Investing in property is often a decision involving too much emotion. Peter Esho details a 26-step process that can help change this predicament.

Plenty of advisers are keen to receive an update on the position of the domestic property market as it is such a popular asset class among SMSF members. However, there is no point in monitoring the market, reading facts and figures unless you know exactly what you’re looking for.

Imagine watching a game of cricket without knowing the rules, the players, the teams, the competition they are playing in or the length of the match. Take all that away and you’re left with a bunch of men dressed in white standing on a large oval. Talking about the property market, without knowing what to look for, is pretty much the same.

Every single asset in the world is valued on the expected income it will generate. Stocks, funds, bonds and property are all based on expected earnings. When it comes to the stock market, I see a lot of sophistication in the way investors go about their selections: complex models, research reports, formulas and no shortage of academics. Same with bonds. It’s even worse when it comes to managed funds. We have thousands of self-proclaimed ‘professional’ fund managers.

But when it comes to property, that sophistication breaks down. Investors tend to get emotional. People start to talk about ‘crashes’ and all sorts of other silly things. RP Data estimates the total value of residential real estate in Australia is somewhere near $6 trillion. Yes, trillion. That compares with around $2 trillion in the total pool of superannuation funds and somewhere in the order of $1.5 trillion when adding up all the stocks on the ASX.

Residential property is four times as valuable as the entire stock market and three times the value of our total superannuation and retirement assets. Yet, emotion still tends to dominate investment decisions about this asset class.

To address the situation, I spent six months applying the methodology, experience and knowledge from my years in the stock market to build a research methodology for property investing.

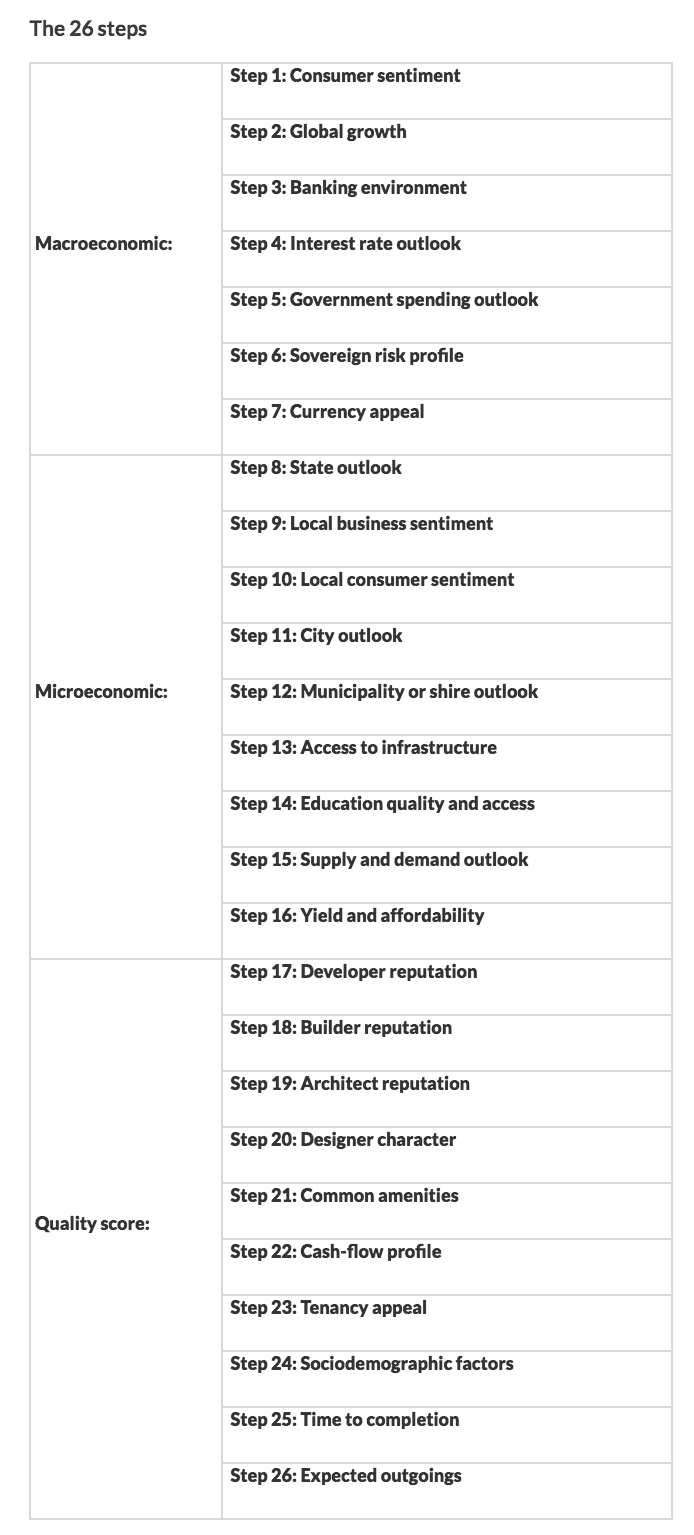

The process involved consulting the big four accounting firms, and having them audit my methodology. The end result is 26 steps I think are essential to use when assessing the merit of an investment property in Australia.

These 26 steps are not an exact science, in the same way a price-to-earnings ratio of a discounted cash-flow model is not a precise science when valuing a stock. But these steps are a starting point, a framework and a process with which we can start taking the emotion out of property investing and stop reading the negative news flow, which is usually written by journalists who have never invested in property themselves.

If you’re a trusted adviser, chances are your clients will ask you for an opinion on property investing. When they do, have these 26 steps in mind. Add any steps you think I have missed and remove the ones you think are not relevant.

Three broad areas

The 26 steps are broken down into three key areas:

- the macroeconomic environment,

- the microeconomic environment, and

- the quality of the asset.

Let’s start with the macroeconomic environment. What happens around the world is important. If central banks in the United States, Japan and Europe decide to pump up the financial system by printing money and easing rates, it will have an impact on all global assets. Whether your investment property is in Goulburn or Glebe, the global economic environment makes a huge difference.

The macroeconomic environment also impacts on interest rates, sovereign risk and other factors. When the Australian dollar devalues, investors from US dollar-dominated economies are going to migrate their capital here. When the currency moves in the opposite direction, our economy will stall. Things will slow down. It’s all interlinked and every single investment decision, be it stocks, funds, cash or property, needs to start with careful consideration to what is happening around the world.

Once we know what’s happening around the world and how that impacts on our country, we then need to drill down and understand the various micro markets. The difference between Perth and Sydney is no accident. One city is flourishing while the other is stuck in reverse. Municipalities and states spend money on infrastructure at different points of the economic cycle. Rail links and freeway road expansions make a huge difference. The government’s balance sheet can be used to benefit individual investors if they look in the right place.

After all the homework on the macroeconomic and microeconomic environment has been completed, we need to look for high-quality assets. This means drilling down to find assets that are being managed by a reputable developer, designed with architectural integrity, built by a well-known builder, have tenancy and with cash-flow appeal. We need to take into consideration amenities – what’s desired in Toorak and Double Bay is different to what is appropriate in Penrith or Parramatta.

Common sense

The 26-step research process is not rocket science. It doesn’t need complex mathematics or expensive subscriptions. You can use free tools to grade each step and form a basis for decision-making. The best investors I know have one thing in common – they keep things simple. But they also have a framework and a system in place. They don’t invest on emotion, instead focusing on facts.

Most people purchase a home before moving on to a property investment. But there is a big difference between purchasing a home and purchasing an investment. Unfortunately, after making the choice to purchase a home, most people don’t take their emotional hat off and put their investment hat on. They blur the lines.

Where you live is not purely economic; there are factors to consider, such as lifestyle, proximity to family and the like. When it comes to investing, these factors should take a back seat to depreciation, after-tax returns and debt strategy.

Every single project that comes through our office is put through this criteria. We give each a score out of five, which means a project gets graded on a total of 130 points. For us to recommend it to our clients, we need a score of at least 104 or greater (80 per cent).

We might view a certain cash-flow scenario as attractive, while somebody else views it as unacceptable. That’s fine because this is not an exact science. It is merely a framework to start assessing investment property on merit, based on facts and substantiated opinions, as opposed to a glossy brochure, a promise from an agent or newspaper scaremongering.

Peter Esho is founder of Esho Property Group.