Allocations to emerging markets in the global equities landscape remain relatively low. Alex Duffy details where the investment opportunities lie, as well as some risk mitigation rules to apply to these regions.

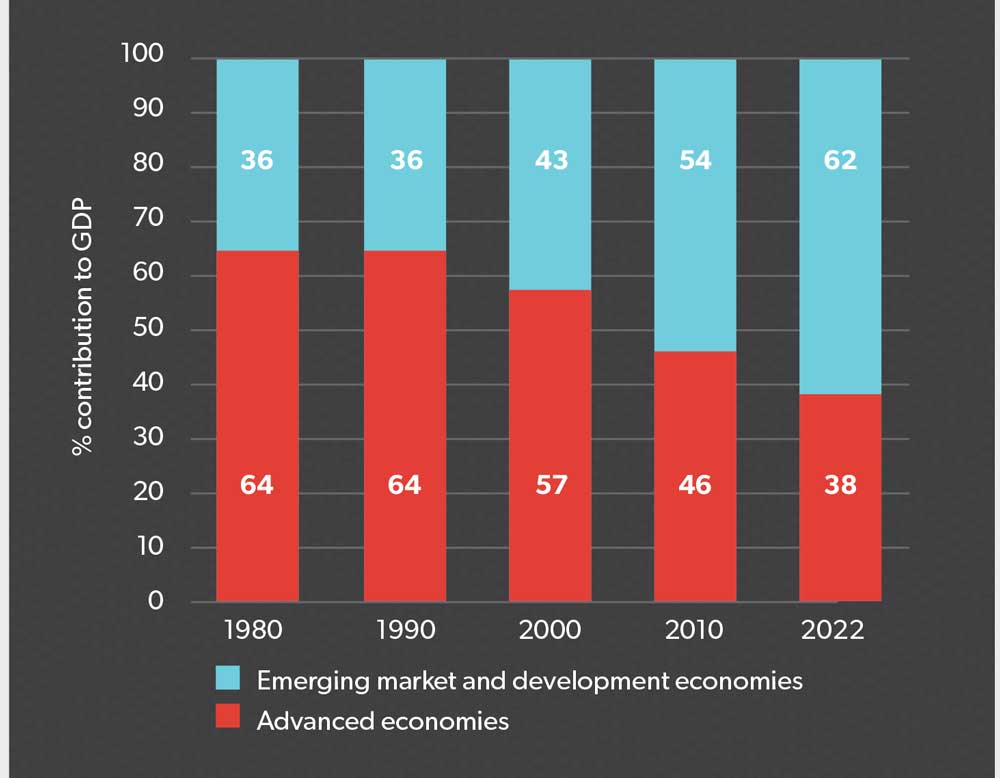

Emerging markets have become increasingly important when it comes to global economic output, today accounting for around 60 per cent of global gross domestic product (GDP). Despite their contribution, companies that reside within these markets remain significantly under-represented within global equity portfolios, today making up only 12 per cent of the MSCI All Country World Index. For many investors, this means their allocation to emerging markets remains a relatively small proportion of their portfolios. While this is set to increase over time as emerging markets become better represented in global indices, there are good reasons why investors should pay attention now.

Positive demographics

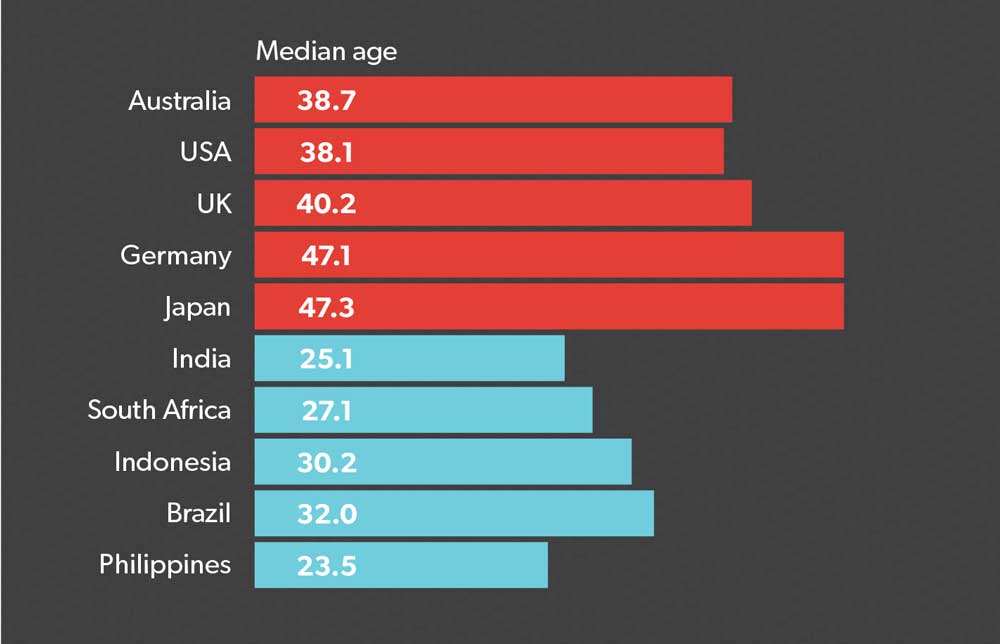

We believe many emerging-market countries have the ability to sustain high levels of economic growth for several years to come, driven by attractive demographic profiles, immature markets, an abundance of untapped natural resources and generally low levels of indebtedness. In developed markets such as Japan, Germany and the United States, the average median age of workers is in the high thirties to early forties, compared to the high twenties to early thirties in emerging markets. This means over the next 10 to 15 years, the majority of workers in developed markets will increasingly be retiring and drawing down on savings, so dissaving. Meanwhile, with a young and growing population and workforce in emerging markets, consumption levels and savings rates are increasing as they continue to develop.

While they are relatively small in terms of global consumption today, emerging markets are starting from very low levels of penetration, so they have the potential to grow at a higher rate than what we currently see in developed markets. This means the opportunity set for investing within emerging markets will increase over time.

Risks

While the drivers of growth in emerging markets are hard to ignore, so too are the risks. The African mining sector offered no shortage of excitement for investors during the commodities boom of the previous decade, but it was also fraught with hidden risks. It was over a decade ago, when I was an analyst focusing on natural resources companies in Africa, I learned critically important lessons about governance. When the business cycle turned for the worse, companies in the sector had their governance structures put to the test and some of them failed with painful results for shareholders. It was a critical learning experience and a focus on governance has since become the bedrock of how I approach investing in global emerging markets. As a result of this experience, I developed a five-part checklist of governance red flags for evaluating potential investments.

1. Who am I investing alongside?

Is the company state owned? It’s not a hard and fast rule, but state-owned companies sometimes have a lower return profile than private firms, for example, because they may have to balance political considerations alongside financial objectives. On the other hand, if a company is family owned, the controlling shareholders might have very different diversification requirements than non-shareholders. Another consideration is whether the founding shareholder is involved in managing the company. If they are, depending on how hands-on they are, it might make it more challenging for outside shareholders to influence corporate strategy.

2. Mind the share structure

I watch out for non-voting shares, which are common across global emerging markets. When companies with these share structures need to raise capital, they often favour issuing non-voting stock, which can leave the affected shareholders with little recourse when their holdings are diluted. It’s also important to read the fine print on shareholders’ rights. Are shareholders entitled to vote at annual meetings? What is the process for bringing new proposals? Are shareholder votes binding on the board?

3. Ensure management thinks like owners

I like to know if the company’s managers have a significant portion of their wealth invested in their company. Staff turnover is also important. It is always a good sign when companies have a low turnover, for example, when competitors say it is hard to poach talent from a firm.

4. Do homework on the company’s track record

Signals I look for include whether the company has a reputation for being involved in frequent litigation. I’ll also ask myself if the company’s cash-flow cycle makes sense. For example, can I clearly see where the company is adding value? Unexplained or questionable cash flows can be a red flag. The other thing I look at is the company’s capital allocation decisions. I’ll question the dividend policies if the money could be better reinvested in growth and look out for frivolous expenditures.

5. Be sure the directors have shareholder interests in mind

Considering whether board members have the professional qualifications and experience to govern effectively, as well as questioning appointments that appear to be driven by personal relationships, is another way to mitigate risk. By looking at attendance and voting records from board meetings, I can get an understanding of how engaged the directors are. I’ll also pay close attention to any politically connected people involved at the board level. Their experience can be valuable, but can also introduce an element of political risk.

Risk can mainly manifest itself in either poor corporate governance or poor balance sheet structure. Addressing those risk factors upfront, to ensure investors have appropriate alignment between their interests as minority shareholders and the interests of the other key stakeholders within the business, provides a great opportunity to create value. This comes through owning good businesses; businesses that invest in their companies’ profitability and seek to own their companies for a three-to-five-year investment period at least.

By understanding at the outset the risks of the companies in the countries in which we are invested, understanding the strengths of the business model, and how those strengths are evolving over a three-to-five-year time horizon and then simply owning those good companies for at least that length of time, we can benefit from the profitable growth that those companies are able to deliver. That growth has to be matched or at least supported over the long term through a commitment to pay dividends to shareholders, because ultimately it is through the remittance of dividends that shareholders are remunerated for their investments in the companies, and so dividends are an important underpin in terms of the discipline of the approach.

Graph 1: The rising importance of emerging markets in the global economy

Source: International Monetary Fund, World Economic Outlook Database, October 2017. Gross domestic product based on purchasing-power-parity share of world total.

Sustainability

When it comes to investing in emerging markets, sustainability is an important consideration. Given environmental, social and governance (ESG) factors are key drivers of both returns and downside risk, they cannot be disaggregated from other fundamental considerations. For most active managers, engagement and ESG analysis are a critical part of the investment process. At Fidelity we leverage the combined strengths of our equity research team, which engages with all investee companies at least quarterly, and our dedicated ESG team to influence and drive better governance, capital allocation and ultimately shareholder return outcomes. For example, during 2018, our ESG team initiated a thematic engagement project concentrating on supply-chain management in the apparel industry. Insufficient management of ESG factors in a company’s supply chain opens it up to reputational, operational and legal/regulatory risks, as well as hidden and uncontrollable risks, such as human rights abuses and corruption. Our main objective for this thematic engagement has been to lift transparency in our investee companies regarding supply-chain management. For those companies we believe are falling behind best practice, we have sought to encourage a more sustainable strategy and increased disclosure. We believe a company manages its supply chain in relation to social and environmental matters can add competitive value to its strategy in the long term and will improve its organisational performance.

Graph 2: A young workforce in emerging markets

Source: PwC World 2050 Report

Outlook

For investors who understand the risks, the opportunity set for long-term patient investors seeking to own good-quality companies in emerging markets at reasonable valuations remains robust. The structural backdrop of favourable demographics, under-penetrated markets and increasing levels of consumption remain intact, so could now be a good time to consider an allocation to emerging markets?

Emerging markets have been out of favour for a number of years. The past five years have been a very strong period for US equity markets in particular, but a weaker period for global emerging markets. On a range of metrics, global emerging markets are trading at a discount versus developed markets, despite the fact they offer comparable levels of profit generation and a positive long-term growth outlook driven by demographic trends.

The major headwind for the asset class has been the strength of the US dollar and the relative weakness that factor creates in emerging-market currencies, brought on by the US Federal Reserve increasing interest rates. However, as the Fed has taken on a more dovish tone recently, pressure on rates has started to abate and US dollar appreciation has moderated. This, in turn, provides a favourable backdrop for investing in emerging markets. That said, there will always be volatility in this asset class. Emerging markets remain relatively underdeveloped both from a capital-market perspective and from a level of sophistication of the financial markets. This means investors in this asset class need a disciplined, prudent approach in order to benefit from the opportunities.