When SMSF trustees fall foul of the law, the ATO can impose either administrative or civil penalties. Daniel Butler and Gary Chau detail some of the circumstances and recent court cases where civil penalties were imposed.

This article considers a number of civil penalty orders that have been imposed by the courts on trustees of SMSFs that contravened the civil penalty provisions under section 193 of the Superannuation Industry (Supervision) (SIS) Act 1993.

Background

Substantial penalties can be imposed for contravening the following sections of the SIS Act:

- section 62(1): the sole purpose test,

- section 65(1): lending or providing financial assistance to members,

- section 67(1): a fund borrowing,

- section 84(1): the in-house asset rules, and

- sections 109(1) and 109(1A): all investments must be made and maintained on arm’s-length basis.

A court under section 196 of the SIS Act has the power to make a civil penalty order where it is satisfied a person has contravened a civil penalty provision. The maximum penalty for contravening a civil penalty provision is currently $420,000 (being 2000 penalty units with each penalty unit at $210 as of March 2018) as defined in section 4AA of the Crimes Act 1914.

The ATO as the regulator of SMSFs, under section 6 of the SIS Act, has the power to apply to the court under section 197 of the SIS Act for a civil penalty order. Generally, the ATO only seeks a civil penalty order as a matter of last resort, such as where there is a severe contravention and where other resolution options are inappropriate.

As a general rule, the ATO would prefer to apply administrative penalties due to the ease with which an administrative penalty can be imposed. Failure to comply with an ATO direction, such as a direction to an SMSF trustee to rectify a contravention within say a three-month period, is a strict liability offence under section 159(7) of the SIS Act, which means the tax office does not need to apply to the court nor establish fault or intention. In contrast, the ATO must initiate court proceedings to pursue a civil penalty order.

SMSF trustees should seek expert advice

It is highly recommended trustees seek advice before undertaking a new or novel transaction. A contravention can easily arise where an SMSF undertakes a transaction thinking it is legal, but may be breaking the law. For example, a loan to a family member or related party by an SMSF is a contravention that can result in serious penalties.

While SMSF trustees should get advice where needed, they should also ensure they seek out an adviser with the right qualifications and expertise to provide the advice. SMSF lawyers, for instance, are best positioned and are qualified to provide legal advice. Other advisers providing advice on superannuation law, such as the application of the SIS Act in respect of a transaction, are not authorised to provide legal advice.

It is worthwhile noting here that SMSF trustees who rely on incorrect advice are still liable to penalties, as was the case in Deputy Commissioner of Taxation v Lyons 2014 (Lyons). This case involved a financial planner incorrectly advising an SMSF trustee that moneys could be withdrawn by SMSF members to pay debtors. In Lyons, the court imposed penalties of $32,500 for contraventions arising from the fund making six loans totalling $190,000 to a relative of Mr Lyons over a 10-month period. The contraventions included:

- failing to maintain the fund in compliance with the sole purpose test,

- lending to a relative,

- failing to take reasonable steps to ensure the loans were within the in-house asset market value ratio, and

- failing to ensure loan dealings were carried out at arm’s length.

While Mr Lyons obtained advice from his financial planner with respect to the transactions, the advice was incorrect. This is why it is important to get legal advice from a qualified lawyer who is also an SMSF expert.

Criminal penalties

In addition to civil penalties, a person can also be charged with a criminal offence upon contravening section 202 of the SIS Act, a civil penalty provision in the SIS Act if their conduct involves dishonesty or deception. A criminal offence is punishable on conviction by imprisonment for up to five years.

What civil penalty orders have been imposed on SMSF trustees?

Penalties are intended to achieve several objectives, including deterrence, denunciation and punishment (Australian Prudential Regulation Authority v Derstepanian [2005] (Derstepanian)). Broadly, in determining the amount that should be imposed for a contravention of the civil penalty provisions, the courts consider the following:

i. the nature and extent of the contravening conduct,

ii. the amount of any loss or damage caused,

iii.the size of the organisation,

iv. the deliberateness or otherwise of the contravention(s),

v. the period over which the contravention(s) extended,

vi. the degree of cooperation of the person concerned, either in the investigation or the subsequent hearing,

vii. the past record of the person,

viii.the person’s financial position,

ix. any amounts already paid by way of compensation or legal costs, and

x contrition.

Further, the courts generally apply the totality principle where there are multiple contraventions that can properly be seen as one contravening course of conduct, albeit over a substantial period of time (Olesen v Eddy [2011]).

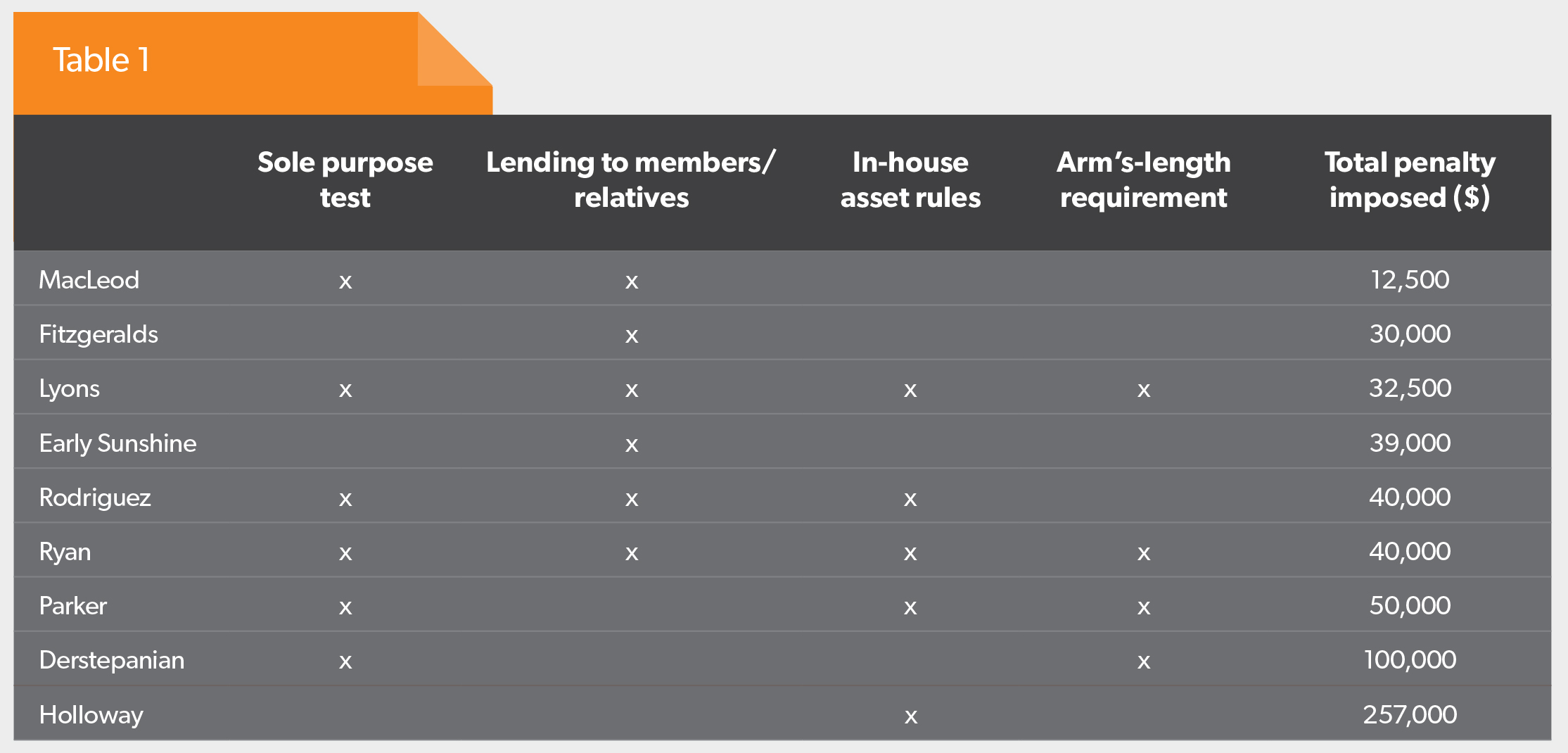

Table 1 is a summary of the contraventions of each SMSF and the penalties actually imposed. The case names have been abbreviated in the table. The full case citation appears elsewhere in this article.

Here is a brief summary of the background for each case and penalties imposed:

- Derstepanian: The fund’s trustees entered into an agreement to purchase 2903 master patterns and jewellery manufacturing dies for $165,870. However, this price was substantially greater than the trustee value of the patterns and dies. It was held that the fund’s trustees contravened sections 62(1) and 109(1) of the SIS Act. Justice Weinberg noted the fund’s trustees were liable to a maximum of 2000 penalty units for each contravention, that is, sections 62(1) and 109(1) of the act. The total was a maximum of 4000 penalty units, a penalty unit equating to $110 in 2005. The fund’s trustees were potentially liable to a penalty of $440,000. Weinberg noted other factors, including that the trustee had already incurred around $500,000 in expenditure and other administrative penalties in relation to the proceedings. It was ordered that the trustees pay a penalty of $100,000.

- Australian Prudential Regulation Authority v Holloway (2000) (Holloway): Justice Mansfield made orders that a company and Mr Holloway pay penalties of $222,000 and $35,000 respectively. This was after Holloway was found to have engaged in transactions that contravened the in-house asset rules, which concerned artificial reductions in the value of in-house assets.

- Deputy Commissioner of Taxation v Rodriguez [2016] (Rodriguez): In Rodriguez, the trustee was held to have contravened sections 62(1), 65(1) and 84(1) of the SIS Act. Justice McKerracher noted each of the contraventions was serious and ordered the trustee to pay a penalty of $40,000 and the ATO’s costs of $14,000.

In Rodriguez, McKerracher provided a summary of the following cases:

- Deputy Commissioner of Taxation v Fitzgeralds [2007] (Fitzgeralds): In Fitzgeralds, the court imposed a penalty of $20,000 and $10,000 on Mr and Mrs Fitzgeralds respectively for providing financial assistance to the fund’s members. Here, the Fitzgeralds as trustees misapplied $148,000 by selling their fund’s principal asset and using those proceeds to pay $48,738.69 to Mr Fitzgerald and the balance of more than $99,000 to settle a claim by a liquidator against the Fitzgeralds in respect of the company formerly controlled by the two. Here, all of the assets were deliberately stripped out and were not repaid. The court took into account the financial circumstances of the Fitzgeralds, their contrition and their former good behaviour.

- Olesen v Parker [2011] (Parker): Justice Gordon imposed a penalty of $35,000 and $15,000 on Mr and Mrs Parker respectively for breaching section 84(1) of the SIS Act by failing to comply with the in-house assets provisions in sction 83(2) of the SIS Act, breaches of section 84(1) by breaching section 109(1) for failing to take reasonable steps to prepare a written plan in compliance with section 82 of the SIS Act and failing to deal with entities in an arm’s-length manner and breaching section 62(1) for failing to solely maintain funds for core and/or ancillary purposes. The penalties recognise different roles played by each of Mr and Mrs Parker and their financial positions including that they were then the subject of amended assessments by the ATO. Those contraventions were deliberate, repetitive and occurred over a three-year period. There were a substantial number of loans made that breached the sole purpose test.

- Olesen v MacLeod [2011] (MacLeod): The court imposed a penalty of $12,500 on Mr McLeod for contravening sections 62(1) and 65(1) of the SIS Act. There were numerous payments out of the trustee to Mr McLeod over a five-year period, which depleted almost the entire fund.

- Olesen v Early Sunshine Pty Ltd [2015] (Early Sunshine): The court imposed penalties of $13,000 on each of the directors of the trustee company, that is, three directors, for contraventions of section 65(1) of the SIS Act. This was due to the payment of a series of loans totalling $551,568.20 over a four-year period to a company associated with the directors, which in each case were usually repaid within a few weeks’ time. There were full admissions and cooperation.

- Federal Commissioner of Taxation v Ryan [2015] (Ryan): The court imposed a penalty of $20,000 each on Mr and Mrs Ryan for contravention of sections 62(1), 65(1), 84 and 109 of the SIS Act. The total sum removed from that fund was $209,677, almost exhausting the fund. The conduct was deliberate, but there were no prior contraventions. Approved penalties were imposed.

In addition to the above penalties, trustees must be aware these amounts do not include the other costs incurred by the trustees in each of the cases, for example, legal costs awarded against them in court and fees for lawyers, advisers and experts, and the enormous amount of time and resources in relation to litigation matters.