. Is this the small opening of the door leading into the broad, vast field that is SMSF reserves?

Case study reprise

The Jones SMSF was established in 1998. Since that time, the financial planner and accountant to the fund have been allocating 20 per cent of the fund’s earnings to an investment reserve created at the time. Following a review of the fund’s trust deed, last upgraded in 1998, you find that the trustee of the fund can maintain an investment fluctuation reserve only.

A separate investment strategy for the reserve has been completed by the fund’s financial planner, investing in an Australian shares exchange-traded fund and for the year ended 30 June 2015 the fund’s audited accounts show an investment reserve of $130,000.

There are two members of the fund – Sam and Pat Jones – both aged 56, with Sam in receipt of a transition-to-retirement income stream (TRIS), valued at $400,000, with a tax-free/taxable proportion of 60 per cent to 40 per cent. Sam also has a lump sum accumulation account with $120,000 that is all taxable component. Sam has his own business and will continue to contribute to the fund whenever possible.

Pat is retired and has an account-based pension of $350,000 (50 per cent tax-free and 50 per cent taxable component), although no pension documentation has ever been drawn up. The fund runs a pooled investment strategy for all superannuation interests with an allocation of 70 per cent Australian equities and 30 per cent cash.

Is the investment reserve legal? Is it best placed as an investment reserve given there are income streams in place? What are the taxation laws for SMSF reserves and should an anti-detriment reserve be put in place?

These are some of the obvious questions for me when looking at the simple facts above and that is one of the important reasons to look at case studies when dealing with SMSFs. It is all very well to know the law, even regurgitate the law as many practitioners and lawyers do, but the real skill, the one that can’t be outsourced offshore thankfully, is the ability to apply the law to a set of facts. If you can get to a seven out of 10 on this one, your career, business and life in SMSFs will be assured.

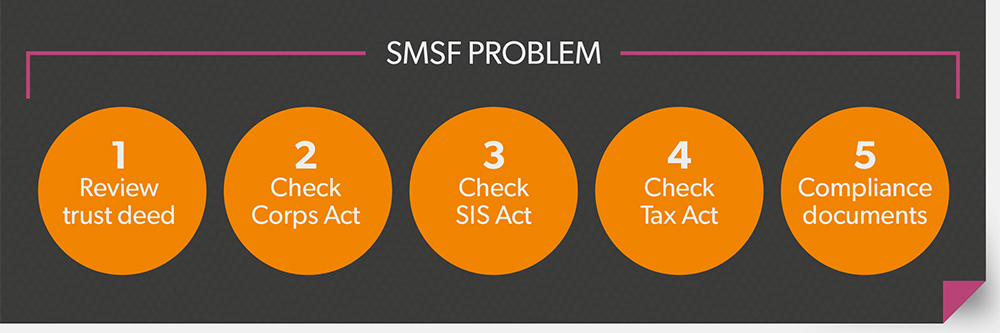

SMSF compliance wheel

Many years ago I developed a simple but effective model to ensure an SMSF strategy works from a compliance perspective. It is a significant component of the RG 146 accountants’ exemption course I teach and to me the most important to not only secure compliance, but to save your sanity when advising on SMSFs as it provides a workflow in which to assess any SMSF and any strategy within that SMSF. The beauty about it is that it works each and every time and more fool the practitioner who attempts to take short cuts as they will get caught every time, particularly on the first step not checking the trust deed.

Back to the compliance wheel. Each component of the compliance framework must be successfully fulfilled otherwise compliance fails. Importantly, each element is not independent from the other as the five components work as one, as demonstrated in the figure below.

Five-step implementation guide

SMSFs and the Corporations Act

In the prior articles of this series, we looked at the trust deed and also the Superannuation Industry (Supervision) (SIS) Act in terms of the Jones SMSF. One step I missed is the impact of the Corporations Act 2001 – a big one, particularly now the accountants’ exemption will go on 30 June 2016. So not only will accountants and administrators need to know, but they will need to be able to apply the Corporations Act to SMSFs and more importantly SMSF transactions and strategies.

So to a brief summary of the Corporations Act. The purpose of the licensing legislation is found in section 760A of the Corporations Act 2001, which states the following:

The main object of the new laws, amongst other things is to promote:

- confident and informed decision-making by consumers of financial products and services while facilitating efficiency, flexibility and innovation in the provision of those products and services; and,

- fairness, honesty and professionalism by those who provide financial services.

In that regard, chapter 7 achieves this purpose through the operation of section 911A. This section requires that any person who conducts a financial services business must hold an Australian financial services licence covering the provision of the particular financial service.

What is a financial services business?

Section 911D provides that a financial services business is taken to be carried on by a person, if in the course of carrying on that business, the person engages in conduct that is:

- intended to induce people to use the financial services the person provides; or

- is likely to have that effect;

whether the conduct is intended, or likely, to have that effect.

The meaning of financial service?

The definition of financial services is the key when it comes to the operation of the new laws. Turning to section 766A(1), it declares that a person provides a financial service if, among other things, they:

- provide financial product advice; or

- deal in a financial product.

Crucial to the operation of the reforms is the meaning of financial product advice. In particular, section 766B(1) declares that the term financial product advice means a recommendation or a statement of opinion, or a report of either of those things, that:

is intended to influence a person or persons in making a decision in relation to a particular financial product or class of financial products, or an interest in a particular financial product or class of financial products; or

could reasonably be regarded as being intended to have such an influence.

Personal or general advice

In terms of financial product advice, there are two types of advice – personal advice and general advice. Section 766B(3) provides that personal advice is financial product advice that is given or directed to a person (including by electronic means) in circumstances where:

- the provider of the advice has considered one or more of the persons’ objectives, financial situation or needs; or

- a reasonable person might expect the provider to have considered one or more of those matters.

In contrast, sub-section (4) states that general advice is financial product advice that is not personal advice. For example, this article while dealing with several financial products is classified as general advice as there is no review of any person’s specific objectives and needs. As such, there is no need for the full licensing regime where only providing general advice – although when dealing directly with a client it is very unlikely not to fall into the personal advice net.

So what is a financial product?

The term financial product is crucial to the issue as to whether SMSFs are caught under the Financial Services Reform Act. In that regard, section 763A(1) provides a general definition of what is a financial product. In particular sub-section (1) states that a financial product is a facility through which, or through the acquisition of which, a person does one or more of the following:

- makes a financial investment;

- manages financial risk; or

- makes non-cash payments.

Without going into too much detail, SMSFs may fall into sub-section a) however, to make sure they are caught, there are some specific financial product inclusions. In that regard, section 764A includes, irrespective of whether they fall within the broader definition under section 763A:

- a security which includes a share, debenture, options in respect of either of those and interests in a managed fund;

- an interest in a registered or managed investment scheme;

- a derivative;

- a superannuation interest;

- foreign exchange contract;

- anything listed in the regulations as a financial product.

Is an SMSF a financial product?

Generally, the context of the investment relationship in an SMSF is between the member of the fund and the trustee of the fund. The member, or a person associated with the member, generally the employer, makes contributions into the fund on behalf of the member. The trustee takes those contributions and then generates a financial return on those contributions, again on behalf of the member of the fund. Accordingly, it may be argued membership of an SMSF is a financial product pursuant to section 763B. Although with the member as trustee, it could also be argued sub-section b) does not apply as the member/trustee has day-to-day control over the use of the contribution to generate a return or benefit.

Irrespective of whether section 763B applies, as noted above, section 764A includes specific investments or products as financial products for the purposes of the Corporations Act. From an SMSF perspective, section 764A(1)(g) provides that a superannuation interest within the meaning of the SIS Act is a financial product. Turning to section 10(1) of the SIS Act, the definition of a superannuation interest means a beneficial interest in a regulated superannuation fund. As such, any interest in an SMSF is deemed to be a financial product for the purposes of the Corporations Act.

This means the following are financial products in their own right:

- Taking superannuation money from an industry or retail fund.

- Advising on any insurance benefits in an industry fund, retail fund or SMSF.

- Establishing an SMSF.

- Becoming a member of an SMSF.

- Advising the trustee in terms of making investments in an SMSF.

- Making contributions to an SMSF.

- Taking a lump sum from an SMSF.

- Commencing a TRIS in an SMSF.

- Commencing an account-based pension.

- Advising on a binding death benefit nomination.

- Advising on an auto-reversionary pension.

- Transferring a business real property into an SMSF – this strategy consists of three financial products.

- On the drawing boards is limited recourse borrowing arrangements as a specific inclusion as a financial product.

In terms of the above, with the exception of the investment strategy, these are all related to personal advice to an SMSF or potential SMSF member and it is not easy to say that the client demanded all these and the accountant or planner was simply providing guidance. In terms of investment strategy, this is the provision of investment product advice to the trustee of the fund.

For SMSF reserves, these are decisions by the trustee to set aside money for a specific fund purpose. Barring any investment decisions in terms of the reserve (which we will consider in part 4), there is no personal or general advice in respect of a reserve and thus it does not form part of a financial services business.