The chase for yield in the current low interest rate environment can lure investors into taking up returns offered by instruments such as hybrids. Chris Boag though warns about the importance of conducting deeper investigations into the returns on offer to avoid any associated traps.

In recent months we have seen two high-profile listed hybrids come to market, Westpac Capital Notes 5 (WBCPH) and CommBank PERLS X Capital Notes (CBAPG). Both of these were oversubscribed, however, we felt their offer for yield was insufficient for Royston Capital to participate. There are many factors to consider when investing for yield, and when you are seeking more yield, you have three choices: extend tenor, move down the credit quality spectrum, and move down the capital structure. In the case of WBCPH and CBAPG, the tenor has been extended to seven years or more, without the necessary pick-up in margin over the 90-day bank bill swap rate (BBSW). To understand this, we set the scene below and explain why we didn’t participate in the offer.

Setting the scene

Leading economic indicators continue to point to a strengthening economy through 2018, with inflation remaining benign. Easy monetary policy is slowly coming to an end with the United States Federal Reserve now firmly in a tightening cycle and Europe removing the words “further easing” from its policy statement at its recent meeting. The Reserve Bank of Australia (RBA) has retained the ultra-low 1.5 per cent rate and is likely to do so for the remainder of 2018, while setting the scene for a rate hike.

In the US, Jeremy Powell, newly appointed chair of the Federal Reserve, painted an optimistic picture of the US economy and even pointed to risks of the “strong” outlook. Some key takeaways were:

- accelerating US expansion is occurring during a “moment of global growth”, when headwinds have shifted to tailwinds, and

- with the unemployment rate at a historically low level and the labour participation rate not moving up much, Powell expressed confidence wage growth would pick up and the recent shortfall in inflation would prove transitory.

Unsurprisingly the Federal Reserve raised rates by 25 basis points recently. The official cash rate in the US is now higher than the official cash rate in Australia. While this has occurred in the past, it has not been frequent.

The prospect of higher US inflation has caused US bond yields to push up erratically on the assumption the Fed will need to increase rates faster. The risk is that bond yields push higher on further strong US economic readings and more signs inflation is increasing. The market had been assuming three rate hikes and possibly four. US short-term rates are likely to be above Australian short-term rates for a while: three to four Fed hikes versus potentially no RBA hikes for 2018 and we could have 100 basis points of difference between our cash rates. Note the cost of funding for the banks in the US has already risen by about 50 basis points, so households are about to start feeling like they have already had three rate hikes.

"The easing bias for the RBA has gone and it is still waiting for the right time to increase interest rates without causing a property market crash."

Chris Boag

Back in 2014 I outlined our preference for hybrids over senior credit in searching for yield. At the time I wrote that to reach for yield one can “i) extend tenor, ii) move down the credit quality spectrum, and iii) move down the capital structure. Moving into high-yield/sub-investment grade doesn’t make sense … extending tenor doesn’t make sense in our view either, a combination of poor relative value (we continue to like the three to five-year maturity buckets) and spectre of US rate rises pushing 10-year yields higher may erode the majority of the term spread pick-up. We continue to prefer to move down the capital structure and advocate overweighting AT1s and T2s in bank capital and sub-notes in investment-grade corporate debt on risk and reward”.

According to Bloomberg, Australian five-year iTraxx data, regarded as a proxy for domestic credit spreads, for March saw a widening in credit spreads. This does not bode well for the CBAPG listing. The years 2016 and 2017, however, were a boon for listed income securities, in fact it was hard to go wrong. Equity markets were experiencing a prolonged period of low volatility and complacency was creeping in. Just take US equity market valuations now topping 19 times price to earnings compared to the long-run average of 15 times price to earnings. This low-volatility environment led to a tightening of credit spreads. This seems to have reversed and will affect longer-dated interest-bearing securities the most.

Despite these incremental rate increases in the US, interest rates globally remain exceptionally low, keeping investors firmly entrenched in a chase for yield. This was quite evident recently when both Westpac and Commonwealth Bank of Australia (CBA) issued the two new listed hybrid securities.

The offer and why we didn’t participate

Westpac came to market in February 2018 with WBCPH offering an indicative margin of 3.2 per cent to 3.4 per cent over the 90-day BBSW. At the time, the 90-day BBSW was 1.80 per cent, thus equating to a gross running yield of 5 per cent to 5.2 per cent. It’s important here to also look at the term of the investment. Westpac was offering a term of seven-and-a-half years with an option for another two. Shortly after, CBA came to market with CBAPG. CBA was offering 3.4 per cent to 3.6 per cent over the 90-day BBSW, which was a little more attractive compared to the Westpac offer. The term being offered was also a fraction shorter at seven years with an option for another two.

Within the Royston Capital interest-bearing securities portfolio, we chose not to participate in either of these offers. I do note both were well supported and oversubscribed. This is unsurprising given the reduction in supply of new issues, general investor demand for yield, and listed exchange-traded funds and fund managers who all need new issues to add depth and liquidity.

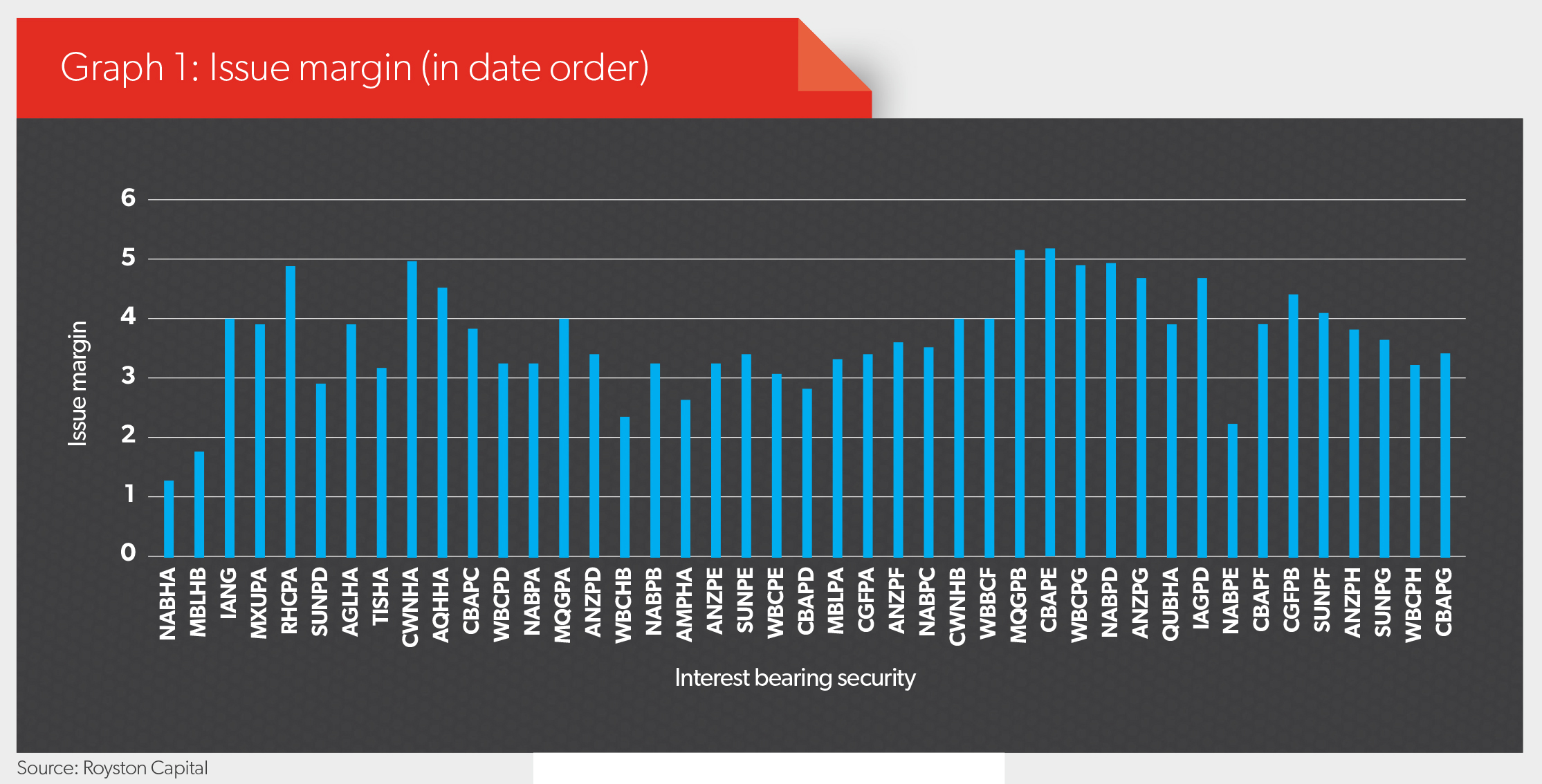

Our view for the WBCPH and CBAPG was that the yield on offer was insufficient for the time period we would need to be invested. Graph 1 illustrates the issue margins of many of the listed income securities in date order. You can see the recent peak in margin was with CBAPE and the margin on offer has since been in steady decline. We simply didn’t see value in what was being offered and were of the view WBCPH was at risk of listing at a discount to its face value (which we have since been proven right on). WBCPH’s low margin and seven-and-a-half-year term was a double whammy for investors, offering poor relative value. We believe CBAPG will also suffer a similar fate.

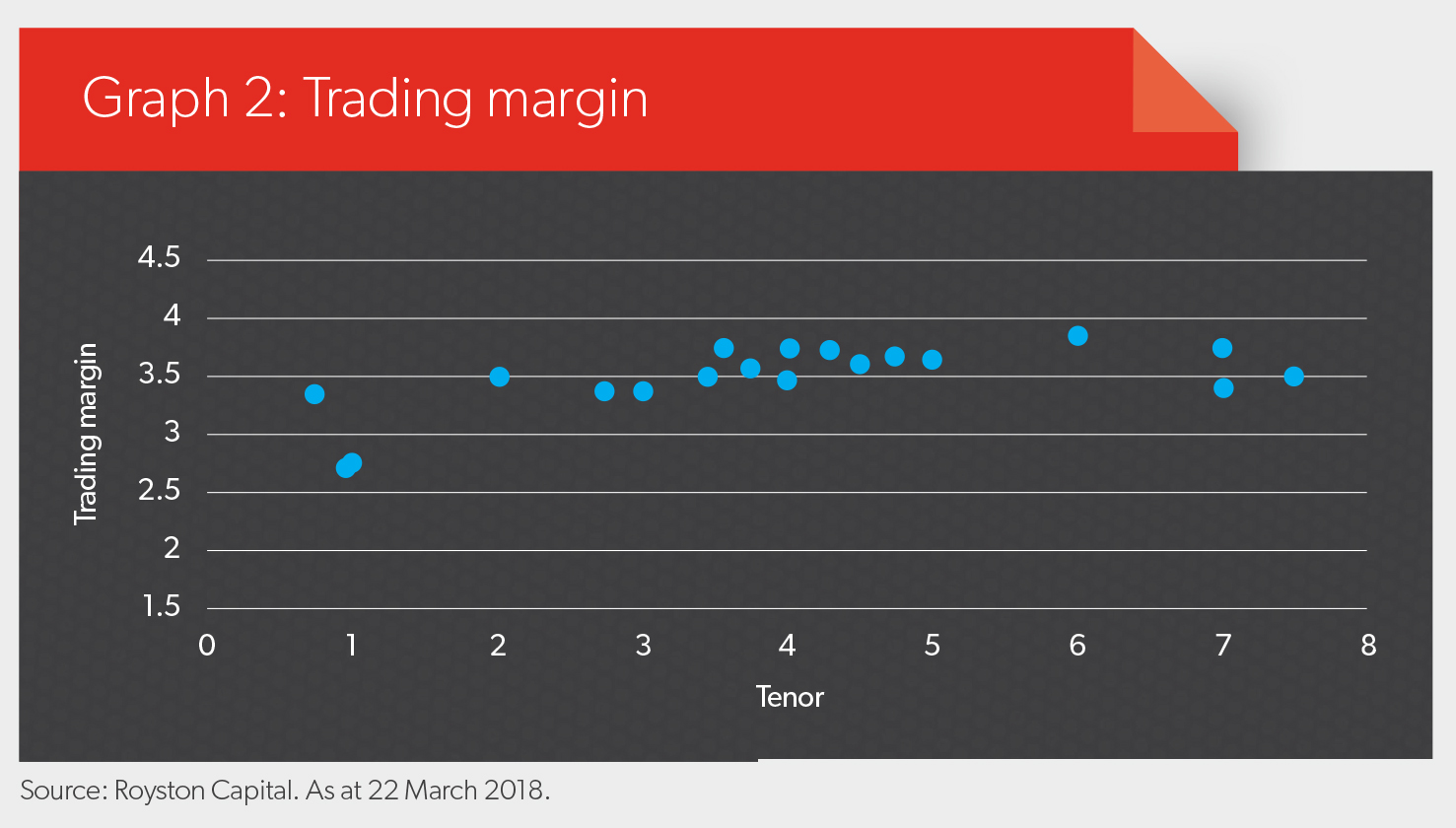

When we look at trading margins, we start to see a clearer picture. WBCPH was issued at 3.2 per cent and CBAPG at 3.4 per cent over the 90-day BBSW. WBCPH has commenced trading and is illustrated as the dot furthest to the right in Graph 2. Our objective when viewing this chart is to seek the best return for the duration. Excluding the early issues of CBA PERLS, all the listed income securities are issued with a $100 face value and at call that $100 is returned to us. As we approach the first call date for the listed income securities, we have a greater certainty about the price of the investment and thus the level of risk reduces. Anyone who has subscribed to WBCPH and CBAPG will need to ensure they have done so for the long term to avoid realising any immediate capital loss. For those who did not subscribe to them, there may be an opportunity to buy in on-market at a more attractive price and perhaps soon. For now there are some attractive yields with tenors of three to five years that are of interest.

Final word

US rates are highly likely to rise further this year and we will see the gap between the US and Australian official cash rates widen further. The easing bias for the RBA has gone and it is still waiting for the right time to increase interest rates without causing a property market crash. Investment markets have become more volatile this year as investors adjust to a world moving past the end of an era of never-before-seen monetary policy and into a rising interest rate environment. Increased volatility in equity markets is causing credit spreads to widen, which is a risk for complacent investors in the chase for yield. This is a time to dig a little deeper, research the opportunity and wait for your moment to invest, for there is no benefit in chasing yield at the expense of your capital.