Fraught with danger, beckoning with hope, micro-caps can offer rich rewards, but are not for the faint-hearted, writes Boyd Peters.

When listed investment company (LIC) Contango MicroCap listed on the Australian Securities Exchange (ASX) in 2004, the micro-cap sector was in such a state of infancy it didn’t even have a name. Almost 10 years later, the sector is more widely recognised, but still a misunderstood part of asset allocation.

Micro-cap stocks can be loosely categorised as those outside the ASX 300 and are generally a no-go zone for most fund managers. Essentially, this is because even a modest allocation by the multi-billion-dollar super funds would represent a significant ownership of many companies within the sector.

Diversification, opportunity, performance and freedom

To their own detriment, many investors refuse to look further afield than the largest 100 stocks on the ASX and so miss out on some good investment opportunities. Reasons for this myopia include elements of both pride and prejudice. Pride in that some investors choose not to lower themselves by investing in smaller often unproven companies, and prejudice in possessing a narrow-mindedness as to the benefits micro-cap companies can provide.

Notwithstanding this, the greater bulk of investors recognise that including micro-cap companies within their portfolios can offer them diversification, opportunity, performance and freedom.

Diversification

There are about 1900 companies listed on the ASX. However, most large-cap fund managers hold the same 50 to 60 stocks, which represent the bulk of the overall market capitalisation of the ASX.

Incorporating a small and micro-cap allocation reduces the blue-chip risk factor of being overexposed to ASX 100 companies.

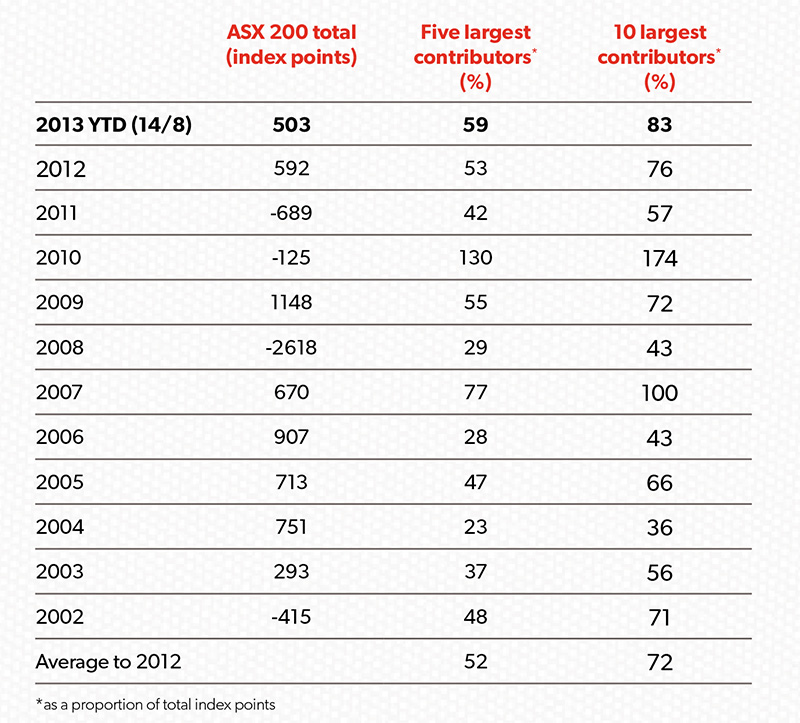

Table 1 identifies just how skewed the large-cap part of the market can be by showing how the contribution of top stocks to the overall S&P/ASX 200 points has moved each year since 2002. Opportunity comes in having a greater chance to identify underpriced bargains. Those specialising in their own stock research can find these growing companies and invest in them.

There is little research available on micro-cap companies because most fund managers will not invest in them as they are outside of their investable universe. Even if they can invest in them, there often isn’t enough volume for them to buy the amounts they want.

Broking houses and institutions don’t have the resources to cover these companies either. For these structural reasons many small-cap bargains go wholly unnoticed by the professionals.

Compared to large-cap stocks, which are covered by hundreds of analysts, these shares can be more heavily oversold and undervalued than their larger counterparts. If it’s a good company, chances are strong it will eventually be noticed.

In relation to performance, small and micro-cap companies can offer some of the best opportunities.

It’s not just that they are often the fastest-growing companies on the share market, but also that increases in revenue often have great impact on profit for them. Big returns generally can’t be found investing in companies already at the top of their industries.

Late, but still early

The stock market is constantly offering the chance to buy stocks at a low price. If you do the research you can be well positioned to enjoy good rewards.

Essentially, your objective is to get into a growing company late enough to be convinced it will succeed, but early enough to capture most of the growth.

Another little recognised point is small companies can give you a freedom no other investment offers. A smart small-cap stock investor is not constrained by bull or bear markets and good companies can go up regardless of global or domestic sentiment.

Never take your eyes off the prize

Naturally, with the potential for high rewards comes risk, and small-cap stocks can be a risky investment. No investment is foolproof, and the smaller the company, the larger price sensitivity and volatility usually are.

Be it a new drug, a great supply chain, game-changing technology, a goldmine worth billions or just a great idea, in all of these scenarios things can and do go wrong and most often unexpectedly.

Compared to household name companies, these micro-cap companies can be unproven enterprises. If you just want blue-chip dividend payers or an investment that offers a smoother ride, micro-caps might not be suitable.

Allocating to micro-caps

As many factors affect their share price, most investors only invest a modest part of their overall portfolio in the micro-cap sector.

For individual investors, particularly those with SMSFs, allocating 5 per cent to 15 per cent of their Australian equities exposure to micro-cap companies would not be unreasonable.

For those considering micro-caps, there are ways to reduce some of the risks of investing in them.

One way is by appointing an investment manager, who can provide you with a diversified portfolio of companies, hence minimising the risk of one or two poorly performing stocks wrecking a portfolio.

Table 1

The value of an investment manager

As well as fund managers, a LIC is a portfolio of companies managed by a professional fund manager that trades equities including micro-caps on a stock exchange.

Typically there are three ways investors can acquire micro-caps for their portfolios. They are to buy shares directly, invest in a managed fund (unit trust) or invest in an LIC.

There are pros and cons to each method. For instance, if a unit trust receives a rush of redemption requests, it has to sell what can sometimes be illiquid investments to the detriment of remaining unitholders. Consider the impact of redemption-forced selling in a falling market.

In an LIC, as shareholders sell their shares to other investors, the manager does not have to sell any of the underlying holdings. The downside here is that LICs can trade at a discount to their net tangible asset value (NTA), while unit trusts are always priced at their net asset value. Of course, a discount to NTA can also present an opportunity to investors who can buy $1 worth of shares for say $0.95c.

Going direct and building a portfolio of 20 to 30 stocks is low cost and tax effective, but it is difficult to undertake the research and time intensive. There is no question self-directed investing can work, as many investors would attest. Provided one has sufficient time, proper resources and of course the inclination, not to mention skill, you usually can create a good portfolio that aside from market effects should be robust enough to withstand shocks to one or two of the holdings within.

The reality is, however, that only a very small number of investors can do this for a long enough time to be successful, not to mention sleep comfortably at night. It’s no surprise these portfolio managers have teams of five to 10 people focusing on these companies full-time.

After all is considered, there is no best way or one-size-fits-all way to manage your micro-cap exposure. It may be worth contemplating creating a hybrid of these options, investing in an LIC, a unit trust and also your own portfolio of micro-cap companies.

The theme for 2013

This year has thus far been a continuation of the past few years, where the slowdown of the China story has impacted on market returns. Resource companies, especially smaller ones, have delivered negative returns, while small industrials have performed quite well.

The impact of the small industrials performance has been to drag down the performance of the headline Small and Microcap Companies Index returns, making the sectors appear less attractive.

The key point to understand is that one must look at the performance and valuations of sectors and stocks to identify potential opportunities. Micro-cap investing is not like the ASX 100 where you can just buy the 10 largest stocks and hope for an index-like return.

Outlook

Investment managers are always asked is now the time to invest in smaller companies. Generally the stock reply is about diversification, opportunity and performance rather than making specific predictions.

However, it is fair to say recent doomsday scenarios did not materialise and investors are recognising the fundamentals in the Australian economy are quite compelling.

On possibly the most simplistic basis – price and earnings (P/E) – we can see that both small and large stocks appear to offer particularly good value. Traditional Indicators beyond P/E such as earnings per share and dividend yield also suggest upside to the market, while recent increases in share prices and market turnover in the September quarter indicate investors are returning to the market, which overall is looking attractive once again.

Again, if one were to remove the impact of those small resource companies with no earnings growth, the small ordinaries valuations could appear even more compelling.

2014 and beyond

Astute investors who prudently allocate to micro-cap companies may be well positioned to capture the growth in quality companies as they progress from micro to small to large, and enjoy an exciting journey along the way.

Boyd Peters is principal of Investment Company Services.