Despite optimism local markets will show some improvement over the coming year, David Bassanese still feels the best investment opportunities will continue to lie overseas.

The Australian share market began the year with a lot of promise, but fortunes have taken a turn for the worse more recently. Sadly, the outlook still appears quite challenged thanks to a weak corporate earnings outlook, the prospect of rising United States interest rates by early next year and the fact that despite the market’s recent tumble, valuations are still not yet at compellingly cheap levels.

There are two hopes for the market over the coming year – a weaker Australian dollar and further interest rates cuts by the Reserve Bank of Australia (RBA). Should both of these come to pass, as I expect, it would support an eventual rebound in the economy and corporate earnings, while also supporting valuations due to the market’s still relatively attractive dividend yield.

Technical backdrop

The market’s broad uptrend since mid-2012 has been seriously challenged by recent market weakness. Indeed, the recent new low of 4998.13 represents a 16.5 per cent correction from the market’s previous closing peak of 5982.69 points.

Importantly, moreover, the market has broken below the last significant closing market low of 5155.80 points in October last year, upsetting the pattern since mid-2012 of higher highs and higher lows. The next level of market support would seem to be around 4655 points, which was the significant low during the mid-2013 market pullback.

Market valuations

The recent market decline has helped correct the divergence between prices and forward earnings that was evident from late 2014 to early 2015. Over the longer term it remains evident the BetaShares weighted-average forward earnings measure has only tracked broadly sideways since mid-2012 and in fact has fallen by 8.5 per cent since mid-2014.

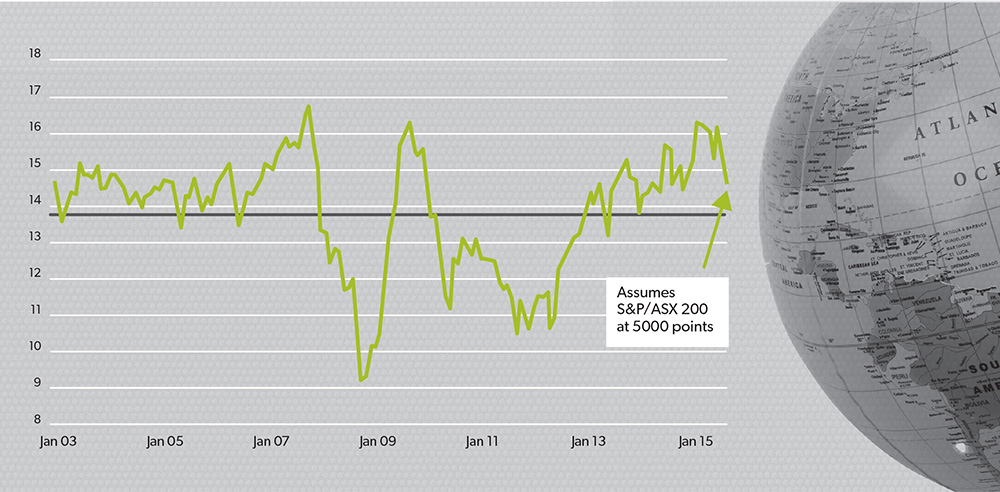

As seen in the chart below, the market’s recent correction has pushed the price-to-forward-earnings ratio (prices relative to the BetaShares weighted-average forward earnings measure) from an end-month closing peak of 16.2 in February, to around 14.5. This level is still above the average (since 2003) forward price-to-earnings ratio of 13.5. Valuations on this measure, therefore, are still at a little above their long-run average (even with the market around 5000 points), and above previous valuations lows of nine and 10.5 times forward earnings in early 2009 and mid-2012 respectively (see Chart 1).

The major support for the market remains valuations relative to the low level of interest rates. Indeed, the differential between the market’s forward earnings yield (inverse of the forward price-to-earnings ratio) and 10-year government bond yields edged up to 4.25 per cent by the end of September, which is above the long-run differential of 2.5 per cent since 2003.

This is accounting for a lot of the continuing interest we are seeing towards yield-focused Australian equities strategies. Indeed, the Australian high-yield exchange-traded fund (ETF) category experienced over $50 million of inflows in the month of August alone.

Chart 1: Forward PE ratio

That said, it is also worth noting the forward earnings-to-bond-yield differential had consistently been above this longer-run average since around mid-2011. The average since mid to late 2011 has been around 4 per cent, suggesting, on this basis, the market’s current relative valuation is closer to fair value. Note, the forward earnings-to-bond-yield gap is still below the peak levels of 6 per cent achieved at the last significant market bottoms in early 2009 and mid-2012.

The still reasonably favourable market valuation relative to bond yields, moreover, is also susceptible to global events. Although the bias on local interest rates remains to the downside, the ongoing strength in the US economy means the Federal Reserve is likely to begin raising interest rates by at least early 2016. At the same time, capital outflows from emerging market economies – in large part due to the fear of rising US interest rates and stronger US dollar – mean they are not accumulating foreign exchange reserves (which are typically invested in US Treasuries) as much as they were, which could also place further upward pressure on bond yields.

Earnings and the economy

Apart from valuations, another fundamental challenge for the market remains the economic and earnings outlook.

Although Australia is not in recession, growth has nonetheless been sub-par in the past four years, resulting in the unemployment rate rising gradually from 5 per cent to just over 6 per cent. Mining investment has slumped and weak commodity prices have hurt local incomes and left the nation with government budget deficits larger than normal. While China’s economic slowdown is likely to be manageable, its commodity demand has clearly passed its peak, while supply – such as for iron ore – continues to expand.

Meanwhile, although the non-mining sectors of the economy are responding to their dramatic improvement in international competitiveness thanks to a timely fall in in the Australian dollar, this much needed economic ‘rebalancing’ is taking time. There is also an emerging risk the home building boom – which has importantly supported the economy in recent years – is close to its peak.

All up, my expectation is that economic growth will remain sluggish for some time, which should eventually push up the unemployment rate to at least 6.5 per cent by mid next year.

This subdued backdrop does not bode well for corporate earnings. Indeed the consensus analyst estimate, according to Bloomberg, for earnings in the current and following financial years (2016 and 2017) have continued to be revised down over recent months – not helped by further weakness in commodity prices.

Although 2016/17 earnings are currently expected to rise by 8.2 per cent over 2015/16 – followed by growth of 10.1 per cent in the 2018 financial year – there’s little sign yet of a stabilisation in the earnings downgrades. As it stands, if earnings expectations are not revised further, our weighted average estimate for forward earnings would rise by 8.7 per cent over the coming 12 months. That said, forward earnings have averaged around 4 per cent less than one-year ahead estimates over recent years (since 2006). Assuming this average one-year realisation ratio holds true, forward earnings are only likely to rise by 4.7 per cent over the coming 12 months.

Conclusion

The market’s near-term outlook remains challenged on several fronts.

For starters, outright forward price-earnings valuations are still a little above average, and far from compellingly cheap territory as in early 2009 and mid-2012.

Compared with low bond yields, the market’s valuations (based on the forward earnings-to-bond-yield differential since 2003) are better.

But even here, relative valuations are only close to fair value if based on the average earnings-to-bond-yield differential since 2011 – and are still at the mercy of rising global bond yields in coming months.

Meanwhile, at best only moderate growth in forward earnings, around 5 per cent, seems likely over the coming year.

In my view, the most likely scenario is more downward/sideways market action – either until such time as either the RBA signals deeper interest rate cuts and/or the Australian dollar falls a lot further – either of which could help lift business confidence and earnings expectations.

This outlook favours seeking offshore exposure, especially in unhedged terms through broad-based international equities ETFs.

Investors seem to be catching on to these market indicators and favouring international exposure – developed international equities was the top category for ETF inflows on the Australian Securities Exchange in August, with over $83 million of funds moving towards these funds. On the local market, defensive high-yielding stocks are likely to remain in favour, as well as yield-focused strategies.

Due to likely actions by the RBA and foreign currency traders, the longer-term market outlook is more positive. Indeed, my call since February has been that the local currency would drop to US68c by the end of 2015, and to around US65c by mid-2016. Again, this bearish exchange rate outlook has been mirrored by investor sentiments as evidenced through the BetaShares US Dollar ETF trading 35 per cent more in September 2015 than its average over the previous three months.

At the same time, a likely resumption of rising unemployment in coming months – together with a levelling out in the home building boom – should lead to two further RBA interest rate cuts by mid-2016.