SMSF investors looking to increase retirement income and cushion the blow of the Australian share market free fall should consider international equities to balance their portfolios, writes Dr Don Hamson.

SMSF investors have recently been on a searing ride with their Australian share investments. The local market slumped almost 10 per cent to 18 January, one of the worst-ever starts to a calendar year, on top of share prices falling 2 per cent during 2015.

What’s more, local share prices are essentially trading at the same level they were at 10 years ago.

The underperformance of Australian equities has highlighted the importance of diversifying globally for all Australian investors, not only to seize opportunities, but to avoid being overexposed to local risks.

However, most Australian SMSF investors have very low allocations to international equities, particularly relative to the average large superannuation fund.

We believe income-focused SMSF investors should consider high-yield global share offerings to not only generate income streams, but to also diversify away from the Australian dollar, particularly those in pension phase.

An isolated continent

Australia is an isolated continent, but we are not isolated people. In 2015, more than 9 million Australians, over one-third of our population, travelled overseas.

Yet when it comes to investing overseas, we’re not nearly as adventurous when we have control of our own investments, as SMSF trustees do.

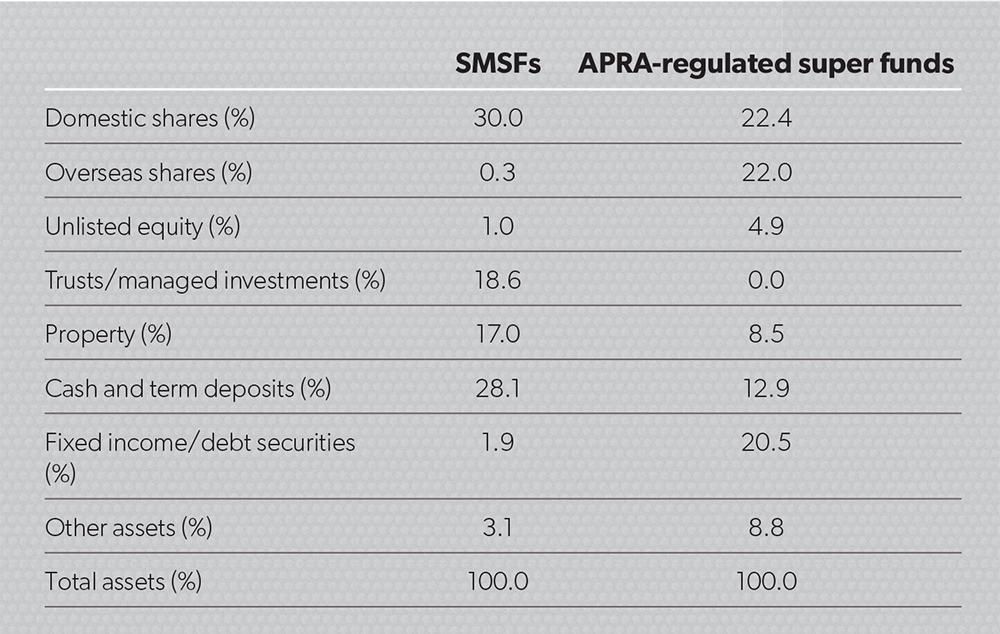

Table 1 shows comparable asset allocations for SMSFs and large Australian Prudential Regulation Authority (APRA)-regulated super funds at September 2015. SMSFs directly hold only 0.3 per cent in overseas shares compared to 30 per cent in domestic shares, and a 22 per cent allocation to overseas shares by large super funds.

The SMSF numbers likely understate actual overseas exposure as holdings in listed, unlisted or other managed investments (18.6 per cent) are likely to contain some overseas assets. But there is no doubt the average SMSF has a substantially lower allocation to global assets than large super funds.

Even if the entire SMSF exposure to trusts/managed investments were in overseas shares, they would still hold less than 20 per cent exposure to overseas shares.

Large super funds also have substantial holdings in international fixed income and international infrastructure, with over 30 per cent of their total assets in non-Australian investments.

A rational response?

Why do SMSFs hold such low weights to global assets and in particular global shares? We believe there are three key reasons:

1. Home bias

Investors around the world have a tendency to overinvest in their own domestic shares, despite the diversification benefits of investing in foreign shares. This home bias is likely due to two reasons. People tend to invest in what they know and they know local equities much more than they do foreign equities. It can also be more difficult and more costly to invest in foreign shares relative to domestic shares.

2. Tax

Investments in Australian shares usually carry valuable franking credits. In 2015, the franking credits on the Australian S&P 200 index were worth 1.6 per cent in returns for a pension-phase superannuation fund, which receives a full refund of those franking credits.

For a pension fund this meant Australian shares returned 4.2 per cent in 2015. On the other hand, investments in overseas shares are often subject to foreign government withholding taxes, which reduce the dividends and thus the total returns investors receive.

3. Income

Australian shares deliver quite high dividend yields relative to global shares.

Australian shares yielded 6.5 per cent inclusive of 1.6 per cent franking in 2015, while global shares yielded just over 2 per cent after withholding taxes.

From an income perspective, Australian shares are clearly more attractive than global shares. Retirees who live off the income they draw down from their SMSF may likely prefer Australian shares over global because of their relatively high income-generating ability. But it’s not all about income. Share investments deliver both income and capital gains, and, as we noted earlier, Australian share prices have essentially gone sideways for the past 10 years.

Domestic dangers

So an SMSF’s decision to focus on domestic shares makes sense at a number of levels.

But it also means missed opportunities and exposure to significant risks.

The first is overexposure to the Australian economy. The Australian economy is cyclical with a heavy focus on commodities – both mining and agriculture. Our economy and our stock market are significantly influenced by the price of commodities.

The Australian equity market is also quite concentrated. While the S&P 200 index is made up of 200 stocks, currently the top 10 stocks represent more than 50 per cent of the value of the index. From an income perspective, the market is even more concentrated, with the top six stocks currently representing about half the value of all dividends paid on the entire index, and four of the top six dividend payers are all in the same industry – banking.

A domestic focus also means overexposure to the Australian dollar. If the local dollar falls, you lose international buying power.

Compared to the US dollar, the Australian dollar has reduced in value by 37 per cent from its peak four years ago. Put another way, the ground cost of taking that holiday to Hawaii has gone up 37 per cent in four years.

When the commodity cycle is poor, the returns on Australian equities will likely be low. In 2015, the single biggest component of SMSFs’ assets – the Australian equity market – returned 2.7 per cent.

If the Australian economy is weak, the likely reaction by the Reserve Bank of Australia (RBA) is to lower interest rates. In 2015, the RBA lowered interest rates to a record low of 2 per cent. Cash and term deposits represent the next biggest allocation of SMSF assets.

SMSF returns will be affected by this. With almost 60 per cent of SMSF assets earning 2 per cent, overall returns would have been low in calendar 2015.

So in a low-growth scenario, SMSFs with a domestic bias take a hit to their returns.

On the other hand, the fall in the Australian dollar meant that even though most equity markets were fairly flat in 2015 in local currency terms, from an Australian perspective the MSCI World Ex Australia Net Returns Unhedged Index in $A earned a reasonably healthy 11 per cent in 2015.

And 2015 wasn’t an unusual year. Global shares in Australian dollars have significantly outperformed local shares over the past three years, earning 23 per cent yearly versus 11 per cent a year, including the value of franking credits.

And we believe the relative outperformance of global shares over domestic shares is likely to continue. Weakness in the local currency is likely to continue due to a soft commodity outlook and low Australian interest rates. Low commodity prices are due to excess global supply for oil, gas and iron ore, which is unlikely to be unwound in the short term.

Table 1. Asset allocation of Australian super funds, September 2015

Global shares will also continue to provide diversification benefits by providing access to sectors that are under-represented in the Australian share market; sectors such as technology and pharma companies. We believe it is never too late to improve the diversification of your SMSF.

Boosting returns through international shares

We believe SMSFs should allocate more to non-Australian-dollar assets such as global shares. Direct investing into global shares is difficult, but it is getting easier. However, we do believe managed investments are probably a better alternative in the global space, and there is a large range of global share options available from simple and relatively cheap index exposure via exchange-traded funds through to actively managed funds.

As an example of the benefits of offshore investing, if the average SMSF had substituted half its exposure to Australian shares into global shares over the past three years, it would have boosted overall total returns by almost 2 per cent a year, assuming it received benchmark returns.

The increase in returns would have come in the form of higher capital values, rather than higher income. Pension-phase SMSFs looking for income may need to look for high-income global share funds.

The benefits of high-yield global share offerings

Industry statistics imply the average SMSF has much lower exposure to global assets, particularly global shares, than large APRA-regulated superannuation funds. Not only does this mean the typical SMSF has missed out on the past three years of strong returns from global shares, it also means it has been heavily exposed to a weakening Australian dollar.

We believe it is not too late for SMSFs to better diversify into global shares.

For pension-phase SMSFs looking for income to fund their retirement, high-yield global share offerings might prove attractive and should certainly be considered.

It would enable the SMSF to better diversify outside of the typical high SMSF exposure to Australian shares, and also diversify away from the local currency by increasing the exposure to foreign currency assets, thus cushioning the SMSF members from falls in the Australian dollar, while still generating strong levels of income.