Last year, the ATO effectively limited the types of reserves allowed to be used in an SMSF and expressed a desire for funds to eliminate those deemed redundant as quickly and efficiently as possible. Marjon Muizer examines the current status of reserves and some of the implications involved with getting rid of them.

You need to be on top of your game when dealing with the reserves in an SMSF. Issues to consider include whether you should leave them in place or allocate them to members, and the associated tax consequences.

The ATO has taken a much tougher approach on reserves as a result of the recent super reforms. Their concerns are outlined in “Regulatory Bulletin SMSFRB 2018/1 – the use of reserves by self-managed superannuation funds”. Incorrect use of reserves may attract the anti-avoidance provisions, which can have significant tax implications. Further, it is common an SMSF reserve is associated with defined benefit pensions commonly referred to as legacy pensions. Failing to plan for the cessation of a defined benefit pension on death or expiration of the term can leave a client or their dependants with a major tax bill.

What is a reserve?

A reserve is commonly understood to be an account held in a super fund holding amounts of money not allocated to a particular member. Commonly, a reserve has been created by allocating some of the fund’s investment earnings rather than allocating the investment earnings directly to members.

Reserves were traditionally created for a variety of reasons, including:

- a defined benefit pension reserve – this included all the capital set aside to fund defined benefit pensions,

- investment smoothing reserve – this included investment returns over a determined amount,

- anti-detriment reserve – monies were set aside to fund an anti-detriment payment,

- self-insurance reserve – monies set aside to provide insurance cover to members without the need for an insurance policy, and

- general reserve – a reserve used to pay fund expenses.

The ATO does not consider holding a contribution in a suspense account pending allocation, commonly referred to as a contribution reserve, to be a reserve.

Reserve balances don’t form part of a member’s benefit. While an existing reserve may be progressively allocated to members, the amount will count towards their concessional contribution cap unless the allocation is done on a fair and reasonable basis for all members – and the amount allocated is less than 5 per cent of the value of the member’s interest in the fund. For the purpose of calculating the 5 per cent allocation limit, the value of the member’s total interest should be used, including accumulation and pension interests. However, in accordance with SMSFRB 2018/1, the total amount must be allocated to the member’s accumulation interest only.

Increased ATO scrutiny on use of reserves

Released by the ATO in March 2018, SMSFRB 2018/1, which outlines concerns about the use of reserves in SMSFs. It specifically addresses strategies potentially designed to circumvent legislative restrictions as a result of the recent super reforms.

The ATO is concerned about the intentional use of a reserve to artificially reduce a member’s total superannuation balance (TSB) as amounts allocated to a reserve are not included in this figure. This may enable the member to make non-concessional contributions and access the bring-forward rule without breaching their non-concessional cap or allow access to the catch-up concessional contribution arrangements.

Using reserves to artificially reduce the member’s TSB is not the regulator’s only concern. There are situations where an SMSF trustee may use an existing reserve to circumvent the transfer balance cap rules. This could occur where the capital supporting an existing pension account is increased by an allocation from a reserve.

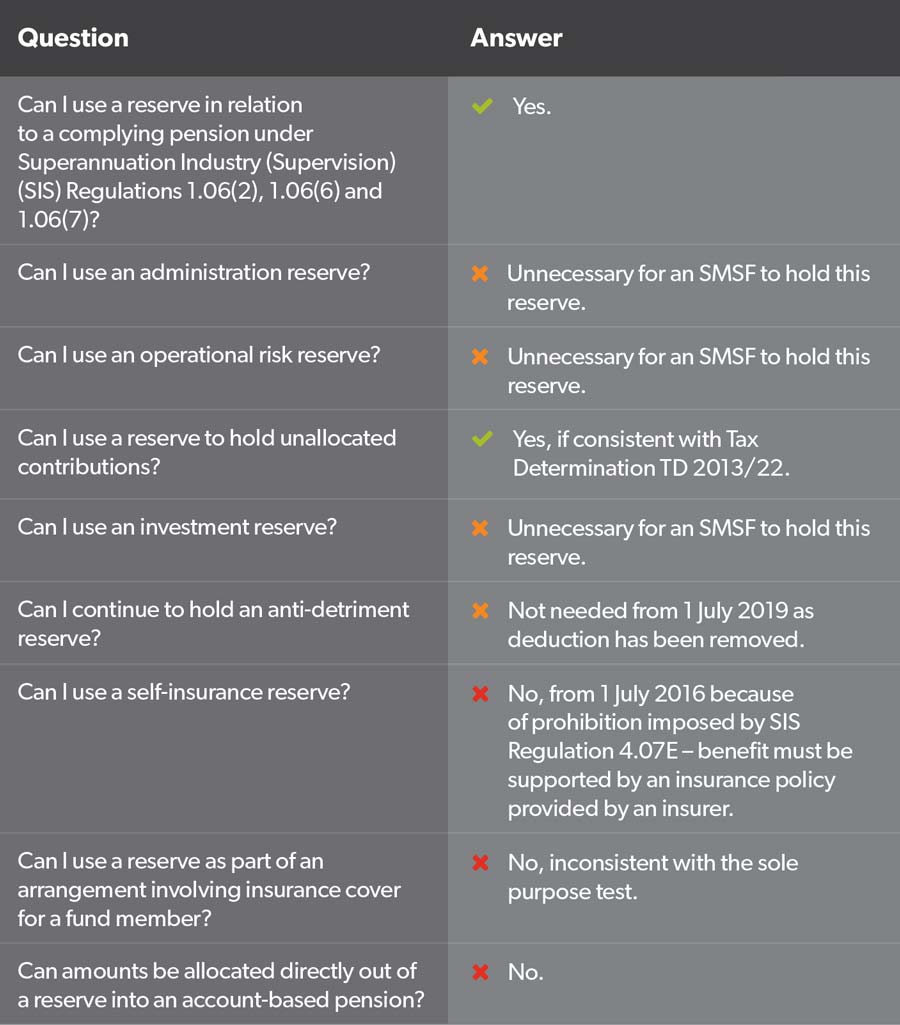

Table 1: ATO position on the use of reserves

This strategy would attempt to gain a tax advantage by allocating capital directly into the retirement phase without triggering a transfer balance credit to the member.

The ATO has clarified its position on the use of reserves (see table 1).

The creation of new reserves, or unexplained increases or decreases in existing reserves, will be scrutinised by the ATO. Inappropriate use of reserves will potentially attract the anti-avoidance provisions and may result in tax penalties.

Trustees need to ensure any reserve has a clearly articulated purpose, adheres to the sole purpose test, gives effect to the fund’s investment strategy and is not prohibited by the fund’s trust deed. The ATO expects SMSFs to progressively reduce reserves that no longer have a clearly articulated purpose.

Common issues with reserves and legacy pensions

The main issue with reserves is generally how to effectively manage the size or how to get rid of the reserve when it is no longer needed, without adverse tax outcomes.

A common example is where the allocation of reserve monies may result in a significant tax bill after a defined benefit pension ceases.

Normally, with these types of pensions, there is no member balance. Instead, a pool of monies is set aside in the fund to cover the pension payments due to the member either for a fixed period or until death.

Any capital left over when the pension ceases generally does not belong to the member. This also means it doesn’t form part of the member’s death benefit and may not be subject to a valid binding death benefit nomination.

Consider the following example:

- Alison is the sole trustee director and member of the Pink Parrot Super Fund,

- she has three adult children, who are the nominated beneficiaries upon her death,

- she has a lifetime complying pension,

- the fund assets total $1.5 million, comprising:

– Alison’s accumulation account balance of $500,000, and

– a reserve supporting her lifetime complying pension payments of $1 million, - Alison dies.

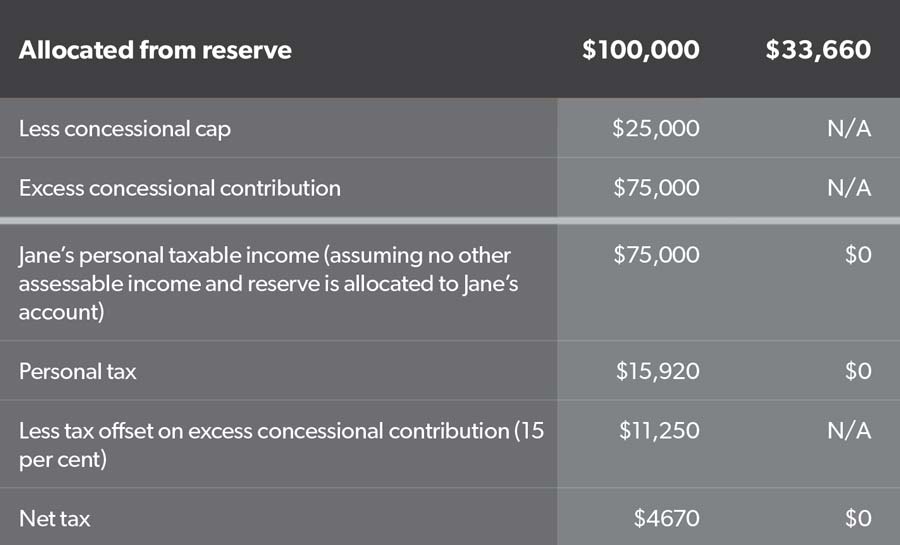

The reserve does not form part of Alison’s member balance and the standard reserve allocation principles apply. Generally, allocations from reserves are not counted for concessional cap purposes if allocated in a fair and reasonable manner to every member and the amount allocated for the financial year is less than 5 per cent of the member’s interest in the fund. If the full value of the reserve of $1 million is allocated to Alison’s member balance, so it can be paid out as part of the death benefit, the majority will be taxed as an excess concessional contribution at Alison’s marginal tax rate (Table 2).

Table 2

Table 3

In addition, Alison’s adult children will most likely be required to pay 15 per cent tax on any benefits received with a taxable component if paid via the estate or 15 per cent plus the Medicare levy where the death benefit is paid to the beneficiaries directly from the SMSF. Not such a great outcome from a tax point of view.

An alternative option to consider would be for Alison’s children to become members of the fund so the reserve can be allocated to them over time to their respective member accumulation interest.

That may take several years and would require the fund to be retained.

Another option prior to Alison’s death may have been to transfer her entire lifetime complying pension to a market-linked pension as then there would be no reserve to deal with after her death.

Reducing the value of a reserve over time

To avoid a large reserve being left over on death of the member or cessation of the pension, it is important to manage the reserve value accordingly.

Consider the following example:

- Jane, 77, is the only member of the Tiger Super Fund,

- her only income is her SMSF pension,

- her member balance is $680,000,

- the fund has a reserve with a balance of $100,000,

- Jane’s concessional cap is $25,000.

Table 3 compares the different tax outcome when 100 per cent of the reserve is allocated versus just under 5 per cent of the member’s interest.

It is worthwhile to monitor the reserve balance over time to ensure no adverse tax consequences arise where the pension ceases.

Commuting a defined benefit complying pension

When a defined benefit pension ceases, there is the possibility the fund will end up with a large reserve, which may have significant tax consequences if allocated to members. Advisers should therefore be aware of all options available to manage this.This is especially crucial where the pension is about to cease or the member’s personal circumstances indicate they are likely to pass away in the near future.

Options available may include:

- commuting the pension and transferring it to a retail complying annuity,

- commuting the pension and commencing a market-linked pension, and

- allowing the pension to cease and allocating funds from the fund reserve.

What’s next?

As you can see, it may take a long time to deal with a reserve in an SMSF. Funds that have reserves or old legacy defined benefit pensions need to consider the available options. Failing to have a plan could result in significant adverse tax consequences for members, so talk to your clients who have reserves in their SMSF before it is too late.