While retirement is still a long way off for generations X and Y, SHANE ELLIS explains the use of some prudent strategies can make running an SMSF beneficial for these individuals.

“What’s the point? All superannuation is the same.”

“Superannuation is just for old folks.”

“Why bother when I can’t gain access to my funds for so long?”

These are some of the standard misconceptions expressed by some of the young people who are not in the know when it comes to investing via SMSFs; whereas wise superannuation investment is an integral part of how the wealthiest Australian families have become so wealthy and have stayed so wealthy. These families teach financial wisdom to their kids so they can take control of their financial affairs from a young age, and then retain sovereignty of their financial affairs throughout their lives.

Let’s have a closer look at some of the strategies these wise people may teach their young ‘uns at an early stage of their financial development so they better understand the major benefits of SMSFs.

Strategy 1: Loan some

At a young age, access to your superannuation seems like a million years away. So what’s the point of starting it now?

The simple answer to that very simple question is that if you’re in now, you win, and if you snooze now, you lose.

The first universal rule the wise apply is that if you are personally involved or fully engaged with anything in life, including your investments, you will get much better results. If you are unengaged or lacklustre in your involvement, or off snoozing and playing while other people waste your money due to poor investments, then you get what you deserve. Your superannuation – your investment – is quite likely to be a diminishing return, while others who are engaged in what they do will prosper, that is, make money in a low or no-tax environment.

So, while I agree healthy young ‘uns may not be able to access their SMSF benefits for some time, I feels it will make little difference because wealth is predominantly built over time.

Many gen Xers and gen Ys in the workforce are earning great incomes, and with the 9 per cent superannuation guarantee (SG) contribution, which will soon increase to 12 per cent, they are building up a good nest egg inside their SMSF quite swiftly.

In addition, a good income and wise saving allow for sizeable sums of money to be built up in young people’s own names, in the names of their family trusts or private companies outside of their SMSF.

If the youngsters were to put this money into their SMSF as a contribution, it would be locked away until they hit their retirement release age. This may well be somewhere between 60 and 75. So what do they do?

Well, the wise wealthy ones don’t go out of their way to make contributions to their SMSF; they prefer to make related-party loans to their SMSF.

How is this done?

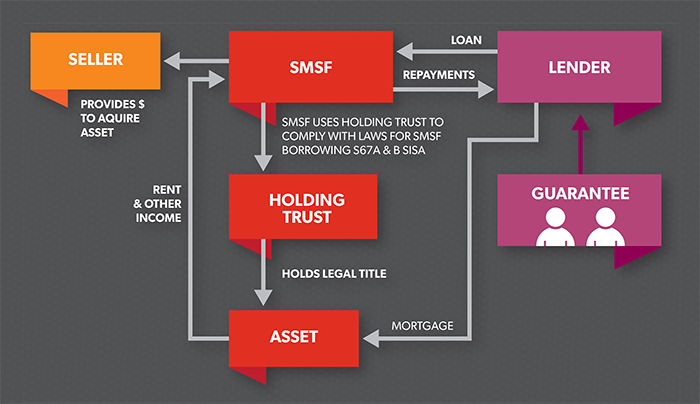

Figure 1 depicts the word ‘lender’ not the word ‘bank’ because anyone can make loans to an SMSF as long as the laws are complied with, and as long as the lender is being paid rates of interest that are no more than standard rates of return on commercial loan facilities.

Figure 1: SMSF borrowing structure

What is even better is the rates of loan interest charged to the SMSF don’t have to be at a commercial rate at all, meaning the SMSF by agreement with the lender may actually pay a rate of interest anywhere between the standard commercial rate at that time and zero. That’s right, zero, as was determined by Australian Taxation Office (ATO) ID 201/162. As such, a wise gen Xer or gen Y will make loans to their SMSF to acquire single acquirable assets (such as real properties or a parcel of the same listed shares) with low or no interest payable by the SMSF. They lock the income from the investment into their SMSF as well as any capital gain. The added benefit is that if the gen X or gen Y lender needs their capital back, they simply call for its return under the terms of their loan agreement. As long as they comply with the SMSF loan laws, they can make as many loans to their SMSFs as they wish to, as often as they wish to. That is what strategy 1 is all about.

Summary: Wise gen Xers and gen Ys make measured contributions to their SMSFs other than their SG contribution. They take more notice of their contributions as they get nearer to retirement age and then ramp them up considerably the closer they get. They make loans to their SMSF to acquire single acquirable assets regularly.

Now, let’s look at how strategy 1 can be linked to another strategy to even further maximise investment returns.

Strategy 2: Doing your block

Okay, you have been employing the first strategy for some time and you have locked some good money away into your SMSF, so what now?

Well why not use the money you have built up as a deposit on a renovator (you know, the worst house in the best street)? The ATO kindly released ruling SMSFR 2012/1, confirming that it was acceptable for an SMSF to use its own resources to renovate a property that has been bought with an SMSF borrowing. Prior to that ruling, an SMSF could only repair but not renovate the property.

This has created a really ‘fun’ strategy for SMSF owners who can now renovate their SMSF investment property. This means you can now renovate the kitchen, the bathroom, slap on new paint, fix the roof or whatever needs to be done as long as you don’t change the underlying character of the investment property. For example, you can’t build a block of units on a single dwelling site and say that was the house renovation.

Summary: Enjoying the journey every day may well mean building your wealth by improving your assets. Get the bucks into the SMSF wisely, then use the bucks in the fund to improve the asset. Improved asset equals higher value. Higher value equals higher rent, which equals wise wealth building.

So, buy it with an SMSF loan and the renovation will come.

But with all of the capital growth that your SMSF is enjoying, what is your Plan B should something go wrong?

Strategy 3: Building the family safety net

Okay, we are building all of this great wealth by being engaged with our SMSF and employing the first two strategies, but will having all of these loans and using the money from the SMSF expose my family to greater risk if I pass away?

Well, the answer lies in strategy 3, which involves building a safety net for the family.

It is always wise to ensure there is a back-up plan in place as a safety net for the family if anything happens to you or to your spouse. The back-up plan for young people while they are growing their wealth is to have ample insurance in their SMSF to cover off the risk of incapacity or death. The really good thing is that this insurance can be paid for by the SMSF, so you are again putting your retirement savings to great use for your family. In fact, since recent changes to the SMSF laws, trustees are now required to regularly consider the need for insurance in their SMSF. That way if fate removes an individual from the workforce, or causes loss of life, the able bodied/surviving partner will be protected by insurance payments going into the SMSF. This insurance money covers the loans, pays the bills, and compensates on a financial basis if not an emotional basis in the event of a catastrophe.

Summary

Build your safety net for your family; your plan B, if plan A should fail, by having adequate insurance within the SMSF. Regularly review the insurance inside your SMSF.

Generations X, Y and beyond have massive opportunities through being engaged with their wealth creation, legal tax minimisation and SMSFs from a young age. These are just some of the useful strategies the younger players in the SMSF sector can employ to maximise their retirement return and fully protect their family wealth.