Some SMSF investors believe the solid returns generated from the domestic residential property market will last forever. Chris Bedingfield examines why this thinking in the current climate may be flawed.

The love affair Australians have with residential property is well known and well documented. Not surprisingly, SMSF trustees have also taken to the idea of residential property investments as part of their asset base with gusto.

While the arguments for and against including residential property in an SMSF continue, another issue not often canvassed is whether Australian residential property offers the best prospects for investment returns, or whether there are other, more suitable, alternatives.

Recently, there has been much discussion regarding the outlook for Australian residential property. From high-profile media coverage predicting a ‘mortgage meltdown’, to debate in parliament suggesting changes to negative gearing will trigger an Australian property price collapse, and even hedge fund managers creating the ‘great short’, it seems everyone – including experts both locally and internationally – has a view on whether there is an Australian property bubble.

Indeed, if you type ‘Australian property bubble’ into Google, the search will return no less than 500,000 results.

So is it a bubble or does this simply reflect the recency bias of the global financial crisis (GFC)? Recency bias is an important human trait: it is the tendency to think trends and patterns we observe in the recent past will continue in the future.

It is important long-term investors are not influenced by these kinds of behavioural biases. At Quay, we try to avoid such emotive terms. We also prefer not to think about fair value, but rather prospective returns.

In this respect, we feel the prospective return prospects for Australian property to be quite low on a medium to long-term basis.

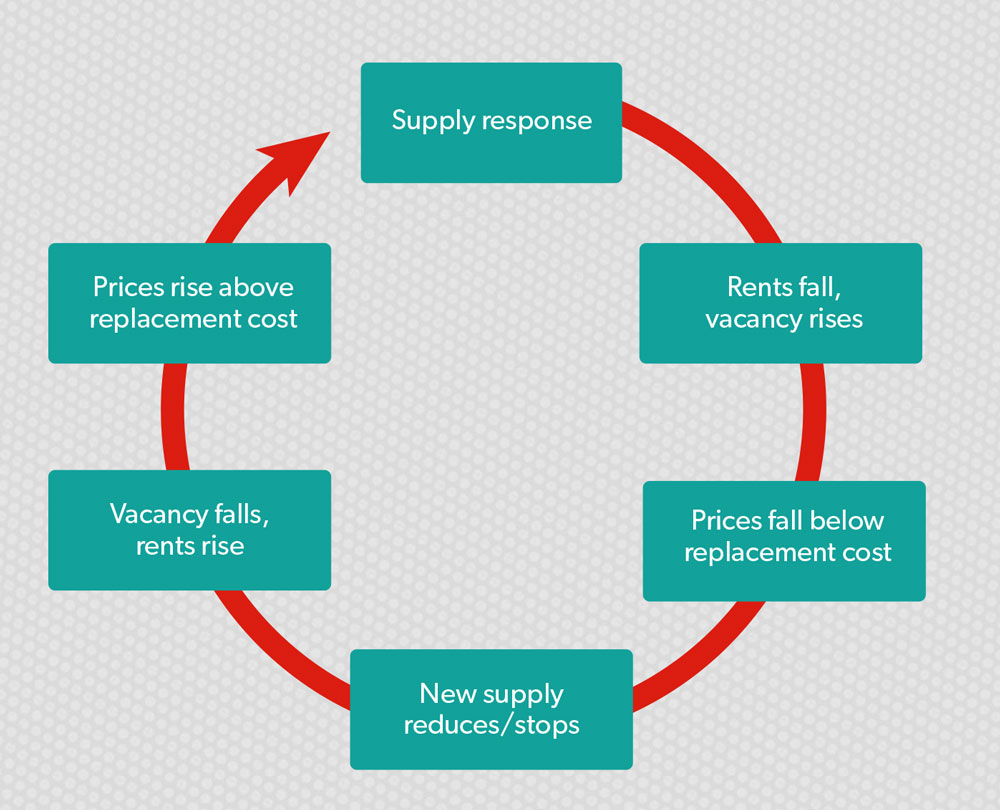

Figure 1

Property as a commodity

We have a set framework when assessing property cycles and consider most property to be ‘commodity’ in nature. That is, it is easily substituted or replaced when the development profit equation favours new supply. While we consider most residential property to be commodity in nature, this is especially the case when credit is widely available. Figure 1 depicts our view on the cycle for typical commodity property.

From an Australian residential property perspective, it seems we are at or around the ‘supply response’ stage.

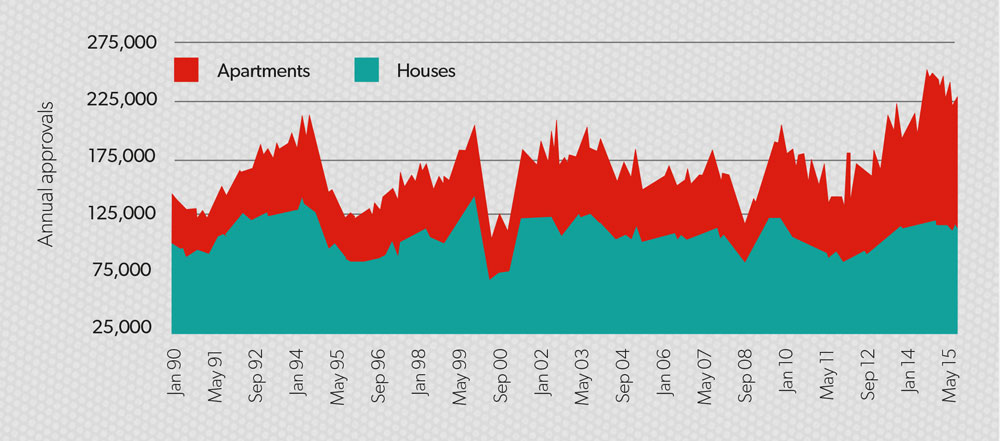

The approvals chart (Figure 2) from the Australian Bureau of Statistics (ABS) confirms this view.

Some may argue Australia has experienced a housing shortage in previous years and that may be true. However, that does not alter the reality Australian house prices, on average, are trading well above the cost to build (including land), which has facilitated a strong supply response. In fact, as per the ABS chart, dwelling approvals are running at a record pace.

When prices are greater than the cost to produce, it is unlikely prices will continue to grow at or above inflation since that situation will only stimulate more supply, which is unsustainable. It is more likely prices will grow at a lesser rate than cost. That is, real prices will fall, leaving investors to rely on yield to make up most of the total real return.

Property yields

So how do Australian property yields stack up?

Yield can be quoted three different ways for the same property:

gross yield, net yield = gross yield minus operational expense (rates, leasing costs, marketing, et cetera) or

free cash-flow yield = net yield minus recurring capital expenditure (building structure, internal fixtures and fittings, carpet, et cetera).

In Australia, residential investment yields are generally quoted on a gross basis. For a typical apartment in Sydney, the average gross yield is around 4.1 per cent, which looks okay compared to cash and bonds.

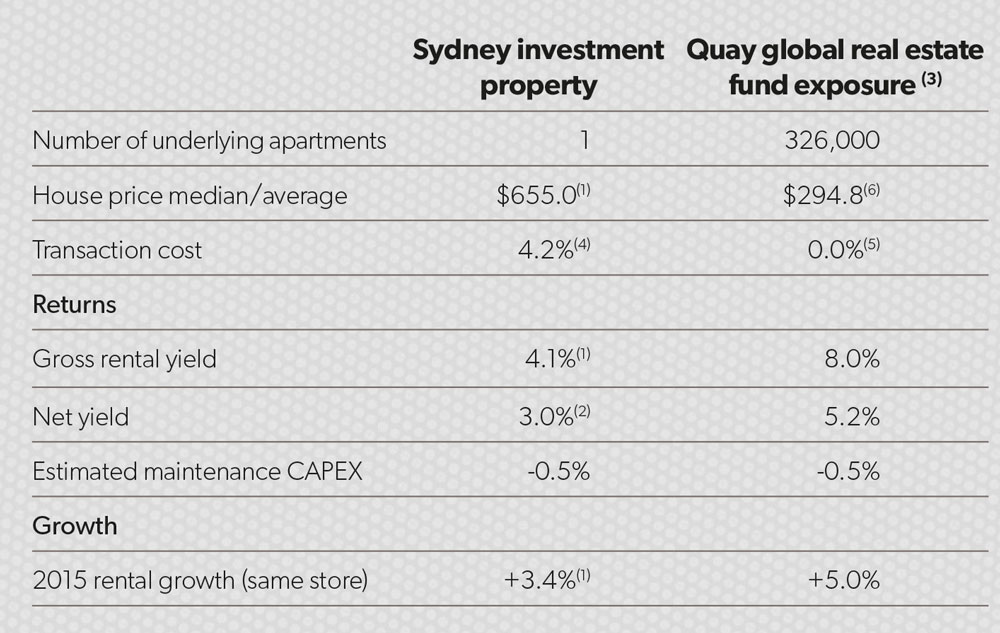

But an important question for SMSF trustees is: what is the true free cash-flow yield and how does it compare to global benchmarks? We have compared the investment metrics of a typical Sydney apartment to the metrics of the apartment exposures that are held in the Quay Global Real Estate Fund across a number of international jurisdictions.

Table 1 compares gross yield, net yields and free cash flow, as well as historic rental growth and transaction costs.

As can be seen, when compared to Quay’s global apartment exposure, Sydney apartments have:

- lower gross yield (in a higher interest rate environment),

- lower net yield,

- lower free cash-flow yield,

- higher transaction costs, and

- lower historic growth.

On average, we expect our investees to deliver 4.9 per cent rental growth in 2016. In Sydney, there is no consensus on rental growth for this year, however, when we look at new supply compared to (say) the United States, it is difficult to mount an argument that it will be much better than last year.

Table 1

(1) Source: CoreLogic RP Data. (2) Assumes $7000 per annum in strata fees, water rates, council rates, marketing & leasing costs, agents commission. (3) Company data, Quay Global Investors Estimates. (4) Based on NSW Stamp duty and conveyance costs (Assumption not first home). (5) Based on Quay Global Real Estate Fund entry fee. (6) Company enterprise value divided by number of apartments owned, weighted for Quay Global Fund ownership. Share prices and currency as at Feb 29, 2016.

Figure 2: Australian dwelling approvals (annualised)

Source: ABS housing approvals seasonally adjusted Cat 8731, Quay

Lessons for SMSF trustees

Recency bias is a powerful human trait that has been instrumental to human survival. For instance, when we touch fire it burns, so we learn not to do it again. But in the ever-changing world of investment where prices and fundamentals are always changing, it is a trait that could result in missed opportunities or unintended risk.

This may be occurring regarding commentary around Australian real estate today as the scars from the GFC are still raw. Without buying the ‘is it/isn’t it a bubble’ argument, at Quay we simply look at the best return prospects. And based on the limited supply outlook, yield and growth profile, we continue to believe Australian property doesn’t provide the same investment prospects as a well-chosen exposure to a range of international apartments.