Let’s go back to October 2017. By my reckoning a significant event happened. The bell rang to announce the bottom. The 90-day bank bill rate hit its low point of 1.68 per cent. It has now quietly climbed to 2.04 per cent. That’s only a tiny increase of 0.36 percentage points compared to a fall in interest rates of about 16 percentage points over the past 27 years, but what impact has it had?

Residential property on average across the country hit its peak in September 2017. It showed its first monthly fall in October 2017.

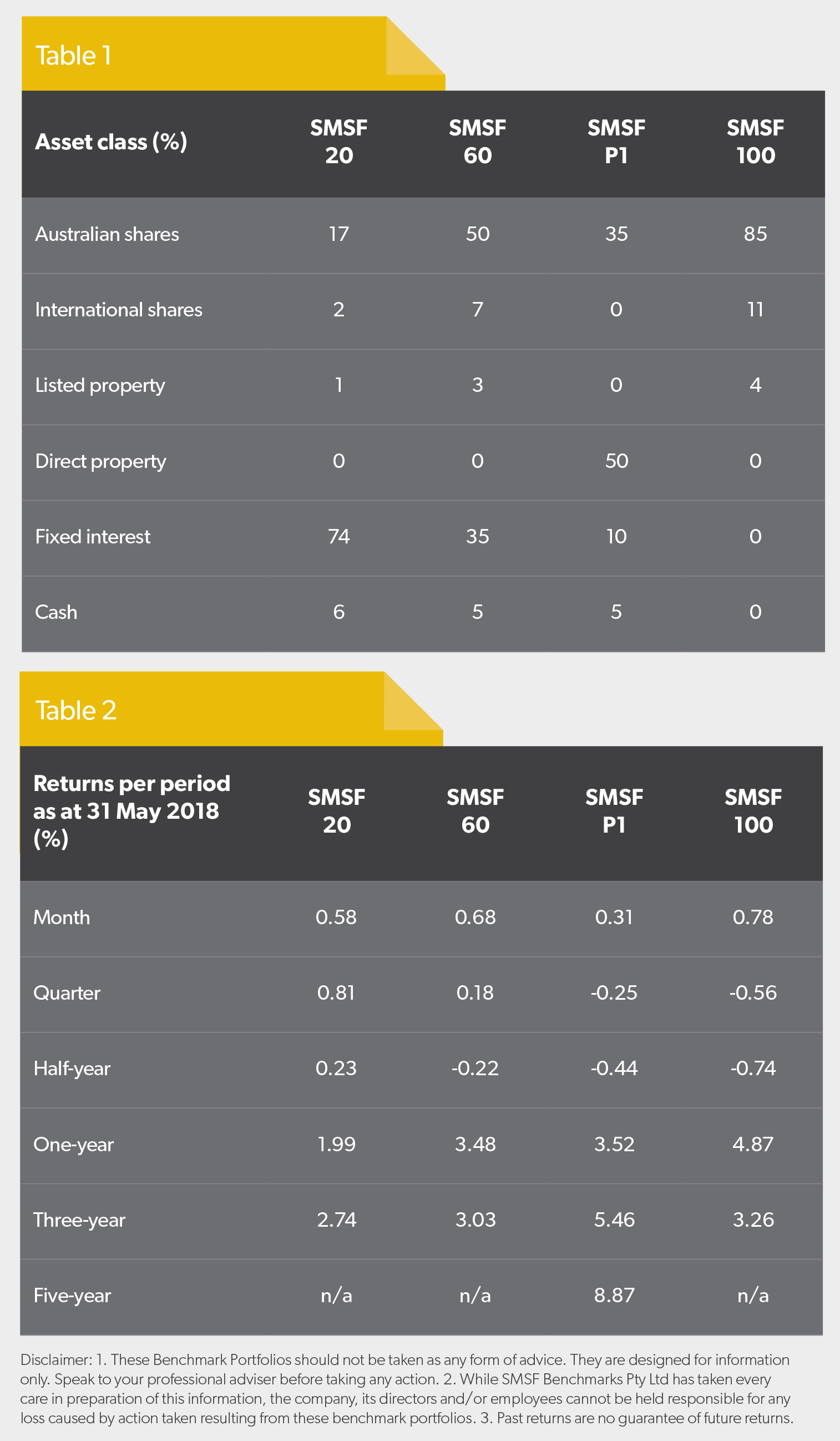

Over the 12 months to 31 May 2018, assertive SMSF 100 investors, who are pretty much fully in shares, are likely to have performed better (4.87 per cent) than SMSF P1 investors, who have directly owned property as part of their mix (3.52 per cent).

What really drives the property market? Unless you are investing in an area or a time where there are unusual circumstances, there is a theory that says property should go up in value at the rate of wage increases.

An investment property has a tenant who has an income. As their wage theoretically increases over time, they can afford to pay more rent. So in theory you have an asset with an increasing income stream and that is what makes the value of your property go up.

This theory ignores several practical issues, such as the effect of wealthy immigrants, local economic issues, such as dependence on the resources sector, interest rates and banks’ appetite for risk.

In 1990, bank advertisements showed a couple sitting across a desk from a bank manager who said: “You might have to go without dining at restaurants for a while. Are you prepared to do it?” The couple considered this and said: “Yes, we promise – please.”

Later the banks decided they were in the business of selling debt. So instead of being the gatekeeper to make sure people were not overextending themselves, they became the ‘enablers’ and the ‘feeders’.

"This is where benchmarking is important. What has done well in the past decade may not do so well in the next decade. Be aware of alternative investment approaches you could be adopting."

Nick Shugg

When people came to the bank manager over the next 27 years, they asked: “How much can I bid up to at an auction this Saturday?” The sales consultant plugged their assets, their income and the current interest rates into a calculator and told them they could bid up to $1 million.

If they had come in several weeks later, after interest rates had fallen again, the bank manager would have told them they could bid up to $1.4 million because when they plugged in a lower interest rate, it gave a different answer.

So investors bid up to whatever level the bank told them they could afford based on current rates. This made interest-only loans very accessible as they competed for debt against each other. Does this mean the property was actually worth $1.4 million all of a sudden?

Since October 2017, the average property price has declined. It has only come off 2 per cent, but nevertheless we have seen a correlation and a ‘heads up’ about what could happen if interest rates continue to increase.

The banks have also seen this and are a bit worried about the level of debt on their books. They are starting to write to customers with interest-only loans to request they start paying off some of the principal as well as the interest.

Investors who have borrowed to their maximum capacity have had a great run, but if they are at capacity, some will decide to sell off an investment property or two in order to reduce their debt levels.

This is where benchmarking is important. What has done well in the past decade may not do so well in the next decade. Be aware of alternative investment approaches you could be adopting. You are not wedded to any one approach.