Longevity risk is something all superannuants face, but the new pension rules invoked from 1 July 2017 have offered up a new solution to this problem, Michael Hallinan reports.

The issue of longevity risk and account-based pensions has been the subject of much discussion. Essentially, longevity risk is simply the risk that the member will outlive their pension balance. This may happen due to poor investment performance, the suffering of significant capital losses when the pension has just commenced or subjecting the pension to an excessive drawdown rate. However, it should not be overlooked that account-based pensions are intended to suffer from longevity risk and this intention is achieved by the age-increasing minimum drawdown rate.

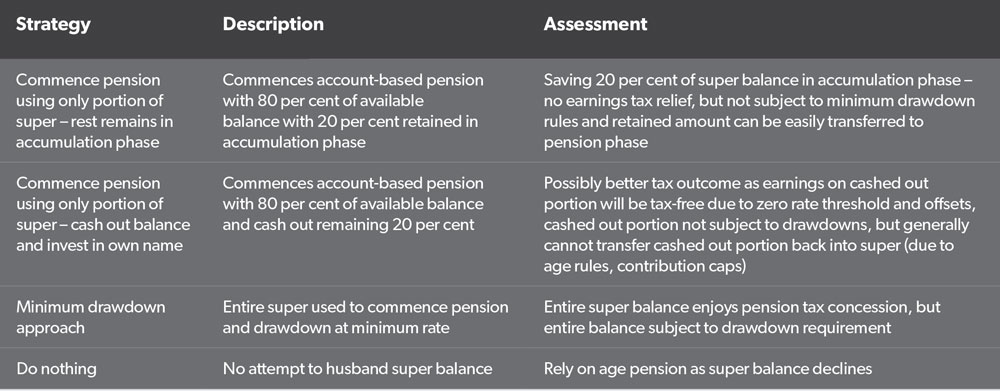

Currently taxpayers have a number of responses to longevity risk, summarised in Table 1.

With the introduction of the new pooled super income rules, another strategy could be employed in the management of longevity risk. The new strategy involves purchasing a deferred superannuation income stream using a portion of the pension balance. The example below will illustrate the impact a deferred superannuation income stream could have on managing longevity risk.

How can an SMSF issue a lifetime pension?

Since May 2004 (subject to certain limited grandfathering provisions), SMSFs have been precluded from issuing defined benefit pensions. As the deferred superannuation income stream is payable for life, it is certainly a defined benefit pension. SMSFs are permitted to pay defined benefit pensions if the pension is entirely supported by an annuity policy issued by a life company or other registered organisations. In this case, the deferred superannuation income stream is expressly excluded by Superannuation Industry Supervision (SIS) Regulation 9.04E(a) from counting as a defined benefit pension.

What is a deferred annuity?

A deferred annuity is simply a life insurance contract where the purchaser (in this case the trustee of the SMSF) pays a single lump sum amount to the life company and the life company agrees to pay an income stream to the trustee, which commences after the end of an initial period (the deferral period). The deferral period must be at least 12 months and could be much longer – such as 15 years or more.

What are the tax consequences of buying the deferred annuity in respect of Bertie?

In the case of Bertie, the $400,000 will be considered to be in retirement phase even though no pension payments are made in respect of the 15-year deferral period. Consequently, a transfer balance credit will arise for Bertie of $400,000 when the annuity is purchased/pension is issued. The issuer of the annuity will treat the life contract as being on the retirement-phase side of its business and will be entitled to claim the pension earnings exemption.

Will pension payments have to be made during the deferral period?

In short, no. The income stream is not subject to any minimum payment requirements in the deferral period. Bertie will not be able to make any drawdowns during the deferral period unless the income stream is terminated. What happens when the deferral period ends and Bertie starts receiving pension payments?

Once the deferral period has expired, the pension payments will commence at the rate specified by the contract. Pension payments will be tax-free.

Pension payments will continue for the remainder of Bertie’s life.

Importantly, there is no transfer balance account credit arising on the expiration of the deferral period, so the increase in the assets supporting the pension are not taken into account for transfer balance purposes.

Can Bertie adjust the income stream payments once they commence?

Deferred superannuation income streams do not have the same flexibility as account-based pensions. Consequently, the pension amount and any indexation arrangements (whether indexed and if so, by reference to what fixed rate or the consumer price index) are determined at the time the income stream is issued.

What happens if Bertie dies and the income stream is not reversionary?

This depends on whether Bertie dies during the first half of his life expectancy, during the second half of his life expectancy or later.In Bertie’s case as he was in retirement phase at the time the deferred superannuation income stream was issued, his life expectancy will be determined as at the issue date of the income stream. For ease of illustration we will assume he had a life expectancy period of 20 years (the actual period is measured in days and is based upon the life tables and rounded down to the next whole number).

If Bertie dies within the first half of the life expectancy period, that is, he dies within, on or before age 75, the maximum amount that can be paid on commutation of the income stream (death constitutes a pension commutation for this purpose) is 100 per cent of the purchase price of the annuity. In Bertie’s case, this will be $400,000. This amount will be a superannuation death benefit and taxed accordingly. The tax components of the death benefit are determined at the time of issue of the income stream.

If Bertie dies within the second half of his life expectancy period, that is, he dies after age 75 but on or before age 85, then the amount payable on death will be related to the remaining portion of the life expectancy. In this case, the remaining portion is 25 per cent of the life expectancy period. Consequently, 25 per cent of the purchase price will be paid, namely $100,000, which will be taxed as a superannuation death benefit.

If Bertie were to die on or after age 85, then no superannuation death benefit is paid as the remaining portion is now zero.

What happens if Bertie dies and the income stream is reversionary?

In this case, the income stream will transfer to the nominated reversionary beneficiary and continue to be payable to the nominated reversionary beneficiary until they die.If the nominated reversionary beneficiary predeceased Bertie, then the position will be the same as if the income stream was not reversionary.

If the nominated reversionary beneficiary survived Bertie, but was then not in retirement phase, the pension cannot transfer to the nominated reversionary beneficiary and the position will be the same as if the income stream was not reversionary. Like transition-to-retirement pensions, the deferred superannuation income stream can only transfer to a beneficiary who is in retirement phase at the date of transfer.

If the deferred superannuation income stream does transfer to the reversionary beneficiary, the life expectancy period is not reassessed: Bertie’s life expectancy period would continue to apply to determine the commutation value of the income stream.

What happens if Bertie wishes to terminate the deferred income stream?

The maximum amount that can be paid on the commutation of the pension is a straight-line reduction in the purchase price from the start of the life expectancy period to the end of the life expectancy period.In Bertie’s case as the life expectancy period is 20 years, the maximum amount will be 100 per cent (if terminated within the first 14 days of issue – the free look period) to zero if terminated on Bertie’s 85th birthday.

If the pension is terminated, say, five years into the life expectancy period (terminated at age 70), then the commutation amount will be $300,000 (being 75 per cent of the purchase price). If the pension is terminated at 18 years into the life expectancy period (terminated at age 83), then the commutation amount will be $40,000 (being 10 per cent of the purchase price).

If the pension is commuted on or after the life expectancy period, then the commutation amount is zero.

Can a deferred income stream be made reversionary mid-stream?

The answer would be no. The sex and age of the nominated reversionary beneficiary is critical to the actuarial parameters of a lifetime income stream. For similar considerations, it would not be possible to change the identity of the nominated reversionary beneficiary. These changes could only be made by commuting the deferred income stream and starting another income stream – commuting and restarting the income stream would have the same effect as if Bertie died.

What is the Centrelink treatment of deferred superannuation income streams?

It seems that the Centrelink treatment of deferred income streams is that for asset test purposes, the commutation value of the income stream is assessed as the capital value of the income stream. This value reduces and on the expiration of the life expectancy period is zero. In the case of the income test, the amount counted for income test purposes will be the actual pension amount. During the deferral period, no amount of income will be counted. Once the deferral period ends, the income counted will be based upon the ‘return of capital rules’ (otherwise known as the pre-1 January 2015 rules); that is, gross annual income of the pension less the deduction amount.

Conclusion

The new pension rules that have applied from 1 July 2017 have provided another means of dealing the with longevity risk associated with account-based pensions. While deferred superannuation income streams are lifetime pensions, Bertie will effectively pay for this lifetime guarantee in various ways. One way is the lack of flexibility associated with lifetime pensions as to drawdown terms and reversionary beneficiary status (both are set at the outset and cannot be changed mid-stream). Another cost is the reduction in the commutation amount over the life expectancy of the pension. While the worst impact of early death on the commutation value of the income stream is mitigated (if death occurs in the first half of the life expectancy period), the impact of death during the second half of the life expectancy period is not.Additionally, there is the locked-in factor. Once the income stream has been issued, to change issuers, superannuation funds or to move to a different type of pension will involve a commutation and therefore expose the income stream capital to the straight-line access rule.

Bertie will clearly have to make a very considered decision if he wishes to manage longevity risk of account-based pensions by means of a deferred superannuation income stream.

Example: Bertie

Bertie is currently aged 64 and is in retirement phase. He has a superannuation balance of $1.2 million and is concerned that, given the form of his ancestors, he will most likely live for another 30 years. Longevity risk weighs heavily on his mind.Bertie has already considered the three current strategies (and also the do nothing strategy), but has found them to be defective. The first strategy (retaining a portion in accumulation phase) suffers from the exclusion of the retained portion from the earnings tax exemption. The second strategy (cash out a portion and invest in his own name) exposes Bertie to the temptation of spending too much. The third strategy (minimum drawdown) is unappealing and probably impossible to implement given Bertie’s ability to spend money. The fourth strategy (do nothing, but rely on the age pension when eligible) is not viable for Bertie given his belief the current social security system will collapse from its own internal contractions.

Bertie is therefore receptive to the strategy of having a deferred superannuation income stream.

The deferred income stream strategy is implemented by Bertie applying $800,000 of his superannuation balance to an account-based pension. The balance, being $400,000, is applied as the purchase price of a deferred complying annuity. The trustee of Bertie’s SMSF buys the deferred annuity and issues a deferred superannuation income stream pension to Bertie. The terms of the annuity are that the deferral period is 15 years (commencing payment when Bertie turns 80) and will then be payable for his lifetime.

Bertie is now in the position that he has an account-based pension with an initial pension balance of $800,000 and also has a presently existing right to a lifetime pension, which will commence at the age of 80. The actual dollar amount of the pension that commences at the age of 80 will depend on various factors.