The ATO has been granted a new set of powers, including the capacity to fine SMSF trustees for compliance breaches. Brian Hor details what they mean for advisers and their clients.

A change in the powers available to the Australian Taxation Office (ATO) has provided yet another extremely compelling reason for changing from individual trustees to a corporate trustee. The ATO can now impose administrative fines, or speeding tickets as we like to refer to them, on each trustee of an SMSF. It means one fine will be issued for a corporate trustee or a fine each for every individual SMSF trustee.

Speeding tickets are officially here

On 18 March 2014, royal assent was given to the Tax and Superannuation Laws Amendment (2014 Measures No 1) Bill 2014, ushering in new powers for the ATO to give directions and impose administrative penalties for contraventions relating to SMSFs.

This means effective from 1 July 2014, a breach by an SMSF reported in an auditor contravention report can result in the trustees of the fund being personally liable to pay significant fines of up to $10,200 each.

So what’s it all about?

Previously, when an SMSF contravened the super laws, the ATO had a limited range of options available to it to enforce compliance, including:

- issuing a notice of non-compliance to the SMSF, under section 40 of the Superannuation Industry (Supervision) (SIS) Act 1993, thereby revoking the SMSF’s complying fund status for taxation purposes,

- applying to the court to impose a civil penalty, such as for a breach of the sole purpose test under section 62(1),

- applying to the court to impose a criminal penalty if the breach involved dishonesty, deception or fraud under section 202,

- accepting an enforceable undertaking to rectify the contravention under section 262A, and/or

- suspending, removing or disqualifying one or more of the trustees under section 133.

This situation was unsatisfactory for a number of reasons.

Firstly, issuing a notice of non-compliance to the SMSF was considered a draconian measure to take, particularly where the offending conduct is relatively minor in nature, or had already been rectified by the trustees, as it would mean the fund would no longer be eligible to receive super guarantee contributions and it would lose its tax concessional status, so that any income received in a financial year would be taxed at the highest marginal rate of 45 per cent.

But, worst of all, the total assets of the SMSF, other than non-deductible member contributions, would be subject to tax at the highest marginal rate, effectively clawing back all of the tax concessions received by the fund since inception in one swoop.

Secondly, making the fund non-complying would penalise all the members of the fund even though on the face of it all fund members are also the trustees (or all directors of the corporate trustee, as the case may be) of the fund.

In practice, if the contravention essentially related to the actions of one particular member who effectively controlled the fund, it would be patently unfair for all the other members to suffer the same consequences.

Thirdly, applying to the court for the imposition of a civil penalty or a criminal penalty involves expensive, time-consuming and uncertain legal action.

The practical result to date has been that the ATO has really only resorted to these sanctions in cases of significant non-compliance with the superannuation laws that remained unrectified for a significant period of time, such as in the matter of JNVQ and the Commissioner of Taxation [2009] AATA 522.

In that case, an SMSF had loaned funds to a related-party entity and the funds loaned in total were greater than 95 per cent of the assets of the SMSF, resulting in a breach of the in-house assets test as per section 84 of the SIS Act. The loans remained outstanding for some years. The issue of a notice of non-compliance was confirmed by the Administrative Appeals Tribunal with all the consequential adverse implications for the taxation of the fund.

From the perspective of the SMSF, the situation was also unsatisfactory as the resulting all-or-nothing approach meant there would be an uncomfortable uncertainty as to whether or not the ATO would apply the ultimate penalty in the event of a minor breach of the superannuation regulations, even if the breach had already been rectified at the time it was reported by the fund’s auditor.

How the new regime came about

On 29 May 2009, the government announced a comprehensive review of Australia’s superannuation system, the Super System Review (also known as the Cooper review). Following a period of reviewing submissions received in response to an issues paper released on 14 December 2009, the review panel issued its “Phase Three – Preliminary Report” on 29 April 2010.

This report made numerous recommendations in relation to SMSFs, including the ATO should be provided with a more flexible penalty regime that would enable it to tailor penalties more commensurate with the contravention, as opposed to only allowing the regulator options where the potential consequences would be disproportionately severe and more suitable for very serious breaches.

The former Labor government introduced measures adopting these recommendations into the House of Representatives on 29 November 2012 under the Superannuation Legislation Amendment (Reducing Illegal Early Release and Other Measures) Bill 2012. However, that bill did not pass through the lower house, meaning the measures did not come into effect on 1 July 2013 as originally anticipated.

The new powers were reintroduced to parliament on 26 February 2014 as part of a new bill under the coalition government, the Tax and Superannuation Laws Amendment (2014 Measures No 1) Bill 2014, with a revised start date of 1 July 2014. After finally having passed both parliamentary houses on 6 March, the bill received royal assent on 18 March.

So what are the new penalties?

The new powers are contained in a new part 20 of the SIS Act and apply to contraventions occurring from 1 July 2014. They cover:

- administrative penalties (section 166),

- education directions (section 160), and

- rectification directions (section 159).

They also apply to contraventions made prior to 1 July 2014 and continue after that date.

Administrative penalties

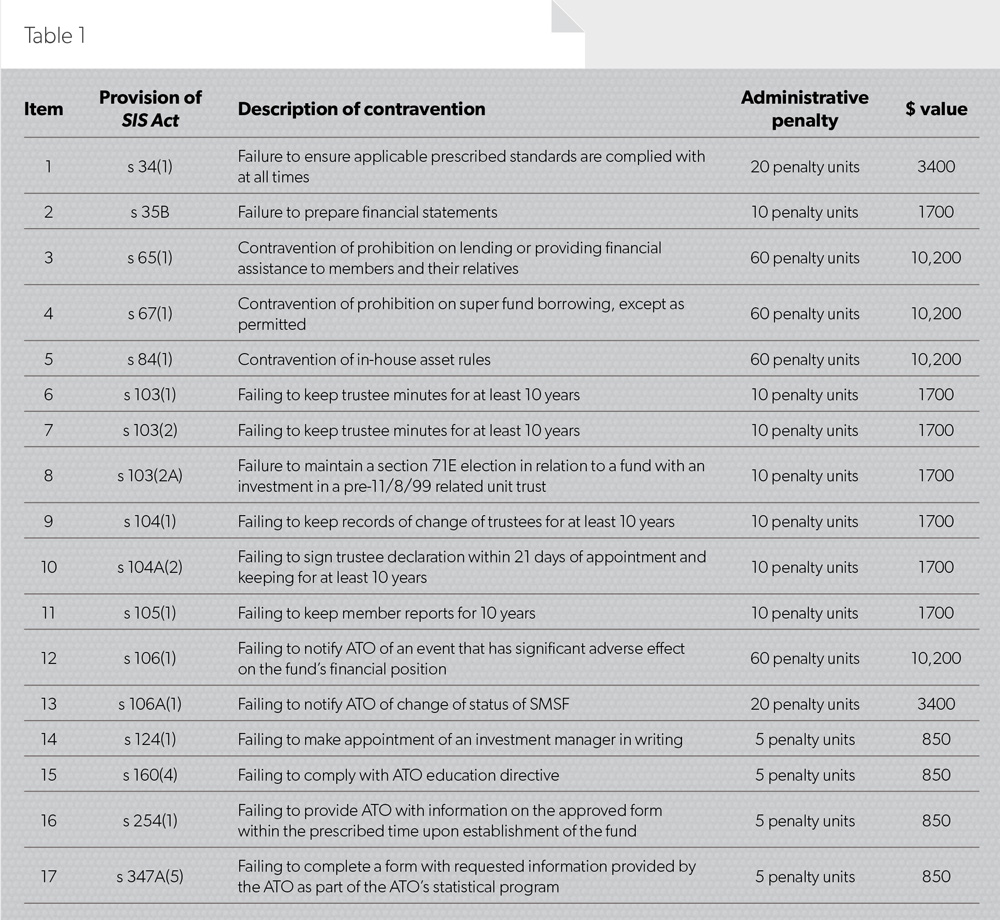

There are 17 administrative penalties, which are set out in a table in section 166 (see next page).

Under section 4AA of the Crimes Act 1914, a penalty unit currently means $170.

If a trustee of an SMSF is liable to an administrative penalty and is a body corporate, the directors of the body corporate, at the time it becomes liable for the penalty, are jointly and severally accountable to pay the amount of the penalty (section 169).

Importantly, these penalties cannot be paid using the resources of the SMSF (section 168). Doing so would be considered a serious breach in itself and likely to attract more significant penalties from the ATO.

Rectification directions

The ATO may give a rectification direction or an education direction where it reasonably believes a trustee or director of a corporate trustee of an SMSF has contravened a provision of the SIS Act(sections 159 and 160).

A rectification direction will require a person to undertake specified action to rectify the contravention within a specified time frame and provide the ATO with evidence of the person’s compliance with the direction. The rectification direction must specify the period within which the person must comply with the direction, which must be a period that is reasonable in the circumstances (section 159).

Education directions

An education direction will require a person to undertake a specified course of education within a specified time frame and provide the ATO with evidence of completion of the course. The education direction must specify the period within which the person must comply with the direction and must be a period considered reasonable under the circumstances (section 160).

The ATO may approve courses for the purposes of the education direction (section 161). If a person undertakes a course of education in compliance with an education direction, the person must ensure none of the costs associated with undertaking the course are paid or reimbursed from the assets of the fund (section 162).

What should SMSF trustees and their advisers do now?

Here are a few practical tips for SMSF trustees and their advisers:

To avoid these penalties, ensure your SMSF is fully compliant with the superannuation laws from 1 July 2014 so the trustees do not become liable for a penalty or other sanctions.

Given the penalties will also apply to contraventions that were made prior to 1 July 2014 and continue after that date, trustees and their advisers should ensure all contraventions are rectified as soon as possible and no later than 30 June. Having said this, the ATO advises that if trustees are making progress in resolving one or more contraventions by 1 July 2014, it will consider these circumstances in any request to remit any imposed administrative penalties. In its “SMSF News – edition 29”, the ATO gives an example where a fund lent money to a member or relative and the loan still exists on or after 1 July 2014. In this situation, each individual trustee will be personally liable for a penalty of $10,200. On the other hand, if the SMSF had a corporate trustee, each director will be jointly and severally liable for a single penalty of $10,200.

Finally, from an SMSF adviser’s perspective, you need to be speaking with your SMSF clients as soon as possible to conduct a compliance review identifying any contraventions and assist your clients to rectify them as soon as possible. Failure to do so, or to at least alert your clients in a timely manner, could mean the adviser is held responsible for the situation if their clients incur a penalty.