While some headwinds are predicted for the local economy and share market, certain sectors will still present good opportunities for investors. Philipp Hofflin assesses the year ahead and identifies the industries individuals should consider.

Equity markets experienced a strong year in 2017 and Australia was no exception, with the S&P/ASX 200 rising by 12 per cent over the year. Looking over the medium term, we anticipate below average long-run returns for the market from this point, given the reasonably high overall level of valuations and some risks in the domestic economy. That said, we do think there are still opportunities for investors if they are selective.

Consumers under pressure

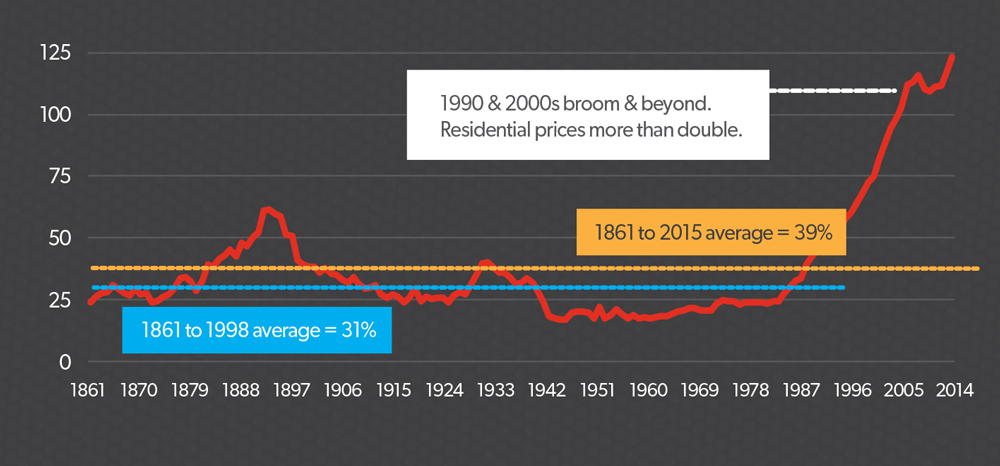

In our view the biggest issue for both the equity markets and the economy is the financial health of the Australian consumer.It will not surprise anyone at this point in the cycle that Australian households have high debt levels. These debt levels have been rising for a long time now (Graph 1) without unwinding dramatically, yet we think there are several reasons to be cautious in 2018.

The first relates to the regulatory action from the Australian Prudential Regulation Authority (APRA) that has resulted in an increase in effective mortgage rates even though the Reserve Bank of Australia’s cash rate has remained flat. Banks have moved large numbers of customers from interest-only loans to principal and interest mortgages, the effect being that some people have had a 25 per cent to 30 per cent increase in their monthly repayments. This is a major headwind for household discretionary spending.

The other impact of this is the knock-on effect on housing prices. In the latter half of 2017, we saw some softening in the housing markets in Sydney and Melbourne, with auction clearance rates pointing to more weakness in 2018. While it is difficult to predict the downturn in the Australian housing market, we believe the risk is now higher. With apartment supply peaking in Sydney, Melbourne and Brisbane, the apartment market looks the most vulnerable. In addition, there are clear signs that overseas demand for Australian property is falling. Negative sentiment in the Australian housing market would materially adversely impact on consumer discretionary spending.

Given the extreme debt levels on the Australian household balance sheet, the positive wealth effect from rising house prices that has helped fuel the Australian economy during this cycle could conceivably reverse. The saving rate of Australian households has been falling. Australian Bureau of Statistics figures as at 30 September 2017 showed the household saving rate had decreased to 3.2 per cent in the third quarter, down from 9 per cent in July 2015.

In addition to the issues around housing, wage growth in Australia (like much of the developed world) has also been persistently low.

Furthermore, the cost of necessities continues to rise. The issues in the energy market leading to higher power prices are well known, but they remain a major concern for business and consumers, despite some easing late in 2017. Less discussed is the rising cost of insurance premiums and education, which have also been reducing disposable income for many consumers.

These issues combined make us very wary of consumer discretionary spending and the flow-on effects for growth rates in the Australian economy.

Graph 1: Australia’s bank credit: GDP ratio – still rising

Source: Reserve Bank of Australia, UBS

US rates and global growth

The pace of United States Federal Reserve (the Fed) rate hikes in 2018 is another key concern for markets. The market has doubted the Fed’s own projections for rate rises for the past 18 months. Looking ahead to 2018, the market (as measured by the forward rate curve) is again significantly more dovish than the Fed’s own dot-plot forecasts for 2018 (that is, predicting the federal funds rate at 2.1 per cent by the end of 2018). But like in 2017, it is possible the Fed will deliver on its dot-plot forecasts in 2018 and may even need to revise them higher. This would increase the likelihood of a cooling in equity markets.

It is important to understand, for Australia in particular, that the composition of global growth is important. An ideal scenario for Australia is strong Chinese growth (driving our exports) and modest growth in the US (keeping interest rates low). While this situation has been in Australia’s favour since the global financial crisis, it may not be going forward, with China’s growth slowing and US growth (and rates) picking up.

Opportunities

Even with this cautious backdrop, we do still see some opportunities in certain sectors and idiosyncratic stock ideas.

Telcos

Share prices of telecommunications companies have been under pressure in the past year. This reflects market concerns of heightened competitive pressures in the fixed business as we transition into the national broadband network (NBN). The fundamental issue that is plaguing the NBN is not in our view the technology rollout, rather the cost charged by NBN co to the telco retailers. The cost is not competitive and putting huge pressure on the margins of telcos and, as a result, the service that is being provided. Ultimately, we think the cost charged by NBN co to retailers must come down for the project to be viable.Furthermore, competitive pressures have broadened into the mobile sector with TPG’s arrival as a fourth mobile network operator, which will impact on industry profitability.

Yet even with this industry backdrop, we still see value in names such as Telstra and TPG.

Energy

Resources have performed well over the past two years, bouncing back from their lows in early 2016. The sector that has been left behind is energy. We believe 2018 could be the year energy catches up to resources. We are positive on our outlook for some energy stocks, specifically oil-related stocks. Oil is back above US$60 a barrel, up from the lows of US$28 a barrel, but energy companies have still not rebounded to the same magnitude. We currently see value in Woodside Petroleum and Origin Energy.Areas of risk

Consumer discretionary

Given the concerns highlighted earlier around the consumer, we are materially underweight the consumer discretionary sector. In addition, many of these companies are also facing competitive pressures from the arrival of Amazon.

Banks

We remain cautious around the big four banks. Any cooling in the Australian property market would be materially negative for the share prices of the big four banks and we are substantially underweight the banks in our benchmark unconstrained strategy.

High-multiple darlings

High-multiple stocks or the ‘darling stocks’ continue to trade at premiums above their long-term averages. The top quintile forward price-to-earnings ratio stocks are trading at a 30 per cent premium to their long-term average and are around 10 per cent more expensive than the rest of the market. We would expect them to trade at a premium in recognition of their large profit margins and strong balance sheets, but we are not comfortable with the level of premium at current levels for some of these names.

Concentrate on valuation

While we do not see large returns on offer from the general equity market, there are substantial differences between how sectors are priced and there are some select opportunities. Given the concerns over the consumer and elevated valuations, there are clear risks investors need to consider. We believe investors will need to concentrate their portfolio in names that are attractively priced and not exposed to the major risk factors to generate an adequate return.