The Financial Adviser Standards and Ethics Authority proposed recognition of existing qualifications with regard to the industry’s new educational standards has caused a lot of concern, especially in the accounting community. Bronny Speed illustrates what the current situation looks like and details some changes the industry is calling for.

As a qualified chartered accountant (CA) and certified financial planner with a Bachelor of Education degree, I have devoted a considerable amount of time in the months since the release of the Financial Adviser Standards and Ethics Authority (FASEA) proposed guidance on education pathways listening to practitioners from many parts of the industry – accounting, financial planning and education.

My findings have been consistent: there is confusion in the marketplace as to what education counts, and for the areas that do count, how they will count.

Market intelligence

What I have learned from our clients, polls, online and phone feedback, presentations, industry liaison groups, other member organisations, educators, regulators, as well as Chartered Accountants Australia and New Zealand (CAANZ) Sharing Knowledge sessions, advice workshops, member newsletters, publications and surveys, and other important stakeholders, is industry sentiment in relation to the proposed reforms is overwhelmingly one of confusion and anxiety.

Professional designations currently not recognised

FASEA’s current stance is that “designations … do not equate to a qualification on their own” and “a professional designation is a valuable component of professional expertise and background” and can be taken into account in certain circumstances if higher education providers feel like it. One wonders how a member of other leading professional associations, such as the Royal Australian College of Surgeons, might feel about their postgraduate study, ongoing professional development and ethical requirements being considered in this way. Probably just the same as the many practitioners who have arduously studied postgraduate courses, completed considerable ongoing professional development and adhered to a strict code of ethics through professional member associations such as CAANZ.

The answer is disappointed, disenfranchised and, in part, insulted.

I was appointed in a consulting capacity to the role of financial advisory senior policy adviser at CAANZ in November last year. This was just prior to the initial release of FASEA’s proposed guidance on existing adviser qualification pathways where it was announced individuals with a degree in accounting-related areas weren’t deemed to hold related degrees for the body’s purposes. Fortunately, FASEA listened to the industry and in its revised guidance, released in March, those with a degree that contains a major/specialisation in any of financial planning/advice/services, accounting, finance, tax, law and economics were deemed to have a related degree.

Further industry feedback consideration needed

To have a related degree is really important as at this stage of the consultation process FASEA has judged the type of degree, as well as the supplier of postgraduate studies, to be of critical significance.

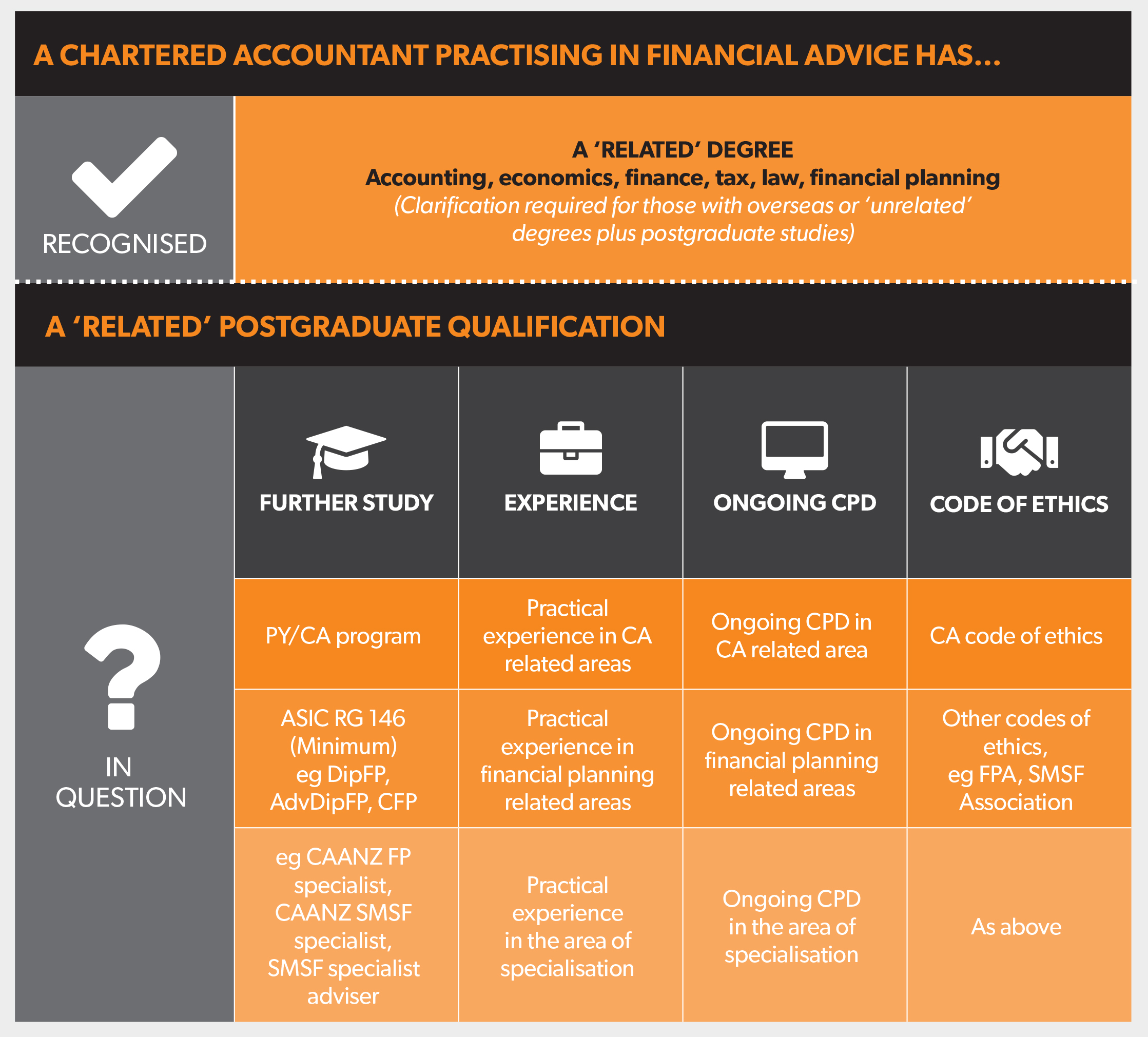

AccountantsIQ has developed the diagram on the next page, which examines the situation of a chartered accountant who provides financial advice. Embedded in the diagram are key issues for these practitioners, as well as the potential impacts of the proposed guidelines.

AccountantsIQ will be making a submission to FASEA on the proposed education standards and I will also be working with CAANZ’s senior policy leaders to develop the accounting body’s submission.

"Industry sentiment in relation to the proposed reforms is overwhelmingly one of confusion and anxiety."

Bonny Speed

Above the diagram’s dotted line

A related degree is one from an Australian education provider with a major or specialisation in financial planning/advice/services, accounting, finance, tax, law or economics

So, will FASEA accept the following as related degrees?

- An overseas degree plus postgraduate studies, or

- an unrelated degree plus postgraduate studies.

Since many courses such as postgraduate diplomas in accounting and Master of Business Administration degrees require(d) an undergraduate degree, one would consider this to be reasonable.

Below the diagram’s dotted line

Under FASEA’s current proposal, an accountant who holds a related degree without related postgraduate studies will be required to complete three university-level subjects in the areas of the Corporations Act, FASEA’s code of ethics and behavioural finance, whereas an accountant who holds a related degree with related postgraduate studies will be required to complete one university-level subject.

The CA program and its recognition at AQF level 8

Since way back in 1972, entrants to the professional year (PY), pre-2000, and CA program, post-2000, have been required to meet the same academic entry requirements as follows:

- must hold an Australian or New Zealand qualification at least at bachelor degree level (or overseas equivalent), and

- must have passed subjects in CAANZ’s required 11 competency areas, including accounting, finance, tax, law or economics – with the only one on the FASEA wish list missing being financial planning.

The PY was equivalent to the current CA program in that it was a postgraduate level, professional accounting program candidates had to pass to qualify for full CA membership.

In 2000, the CA program was recognised as a graduate diploma higher education award at Australian Qualification Framework (AQF) level 8 by the Australian higher education authorities. Prior to then, it had not been submitted for formal registration as a higher education award.

Given these strict requirements to become a member of CAANZ since 1972, it would seem logical for FASEA to consider all members to have related degrees and related postgraduate qualifications.

Demonstrated financial advice experience

While members of CAANZ have done extensive studies in related major areas of specialisation outlined by FASEA, AccountantsIQ also believes personal financial advice experience must be demonstrated for accountants to have the right to complete only one further subject. We feel experience should be demonstrated by:

- full membership of CAANZ for five of the past eight years,

- proof of entry on the financial advisers register for five of the past eight years, with pro-rated requirements for those with limited licences,

- continuing professional development (CPD) records showing financial advice in areas of authorisations, and

- no Australian Securities and Investments Commission enforcement record whatsoever.

FASEA code of ethics subject to be replaced with a composite subject at AQF level 6

Based on national feedback, AccountantsIQ will be strongly advocating to FASEA for members of CAANZ (or any other practitioners who are members of professional member associations) currently required to complete the new FASEA code of ethics subject to have this one subject replaced with a composite subject that will better prepare them for the compulsory proposed exam. Subject areas could include the Corporations Act gaps in their existing code(s) of ethics compared to FASEA’s, behavioural finance, legal obligations and important regulatory requirements.

AccountantsIQ would also like FASEA to endorse this subject to be at AQF level 6, offer several study formats and allow professional member associations to badge courses and offer them through their education teams, should they wish to do so.

FASEA clearly has an important mission to, in part, improve trust and confidence in financial advice.

So we urge FASEA to consider the points above so those who have completed degree and postgraduate studies, act under a strict code of ethics, maintain 120 hours of CPD every three years (including financial advice) and are answerable to a high-class professional member organisation, will stay in the world of advice.