Investing in small caps is worth considering now index weightings are a more accurate performance indicator for the sector, writes John Campbell.

Investing in smaller companies in Australia has always been regarded as a riskier undertaking than investing in large-cap stocks.

This view has been driven by various factors, such as the perception that the average small industrial company has a weaker and more volatile franchise than the average household name large cap and that management of small caps is often of a lower quality and perhaps even integrity than large caps.

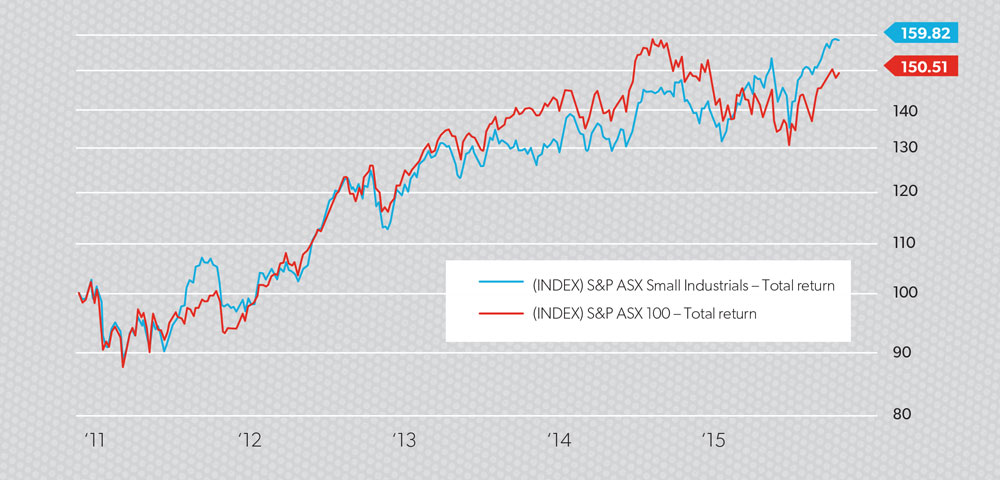

However, it may surprise some to discover over the past five years, as can be seen in Figure 1, the S&P/ASX Small Industrials Accumulation Index rose 60 per cent (10 per cent a year) [blue line] compared to the S&P/ASX 100, which is up by 51 per cent (8 per cent a year) [red line].

Figure 1: S&P ASX Small Industrials

Source: Avoca Investment Management, Factset

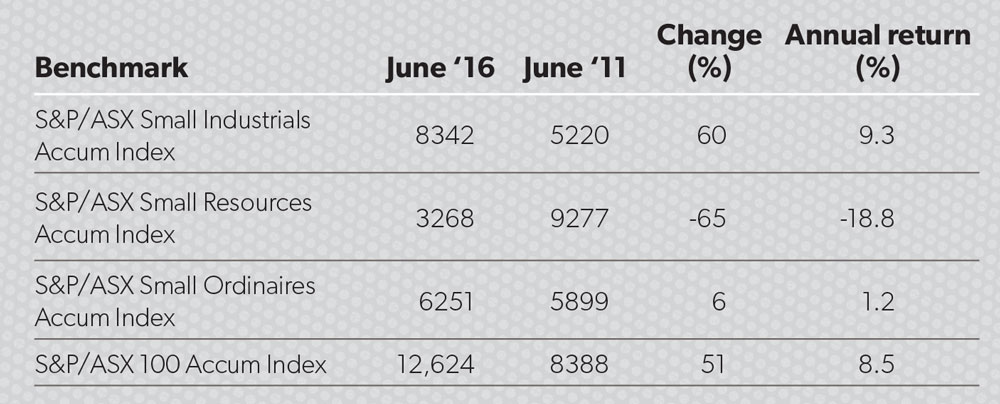

Unfortunately, that strong performance from the small industrials component of the S&P/ASX Small Ordinaries benchmark was offset by what can only be described as a calamitous performance from the small resources component, which fell 65 per cent over the same period (minus 19 per cent a year).

Compounding this was the fact at the beginning of that five-year period in June 2011, small resources represented some 48 per cent of the S&P/ASX Small Ordinaries.

Accordingly, their negative performance impact was significant, resulting in the S&P/ASX Small Ordinaries Accumulation Index producing only a 6 per cent return over that five-year period (1 per cent a year compound). (See table 1.)

Table 1

Source: Avoca Investment Management, Factset

The moral of this story is beware index composition. Five years ago, with its absurd resources skew, the S&P/ASX Small Ordinaries benchmark bore little resemblance to the Australian economy (resources have never represented anything like 48 per cent of Australia’s gross domestic product). This skew caused massive pain for investors when the inevitable happened and China started to slow with the flow-on impact on commodity prices.

Happily today the composition of the S&P/ASX Small Ordinaries is much more balanced and aligned to the Australian economy. Consumer discretionary stocks comprise 23 per cent of the benchmark, resources (including energy) 18 per cent, industrials 15 per cent, financials 10 per cent, property 10 per cent, healthcare 6 per cent and so on.

Paradoxically if one analyses the composition of the S&P/ASX 100, one discovers financials represent some 40 per cent of the benchmark. To us this appears a worrying level of concentration risk.

While the oligopolistic big four Australian banks have been a great long-term investment, and SMSFs have been a major beneficiary, with ever-increasing capital requirements, increasing government and Australian Prudential Regulation Authority oversight (to say nothing of a possible royal commission into banking), likely softening in mortgage lending, and the spectre of encroaching fintech, it seems less likely the returns of the past will be emulated going forward. Not surprisingly the chief executives of all the big four have voted with their feet and retired in the past two years.

Our point is that concentration risk has diminished in small caps but increased in large caps over the past five years. Self-funded retirees need to understand these risks and, in the case of large caps, understand the glory days of setting and forgetting their portfolios with a huge bank exposure is unlikely, in our view, to be a smart strategy for the next five years.

Having put a bit of context around investing in small caps, and having highlighted some risk issues, it is worth focusing on the positives of this asset class.

These positives can broadly be summarised as three:

Size benefits – a smaller company with a small market share, but an attractive business model can grow much faster than a large company with a dominant market share. There is no better place to observe this effect than telecommunications where Telstra – the incumbent with 60 to 80 per cent share across most of its markets – has significantly underperformed as an investment over the past five years against its more nimble small-cap competitors Vocus and TPG.

Breadth benefits – In not limiting yourself to the top 100, you open up an investment universe of potential investment ideas far exceeding that on offer in large caps. By way of example, there are eight metals and mining stocks in the top 100, but there are 22 in the Small Ordinaries and literally hundreds more outside the benchmark. There are seven stocks within the hotels, restaurants and leisure sector in the top 100, but there are 10 in the Small Ordinaries and again many more outside the benchmark. This breadth allows investors large and small to add more value via judicious stock selection than is generally possible in large caps.

Mergers and acquisitions – Of the roughly 25 announced merger and acquisition (M&A) transactions in the past two years in the S&P/ASX 300, only one has occurred in the top 100 (ALS Ltd). While M&A has the potential to add significantly to a portfolio, it is unlikely to have much impact in the top 100, but could potentially be material in the Small Ordinaries.

So where to from here for small caps? As discussed above, our view is that the major handicaps the sector was encumbered with in recent history are no longer there. The excess valuations of the resource bubble are well and truly gone. The index is now well balanced against the economy and has and continues to have the cleansing effects of new entrants coming in, and underperformers dropping out as S&P rebalances its indices.

While at Avoca we are generally circumspect on IPOs until they get well beyond the prospectus period, we do recognise there has been some genuine quality names that have listed in the past few years as private equity has realised the gains from investing during the low points around the global financial crisis.

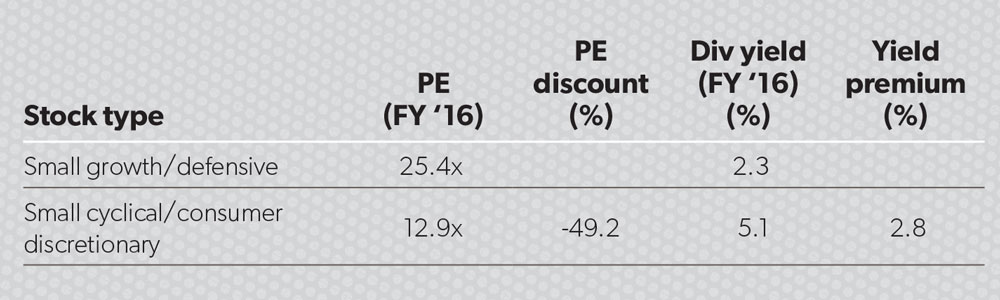

So we have no overarching concerns with respect to the S&P/ASX Small Ordinaries. Indeed any issues of this nature relate more to the top 100. Our concerns are more at the sectoral level and even the stock level where we believe ultra-low interest rates and the pursuit of yield has resulted in certain perceived quality/defensive names being bid up to valuations that are not sustainable in the long run, particularly as the United States proceeds on its rate tightening cycle. Small growth/defensive stocks are now on a median prospective price-to-earnings ratio (PE) of 25 times and yield of 2.3 per cent. This compares to small cyclical/consumer discretionary stocks on a median PE of 13 times (a 48 per cent PE discount) and yield of 5.1 per cent (a 2.8 per cent yield premium). (See Table 2.)

Table 2

Source: Avoca Investment Management, Factset

We find it very difficult to justify such valuation discrepancies, particularly when you scratch the surface of the high PE defensive names and find they include stocks such as aged-care providers Regis Healthcare on 26 times and Japara Healthcare on 22 times, and waste services company Cleanaway on 24 times.

Our assessment of the growth/defensive names is that while some have relatively strong structural stories for the next few years and can sustain their high market ratings, many don’t and run significant risk of a PE de-rating if and when they deliver a below-expectations result. Accordingly, within our funds, we remain well underweight in these names.

In conclusion, while Australian small caps has been a problematic asset class in the past five to 10 years, most of the problems can be attributed to the small resources component, which at the peak, represented around 48 per cent of the S&P/ASX Small Ordinaries benchmark.

This skew was completely at odds with the Australian economy and was a clear warning signal.

Today the composition of the benchmark is much more consistent with the Australian economy, with, for example, resources representing only 18 per cent. Paradoxically, the top 100 has developed a massive skew to financials over the past 10 years with these companies (mainly the big four banks) now comprising 40 per cent of the S&P/ASX 100 benchmark. With banks now coming under ongoing capital and operational pressure from regulators and with demand for mortgage finance likely to have peaked, we believe this index skew is a risk to those that assiduously follow benchmark weights. We are aware that many self-funded retirees are well overweight banks and we believe these weightings should be reviewed for their appropriateness.

Our view is that small caps are a good place to invest in the future given the better opportunity to grow that small companies (with generally smaller market shares) have over large companies, the breadth of opportunity in stock selection, and the greater likelihood of M&A activity benefiting smaller companies than top 100 companies.

While we are broadly positive on the small-cap asset class, we remain vigilant as we believe various stocks – typically considered growth or defensive growth names – have reached unsustainable valuation metrics. For us, better opportunities for above average returns reside in the more boring, higher-yielding industrials.