Exchange-traded funds can be a highly effective way for SMSFs to access the diversification benefits of international equities, without the complexities of a direct investment. Amanda Skelly discusses the benefits for SMSFs in investing internationally and considers practical tips for advisers looking to introduce international investments to SMSF clients.

Recently there has been a resurgence of interest in international equities among Australian investors. According to independent researcher Investment Trends, one in four Australian investors plan to increase their exposure to international equities in the near future, with North America being the most popular investment destination.

In part, this renewed interest in offshore opportunities may simply reflect the recent outperformance of international equities set against a domestic market weighed down by a high dollar and below trend economic growth. Yet it may also be influenced by the increasing accessibility of low-cost overseas diversification for both self-directed and advised SMSFs.

Investment Trends has found that both unlisted equity funds and exchange-traded funds (ETF) are increasingly popular vehicles for gaining overseas exposure. For example, in late 2013, 30 per cent of financial planners said they were likely to use ETFs to access United States markets.

Nonetheless, SMSFs remain largely underexposed to international equities as an asset class. As a result, many are missing out on the considerable diversification benefits they can offer. By increasing an SMSF’s allocation to international markets, you may be able to improve portfolio performance and the potential for higher long-term returns, while reducing risk through more effective diversification.

Asset allocation and risk management

It has long been recognised asset allocation, not security selection, is the key driver of long-term investment results. One of the most powerful insights of modern portfolio theory is the finding that allocating capital across risky assets can actually reduce overall portfolio risk, due to the benefits of diversification.

For this approach to be successful, SMSFs need to combine asset classes whose performance is relatively uncorrelated so that when one asset class underperforms, another is likely to be delivering healthy returns. This has historically been a challenge for many SMSF’s where yield, safety and familiarity often trump diversification. The role of advice then becomes critical.

Historically, international equities have shown varied correlations to both Australian equities and bonds. As a result, they offer significant diversification benefits to Australian investors. For example, an analysis of asset class returns for the 10-year period between January 2004 and February 2014 by State Street Global Advisors shows an investment portfolio consisting of a split between Australian equities, international equities and bonds results in reduced risk and increased return. Simply by shifting 10 per cent of the capital from Australian equities to overseas shares can result in a 0.36 per cent reduction in annualised portfolio volatility. This suggests international equities can be an attractive risk management tool, as well as offering the potential for enhanced returns. This reduction in annualised portfolio volatility increases to 0.79 per cent as 30 per cent from the Australian equity allocation is shifted to international stocks.

Diversifying away from home bias

Despite these potential benefits, many SMSFs have a minimal allocation to international equities. For example, recent Australian Taxation Office (ATO) data shows SMSFs invest an average of only 3.9 per cent of their capital in international equities, with the bulk of their assets in cash (28.9 per cent) and Australian equities (32 per cent). This is an example of the well-observed phenomenon of home bias, where investors focus on domestic assets rather than diversifying offshore. Home bias has often been characterised as irrational, since it leads investors to make suboptimal investment decisions, neglecting opportunities to reduce risk and improve returns at relatively little cost. But it also has rational underpinnings, due to the administrative and financial barriers that frequently discourage investors from accessing overseas markets.

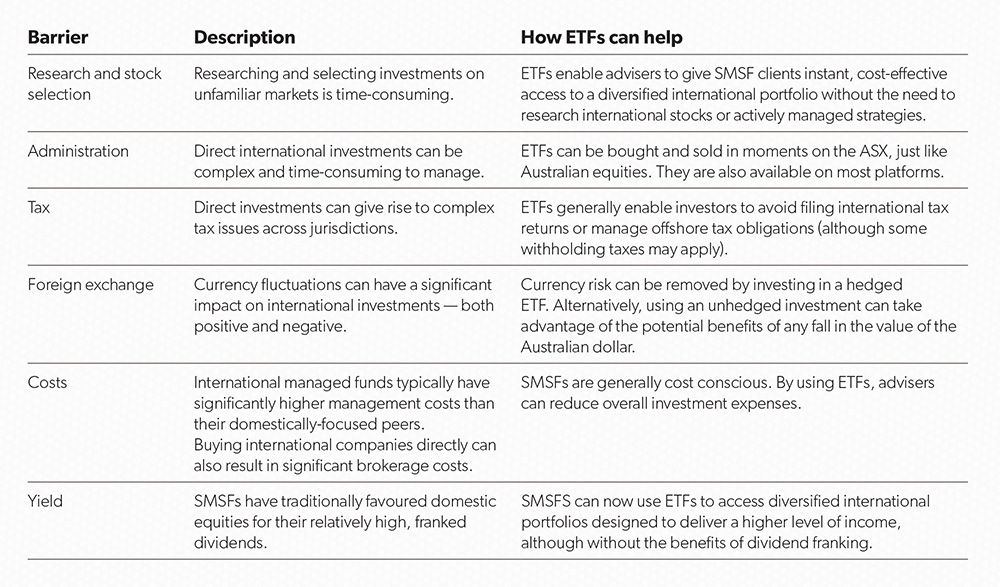

Fortunately, SMSFs can now access a growing range of investment options that overcome many or all of the most frequently cited reasons for avoiding international equity investments. ETFs in particular offer a cost-effective and easily administered vehicle for offshore diversification, without the complexities of a direct investment (Figure 1).

Figure1: Overcoming barriers to investing in ETFs

By adopting a core–satellite approach, advisers can help SMSFs use ETFs to achieve a precisely targeted allocation to international markets through a passively managed core holding, at relatively low cost.

Your investment objectives

As always the starting point for any asset allocation decision is an analysis of the investment objectives for the fund’s members. Those objectives will determine both the overall proportion of the capital allocated to international equities and the risk–return characteristics of the international holdings selected. While Australian equities are highly concentrated in a small number of sectors and a mature economy, international markets make up an enormously varied investment universe, ranging from defensive blue chips to high-growth companies in emerging markets. Using ETFs, SMSFs can access a variety of diversified international investment options with distinct risk and return profiles. This enables an SMSF trustee to fine-tune the international portion of the fund’s investments to meet the distinct investment objectives of its members.

Defining the risk and return profile

According to the ATO, SMSF trustees are required to prepare and implement an investment strategy for the fund, and invest in a way to maximise member returns while taking account of the risk associated with the investment. Let’s recap on some of the factors trustees need to consider to understand the risk-return trade-off:

- Investment time frame. The longer the time frame of the fund and its members, the more opportunity the fund has to ride out market fluctuations and take advantage of the growth potential of more volatile assets. Funds with a longer time frame may prefer a higher allocation to international assets, often including emerging markets.

- Required return. As international markets offer potential for higher returns, the higher the return required of the fund and its members, the higher the allocation to international equities is likely to be. For growth-oriented funds with portfolios highly concentrated in Australian equities, an increased allocation to international markets can significantly reduce portfolio risk without impacting on the portfolio’s growth profile.

- Risk tolerance. The ability of the fund to pay benefits as members retire needs to be balanced against the required return and level of risk taken, for example, the number of years of negative returns the fund can accept in pursuit of higher returns.

- Income versus growth. While Australian investors have traditionally regarded international equities as a high-growth option, they also offer significant opportunities for reliable income. By selecting a dividend-oriented international ETF, trustees can diversify a high-yield portfolio to create a more consistent income stream.

- Currency impact. Trustees should consider the impact of currency fluctuations that can significantly add both upside and downside volatility to investment returns.

- Fortunately there are now ETFs that seek to hedge movements of international currencies versus the Australian dollar. Investing in a currency-hedged international fund may be a good way for SMSFs to mitigate currency risk while accessing global equity exposure.

Once a risk and return profile has been defined, an initial asset allocation needs to be set. With the recent growth in international equity ETFs, SMSFs have a wide range of options for their allocations in the asset class.

Case study

Andrew and Theresa — building retirement savings

Andrew and Theresa are in their early 50s, looking to retire within the next 13 years. Recently promoted to a senior management role in an environment consultancy, Theresa earns $185,000 a year. Andrew runs a landscaping business, earning around $150,000 a year.

Ten years ago they started an SMSF, which currently has a balance of $637,000, divided between high-yield Australian equities and cash investments. They also own two small investment properties. Now they are looking to take advantage of their SMSF and Theresa’s increased earning power to build their savings as they approach retirement. But while they are interested in diversifying their investments, they are also risk averse, preferring the certainty of immediate income to the potential for higher growth.

Investment strategy

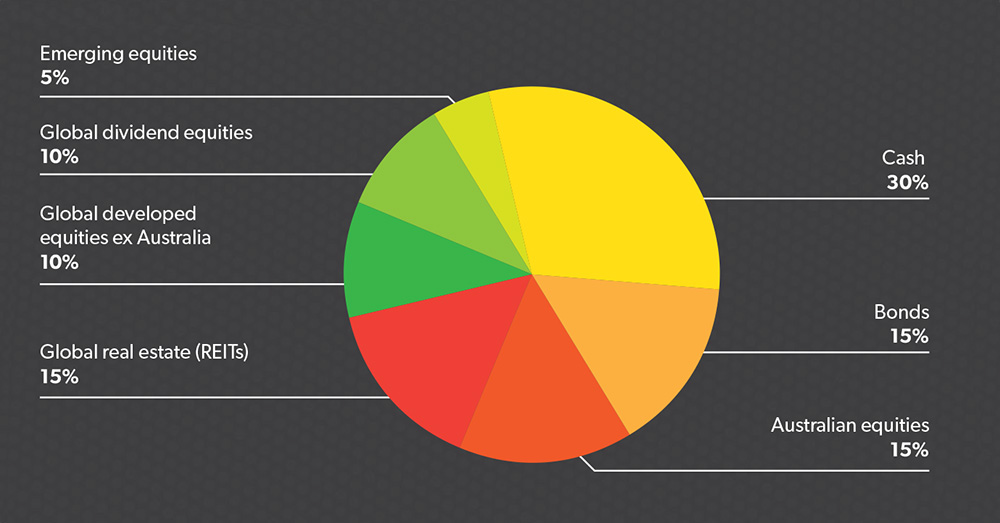

With over a decade before retirement, Andrew and Theresa are most likely looking to build capital while preserving wealth and thus should take a balanced approach to investing. This approach suggests holding a fair split across safe and risky assets. Therefore, 45 per cent of their portfolio should be allocated to safer assets such as cash and fixed income, which provide steady and stable streams of return. The remaining 55 per cent of the portfolio should hold riskier assets across domestic and international equities.

Within the international equities the following considerations were included:

Given the preference for income in addition to growth, the portfolio is tilted to international equity strategies that offer both income and growth potential. These strategies included a higher dividend yield international shares strategy and a global real estate allocation.

Due to Andrew and Theresa’s risk-averse nature and medium-term investment time frame, only a small allocation to emerging market equities is appropriate.

A broad-based developed market equity allocation was used to provide further diversification across countries, sectors and companies.

Over time, Andrew and Theresa’s investment approach should shift toward the conservative and ultra-conservative models to reflect their decreasing risk appetite and higher priority for capital preservation.

Sample balanced portfolio