David Zammit puts forward compelling reasons to include investment-grade bonds from various overseas regions to enhance SMSF portfolios.

Nearly half the members of SMSFs rely on a pension from their fund. However, achieving stable returns is difficult in an environment where Australian interest rates languish at historical lows within a global environment set at multi-decade lows.

To thrive in this context, SMSF investors need to look beyond the traditional favourites of Australian listed equities and cash – asset classes that currently represent over 60 per cent of the $700 billion controlled by the sector – and seek diversification opportunities elsewhere.

It is Citi’s view a globally diversified portfolio represents the biggest opportunity to SMSF trustees in 2018.

A world of opportunity

Citi expects an acceleration of economic growth around the world in 2018. We believe this synchronised global growth will reward those who diversify their local risks and position into faster-growing economies and themes.

As we’ve seen in the first quarter, 2018 has been no stranger to higher volatility, a trend that is in sharp contrast to last year. We think this volatility is here to stay as markets now have to grapple with central banks that continue to telegraph an expectation to raise interest rates and reduce asset purchases.

While volatility can be unsettling, it need not be seen as a danger, but rather as an opportunity, especially with high valuations across most equity markets.

"It is clear investors have a low awareness of the broader range of fixed income solutions available, so it is no wonder SMSF trustees are struggling with yield."

David Zammit

In this context, Citi views the most attractive global opportunities as outside the United States, in particular developed Asia, emerging markets and Europe outside the United Kingdom.

Our overweight position in Europe ex-UK equities is reliant on the growth upturn that is very much intact, according to the European Central Bank (ECB). The ECB recently upgraded its growth outlook at its March meeting. It raised its 2018 gross domestic product growth forecast from 2.3 per cent to 2.4 per cent, close to Citi’s estimates of 2.5 per cent. We continue to be mindful of downside risks that include disappointing reform outcomes and an escalation of political, geopolitical and trade tensions.

We recommend investment-grade fixed income issued by local and foreign multinationals, which has historically brought lower levels of absolute volatility and correlation to equity markets. Given the higher realised volatility, it would be prudent to adopt a degree of a defensive stance using investment-grade bonds. This is in contrast to government bonds where we have an underweight position.

We have adopted this stance as government bonds tend to underperform investment-grade bonds in an environment of rising yields. Coupled with attractive levels of returns for the conservatively minded, a well-diversified fixed income portfolio can help long-term investors, such as SMSFs, look beyond the current business cycle and adopt a higher credit profile that reduces the risk of corporate default to help achieve consistent levels of income.

Emerging market growth is strong across the globe and we expect that position to be strengthened by our expectation the US dollar will move lower over the medium term. Further US fiscal deterioration from recent tax reforms is also likely to weigh on the greenback. In contrast, the Australian dollar stands to benefit from the positive global growth narrative. It’s closely correlated to the Asian supply chain given our large export market for iron ore, coal and increasingly gas.

An alternative way to seek income

We recognise generating a higher stable yield is at the forefront of investment decisions for many SMSF trustees. However, in our low interest rate environment, it is easy for investors to discount the benefits of fixed income. For investors willing to look globally, however, there is still value in using a portfolio of global bonds to generate income and reduce overall portfolio risk.

Our home bias is one factor impacting on SMSF trends to look globally for income. When speaking to SMSF trustees in Australia about their exposure to fixed income, the most common response is they have it covered. They tell us they have money in cash and term deposits held with local banks. In fact, SMSF trustees hold on average over 25 per cent of their portfolio in this asset class, according to the ATO.

It is clear investors have a low awareness of the broader range of fixed income solutions available, so it is no wonder SMSF trustees are struggling with yield. The risk for those SMSFs paying a pension is the possibility their capital will be eroded significantly. Without knowledge of the broader options, many SMSF trustees feel the need to take on higher levels of risk than they may be comfortable with in order to chase yield through investing in riskier asset classes.

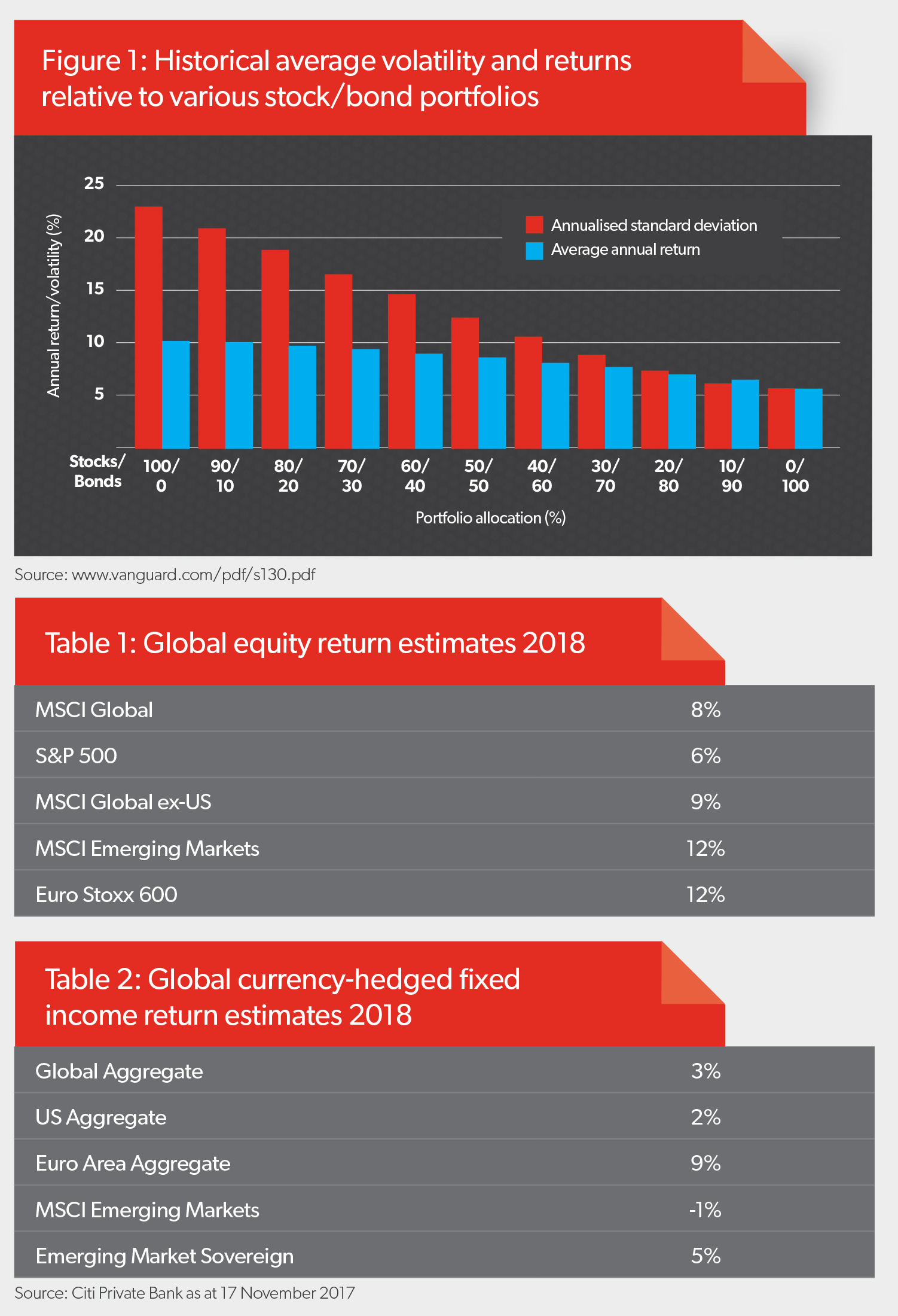

Coming back to our focus on diversification, we note that adding fixed income to an equity portfolio using bonds can have a dramatic effect on reducing volatility in portfolio returns without overly hindering performance. Figure 1 shows that a 50/50 bond-to-equity portfolio helps to reduce volatility from 23 per cent to 14 per cent without having a dramatic impact on returns.

With the range of investment-grade bonds on offer, SMSF trustees are able to maintain an exposure to fixed interest while generating a better return.

We recommend using bonds combined with other asset classes to build, manage and adjust investment portfolios according to the trustee’s risk appetite. Given the opportunities for higher yield to be generated by investing globally, trustees should seek to access bonds with specific characteristics from various markets that match their investment strategy.

A trend that is proved historically

Looking globally to diversify a portfolio is not a new trend, and it is in fact a trend that is proven to deliver value historically, whether by driving returns or assisting with risk management. Looking at the period between 1952 and 2017, a globally diversified multi-asset-class allocation would have produced an annualised total return 1.3 per cent above that of an equity and fixed income allocation entirely drawn from the world’s best-performing region – the US. What is more, the global allocation’s annualised volatility would have been 1.8 per cent lower than the US-only allocation.

The long-term outperformance of global allocations is no coincidence. Economic dislocations and geopolitical shocks that strike multiple regions simultaneously are relatively rare, the global financial crisis of 2007-09 being one example. Such episodes are more frequently focused upon a particular region, such as the Asian crisis of 1997-99 or the European sovereign crisis of 2012-13.

According to our analysis of the four main regional economic crises of recent decades, financial markets outside those regions were negatively affected, while economies were generally not. Those external markets subsequently recovered much faster than those of the affected regions, outperforming them by an average of 33 per cent in the year after the onset of a regional recession.

Having a globally diversified portfolio is intended to mitigate the effects periodic regional difficulties can have upon performance.

With many regional economies worldwide likely to experience faster growth, globally diversified investors may be better placed to experience robust returns in both the coming year and, more importantly, over the long run.

How to take the first step towards investing globally

The power of diversification comes from having exposure to multiple sources of risk and return. Various countries’ business and financial market cycles are often at differing stages and by investing in a country or region with faster economic growth than one’s own, potentially higher returns from that growth may be captured. Despite these benefits, many clients are still reluctant to embrace global multi-asset class diversification fully. There is a surprisingly widespread belief that portfolios exposed to emerging markets, different currencies or illiquid asset classes actually increase overall risks, when, in fact, historical data shows the opposite is true.

For unadvised SMSF investors, the challenge of understanding global markets and the ease of investing domestically makes a global diversified portfolio difficult to achieve. Furthermore, there is a widespread perception global markets have generally been difficult to understand and expensive to access directly. It is therefore not a surprise to us when speaking to new clients that their exposure to global markets is exclusively through managed funds or exchange-traded funds and represents only a small percentage of their overall portfolios.

This is compounded as most locally based advisory firms generally do not have the scale to research global opportunities and in many cases are restricted to recommending only managed funds via their approved product list.

As more and more SMSF investors are forced to look offshore to seek returns, we believe these barriers to investing globally will reduce. Education will play a crucial role in giving investors the comfort required to fully understand whether going global for growth is the right path for them.