The coming year is shaping up well for the domestic equities markets with some solid opportunities in a few specific sectors, writes Don Williams.

Arguably 2013 was the best year for Australian equities since the global financial crisis (GFC). The market rallied strongly in the first quarter, trading over 5000 on the ASX/S&P300 Index on a sustained basis for the first time since 2008. Following a short but sharp mid-year correction, the market closed at 5304, up 19 per cent, including dividends.

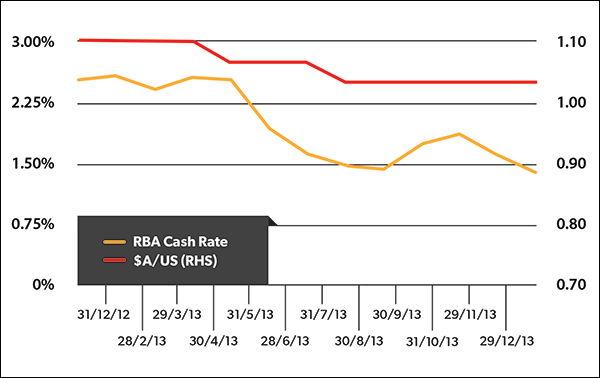

The improvement in market performance was underpinned by a gradual but persistent improvement in fundamentals throughout the year. The main factors at work were the lagged impact of lower interest rates, a declining currency (Graph 1) and, in the last quarter, a material pick-up in the property market. In addition, consumers are slowly becoming more optimistic, and with debt levels elevated, but not at all-time highs, there is reason to expect consumers will remain positive.

All these factors will continue to support Australian equities through 2014.

Lots of stimulus

In reference to Graph 1, showing the exchange rate and Reserve Bank of Australia (RBA) cash rate over the past year, the currency is beginning to respond to the reduced interest rate differential which, in our view, is unlikely to expand from these levels.

There are a number of risks to our positive view on Australian equities. One is the property market, where the recent resurgence, driven largely by Sydney, has led to some public commentary on possible bubble-like behaviour.

Graph 1: RBA cash rate and currency

Property in Australia is expensive on most metrics, but we believe it is premature to talk of bubbles and their inevitable correction. We’d expect a correction to occur if there are forced sellers, something likely to happen if owner-occupiers are overly indebted and become unemployed. Debt levels have been slowly declining since 2006, and the savings rate has remained elevated and stable since the GFC, leaving consumers in a relatively sound position.

Although investors have primarily driven this recent price movement, building approvals are up, which will improve supply. All in all, we believe the risks of property prices dropping substantially in the immediate future are low, mitigating any negative flow-on effect to equities.

Beginning of a new housing cycle?

Private building approvals, which include renovations as well as new builds, experienced a material pick-up towards the end of 2013. Looking at the data in a historical context, it appears we are at the beginning of a new housing cycle that is no different to any other that we have seen in the past few decades.

Another risk to our positive view is that the mining slowdown continues and bulk commodities experience further price depreciation. Although this is possible, we believe prices will remain reasonably firm, driven primarily by an iron ore market that is still tight and the fact the correction in metallurgical coal prices is fairly mature.

Also, it is worth remembering from a demand perspective that if China’s gross domestic product grows at 7 per cent, that is still 7 per cent on a very big number. In this sense, we think a lower iron ore price is already factored into the share prices of the majors, leading us to believe there is more risk of upside, rather than downside, surprise.

With respect to global market averages, over the calendar year Australian equities underperformed the United States (the S&P 500 returned 32 per cent), the German bourse (which returned 25 per cent), and Japan (which returned 59 per cent). We do not expect this underperformance to continue as the fundamentals here in Australia are only just beginning to get better, while they have been improving for some time in those markets. This brings us to the question: if the improved fundamentals of low interest rates, a low currency and an improved building cycle will support Australian equities in 2014, how much is already priced in?

Two data points lead us to believe Australian equities present good value for investors. The first is the market yield compared to the cash rate and the second is the improvement in company earnings. Yield stocks have done very well in 2013, but simply owning the market as a whole still gives you a better yield than cash. From a long-term perspective, an investor is being paid to hold equities at these levels.

Market yield still attractive

The market yield is attractive compared to the cash rate, leading us to believe the yield trade still has some time to run. The impact of franking serves to further this effect.

Company earnings are improving, without large valuation expansion. The average forward price-to-earnings (PE) ratio of the market since the early 1990s is 14.4 times, and at present the market is trading on 14.6 times. This is not expensive by any means. The forward earnings for the market are improving and the market as a whole will grow earnings by at least low double digits in 2014. This is a reflection of the positive macro environment we are now in, and shows the double impact of a lower currency and lower rates on company earnings.

Company earnings improving without strong valuation expansion

Market earnings are improving, and the PE, while not at low levels, is not expanding dramatically either.

Looking forward, investors have every reason to believe we are in the early stages of a bull market that started in the middle of last year, and is primed to continue in 2014 and possibly beyond. The vast majority of issues that were ailing the economy and the ability of Australian companies to grow profits in the past two years have been resolved or are dissipating. As a result, we are expecting better results from corporate Australia in 2014 and 2015, and higher equity prices.

Opportunities

So, where are the best opportunities within Australian equities?

Financials

While we believe bank share prices will be supported by mid-single-digit earnings growth and attractive yields, we think there are better opportunities in other financials. Strong equity markets tend to correlate with improved fund flows, and so asset managers should benefit from this. There is anecdotal evidence that fund flow into equities continues to increase and we believe Henderson, which is a well-run emerging and diversified global player in the asset manager space, should be well placed to benefit from this trend as it continues to grow its global equity presence.

Materials

The materials sector was unpopular with investors during 2013. However, we expect investor sentiment for the sector to improve during 2014 for strong profit growth, largely driven by iron ore.

We are positive on the prospects for iron ore, due to continuing demand and ongoing supply issues from China. According to the head of the Chinese Metallurgical Industry Planning and Research Institute, Li Xinchuang, China’s demand for iron ore is forecast to grow to 1.172 billion tonnes in 2014, implying the market will have to find more supply to satisfy this demand. With respect to the downstream sectors for Chinese steel demand, Li expects railways and automobiles to contribute the biggest growth in 2014 steel consumption, forecast at 8.3 per cent and 8.0 per cent respectively.

On the supply side, the industry has consistently underperformed expectations. Of the announced seaborne production capacity, about one-third has been delivered in the past few years, according to Rio Tinto and the United Nations Conference on Trade and Development. The world’s largest producer, Vale, is also the largest offender, often missing production targets due to a combination of labour, seasonal, operational and regulatory issues. The major Australian iron ore miners, BHP and Rio Tinto, have also downsized or cancelled some of their aspirational production in the past five years. The newcomer, Fortescue Metals, has come much closer to delivering on production targets than the more experienced majors, which is why Fortescue is our top pick for the sector.

Consumer

With debt levels below all-time highs and Australian consumers more positive in general, we see opportunities in the discretionary sector. One of the issues with Australian retailers has been their slow take up of technology, and their reliance on face-to-face sales. Even now, many Australian retailers do not have the online functionality that their international peers offer. So we believe investments in the Australian consumer sector should be in companies that have invested in their technological capabilities and, as a result, are more in line with global best practice. Three opportunities that stand out are Kathmandu, Domino’s Pizza and Flight Centre.

Kathmandu is making significant investments in improving its online retail capabilities, in online customer engagement, collecting customer feedback and in data-mining customer information. Ongoing customer engagement will allow it to incorporate the most recent customer feedback into its product development. It will also enable it to improve its inventory management, right down to being able to forecast individual store inventory requirements.

Domino’s is one of Australia’s leading online retailers and has a proven track record in using customer feedback in menu and product development. Domino’s product capabilities are one of its management’s core skills and have on a number of occasions been copied by the US parent entity.

Flight Centre is Australia’s leading travel retailer. We remain positive about its ability to improve profitability within its local division and in its major international businesses, such as in the United Kingdom, the US and Canada. In addition, we believe another source of growth for the company will come from its corporate division and in particular the ability to grow this in the US.

Telecommunications

The telecommunications sector in Australia is often in the press primarily because the sector is heavily influenced by government policy. We think the new and modified ‘coalition national broadband network (NBN) world’ will lead to NBN Co providing much less infrastructure in the near term, relying on current market players to continue to build out their own networks, particularly in metropolitan areas. So infrastructure is probably going to be more important going forward under a coalition government than it was under a Labor government. The cost of moving data around a network from hub to hub remains a key cost for the market and companies with stronger networks should continue to be able to create shareholder value. We think TPG could benefit from its cost leadership in the market, resulting from its relatively strong network: the acquisitions of Pipe Networks and now AAPT have left it in an enviable position.

In summary

We are positive on the Australian equities market for 2014. Our view is supported by a lower currency, low interest rates and an improving building cycle that will help mitigate the reduction in investment by mining companies. If we are wrong, and things do get markedly worse, the RBA still has room within its mandate to act, and we believe that because there are few signs of inflation, it will act if necessary. Specific opportunities within equities will come from companies that have good business models and that can support sustained earnings growth. Companies such as these will benefit the most from the supportive economic environment we find ourselves in.