Chris Smith says advisers should not allow SMSF investors to ignore healthcare property for generating yield and providing better portfolio diversification.

As interest rates have come off and term deposits mature, many SMSF trustees have moved from cash to equities as they search for sustainable sources of yield for income. Others still have turned to property, be it residential or commercial.

This current move from cash to equities, brought about by falling interest rates, shouldn’t mean investors bypass other asset classes that provide growth and income as well as valuable diversification benefits. A better rebalancing for consideration would be to include a selection of property sectors as well as equities, for both growth and defensive reasons.

When looking for investment options to create income streams in retirement, SMSF trustees should not overlook healthcare property. It is well positioned to deliver solid income and capital stability and is a proven performer regardless of economic conditions.

Healthcare property – a proven outperformer

Healthcare property has been a standout property performer for some time, with healthcare asset returns proving their resilience over both short and long-term time periods. For example, the healthcare property sector posted an 11 per cent annualised total return for the year ending December 2013, according to the latest PCA/IPD index—outperforming all other property sectors.

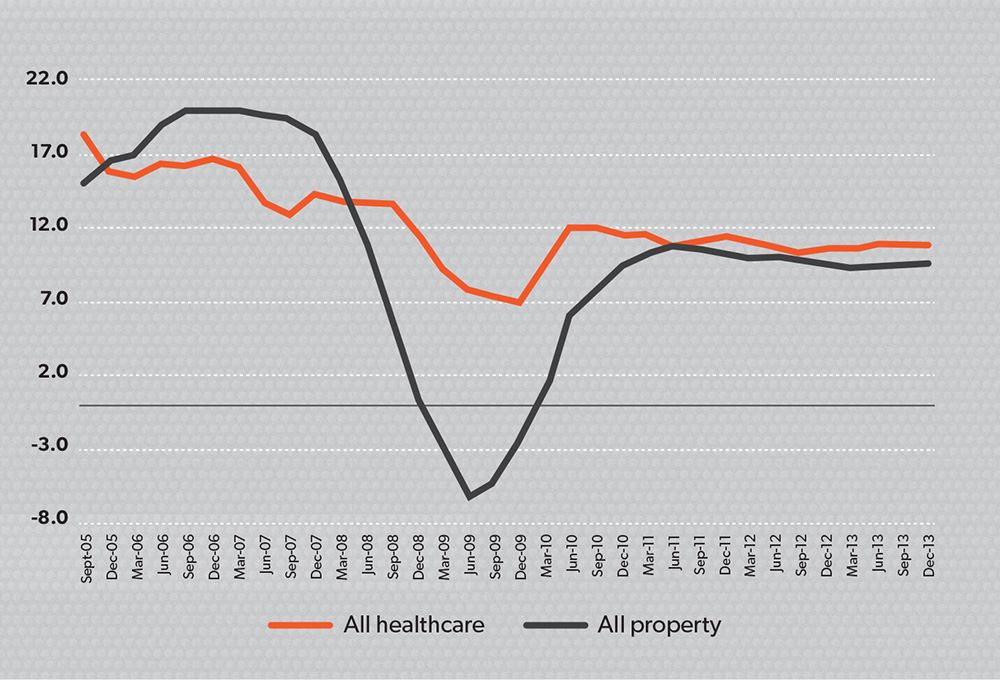

As Figure 1 shows, the healthcare property sector has also outperformed all other property, be it retail, office or industrial, on a one, three and five-year basis.

Figure 1: Healthcare property versus other property sectors (total return rolling per cent per anum – 1 September 2005 – 31 December 2013)

Source: IPD Research, December 2013

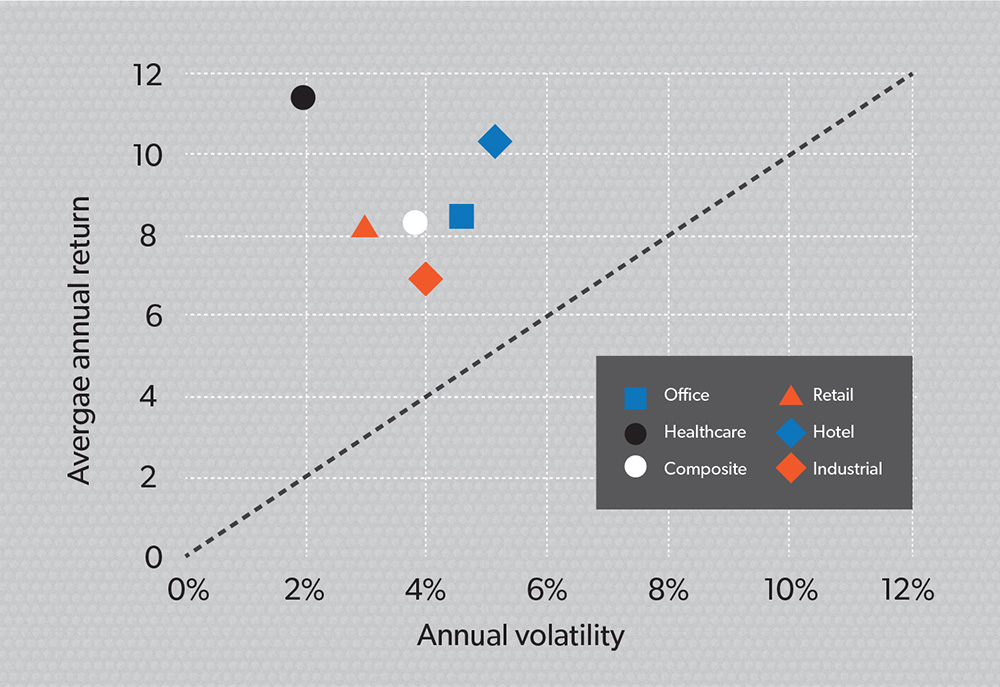

Furthermore, this outperformance has not come with increased volatility, as shown in Figure 2. Healthcare property outperforms in risk-adjusted returns as well, and also has the lowest correlation with other property sectors, making it a desirable addition to a diversified property portfolio.

Figure 2: Australian property risk-reward trade-off (quarterly observations from 1 July 2006-30 June 2013)

Source: IPD Research, June 2013

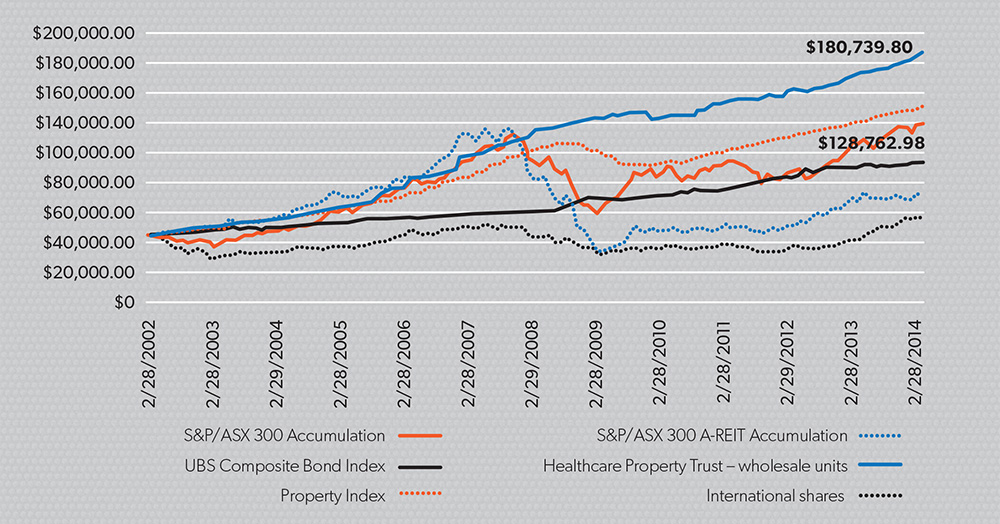

The performance of healthcare property (which in Figure 3 is evidenced by the Australian Unity Healthcare Property Trust), compared to other non-property asset classes, is also impressive.

Figure 3: Performance of the Australian Unity Healthcare Property Trust (Wholesale Units) compared to the non-property asset classes (February 2002-31 March 2014)

Source: Australian Unity Investments, Bloomberg, April 2014. Australian shares (S&P/ASX 300 Accumulation Index), listed property (S&P/ASX 300 A-REIT Accumulation), fixed interest (UBS Composite Bond Index), Direct property index (PCA/IPD Pooled Property Fund Index – Unlisted Retail), international shares (MSCI All Countries ex Australia in A$ Net Unhedged Return Net Dividends Re-invested).

Returns for the trust are calculated after fees and expenses and assume the reinvestment of distributions. Inception date for the trust is 28 February 2002.

This figure shows that a $50,000 investment in the Healthcare Property Trust (Wholesale Units) on 28 February 2002 grew to $180,739.80 at 31 March 2014, significantly outperforming a $50,000 investment in Australian shares, as measured by the S&P/ASX 300 Accumulation Index, which increased to $128,762.98 over the same period.

Outlook for healthcare property – supported by a growing and ageing population

The outlook for healthcare investment in Australia is bright. According to the federal government’s Productivity Commission report in November 2013: “Australia’s population will both grow strongly and become older.”

he same report says Australia’s population is projected to rise to around 38 million by 2060, or around 15 million more than the population in 2012. Importantly, as the population steadily ages, there will be increasing demands for more and improved healthcare services.

It’s hard to think of a higher priority than health and as a result people will continue to spend a larger portion of their income to ensure access to the best healthcare services they can afford.

Medical advances also mean people are living longer. For instance, at one time people didn’t survive a heart attack or only had one hip replacement during their lifetime. Now they survive a heart attack or have multiple hip replacements, and may need ongoing monitoring, post-operative rehabilitation, care and treatment for many years.

The private health sector continues to play an increasingly important role in the provision of services traditionally provided by the public system. Australian Institute of Health and Welfare (AIHW) hospital statistics show the sector currently provides one out of every three beds, conducts two out three elective surgeries, and manages 45 per cent of chemotherapy treatments and 47 per cent of heart surgeries.

In addition, governments of both persuasions continue to support policy to encourage the take-up of private health insurance. According to the AIHW report, 47 per cent of the Australian population has hospital insurance and 54 per cent has some form of ancillary (extras) insurance.

As it becomes more difficult (and more expensive) for governments to fund growing healthcare needs, an increasing number of Australians will turn to the private sector to meet their health and medical needs.

Growing infrastructure investment

In recent years much attention has been paid to the inability of the health system to cope with demand, as well as successive governments’ under-investment in hospital infrastructure. As a result there has been a burst of activity to build or rebuild medical infrastructure to meet the growing demand for healthcare services provided in hospitals and medical centres. Most of these tend to operate at capacity as soon as they are built.

Interestingly, state governments are continuing to look at ways to raise cash for future infrastructure without increasing debt. For example, the New South Wales government recently called on the private sector to assist it to plan, build and run the new Sydney northern beaches hospital development, with infrastructure costs for the new hospital provided by the private sector enabling the new hospital to be delivered faster and at a reduced cost to the taxpayer.

Consequently, as demand for private hospitals and medical centres increases, this will likely drive up the value of quality healthcare properties as a result of stable rental income and firming yields.

Understanding the performance drivers of healthcare property

A number of factors support the continued growth of the healthcare property sector.

The sector typically enjoys longer lease terms with its tenants compared to other property sectors. For example, hospitals typically have lease periods of 15 to 20 years, providing certainty of income and capital value stability. In addition, healthcare real estate remained almost fully occupied during the global financial crisis, while vacancy rates in other property sectors increased.

Tenants in the healthcare sector tend to be financially strong. The major operators in the sector comprise large, long-established, listed companies, such as Ramsay Health, and not-for-profits, such as Epworth, Cabrini, St Vincent’s, Calvary, Mater and Uniting Care. These long-established and trusted operators are positioned to continue to benefit from the shift in Australia’s demographics and the population’s growing demand for healthcare services.

Private health funds contribute significantly to client health bills, which supports demand even when employment and economic conditions deteriorate.

Investment in the facilities that provide the health services in demand ensures healthcare property is a growth area, and will remain so. It is also a sound defensive investment, worthy of a place in any diversified property portfolio.

Conclusion

The need for healthcare services is non-discretionary, with demand set to increase as the population ages. Healthcare property has proven its resilience over time and remains well positioned to capitalise on Australia’s growing healthcare needs.

At Australian Unity Real Estate Investment, we are continually seeing opportunities to further invest in developing our existing healthcare property assets. The pace and frequency of these developments have picked up substantially over the past few years, and we expect more expansions in the future will play an increasingly important role in the delivery of community healthcare services.

For investors, the opportunities are significant. Interest continues to be strong in healthcare investments from both on and offshore real estate investment trusts and institutional funds, which is a good indicator of the positive outlook for the sector.

With SMSF trustees looking for steady and consistent income streams as higher term deposit rates roll off, healthcare property is increasingly worthy of consideration in a diversified investment portfolio.