There is widespread belief certain death benefits have to be exited from the superannuation system under the new legislation to take effect from 1 July. Jemma Sanderson writes this may not be the case.

There is a potential irregularity in the Superannuation Industry (Supervision) (SIS) Regulations 1994that could result in our estate planning strategies not being entirely thwarted by the new Fair and Sustainable superannuation provisions.

To frame some context, let’s go back to the beginning.

Under SIS Regulation 6.21(2), when a member dies there are two options available to deal with their benefit:

Commence one or more income streams where the beneficiary is eligible to do so (spouse, child under 18/25);

- Take out a lump sum payment (this can be either a single lump sum or an interim and then final lump sum).

- The above need to be attended to as soon as is practicably possible.

There is no opportunity under the regulations for the surviving spouse to roll over the deceased’s member account directly to the accumulation phase of superannuation for the spouse.

Therefore, under the current rules (that is pre-30 June 2017), and as we have done for many years, where a member of a couple passes away generally the surviving spouse receives a new pension from the deceased member’s account, or they are already the reversionary beneficiary of that account. Ultimately the assets remain within the superannuation environment in a tax-effective manner in the pension phase. Where the spouse required funds outside superannuation, they could take out a payment from the deceased member’s pension account or their own pension account, for instance.

This is regardless of the member account balances.

From 1 July 2017, the above will change, as the commencement of a pension from the deceased member’s account by the spouse, or the receipt of a reversionary pension, will be assessed towards the surviving spouse’s transfer balance cap (TBC):

- Where the pension is reversionary, the spouse has 12 months to deal with it before it counts towards their TBC;

- Where the pension is not reversionary, the benefits must be dealt with as soon as is practicably possible under both the SIS Act and the Income Tax Assessment Act (ITAA) to ensure the pension exemption continues to apply to the benefit after death until it is dealt with;

- Where the deceased was in accumulation phase, the commencement of a new pension for the spouse will be assessed towards the spouse’s TBC also at that time.

In order to retain as many benefits as possible within superannuation, the strategy is therefore to:

- Roll back the spouse’s own pension account to accumulation phase; and

- Subsequently when the deceased’s pension reverts or commences for them and that is assessed towards their TBC, they will not have an excess TBC at that time.

This will depend upon the survivor’s TBC position.

For example:

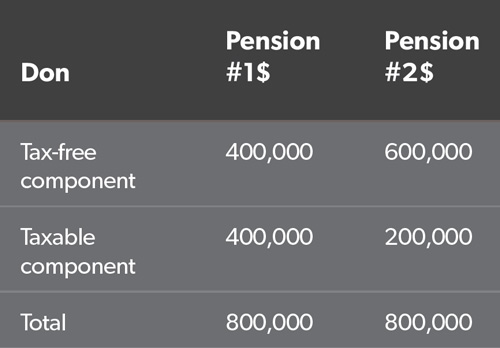

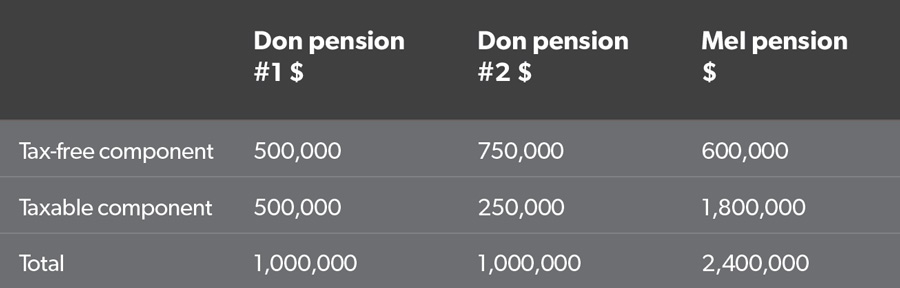

As at 30 June 2017, Don restructured his pensions such that he had $1.6 million in retirement phase, as in Table 1.

Table 1

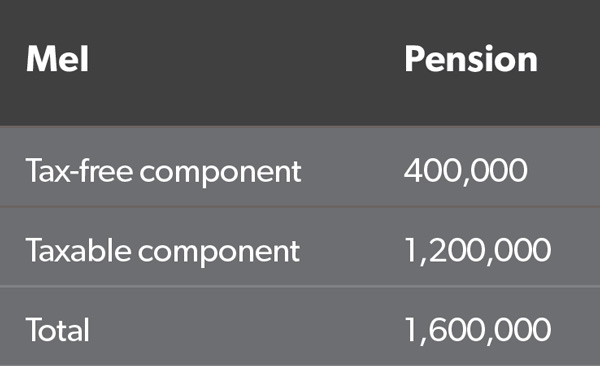

Don’s wife Mel commenced her own retirement-phase pension on 1 July 2018, as in Table 2.

Table 2

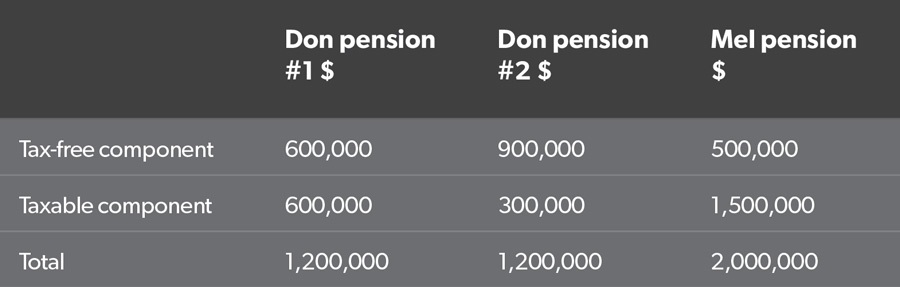

As at 30 June 2023, Don and Mel’s pension benefits are as in Table 3.

Table 3

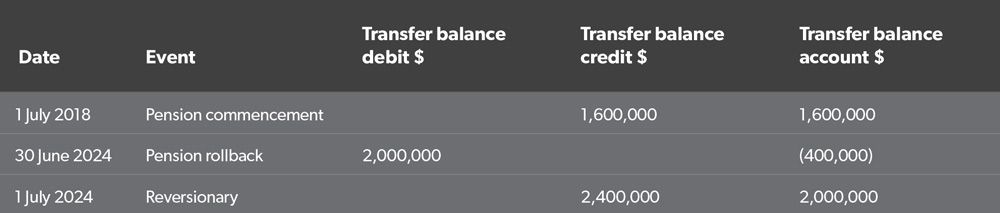

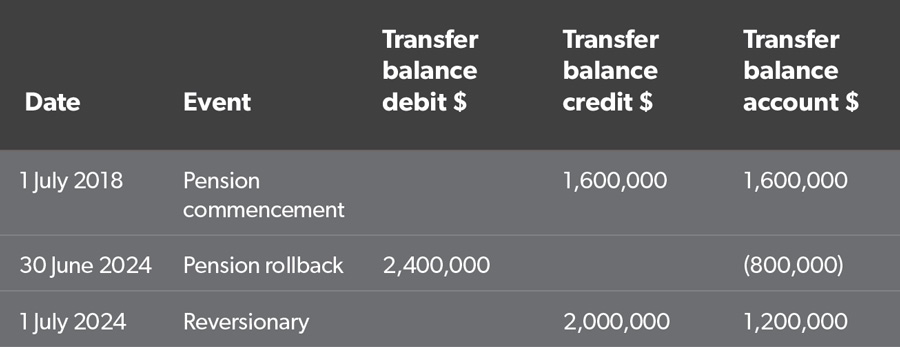

Don dies and his pensions were set up to revert to Mel. Mel has 12 months to deal with them, and in the process of doing so, she commutes her own pension, rolling it back to the accumulation phase. Her transfer balance account would therefore be as in Table 4.

Table 4

With the rollback or commutation of her own pension account, Mel would be able to receive up to $2 million of Don’s pensions without having an excess TBC. Therefore, of the $2.4 million in his accounts, she would generally have to receive $400,000 as a lump sum death benefit to remain within her own TBC.

What if Don and Mel’s accounts were as in Table 5 at 30 June 2023?

Table 5

Don dies and his pensions revert to Mel. She has 12 months to deal with them, and in the process of doing so, she commutes her own pension, rolling $2.4 million back to the accumulation phase. Her transfer balance account would therefore be as in Table 6.

Table 6

Mel would still have $400,000 of her TBC available, whether she retains $400,000 in her pension account and only rolls back $2 million, or she commences a new pension.

Thus, Mel’s TBC position is important, not Don’s.

Accumulation accounts at death

Following on from the above, where the deceased has accumulation accounts as they had already fully used their TBC, under the new rules the expectation would be that those accumulation accounts would be paid out of the fund as a death benefit lump sum. This is on the basis that a survivor only has two options to deal with the benefit:

- Receiving a new pension – if they are already receiving the deceased’s pension benefits up to their TBC, then they wouldn’t be able to commence a new pension with the accumulation benefits without having an excess TBC;

- Receiving a lump-sum.

However, what if:

- The survivor deals with the deceased’s benefits by starting a new pension;

- They receive regular pension payments, so a pension is in place with respect to those benefits;

- Pursuant to their fund trust deed, the commencement of the pension results in them having a member account within the fund with respect to that new pension;

- They may well be in excess of their TBC, but they resolve that by rolling back their new pension account in their own name back to accumulation;

- The amount is then retained in accumulation in their own name.

Would that satisfy our prime objective of retaining as many assets as possible in superannuation? What are the TBC implications?

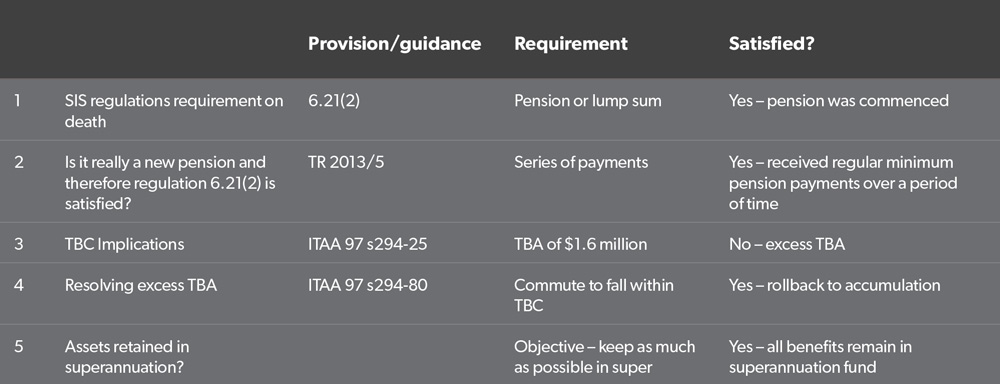

Let’s break it down (see Table 7):

Table 7

Based on the above, the survivor would satisfy all the requirements, and therefore the benefit could remain in the accumulation phase in their own name. The obvious downside of this scenario is the fact the survivor/beneficiary will have an excess TBC for a period of time, which will have some tax consequences, as well as administration considerations.

In this regard, it is important to note there is no provision in the regulations that has a time frame around how long a recipient must receive a death benefit pension before the account becomes their own superannuation benefit. Or alternatively, where a pension that resulted from a deceased member is ceased, if that occurs within a time frame is that benefit still a death benefit or not? There used to be a tax provision in place (repealed as part of the new rules), however, that related to the tax treatment of a lump sum payment from a deceased account after a particular time period, not whether a pension account transferred to the beneficiary or not.

So, we have an anomaly here, whereby in theory the commencement of a new pension by a beneficiary, with a series of at least minimum payments made, and the subsequent rollback of the account to the beneficiary’s own accumulation will effectively enable all of a couple’s superannuation assets to remain within the superannuation environment beyond the passing of one of them.

Existing death benefit pensions – restructuring under TBC

The above is also relevant in the current financial year, where the question is often asked: if Don dies now and Mel receives a reversionary pension, or Mel has been in receipt of a reversionary/new pension as a result of Don’s death for some time, can she roll back an amount from this pension to accumulation to satisfy the new TBC requirements as at 1 July 2017?

The answer is yes – that pension becomes Mel’s, and at present there are no TBC implications. When Mel restructures in accordance with the TBC provisions at 30 June 2017, then that pension account would be hers at the time, where she is able to roll back to accumulation phase.

It is expected this position will be clarified by the government and/or the ATO in the short term to provide certainty.