The ability to refund excess superannuation contributions has been a welcome development for individuals. Jemma Sanderson examines the rules that must be followed to ensure the process is performed correctly.

Post 1 July 2013, taxpayers had the choice to request any excess contributions made to be released from superannuation. However, there are strict time frames and rules that need to be adhered to when using these provisions. Where a member would like the excess contribution released, it is important the correct process and relevant time frame is followed in order to avoid the individual having to pay the tax personally or being subject to excess non-concessional contributions tax or penalties.

There are different rules, time frames, elections and release authorities depending on whether the excess contribution relates to concessional or non-concessional contributions.

Concessional contributions

On 5 April 2013, the government announced it would enable taxpayers who exceed their concessional contributions (CC) limit to elect to receive a refund.

- All excess CCs would be added back to the taxpayer’s assessable income and taxed at their marginal tax rate (with a rebate for the 15 per cent contributions tax payable by the fund).

- The individual would be able to request the excess (net of contributions tax) is refunded to the ATO, which would deduct the additional tax, any charges, and refund the balance to the taxpayer.

- A refund of the excess would be optional.

- Section 292-90 of the Income Tax Assessment Act 1997 is now drafted such that gross excess CCs are assessed towards the non-concessional contributions (NCC) cap, with an adjustment made for the grossed‑up released excess CC amount. Accordingly, where a refund is not sought, the gross excess CCs will be assessed towards the individual’s NCC cap.

- A new charge would apply to the differential between the contributions tax and the tax the individual would pay on the income if it wasn’t contributed to superannuation – the excess concessional contributions charge (Superannuation (Excess Concessional Contributions Charge) Act 2013). This is to ensure the individual is not benefiting from any timing differences in terms of the tax payable:

- The rate to apply would be the shortfall interest charge.

- The new charge would apply from the start of the financial year of the excess CCs until the first notice of assessment for the taxpayer.

- Over the period from the first notice of assessment to the payment of the additional tax, the tax differential becomes subject to a shortfall interest charge.

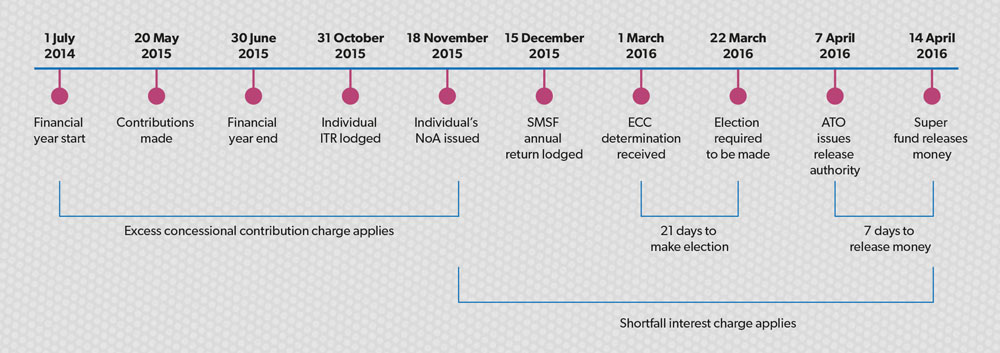

Once the ATO has determined a taxpayer has exceeded their CC cap, they will first issue a notice of amended assessment, together with an excess concessional contribution determination directly to the individual.

The determination provides the individual with the following options:

- pay the tax liability personally (where the gross excess amount will be included as an NCC), or

- elect to release up to 85 per cent of the excess contribution from superannuation.

The ability to make an election to release excess CCs is contained in schedule 1, section 96-5 of the Tax Administration Act 1953 (TAA). Where the taxpayer would like to release the money from superannuation, the approved excess concessional contributions election form is required to be completed and lodged with the ATO within 21 days of receiving the determination. The individual can lodge the election via mail or through MyGov, or alternatively the individual’s tax agent can submit the election through the tax agent portal. Once an election has been made, it is irrevocable.

Once the election is lodged, the ATO will issue a release authority to the chosen fund. The fund has seven days after the release authority is issued to release the amount and return the release authority to the ATO. Where the fund does not release the money and return the release authority to the ATO within seven days, administrative penalties may apply.

Diagrammatically the process operates as in Figure 1.

If an election is not provided within the prescribed time frame, the individual will be liable to pay the tax liability personally, and the excess contribution will count as an NCC. This could also impact on any NCC strategy that is in place, whereby the three-year bring-forward period could be triggered, or an excess CC could also become an excess NCC.

The seven-day time frame to release the money and lodge the release authority is extremely tight, especially when factoring in:

- the notice may be physically received two to five days after the date on the release authority (depending on Australia Post and how the weekend falls),

- the release authority will often be sent to the tax agent, who will then need to mail/email the release to the trustee of the fund, and

- the trustee is then required to complete the form, release the money and return the authority to the ATO.

This is the case where the taxpayer has an SMSF in terms of the taxpayer as the trustee of the SMSF being involved in the release of the money. For public offer fund members, the release would be sent directly to the fund.

Figure 1

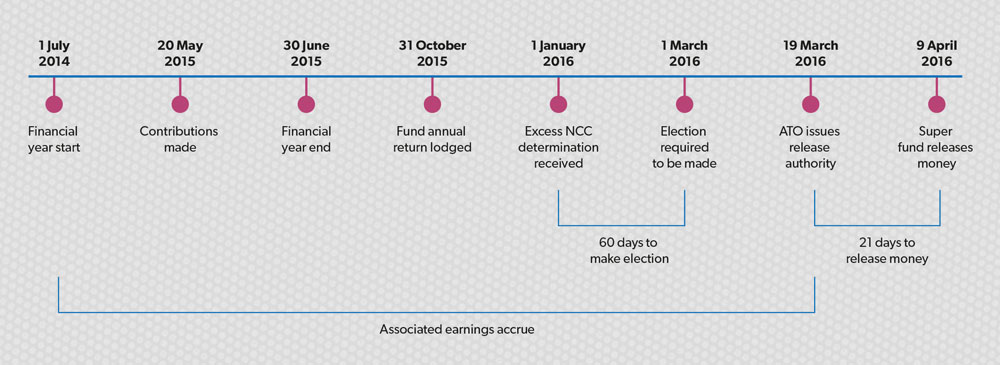

Figure 2

Non-concessional contributions

In the 2014/15 federal budget, the government expanded the refund of excess contributions to excess NCCs. Although royal assent occurred on 19 March 2015, the legislation has applied from 1 July 2013. It stipulates:

- where an individual exceeds their NCC cap, they are able to elect to receive a refund of the amount of the excess, plus 85 per cent of the associated earnings (AE) on that excess,

- the sum of these amounts is the total release amount,

- AE are included in the individual’s assessable income, to be taxed at their marginal tax rate, less a non-refundable 15 per cent offset,

an individual can elect to release the total release amount, or not release anything. There is no mechanism for a proportionate release to be chosen by the member or for the AE to remain in the fund,

- where an election is not made:

- AE does not apply, and

- the excess NCC remains subject to excess NCC tax (currently 49 per cent).

The AE component is a disincentive to making excess NCCs as:

- it is designed to factor in any timing benefits that could be obtained as it is the deemed earnings on the excess contribution amount,

- it is calculated from the first day of the financial year in which the excess NCC is made and ends on the date the excess NCC determination is issued,

- the rate applied is equal to the lesser of the general interest charge rate and a rate that may be determined by legislative instrument or the relevant minister.

Similar to CCs, once the ATO has determined a taxpayer has exceeded their NCC cap, they will first issue an excess NCC determination directly to the individual. The determination provides the individual with the following options:

- pay the excess NCC tax, with this being released by the fund,

- elect to release the total release amount from superannuation, or

- advise the ATO that the individual has no money in superannuation.

The ability to make an election to release excess NCCs is contained in schedule 1, section 96-7 of the TAA. Where the taxpayer would like to release the money from superannuation, the approved excess NCC election form is required to be completed and lodged with the ATO within 60 days of receiving the determination.

Once an election has been made, the ATO will issue a release authority to the chosen fund. The fund has 21 days after the release authority is issued to release the amount to the member and return the release authority to the ATO. Where the superannuation fund does not release the money to the member and does not return the release authority to the ATO within 21 days, administrative penalties may apply.

Diagrammatically the process operates as in Figure 2. If an election is not provided within the prescribed time frame, the individual will be issued with an excess NCC tax assessment, with the excess NCC tax to be paid by the fund.

Implications: release of excess prior to release authority

There are strict rules when accessing superannuation and a member can only receive a benefit (including an amount released in relation to excess contributions) when a condition of release has been satisfied. Schedule 1 of the SIS Regulations (SISR) provides for the conditions of release when accessing superannuation. Among the more common conditions of release outlined in schedule 1 of the SISR are turning 65 or attaining preservation age, and other specific conditions of release in relation to release authorities. A valid release authority satisfies a condition of release and authorises a superannuation fund to release the money to either the ATO or the member.

There may be situations where the client, accountant or adviser are aware a member has exceeded their contribution cap in a given year. At the time the excess contribution is detected, there is no mechanism in place to request the fund to release the excess (unless the contribution falls within the provisions of SISR 7.04(3)). It can only be released on the receipt of the release authority from the tax commissioner. Accordingly:

- Associated earnings cannot be mitigated by refunding the excess as soon as detected,

- The refund of the excess before the release authority would be classified as a payment out of super and therefore subject to the payment standards. If the individual has not met a relevant condition of release, they may breach the payment standards and there will be additional implications for the member and the fund, and

- If a condition of release with a nil cashing restriction has been met and amounts are refunded prior to the release authority, there is no credit provided towards the amounts that must be released as part of the excess determination to ensure that excess NCC tax is not payable.

- The above would also apply in the situation where an individual has received the determination and made an election, however, the release authority has not been issued prior to the money being released from superannuation.

Conclusion

The provisions that allow excess contributions to be refunded from super are incredibly beneficial for many members who inadvertently exceed the caps, particularly if that jeopardises their other contribution strategies or the excess tax rate is greater than their marginal tax rate. However, it is imperative that we as advisers are aware of the above to ensure we obtain the most appropriate outcome for clients and where a refund is desired, it is actually implemented.